本策略为波动率与价格想结合的策略,策略想法较为复杂,交易次数较少。

代码如下:

import pandas as pd

import pyodbc

from sqlalchemy import create_engine

import numpy as np

from statistics import median

import crash_on_ipy

import pdb

import matplotlib.pyplot as plt

# import matplotlib_finance as mpf

# from matplotlib.finance import candlestick

from numpy import nan

#SERVER服务器地址,DATABASE数据库名,UID用户名,PWD登录密码

con = pyodbc.connect('DRIVER={SQL Server};SERVER=192.168.60.5;DATABASE=data_history;UID=gx;PWD=01')

# querystring="select * from [data_history].[dbo].[ag1612]"

querystring="select top (20000000) [time],[price] from [data_history].[dbo].[ag1612]"

engine = create_engine('mssql+pyodbc://scott:tiger@mydsn')

data=pd.read_sql(querystring, con, index_col='time')

# data=pd.read_csv('data.csv',index_col='ID')

print(data.head())

print(data.tail())

# data=data.iloc[:,0:3]

# data['date_time']=data['date']+data['time']

# del data['date'],data['time']

data=data.sort_index()

# data=data.set_index('date_time')

data.rename(index=lambda x:str(x)[:16],inplace=True)

# #得到每小时K线数据的开盘价、最高价、最低价、收盘价

new_data=data.groupby(data.index).last()

new_data['open_price']=data.groupby(data.index).first()

new_data['high_price']=data.groupby(data.index).max()

new_data['low_price']=data.groupby(data.index).min()

new_data.columns=['close_price','open_price', 'high_price', 'low_price']

print('new_date.head():{}'.format(new_data.head()))

new_data.drop(new_data.index[152:181],inplace=True)

# new_data.to_csv('new_data1.csv')

# 得到周期为10的标准差

# 得到所有数据的行数

# 策略判断标准前面需要至少(3*24+10)h,即82h,当天需要6根k线,即6h,总共88h,取前88h,i从87开始。

T=len(new_data.index)

print('T:{}'.format(T))

std=[]

std_mean=[]

#记录开平仓位置

position_locat=[0]*T

profit=[]

#定义前三日第二大方差差值、区间最大值、区间最小值、开仓价

second_diff=0

x=0;y=0;z=0;z1=0;z2=0;m=0;m1=0;m2=0

interval_data_max=0

interval_data_min=0

open_price=0

#std数据为T-10个

for i in range(10,T):

data_close=new_data['close_price'].iloc[i-10:i].values

std.append(data_close.std())

# print(std)

#得到std的均值,为T-10-24个,即T-34个

for i in range(24,len(std)):

std_mean.append(np.mean(std[i-24:i]))

# print(std_mean)

print(len(new_data),len(std),len(std_mean))

#new_data比std数据多10个,std数据比mean多24个,把所有数据量统一,去掉前面多于的数据

new_data=new_data.iloc[34:,:]

std=std[24:]

print(len(new_data),len(std),len(std_mean))

T=len(new_data)

mark_enter=[0]*(T)

mark_leave=[0]*(T)

def vol(i):

vol_open_condition = False

second_diff = median([np.max(std[i - 77:i - 53]) - np.mean(std[i - 77:i - 53]),

np.max(std[i - 53:i - 29]) - np.mean(std[i - 53:i - 29]),

np.max(std[i - 29:i - 5]) - np.mean(std[i - 77:i - 53])])

interval_data=0;std_high=0;std_low=0;interval_data_max=0;interval_data_min=0;interval_begin_time=0;interval_close_time=0

if std[i - 4] > 0.8 * second_diff and std[i - 4] >= std[i - 5] and std[i - 4] > std[i - 3] > std[i - 2] > std[

i - 1]:

# 记录区间的开始位置,(i-4)为高点,(i-5)是高点前一根K线

x = i - 5

b = True

while b:

if std[i - 1] >= std[i]:

i += 1

else:

b = False

break

# 记录区间的结束位置,i-1为低点位置

y = i - 1

interval_data = new_data.iloc[x:y+1, :]

std_high = std[x - 4]

std_low = std[y]

second_diff_satisfy_std = second_diff

interval_data_max = interval_data['high_price'].max()

interval_data_min = interval_data['low_price'].min()

interval_begin_time=interval_data.index[0]

interval_close_time=interval_data.index[-1]

# interval_std_high=std[i-4]

print(x, y, std_high,std_low,interval_data_max, interval_data_min,interval_begin_time,interval_close_time)

vol_open_condition = True

return second_diff,interval_data,std_high,std_low,interval_data_max,interval_data_min,vol_open_condition

return second_diff,interval_data,std_high,std_low,interval_data_max,interval_data_min,vol_open_condition

