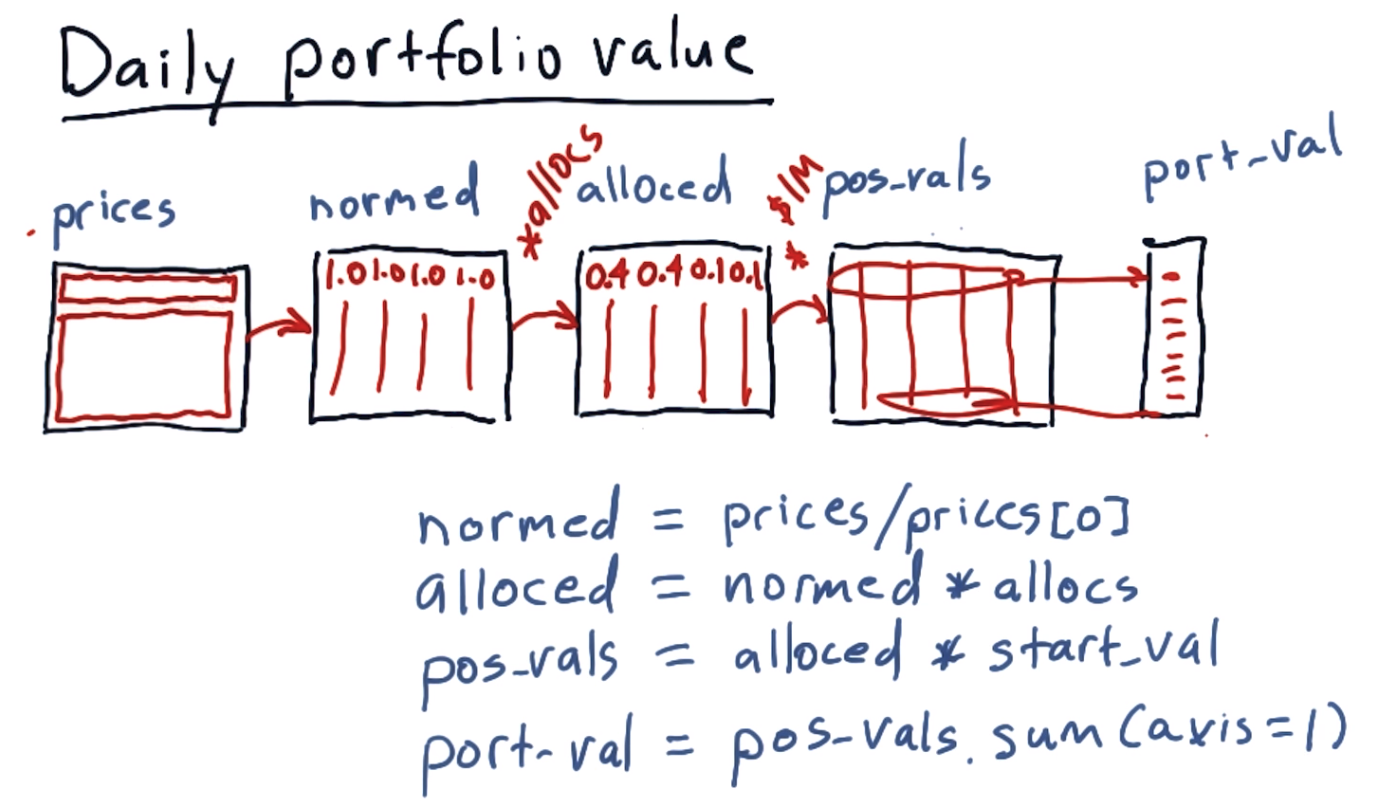

Let's you have $10000, and you inverst 4 stocks. ['SPY', 'IBM', 'XOM', 'GOOG']. The allocation is [0.4, 0.4, 0.1, 0.1] separately.

The way to calculate the daily porfolio is

- Normalize the price by devide price of first day.

- Nored * allocation

- * starting value

- Sum up each row

After we can port value, the first thing we can calculate is the daily return.

The important thing to remember that the first value of daily return is alwasy zero, so we need to remove the first value.

daily_rets = daily_rets[1:]

Four statics:

1. Cumulative return:

Is a just a measure of how much the value of the portfolio has go up from the beginning to the end.

cum_ret = (port_val[-1] / port_val[0]) -1

2. Average daily return:

The mean value of daily return

avg_daily_ret = daily_rets.mean()

3. Standard deviation of odaily return:

std_daily_ret = daily_rets.std()

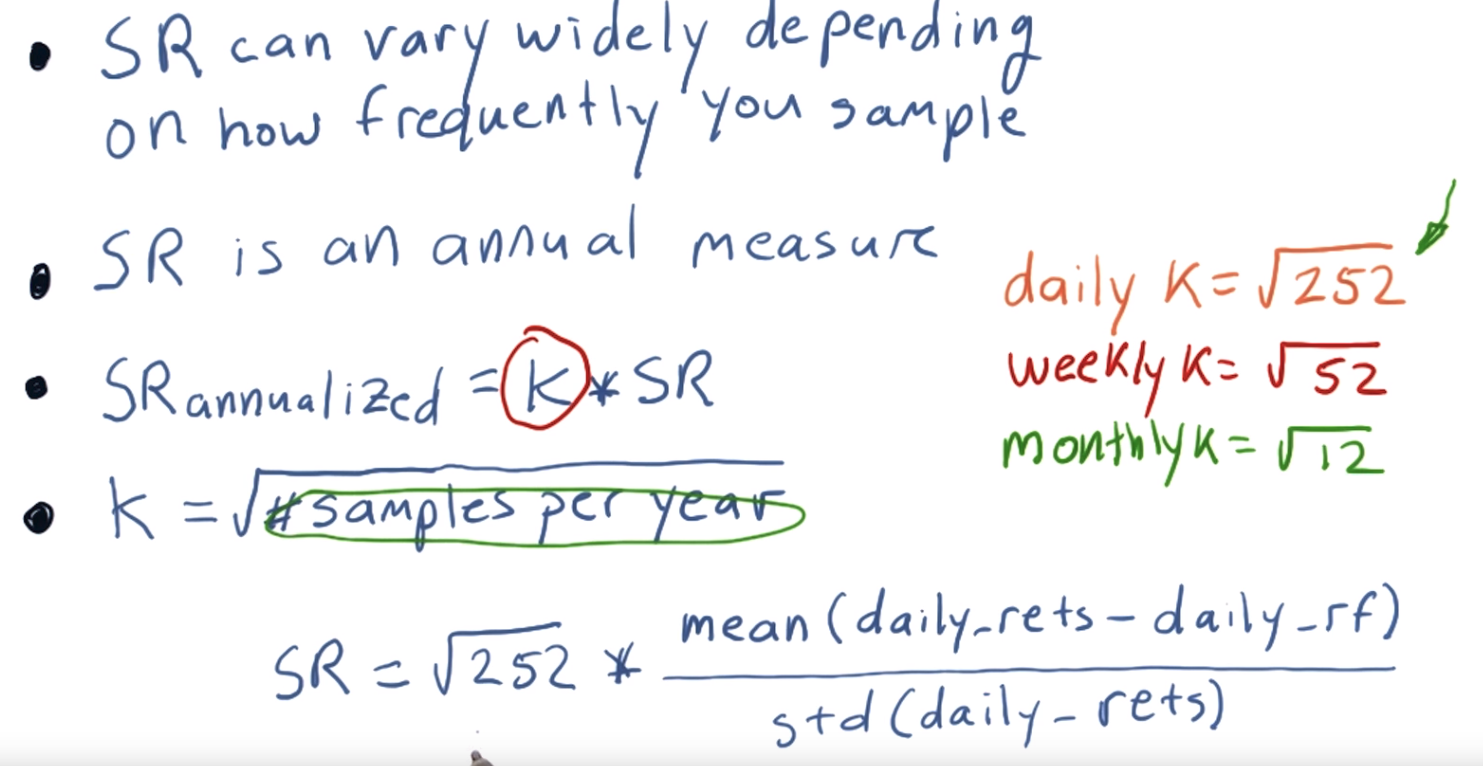

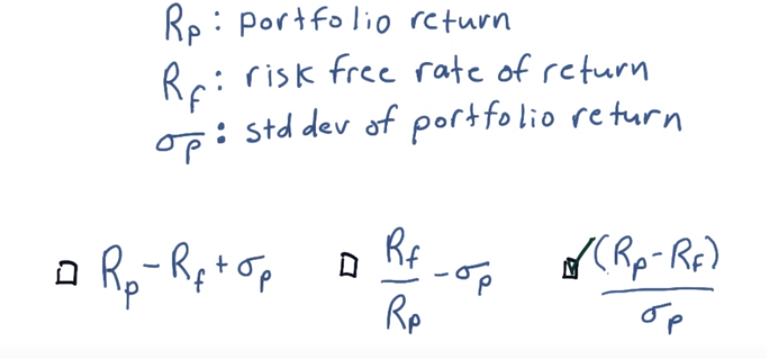

4. Sharp ratio:

The idea for sharp ratio is to consider our return, or rewards in the context of risk.

All else being equal:

Lower risk is better

Higher return is better

Also considers risk free rate of return, nowadays, risk free return is almost 0. (Put menoy into the bank has very low interests)

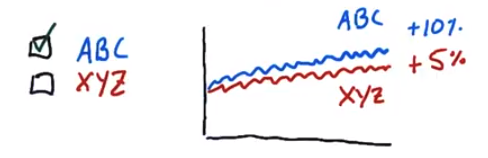

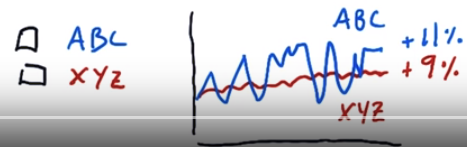

Both stocks have similar volatility, so ABC is better due greater returns.

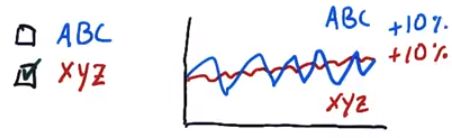

Here both stocks have similar returns, but XYZ has lower volatility (risk).

In this case, we actually do not have a clear picture of which stock is better!

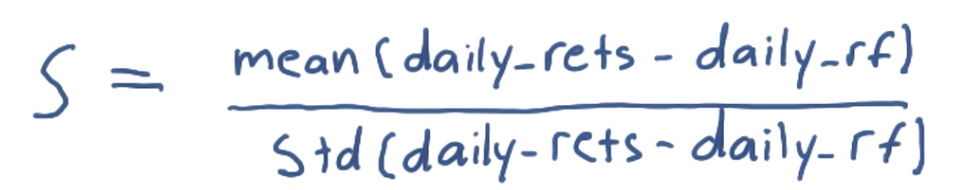

Calculate Shape ratio:

Risk free value can be replace by:

1. LIBOR

2. 3mo T-Bill

3. 0%

Because risk free is so small, noramlly we can just drop it when calculate the sharp raito.

IF we calcualte daily shape ratio: use K = srq(252), monly then srq(12)