# interval_data,std_high,std_low,interval_data_max,interval_data_min=vol(22)

#得到所有最高点和最低点,即对应价格区间(x:y)

open_long=False

open_long_number=False

open_short_number=False

open_condition=False

second_diff_satisfy_std=0

interval_data_satisfy_std=0

std_high_satisfy_std=0

std_low_satisfy_std=0

interval_data_max_satisfy_std=0

interval_data_min_satisfy_std=0

# pdb.set_trace()

#79开始

for i in range(91, T - 10):

if not open_condition and vol(i)[6]:

# vol_condition = vol(i)

# vol_condition[6]

open_condition = True

second_diff_satisfy_std=vol(i)[0]

interval_data_satisfy_std=vol(i)[1]

std_high_satisfy_std=vol(i)[2]

std_low_satisfy_std=vol(i)[3]

interval_data_max_satisfy_std=vol(i)[4]

interval_data_min_satisfy_std=vol(i)[5]

#向上突破后回调情况

if open_condition and not open_long_number and not open_short_number and

interval_data_min_satisfy_std<new_data.iloc[i,0]<interval_data_max_satisfy_std and new_data.iloc[i-1,3]>interval_data_max_satisfy_std:

open_price=new_data.iloc[i,0]

# 开多,记录开仓价格,i+2期收盘价

print('买入开仓,开仓价为:{},开仓位为:{}'.format(open_price,i))

mark_enter[i]=1

open_condition=False

open_long_number=True

# 得到向下突破后回调情况

if open_condition and not open_long_number and not open_short_number and

interval_data_min_satisfy_std<new_data.iloc[i, 0]<interval_data_max_satisfy_std and new_data.iloc[i-1,2]<interval_data_min_satisfy_std:

#开空,记录开仓价格,i+2期收盘价

open_price=new_data.iloc[i,0]

print('卖出开仓,开仓价为:{},开仓位为:{}'.format(open_price,i))

print('i:{}'.format(i))

# position_locat[i+3]=2

open_condition=False

open_short_number =True

mark_enter[i] = 1

#得到波动率大于前高的位置z3

if open_condition and std[i-1] > std_high_satisfy_std:

open_condition=False

std_high_satisfy_std=std[i-1]

print('波动率大于前高位置,重置区间,重置点为:{}'.format(i))

#出场

#出场分四种情况,分别是多头(正常出场和止损出场)和空头(正常出场和止损出场)

#多头正常出场

if open_long_number and std[i-3]>0.3*second_diff_satisfy_std and std[i-1]>std[i-2] and std[i-1]>std[i]:

# 平多,记录平仓位置

# m1=i+4

profit_yield = (new_data.iloc[i, 0] - open_price) / open_price

print('正常卖出平仓,平仓价为:{},平仓位为:{}'.format(new_data.iloc[i, 0],i))

profit.append(profit_yield)

open_long_number=False

mark_leave[i] = 1

#多头止损出场

if open_long_number and (new_data.iloc[i,3]>interval_data_max_satisfy_std or new_data.iloc[i,2]<interval_data_min_satisfy_std):

#平多,记录平仓位置

# m2=i

profit_yield = (new_data.iloc[i, 0] - open_price) / open_price

print('止损卖出平仓,平仓价为:{},平仓位为:{}'.format(new_data.iloc[i, 0],i))

profit.append(profit_yield)

open_long_number=False

mark_leave[i] = 1

#空头正常出场

if open_short_number and std[i]>0.3*second_diff_satisfy_std and std[i-1]>std[i-2] and std[i-1]>std[i]:

#平空,记录平仓位置

# m1=i+4

profit_yield = (open_price - new_data.iloc[i, 0]) / open_price

print('正常买入平仓,平仓价为:{},平仓位为:{}'.format(new_data.iloc[i, 0],i))

profit.append(profit_yield)

open_short_number=False

mark_leave[i] = 1

#空头止损出场

if open_short_number and (new_data.iloc[i,3]>interval_data_max_satisfy_std or new_data.iloc[i,2]<interval_data_min_satisfy_std):

#平空,记录平仓位置

# m2=i

profit_yield = (open_price - new_data.iloc[i, 0]) / open_price

print('止损买入平仓,平仓价为:{},平仓位为:{}'.format(new_data.iloc[i, 0],i))

profit.append(profit_yield)

open_short_number=False

mark_leave[i] = 1

#计算sharpe

#计算总回报

total_return=np.expm1(np.log1p(profit).sum())

#计算年化回报

annual_return=(1+total_return)**(365/30)-1

risk_free_rate=0.015

profit_std=np.array(profit).std()

volatility=profit_std*(len(profit)**0.5)

annual_factor=12

annual_volatility=volatility*((annual_factor)**0.5)

sharpe=(annual_return-risk_free_rate)/annual_volatility

# print(total_return,annual_return,std,volatility,annual_volatility,sharpe)

print('夏普比率:{}'.format(sharpe))

#计算最大回撤

#计算

df_cum=np.exp(np.log1p(profit).cumsum())

max_return=np.maximum.accumulate(df_cum)

max_drawdown=((max_return-df_cum)/max_return).max()

print('-----------------')

print('最大回撤: {}'.format(max_drawdown))

#计算盈亏比plr

from collections import Counter

# win_times=Counter(x>0 for x in minute_return)

# loss_times=Counter(x<0 for x in minute_return)

win_times=sum(x>0 for x in profit)

loss_times=sum(x<0 for x in profit)

plr=win_times/loss_times

print('----------------------------')

print('盈利次数:{}'.format(win_times))

print('亏损次数:{}'.format(loss_times))

print('盈亏比:{}'.format(plr))

# #画出净值走势图

fig=plt.figure()

ax1=fig.add_subplot(3,1,1)

ag_close_price,=plt.plot(new_data['close_price'].values,label='close_price')

ag_open_price,=plt.plot(new_data['open_price'].values,label='open_price')

ag_high_price,=plt.plot(new_data['high_price'].values,label='high_price')

ag_low_price,=plt.plot(new_data['low_price'].values,label='low_price')

plt.legend([ag_close_price,ag_open_price,ag_high_price,ag_low_price],['close_price','open_price','high_price','low_price'])

ag_close_price_mark_enter=new_data.iloc[:,0].values.tolist()

ag_close_price_mark_leave=new_data.iloc[:,0].values.tolist()

# print(type(spread),type(spread_mark))

for i in range(0,T):

if mark_enter[i]==0:

ag_close_price_mark_enter[i]=nan

plt.plot(ag_close_price_mark_enter,'*')

for i in range(0,T):

if mark_leave[i]==0:

ag_close_price_mark_leave[i]=nan

plt.plot(ag_close_price_mark_leave,'+')

ax2=fig.add_subplot(3,1,2)

ag_std,=plt.plot(std,label='std')

ag_std_mean,=plt.plot(std_mean,label='std_mean')

plt.legend([ag_std,ag_std_mean],['std','std_mean'])

ax3=fig.add_subplot(3,1,3)

cum_net_worth,=plt.plot(df_cum,label='cum_net_worth')

plt.legend([cum_net_worth],['cum_net_worth'])

plt.show()

pdb.set_trace()

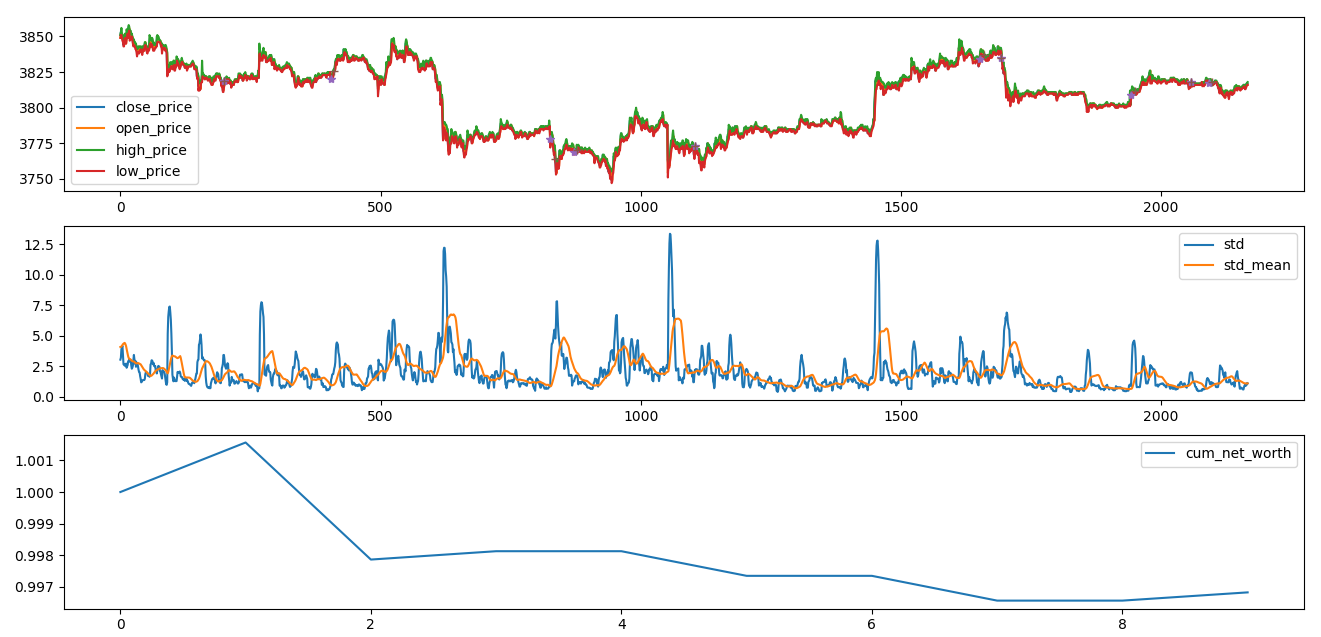

下面为运行结果图: