https://messari.io/article/q2-21-defi-review?referrer=category:defi

A little over a year ago Compound launched its COMP liquidity mining program and changed DeFi forever. With a new mechanism for bootstrapping liquidity in DeFi protocols, the sector has grown orders of magnitude across nearly every metric since. In the process it has not only captured the attention of investors, users, and regulators alike, but also demonstrated to the world clear signs of product market fit.

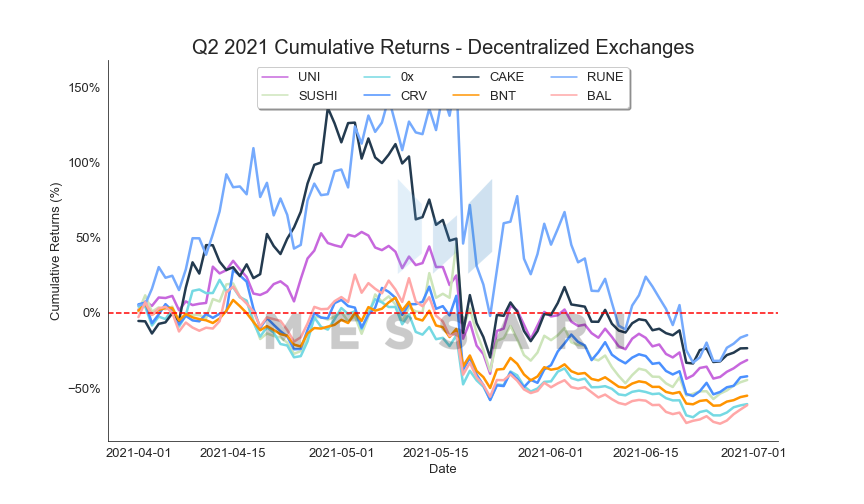

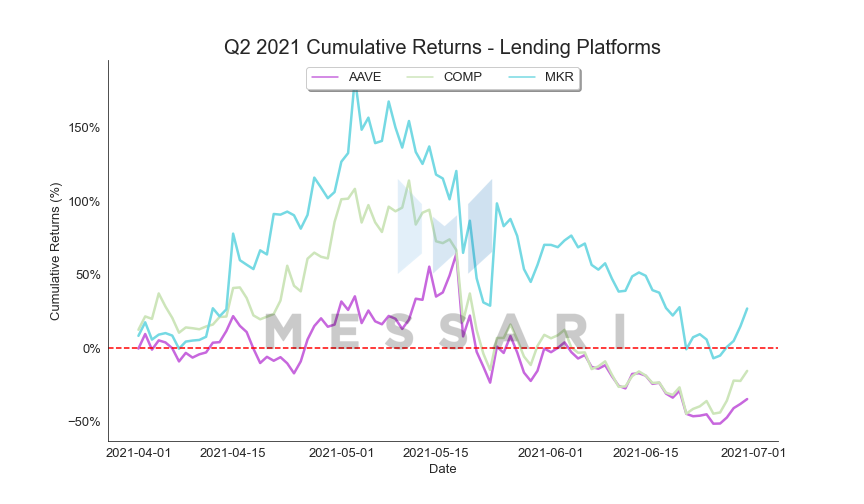

Q2 2021 was a continuation of this momentum with most metrics reaching new all-time highs mid-way through the quarter. However, as broader crypto markets turned, DeFi was not immune. In many cases DeFi protocols saw activity decrease in the second half of the quarter as speculation in markets died down.

But is that all there is to the story?

In this report, we walk you through sector by sector, diving into key performance indicators, market developments, and key things to look out for in the quarters ahead. It was yet again a jam-packed quarter in the world of DeFi, and while asset prices may be depressed, DeFi fundamentals march on, providing the seeds of DeFi’s next leg of growth.

"DeFi is Mankind's Tower of Babel. We have rebuilt money as a language... a computer language that all cultures across all lands can speak. And now that all of our brilliance, greed, and ideals can be unified into one system, the system's growth will be unparalleled. The next 1-2 years will reverberate for decades and possibly centuries'' - Redphonecrypto

Decentralized Exchanges

Decentralized Exchange Landscape

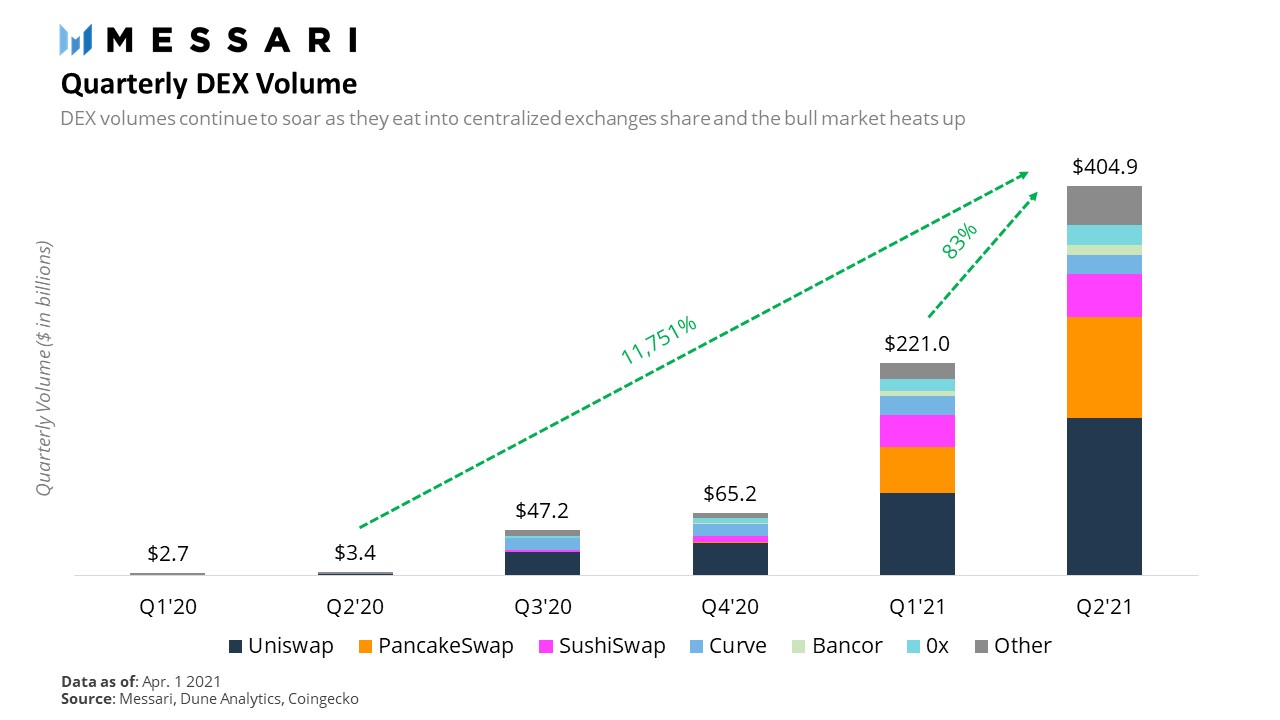

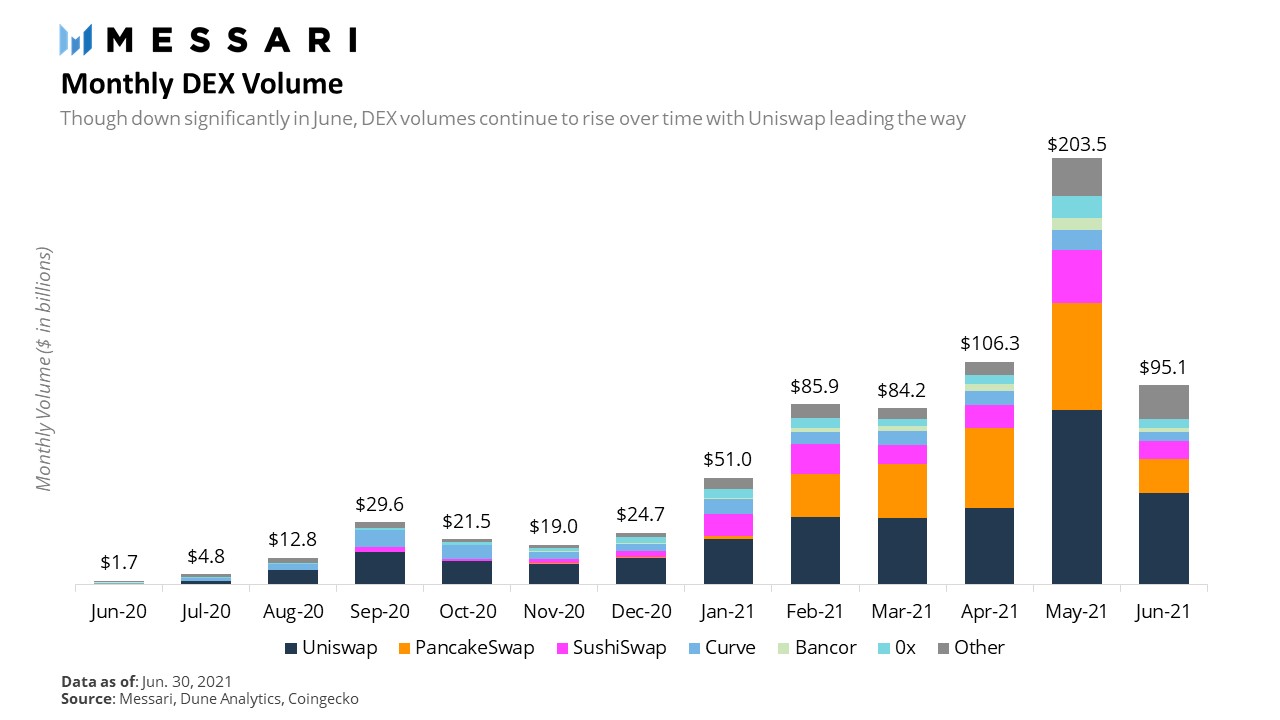

DEX volumes continued their explosive growth in Q2 reaching $405 billion in the quarter – good for a 117x increase year-over-year and 83% increase since Q1. May alone accounted for over half the volume in the quarter, which unsurprisingly also marked the local top of the market.

Since May, DEX volumes have halved, with June volumes falling to $95 billion. Still despite the decrease, the month was still the third highest all-time.

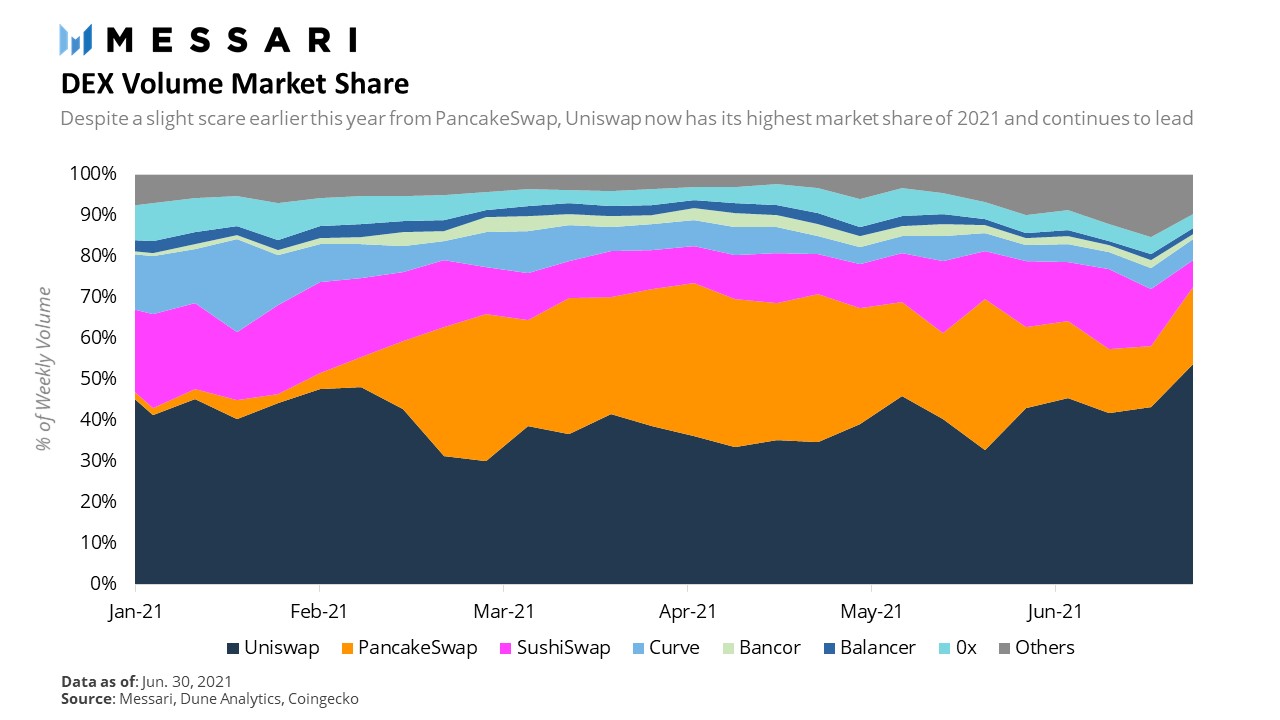

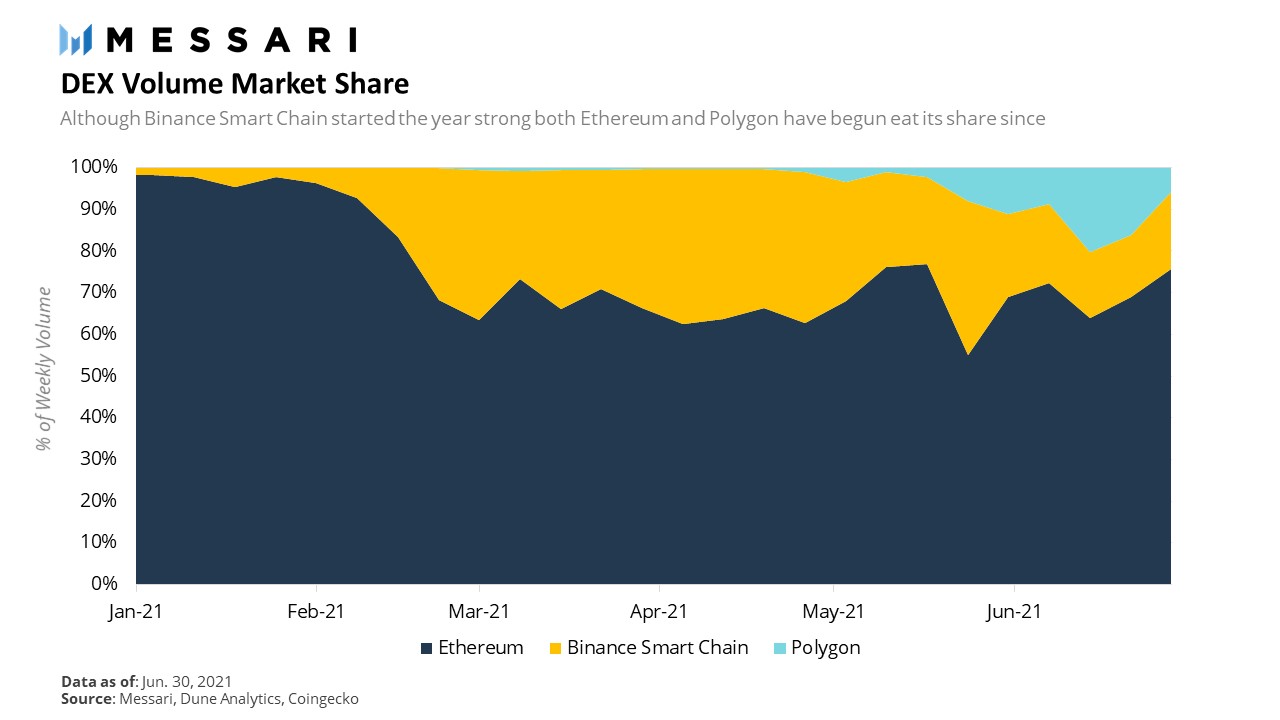

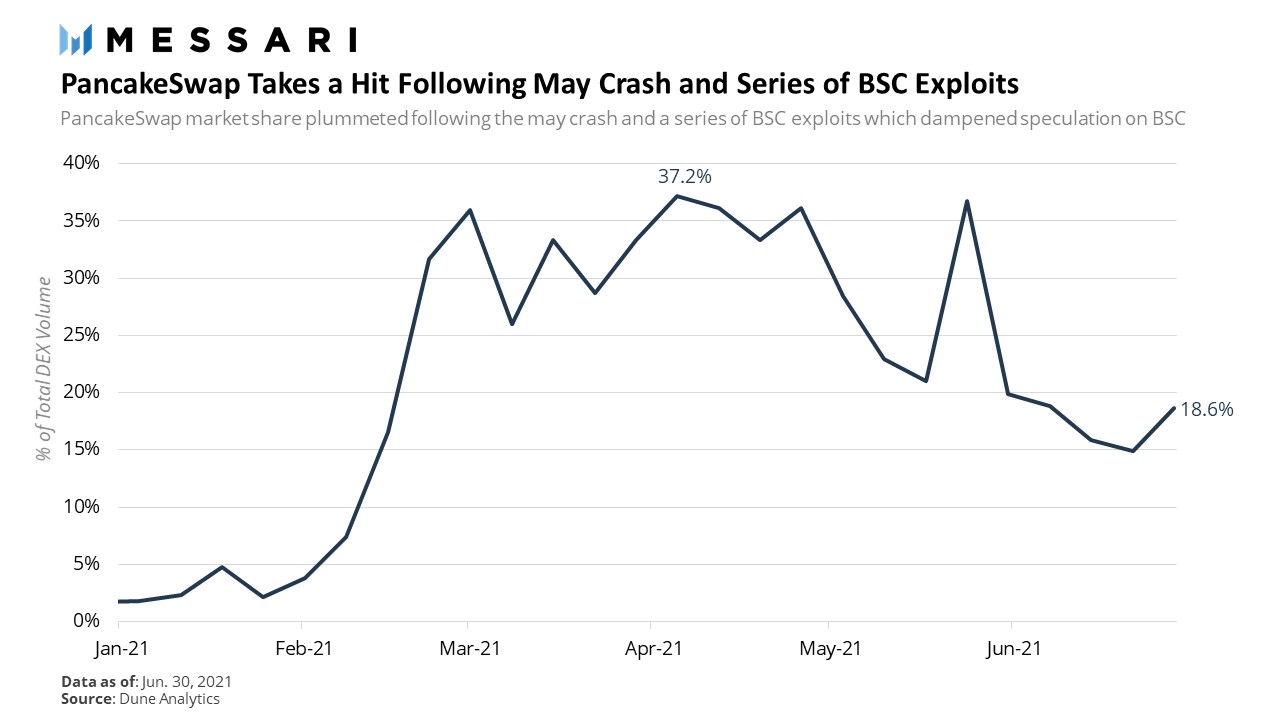

Zooming in on how the competitive landscape evolved throughout the quarter we see a pretty dramatic shift in PancakeSwap’s standing. While for a brief moment in April the breakfast themed DEX flipped Uniswap in volumes, since then its market share has plummeted due to the rise of Uniswap V3 and the fizzling out of the Binance Smart Chain Ecosystem following the May crash. By the end of the quarter Uniswap reached a 54% share of weekly volume, its highest level since November 2020.

The rise of Polygon also played a significant role in eating away Binance Smart Chain’s (BSC) share of decentralized exchange volumes. As the party shifted towards Polygon, with its new set of tokens to speculate on and farms to harvest, BSC was squeezed out of the picture. The activity provided a great glimpse into the developing liquidity wars between blockchains, showing that when token incentives are the primary reason why capital enters a blockchain ecosystem, it will also be the primary reason capital leaves when incentives fall or incentives are more attractive elsewhere.

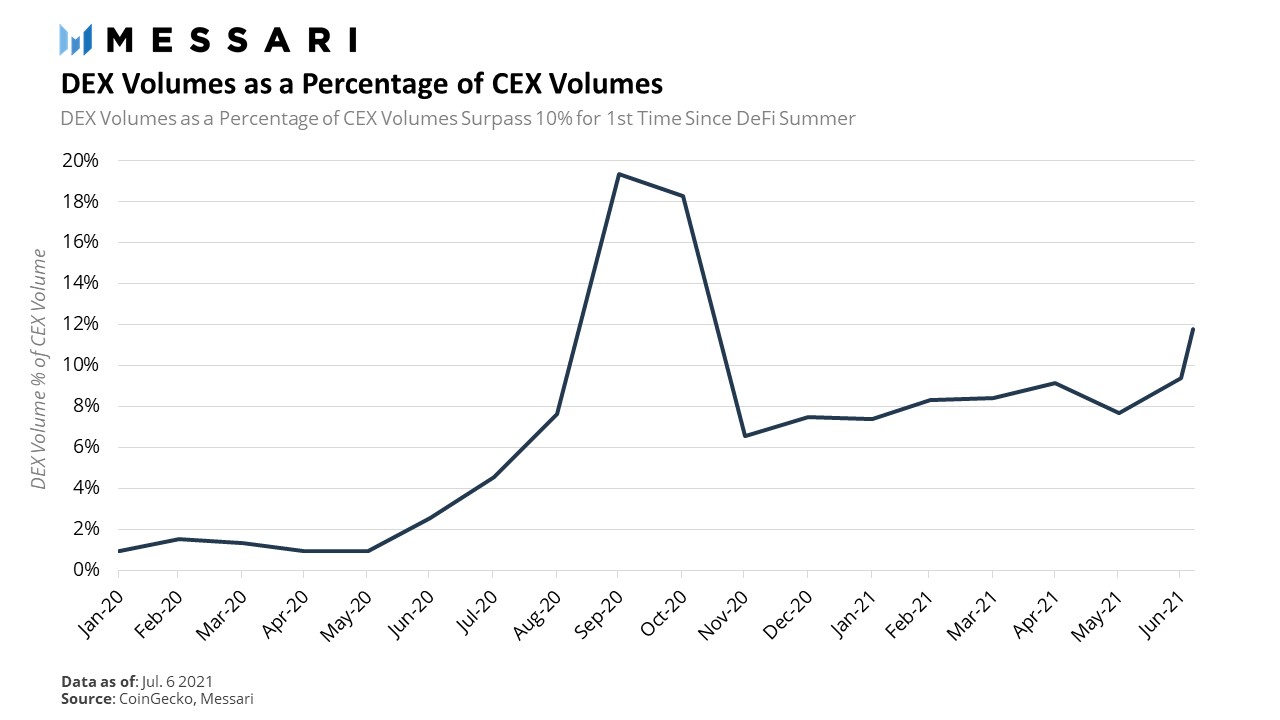

Finally, zooming out on the larger picture for DEXs, volumes as a percentage of centralized exchange (CEX) volumes surpassed 10% for the first time since October 2020. The data continues to show DEXs eating their centralized counterparts as time passes.

Q2 Developments

Uniswap V3 Becomes the Top DEX

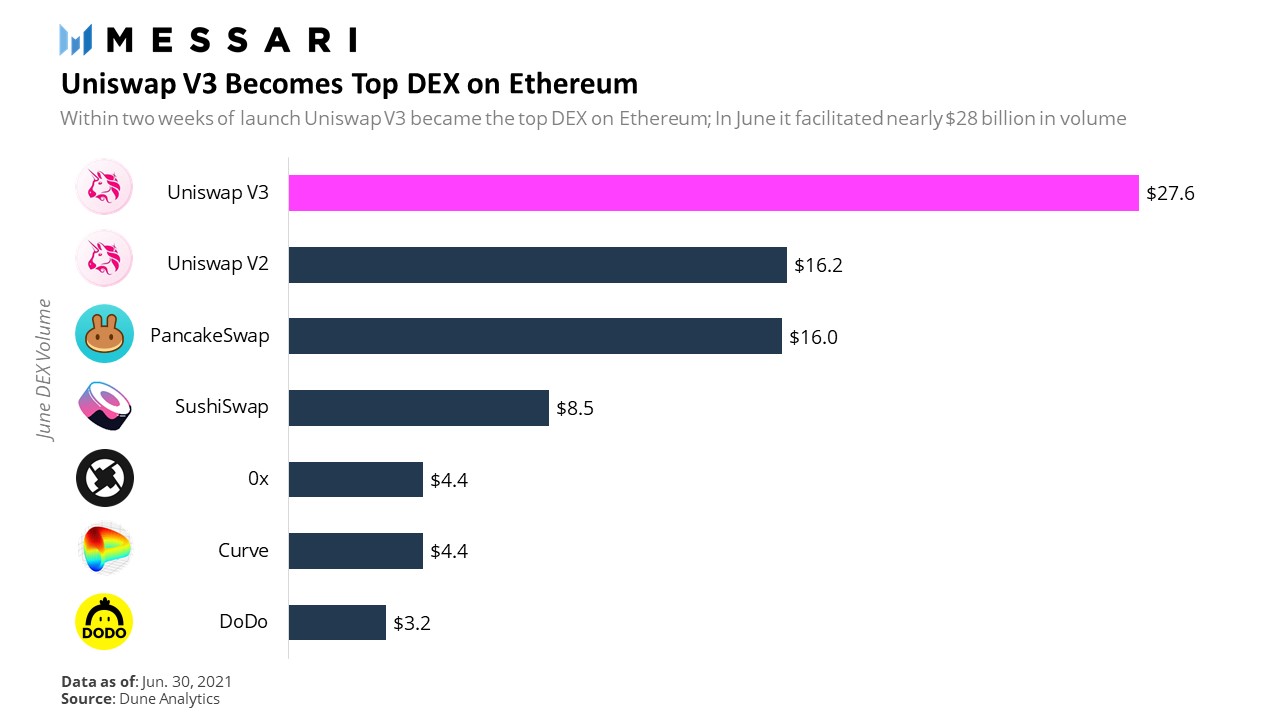

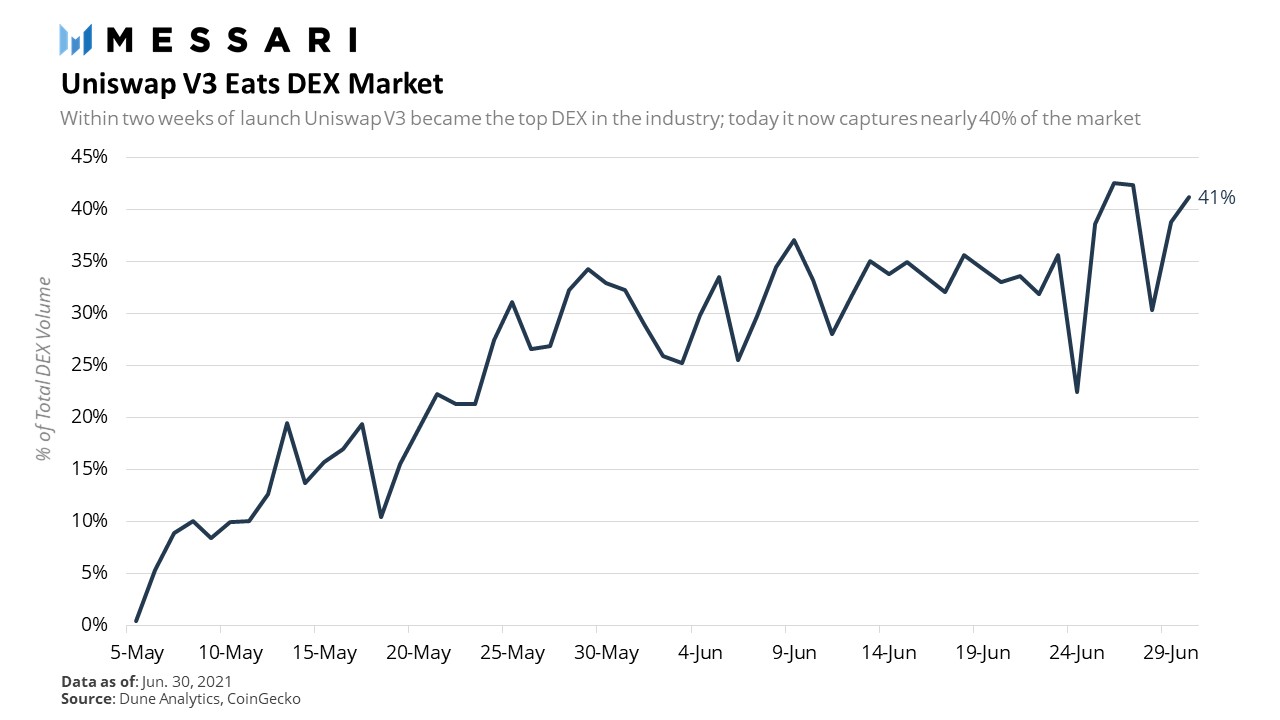

In May Uniswap finally launched its highly anticipated Uniswap V3 protocol, with its crown feature of concentrated liquidity - the ability for liquidity providers (LPs) to make markets within customized price ranges, creating individual price curves in the process. The design promised to increase capital efficiency for LPs by as much as 4,000x by enabling LPs to provide the same liquidity depth as V2 within specified price ranges while leaving far less capital sitting idly. Within just weeks it became the top DEX in the industry and in June it facilitated nearly $28 billion in volume.

Uniswap V3 now accounts for more than 40% of all DEX volume and continues to eat the DEX market, showing no signs of slowing down.

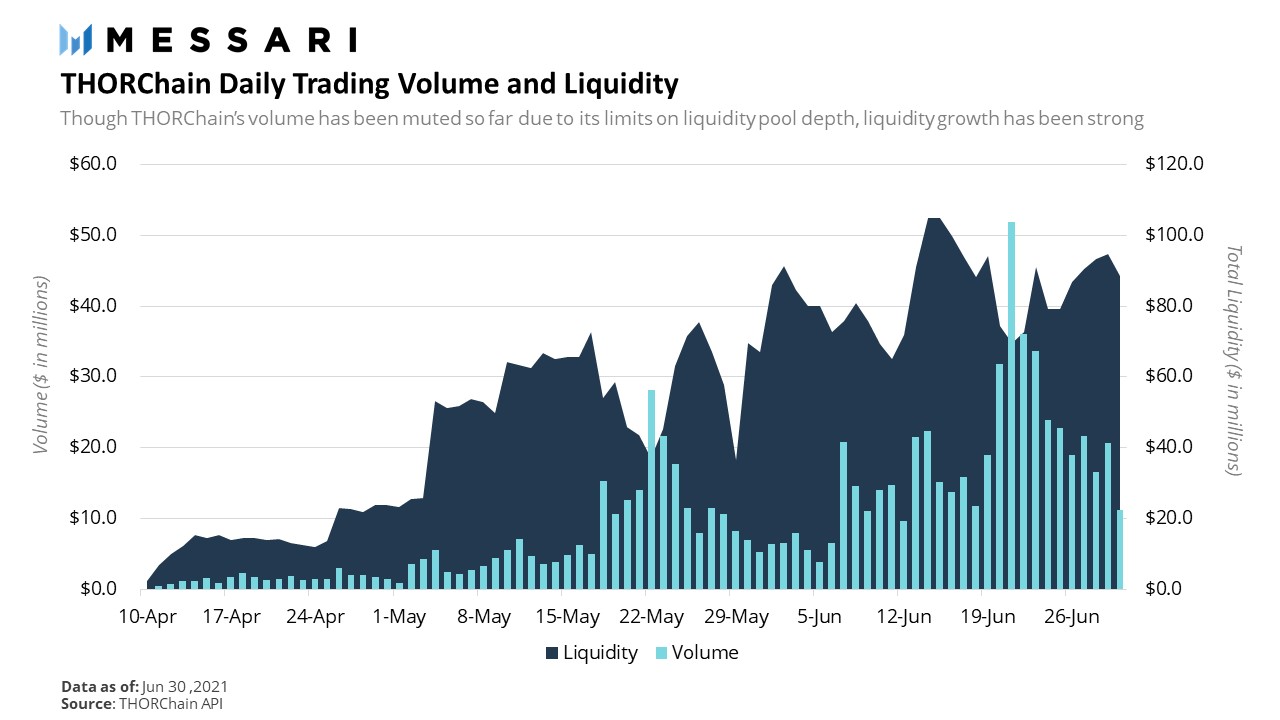

THORChain Launches Multichain Chaosnet

After more than two years of development and multiple delays, the cross-chain liquidity protocol THORChain finally went live in the first week of Q2. It is currently rolling out in a guarded launch, with the community progressively raising caps on liquidity pools as the network grows, proves out its security, and works through bugs. It currently supports five blockchains including Bitcoin, Etherum, Binance Chain, Bitcoin Cash, and Litecoin, with plans to connect with many more in the coming months. While volume so far has been muted due to the self-imposed caps on its pools, liquidity has grown in lockstep with cap raises showing clear market demand to provide cross-chain liquidity. With it increasingly becoming clear that we’re heading into a multi-chain future blockains like THORChain provide the much needed infrastructure to move value between blockchains without trusted third parties.

PancakeSwap Fizzles Out

The BSC ecosystem was hit the worst following the May market crash with TVL falling more than 50% from its peak in a matter of days. Although TVL across all smart contract platforms contracted, BSC’s was particularly hurt given most of the value locked in its applications was mercenary capital and consisted of assets that had little use outside of incentivizing user speculation. Unlike Ethereum’s TVL, which has a healthy dose of stablecoins in the mix, the composition of BSC’s TVL was heavily skewed towards the higher end of the risk spectrum making it extremely sensitive to market swings. Combined with a series of hacks and exploits on BSC leading to hundreds of millions of dollars in losses, BSC saw speculation dry up dramatically in June leading to PancakeSwap volumes diving 69% in June. Its market share also plummeted in lockstep.

Looking Forward

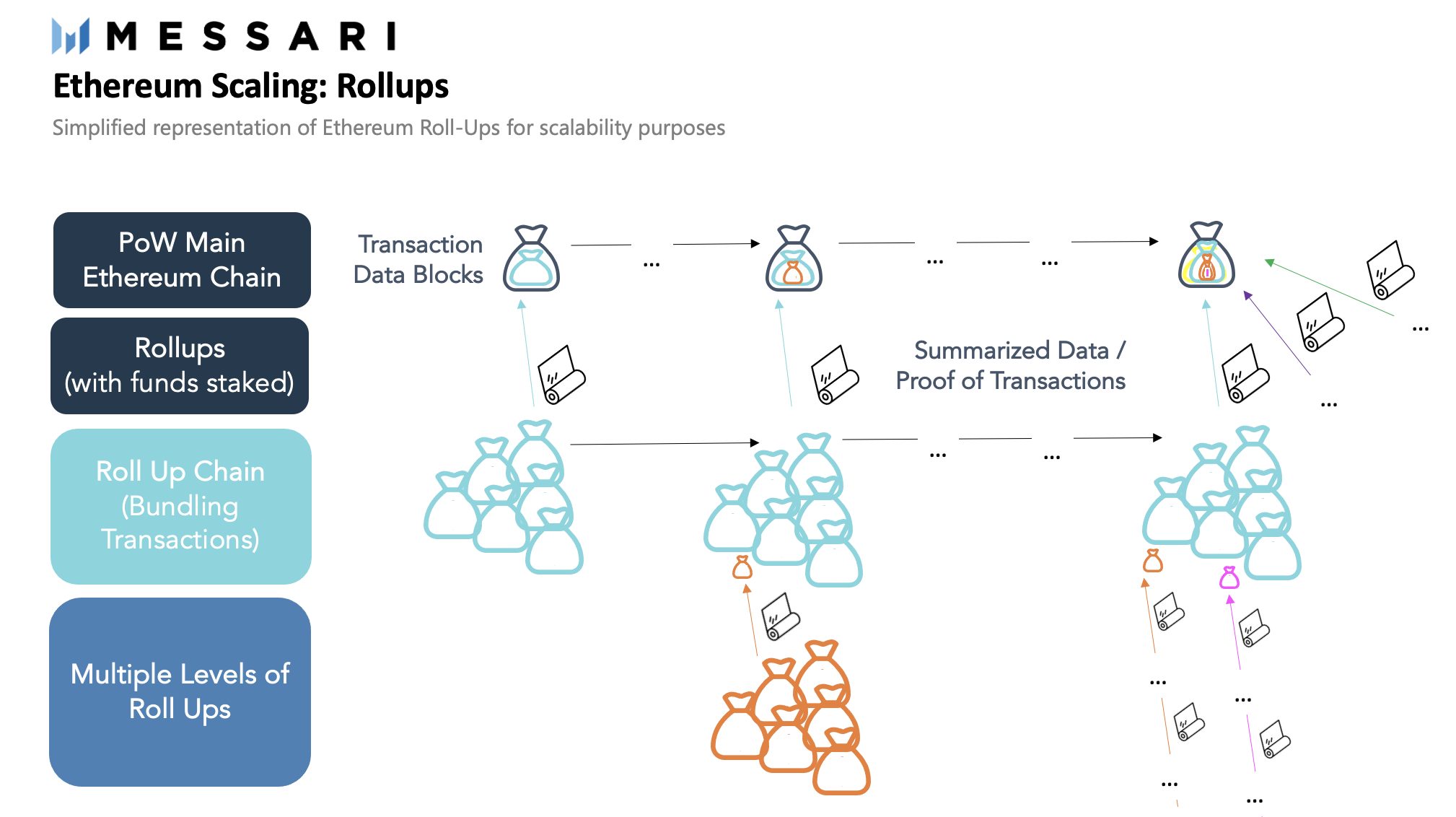

Rolling Up

A common theme for all DeFi sectors moving forward will be the launch of layer-2 scaling solutions on Ethereum that promise to scale DeFi by orders of magnitude without compromising on security. The most anticipated launches of these solutions are optimistic rollups which allow thousands of transactions to be bundled into a single rollup block. The leading solutions are Arbitrum and Optimism which are set to launch in Q3.

DEXs in particular will benefit from scaling by no longer having to operate in a severely compute constrained environment, allowing them to focus more on capital efficiency. Uniswap V3 is the best example of this design philosophy. Although still an AMM, it has begun to approximate more of an order book in pursuit of capital efficiency. With Uniswap V3’s early success, there will be many potential activities unlocked through this scalability, and the recent uptick in activity on Polygon provides a glimpse of the emerging future for layer-2s adoption.

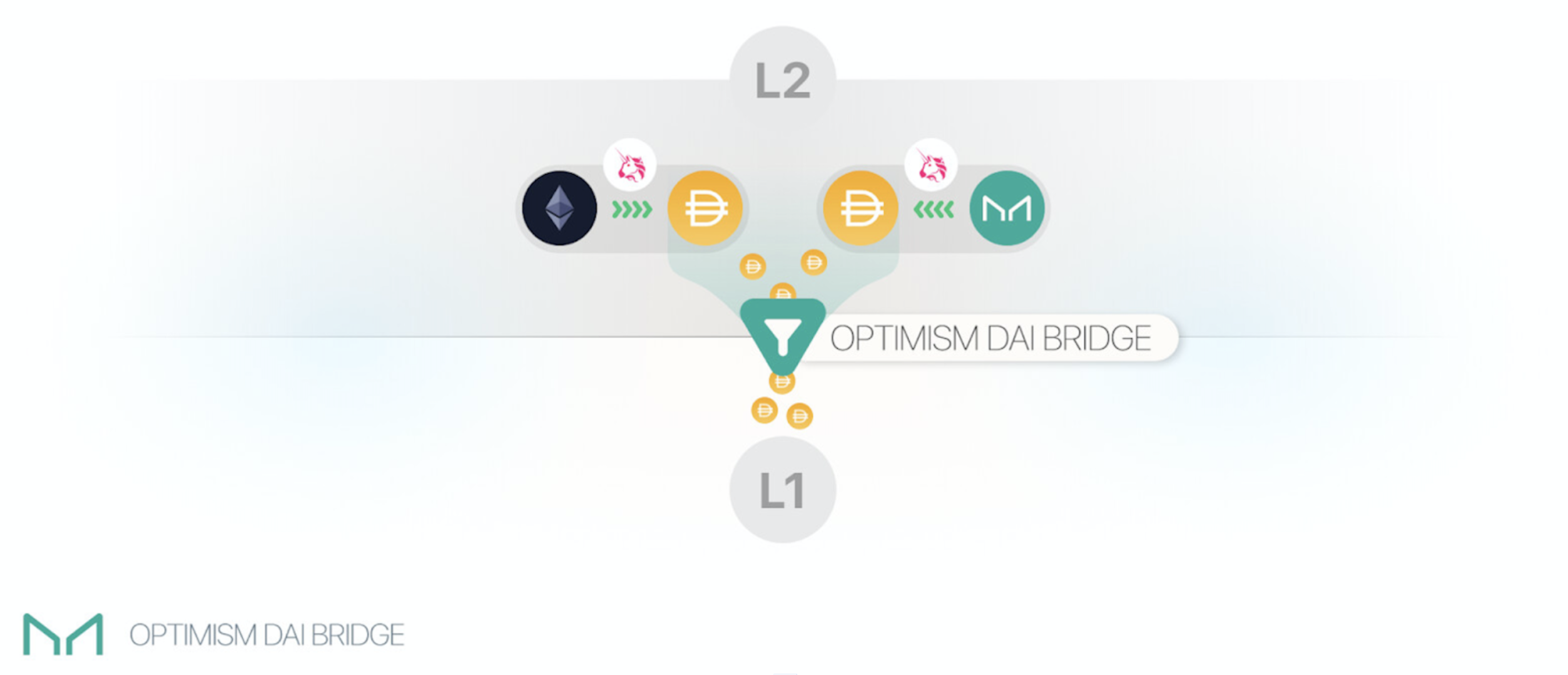

Cross-Chain Liquidity

One of the outstanding questions surrounding Ethereum’s rollup-centric future is around the battle between L2 <> L1 and L2 <> L2 liquidity. As it stands today, users face long withdrawal periods when withdrawing liquidity from rollups to Ethereum, and have no way to move liquidity between rollups without first withdrawing to Ethereum. There are a number of proposed solutions including MakerDAO’s Optimism Dai Bridge which will allow users to lock up L1 DAI to mint L2 oDAI. Once fast withdrawals are enabled later this year, oDAI may be burned in exchange for near-instant access to L1 DAI allowing users to escape the one week lockup period associated with Optimism.

Source: MakerDAO Blog

As for more generalized solutions, Connext and Hop Protocol offer users the ability to move value between various L2s using a network of nodes to front liquidity to users on their destination chains. They promise to allow users to cheaply and quickly move value between L2s without sacrificing on security as well as allowing users to forgo long and expensive L1 transactions. While these protocols are very much in their early stages, they will no doubt play a key role in Ethereum’s rollup-centric future.

Lending Platforms

Lending Landscape

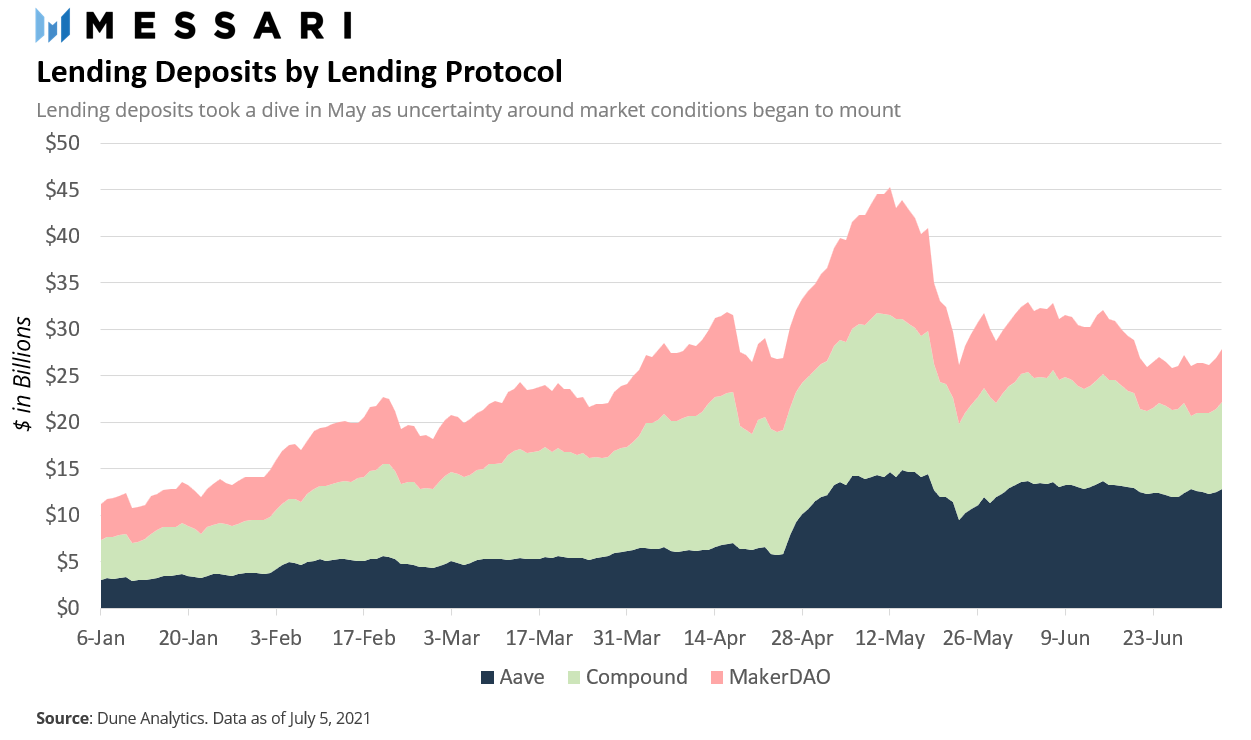

After a booming Q1, the lending sector found itself cooling off during Q2. The first half of the quarter, however, was a continuation of the momentum from the previous quarter. From March up until the May crash lending deposits ballooned from $25 billion to a peak of $45 billion (an 81% jump in just six weeks) as investors sought to capture the exorbitant lending yields available across all lending protocols. However, the party came to a sudden halt as the market turned belly up. Motivated by the mounting market turbulence, investors flocked to safer assets triggering a collapse in lending deposits which completely erased the previous week’s growth. In the end, the total amount of assets locked across the major lending platforms increased a mere 15% quarter-over-quarter.

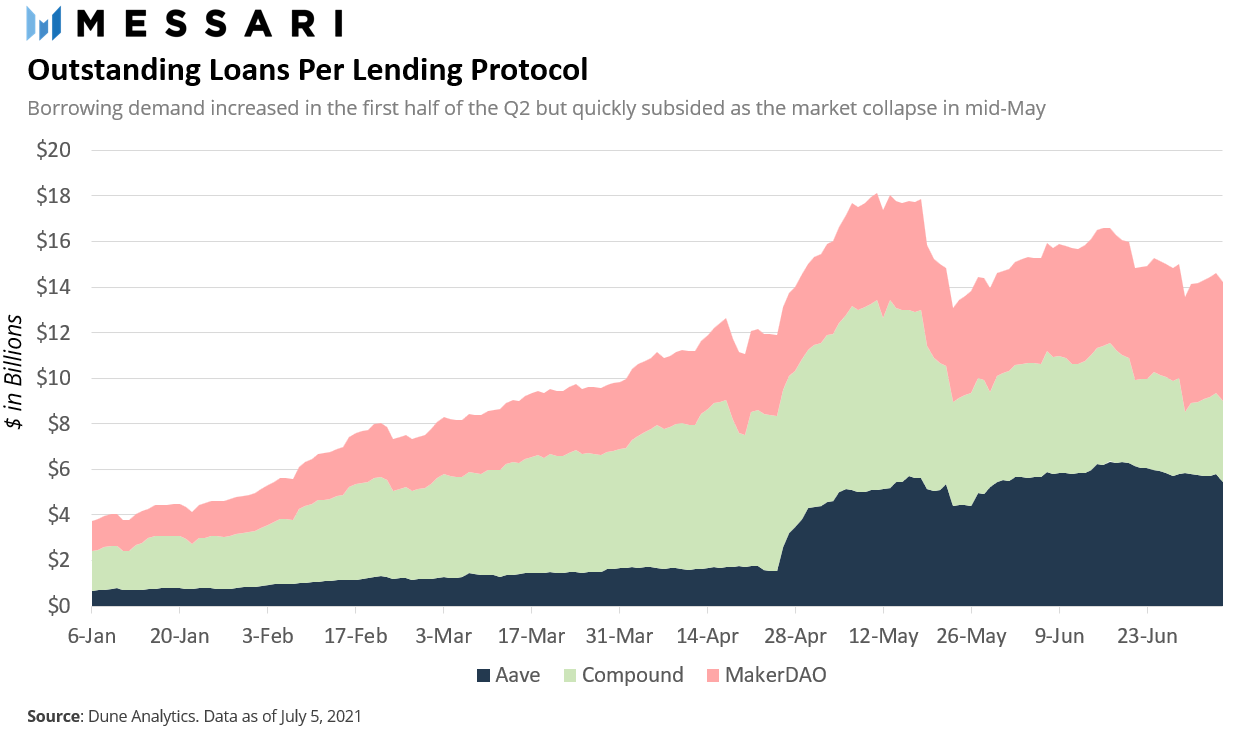

Unsurprisingly, the number of outstanding loans followed a similar pattern. During the first six weeks of Q2, the total amount of outstanding loans increased 62%. However, unlike lending deposits, the decline following the market crash was not as drastic. In total, the collapse amounted only to $4 billion, or 21% from the top, in the following ten days. By the end of the quarter, the aggregate amount of outstanding loans increased approximately 44% over the quarter.

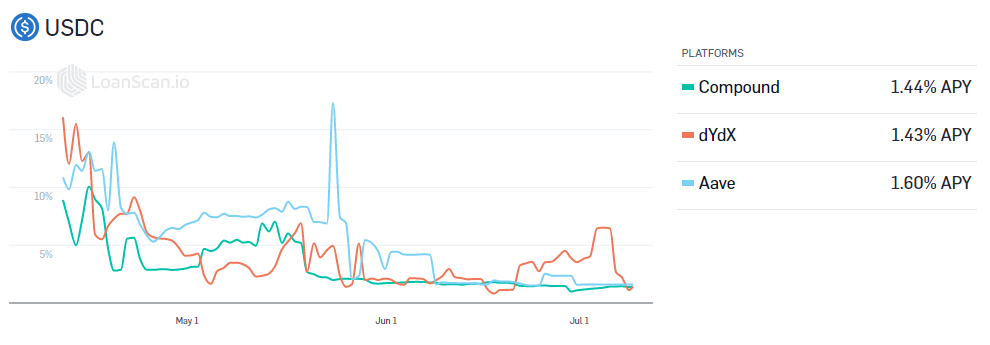

Additionally, supply yields across all lending platforms collapsed as investor’s borrowing demand dwindled. In the span of three months, lending rates for stablecoins, in particular USDC, dropped nearly 85% from an average rate of 9.6% to 1.4%.

Source: LoanScan

Q2 Developments

Aave Joins The Multi-Chain World

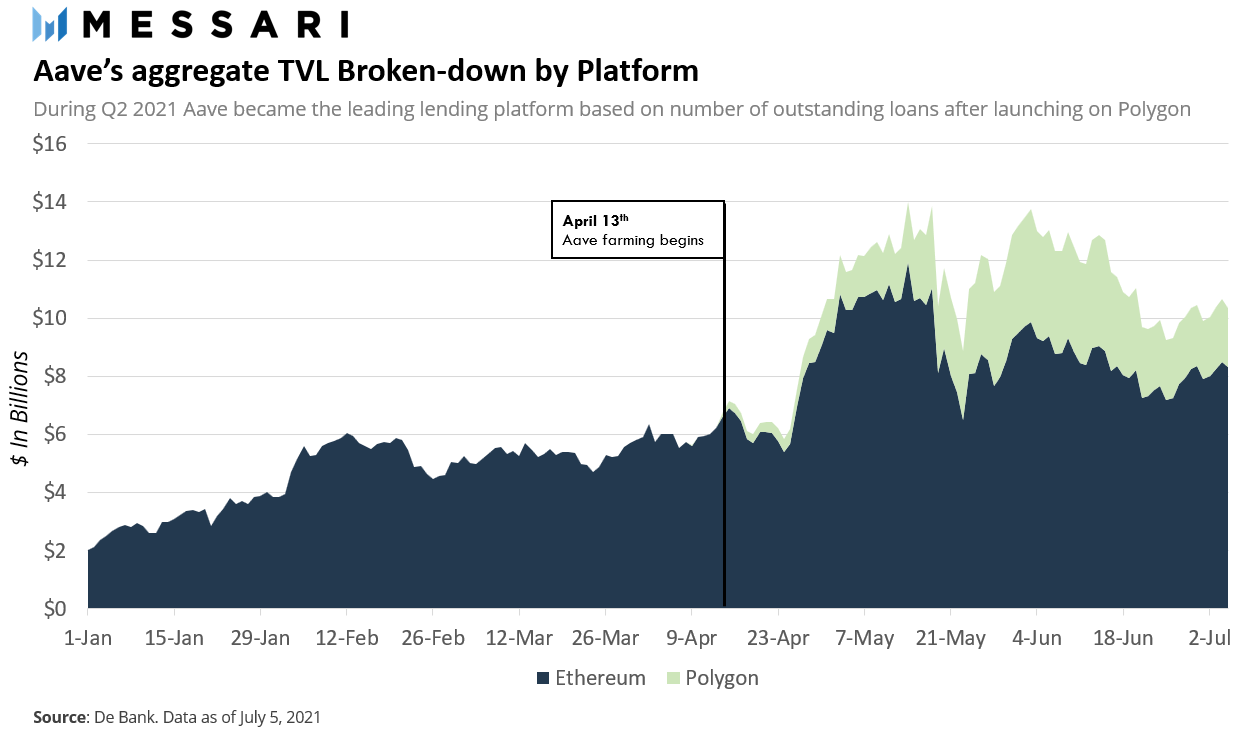

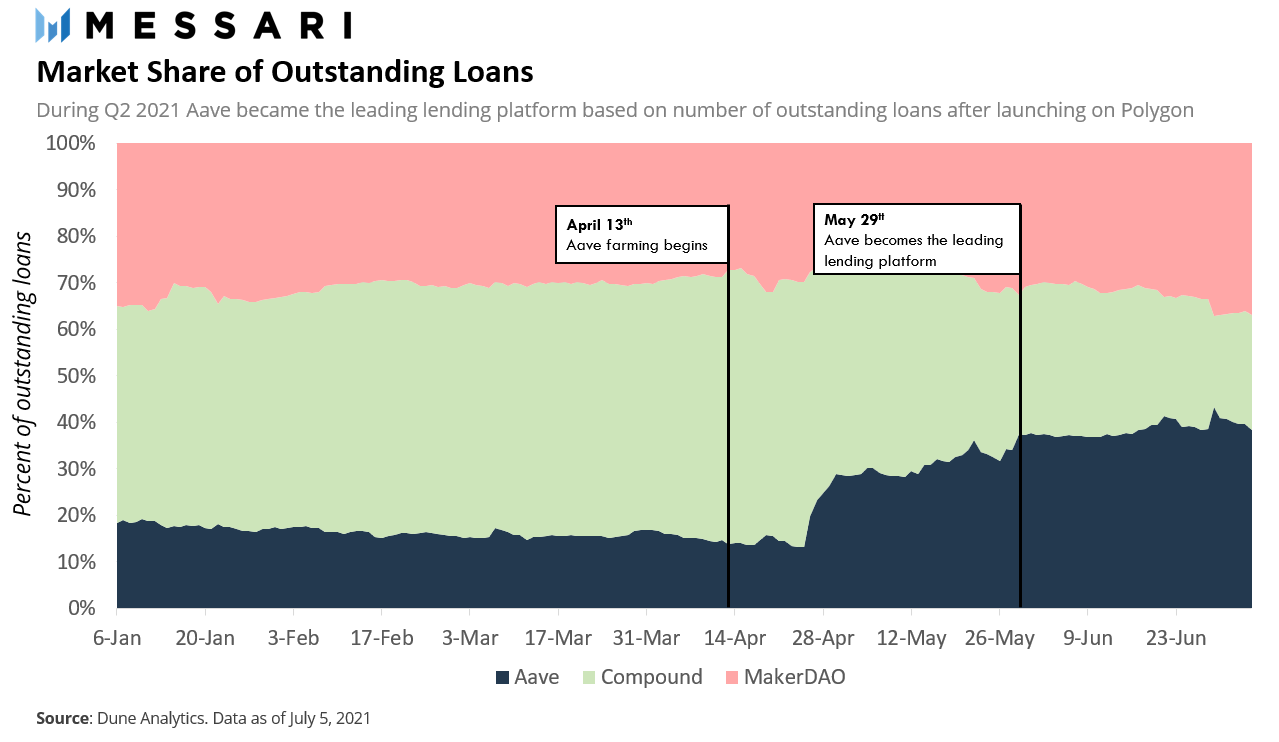

Towards the end of the first quarter of 2021, Aave announced the launch of its Polygon branch in an effort to escape Ethereum’s high fee environment. Following the announcement, Polygon and Aave teamed up to offer early users liquidity mining incentives to incentivize usage as part of Polygon’s DeFiForAll campaign. The program turned out to be a resounding success causing Aave’s TVL to double from $6 billion to $12 billion within two weeks of the announcement.

Propelled by the Polygon launch and the heavy token incentives, Aave’s market share of total outstanding loans spiked in April giving Compound a run for its money. By the end of May, Aave dethroned Compound to become the leading lending platform capturing over 37% of DeFi’s aggregate lending market.

Bridging the Gap Between Crypto and Traditional Banking - Compound Treasury

At the end of the quarter, Compound Labs announced the launch of Compound Treasury, a product designed for non-crypto businesses and financial institutions that wish to tap into crypto’s interest rate markets. The company partnered with Fireblocks and Circle to create a product that allows organizations to access the USDC interest rates available on Compound without needing to worry about crypto-related intricacies such as private key management and crypto-to-fiat conversions. The product guarantees a fixed interest rate of 4% per year on deposits - an astronomical amount compared to the average U.S. saving account.

Looking Forward

Laying the Lending Foundation For The Multi-Chain World - Compound Gateway

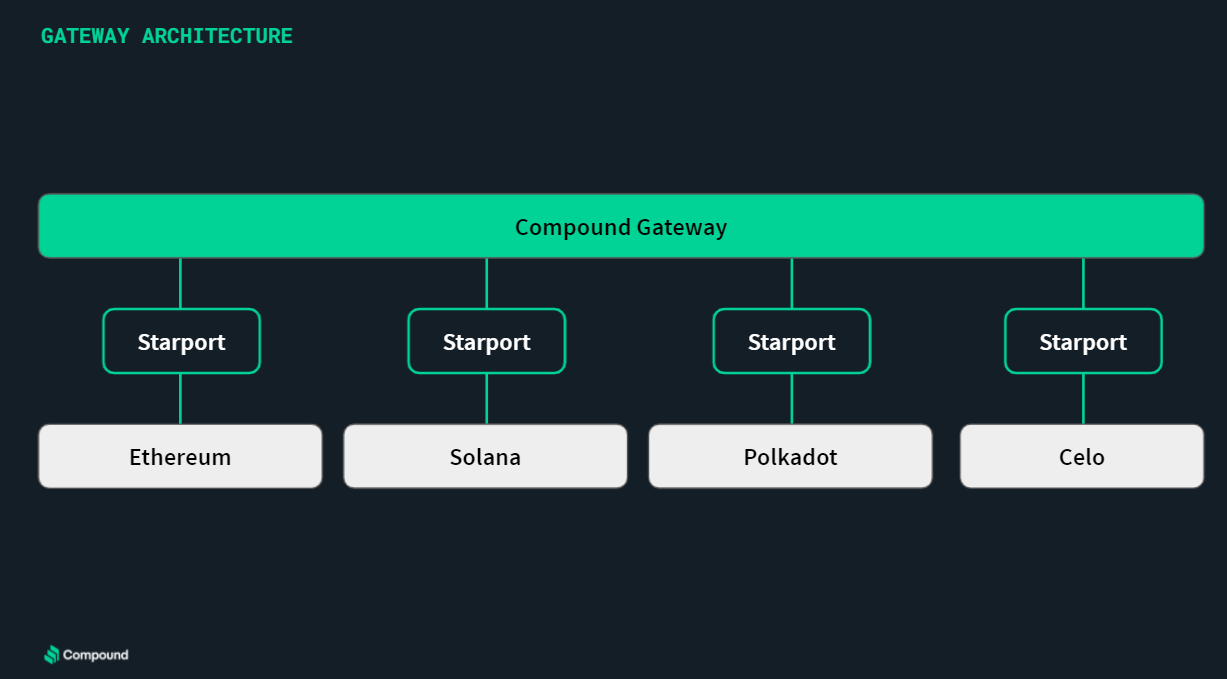

As a multi-chain future becomes increasingly apparent, incumbent lending protocols have begun to explore solutions to adapt to this new way of operating. Compound’s approach revolves around the release of a stand-alone blockchain called Compound Gateway as a way to embrace this emerging paradigm. Gateway is a Substrate based blockchain intending to serve as the infrastructure for cross-chain interest rate markets. Similar to THORChain’s THORFi lending feature (set to launch later this year), Gateway’s goal is to provide users with the ability to borrow assets native to one chain (i.e Ethereum) with collateral from a different chain (i.e Solana).

In a nutshell, Gateway enables blockchain interoperability by using a type of connector contract called Startport as the core mechanism to connect and transfer value between different chains. Starports exist as contracts on peer ledgers (such as an Ethereum smart contract) and have the ability to lock assets until they are released by a Gateway validator node.

Source: Compound

As of March 1st, Gateway is running as a testnet, connected to Ethereum’s Ropsten testnet.

DeFi’s New Frontier - Fixed Income Markets

While the fixed income space is still a nascent niche in DeFi, it is an enormous market in the traditional world. In this context, a fixed income product refers to any instrument that generates a steady and predictable stream of cash flows such as corporate bonds, treasury bills, and fixed-income mutual funds. The concept of fixed rates is a relatively new and unexplored field in DeFi where variable interest rates offered by protocols like Aave and Compound are the norm.

As of today, the fixed income landscape can be broadly defined in three different categories:

-

Securitization and Tranching

-

Fixed-Rate Lending and Borrowing

-

Interest Rate Swaps

Securitization and Tranching protocols were the first ones to hit the market. At a high level, applications such as Saffron Finance and BarnBridge aggregate variable yields from distinct lending protocols to create separate risk tranches each one with a different risk/return profile allowing users to customize their exposure to yields. Before risk-tranching protocols were around, users faced an all-or-nothing scenario. They either incurred 100% of the risk of lending/providing liquidity or none by staying out of the game. With risk-tranching protocols, DeFi users now have a spectrum of risk options available instead of a simple binary option.

The second wave of fixed income protocols that entered the space were fixed rate lending and borrowing applications. Unlike Aave and Compound, which primarily offer variable interest rates, protocols like Yield and Notional enable users to borrow and lend at fixed rates over a predetermined time horizon. These protocols don’t expose users to interest rate volatility making it easy to plan ahead and properly hedge risk when lending and borrowing.

The third and most recent kind of fixed income applications in DeFi are interest rate swap protocols. At their core, these protocols take interest-bearing tokens (like aTokens and cTokens) and separate them into a principal component and a yield component. Given the variable nature of interest-bearing tokens, the value of the yield component fluctuates over time while the value of the principal component stays the same. The result is the creation of interest rate markets that allow users to speculate on the future state of yields. Protocols such as Pendle, Element, and Swivel are at the forefront of the interest-rate derivatives space.

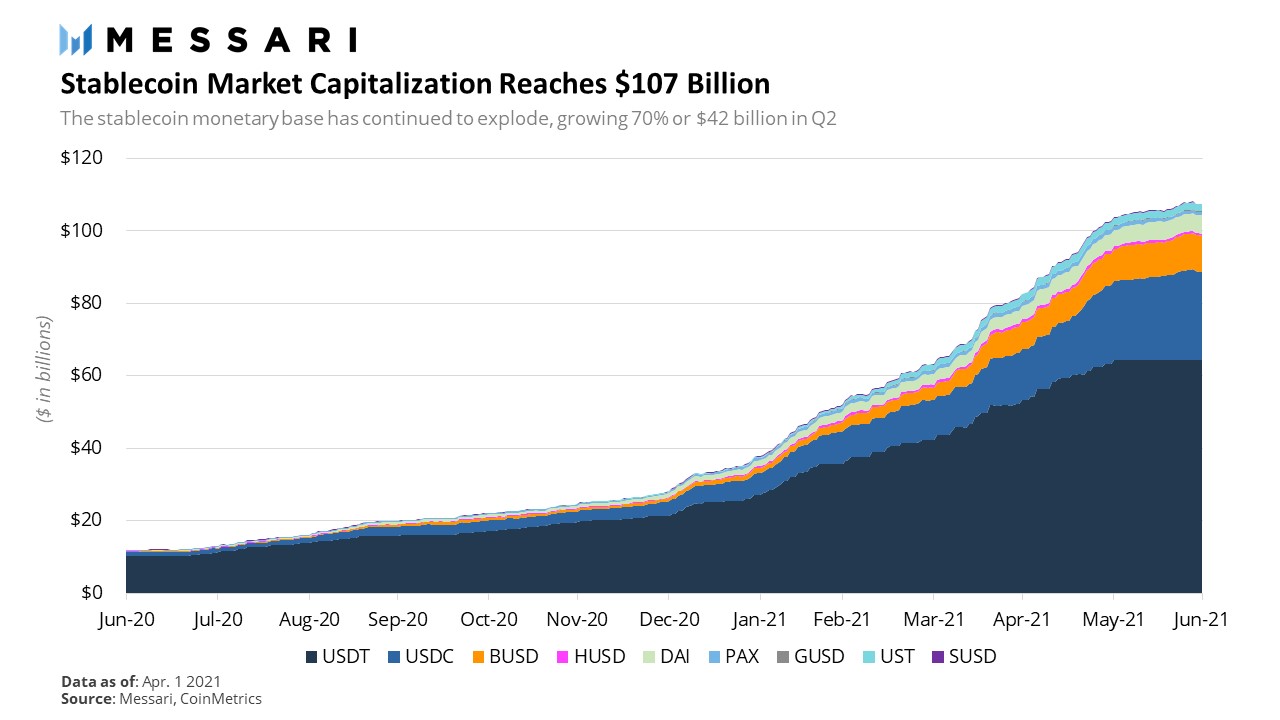

Stablecoins

The stablecoins story continues to rhyme each subsequent quarter – climbing up and to the right. Q2 was no different. In Q2 2021 the stablecoin monetary base reached over $107 billion, up 70% since Q1 and 803% year-over-year.

Stablecoins continue to be adopted for a number of reasons:

-

They’re easy to accept as payments given that all you need is an address on a public blockchain

-

They run on global public infrastructure that operates 24/7/365 which makes them incredibly available and reliable

-

They offer users stronger autonomy, privacy, and interoperability qualities than existing payments solutions which require KYC and often restrict access

-

They’re programmable which allows for developers to trivially build with them and deploy applications with global distribution and instant access to capital

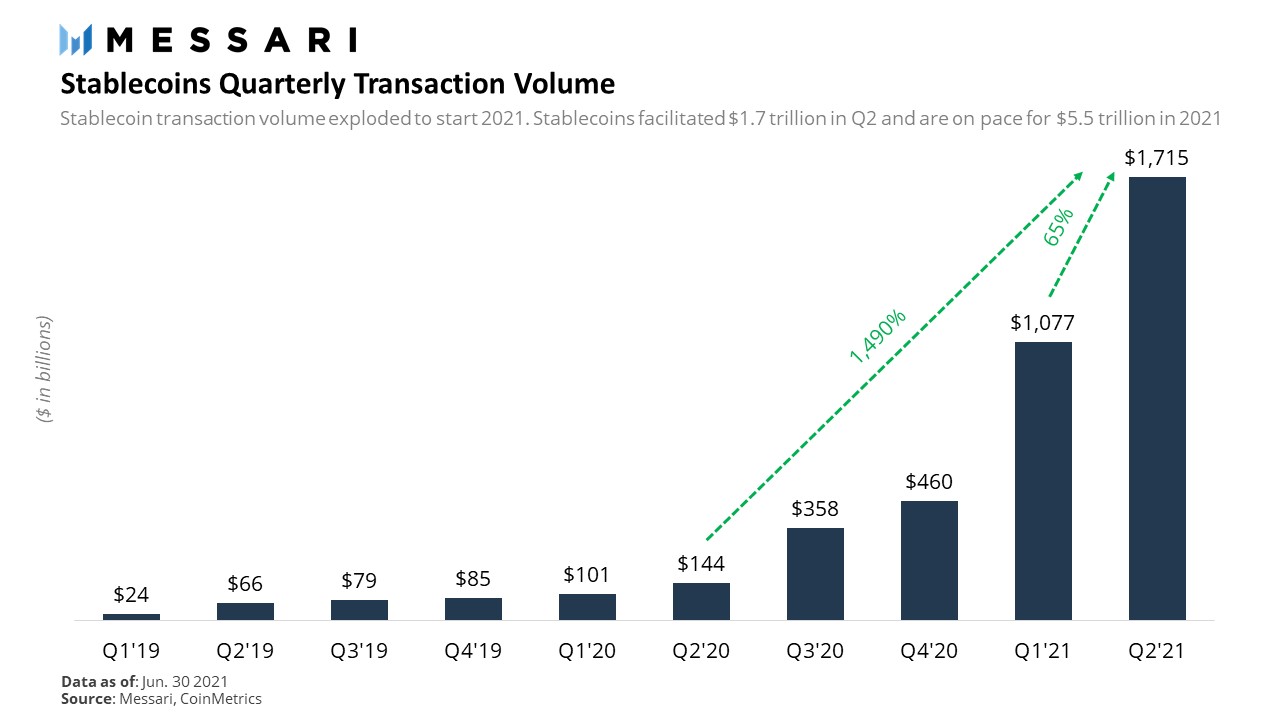

In this quarter stablecoins facilitated an impressive $1.7 trillion in transaction volume, up 1,090% year-over-year and 59% since Q1.

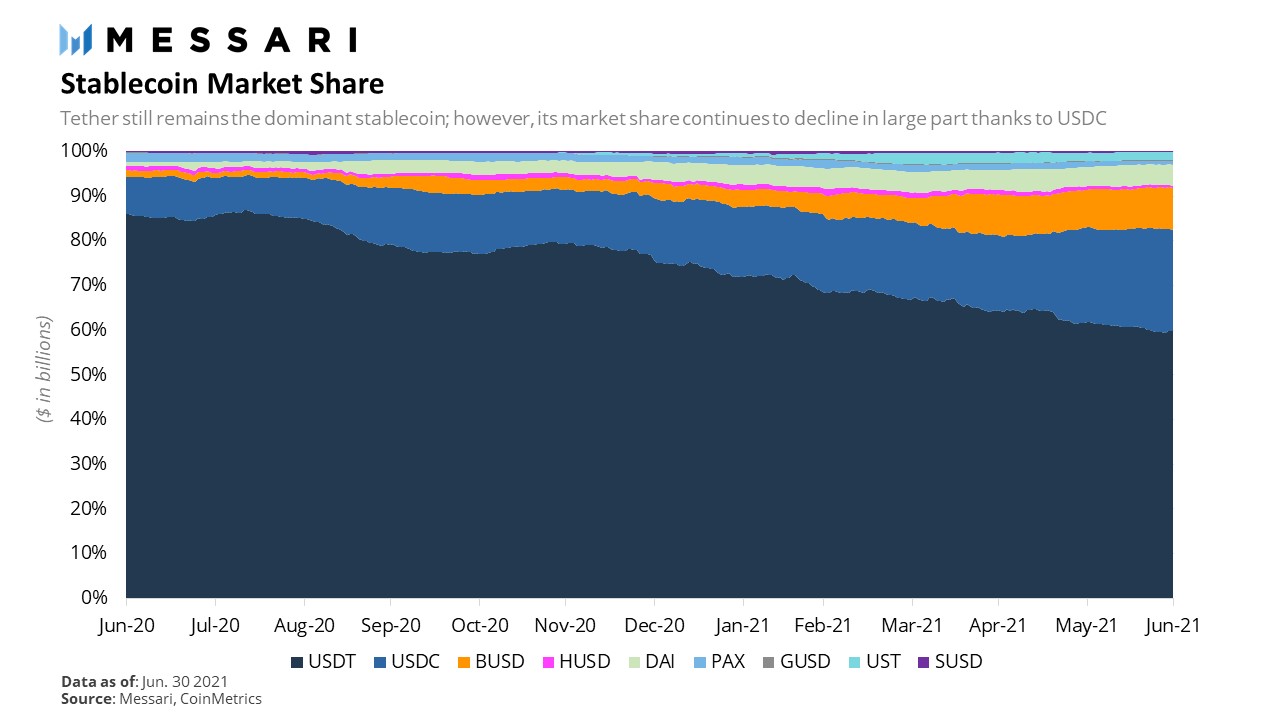

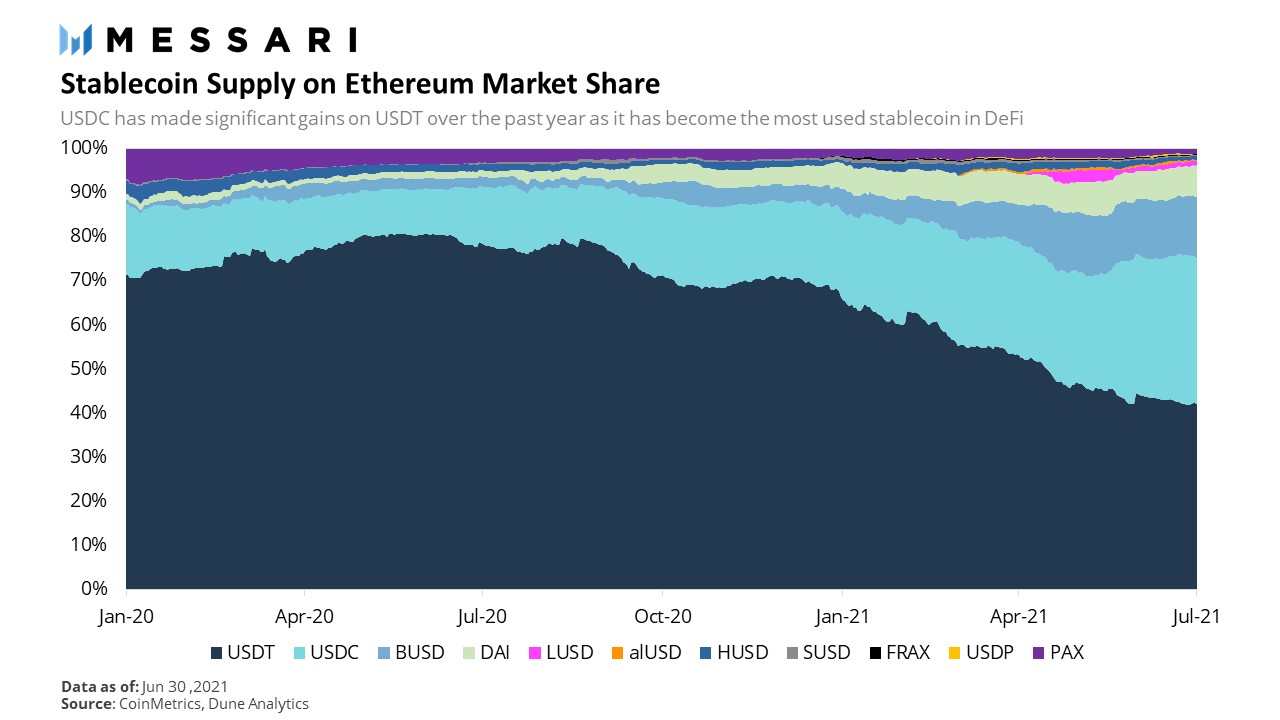

The biggest winners this quarter were USDC, BUSD, and DAI which grew their share to 23%, 9%, and 5%, respectively. Although USDT is still king, its dominance is gradually fading as time passes.

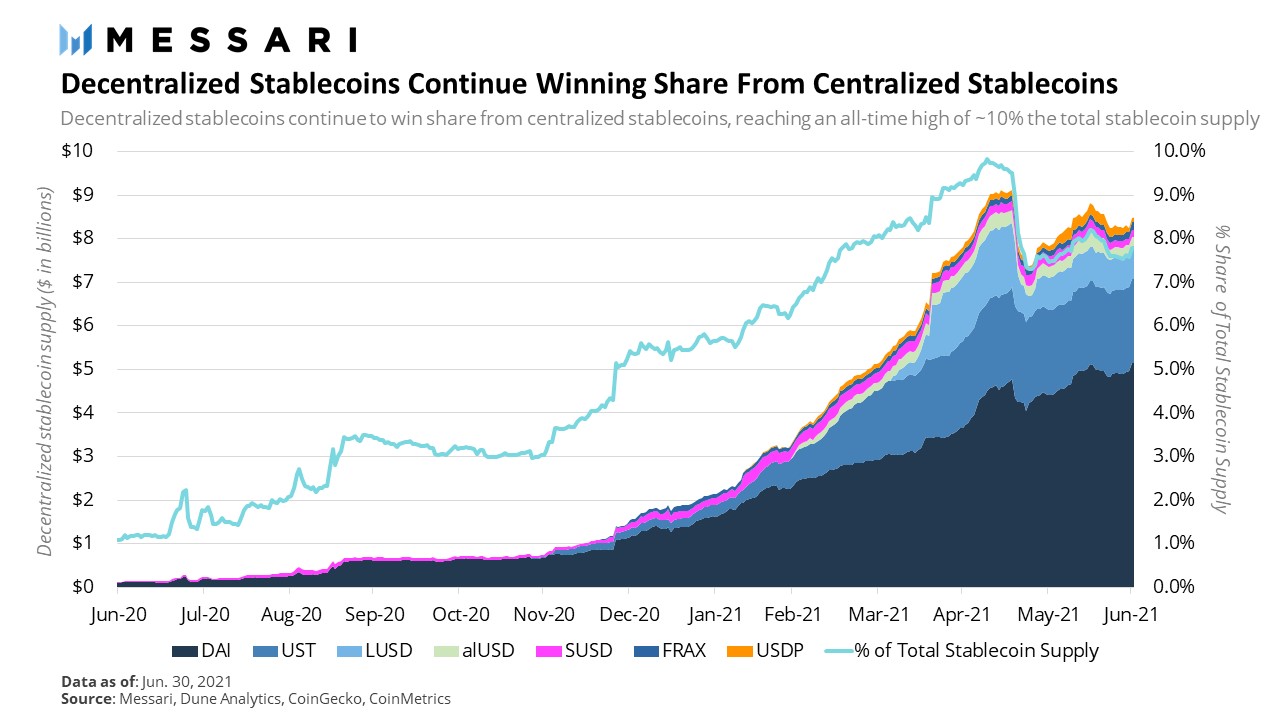

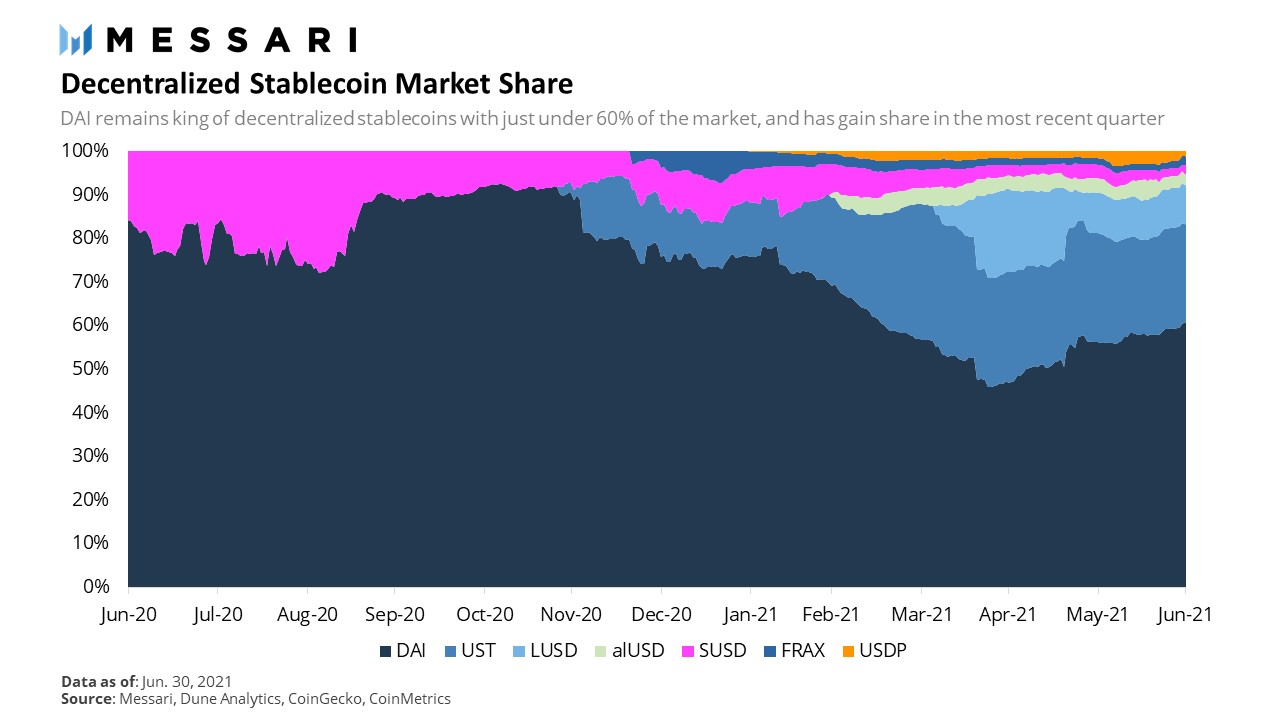

Finally, zooming into the subsector of decentralized stablecoins, we see continued progress as decentralized stablecoins continue to win share from centralized stablecoins. In the beginning of Q2 decentralized stablecoins reached an all-time high ~10% of the total stablecoin supply.

Though DAI’s market share sank in Q1 in large part due to the rise of Terra’s UST, it remains the market leader by a wide margin with a 61% share of the market. In Q2 it recovered some share as it continued to grow while Terra stalled out.

Q2 Developments

USDC Rises and Becomes DeFi’s Preferred Stablecoin

Perhaps no stablecoin had a better quarter than Circle’s USDC. Not only does Circle continue to execute on an impressive turnaround recently announcing a $440 million raise as well as plans to go public in a $4.5 billion SPAC deal, but it also continues to make strides in Ethereum’s booming DeFi ecosystem. It will soon overtake USDT as the dominant stablecoin on Ethereum.

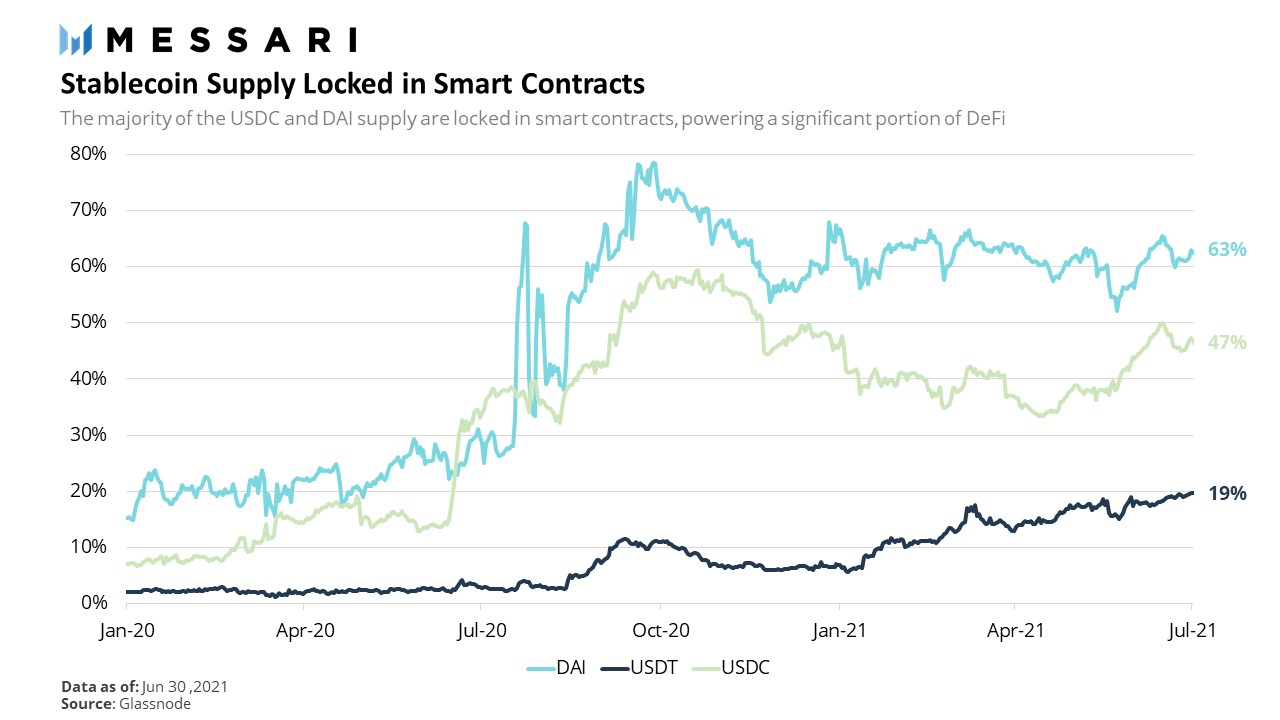

Over 50% of the USDC supply now sits in smart contracts - equivalent to ~$12.5 billion. Although this percentage is not as high as DAI, USDC leads by a wide margin in dollar terms.

DAI Continues Incredible Growth While Centralization Risk Increases

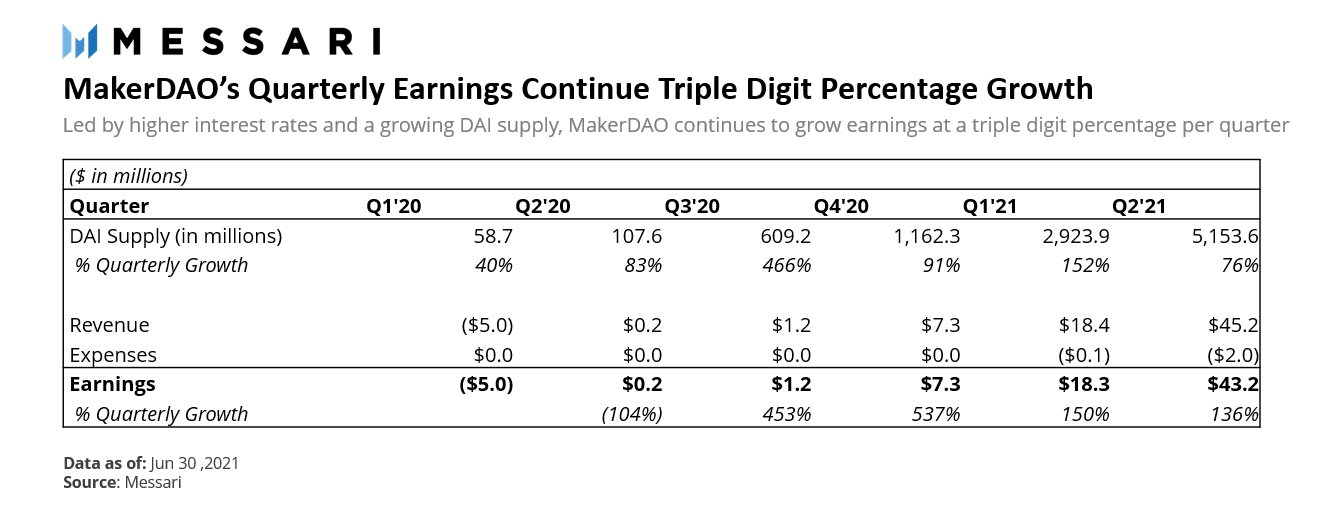

MakerDAO had another incredible quarter growing the DAI supply 76% and earnings 136% over the quarter. The DAI supply reached an impressive $5 billion by quarter ending, while MakerDAO produced $43 million in earnings in the quarter.

However, the flip side of this growth was the increased reliance on USDC via its Peg Stability Module (PSM) which played a significant role in allowing DAI to scale better. The PSM operates similarly to a regular vault type with a zero stability fee and a liquidation ratio of 100% and allows users to swap USDC for DAI with zero slippage and with a small spread. This has allowed DAI to be better arbitraged around its peg, but also meant that as the DAI supply grew the collateral backing it increasingly consisted of USDC. Currently 55% of the DAI supply was generated by USDC via the PSM. This is important because while the majority of DAI is still backed by ETH, vaults only have liabilities against the DAI they created, meaning that not all the ETH that is backing DAI in aggregate necessarily backs each DAI liability.

Source: DaiStats

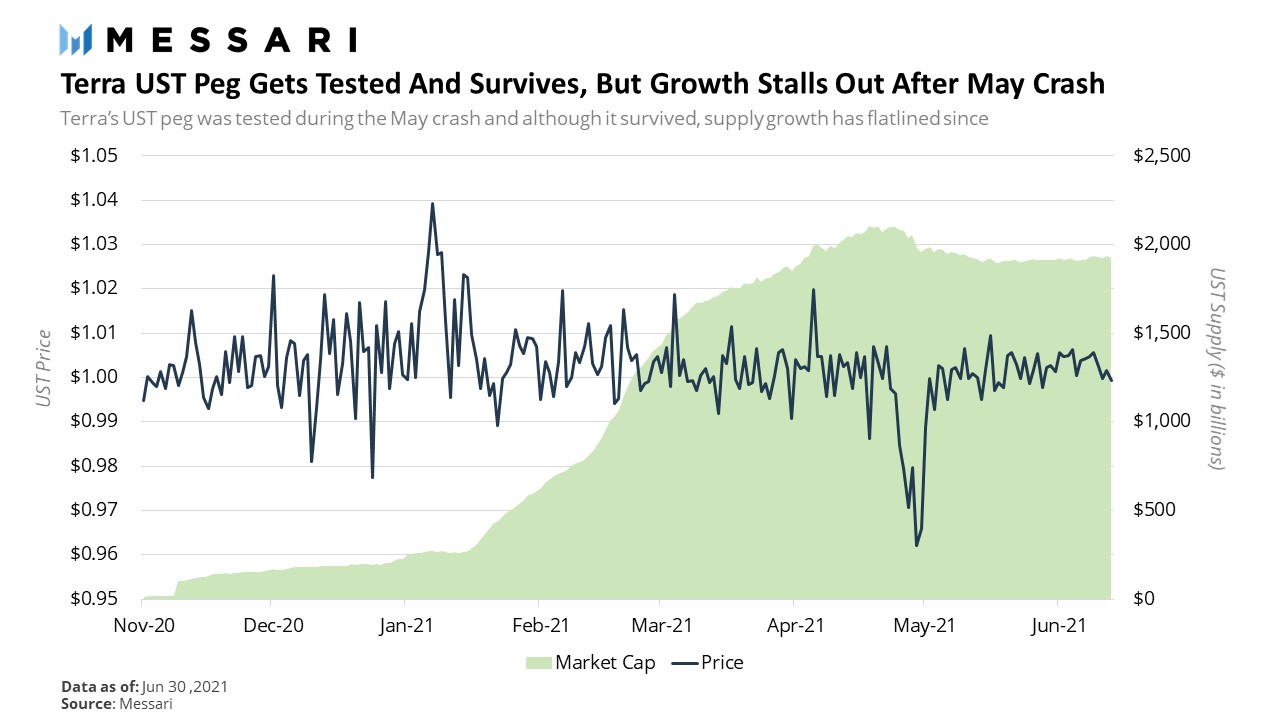

Terra Growth Stalls After May Crash

In Q1 Terra’s UST stablecoin quickly became the second largest decentralized stablecoin in the industry after building a bridge to Ethereum and launching liquidity mining for its new synthetic asset protocol, Mirror. It now has an exciting DeFi ecosystem of its own providing many ways to earn yield on its stablecoins. However, in the months following the May crash, growth has stalled out with the UST supply down slightly. The most likely culprit for this pause in growth is the decreased liquidity mining incentives for all the protocols UST was being used in due to deflated token prices.

Terra also faced its first big test during the May crash as LUNA, the seigniorage token backing it, plummeted 75% over the course of five days, putting serious pressure on the UST peg. However, since then UST has stabilized and confidence in the peg has been restored.

Looking Forward

The Rise of Non Pegged Stablecoins

When Bitcoin was born it captured people’s imagination on the potential for non-sovereign digital currencies. But as Bitcoin began trading it soon became clear that it would not be stable enough to be used as currency anytime soon. The promise was that sometime in the distant future it would eventually stabilize once it became a large enough asset and built up enough liquidity. However, even that is uncertain considering Bitcoin is a fixed supply asset and unable to adjust its supply relative to demand, which may deem it to forever be volatile just like Gold is.

To bridge the gap between now and this promised future the industry created dollar pegged stablecoins which solved the volatility bug and catalyzed adoption for many blockchain applications beyond holding. However, the problem these dollar pegged stablecoins cause is that they dollarized Ethereum. With the dollar ultimately being controlled by the Federal Reserve, this limits Ethereum’s monetary system from becoming sovereign. It also subjects Ethereum to regulatory risk that borders systemic due its reliance on gray market dollar pegged stablecoins (though this risk is decreasing with USDC gaining market share vs USDT).

Fortunately the industry has taken notice and a new wave of projects have recently launched aiming to create stablecoins that are not pegged to fiat currencies at all. Called “non pegged stablecoins,” these projects offer a radical opportunity for Ethereum’s monetary system to achieve stability while eliminating dependence on fiat currencies. In the process they would not only free Ethereum’s monetary system from the influence of the nation state controlled central banks, but also introduce truly trust-minimized stablecoins fit for use across Ethereum’s economy.

For now non pegged stablecoins may seem like a far-out experiment without a clear use case, but they may also be the best bet this industry has on creating non-sovereign stable cryptocurrencies.

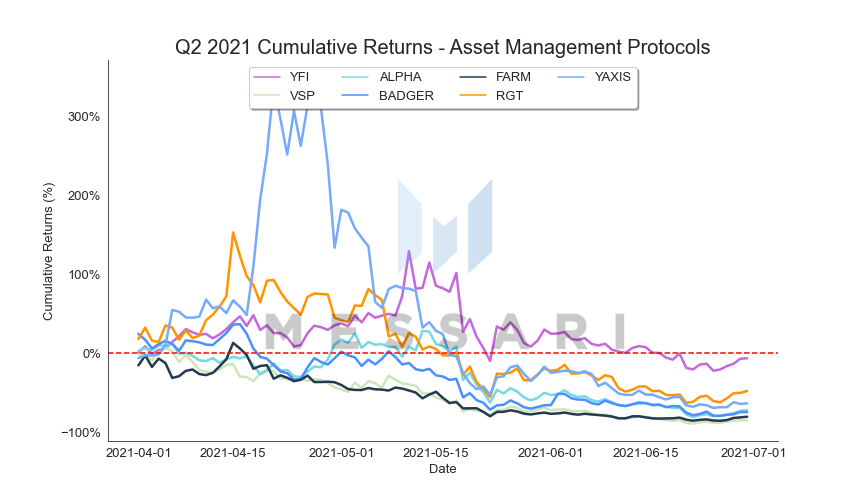

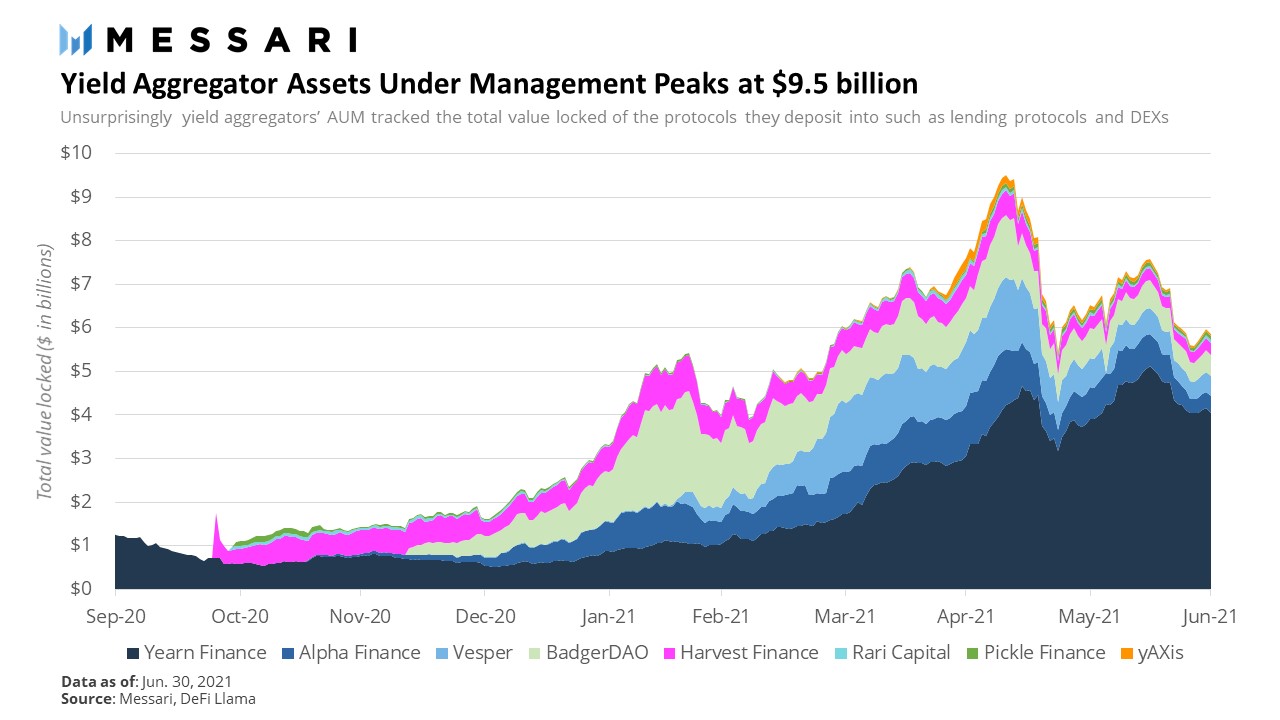

Asset Management

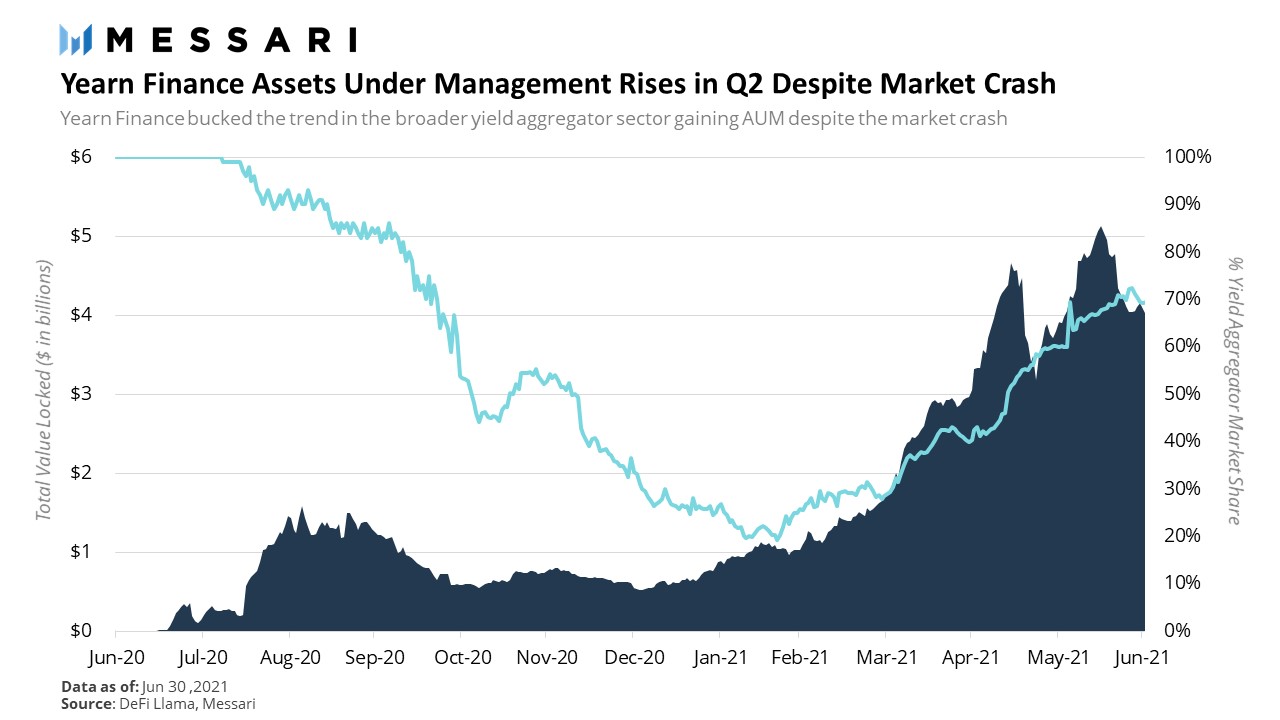

Unsurprisingly as liquidity in DeFi protocols soared over the quarter, yield aggregators, which funnel liquidity into DeFi, saw their total value locked soar as well. Similarly when the market turned many saw their TVL fall in lockstep (with some exceptions like Yearn). After a strong Q1 that saw assets under management rise 272%, assets under management ended Q2 down 2% after having peaked at $9.5 billion mid-quarter.

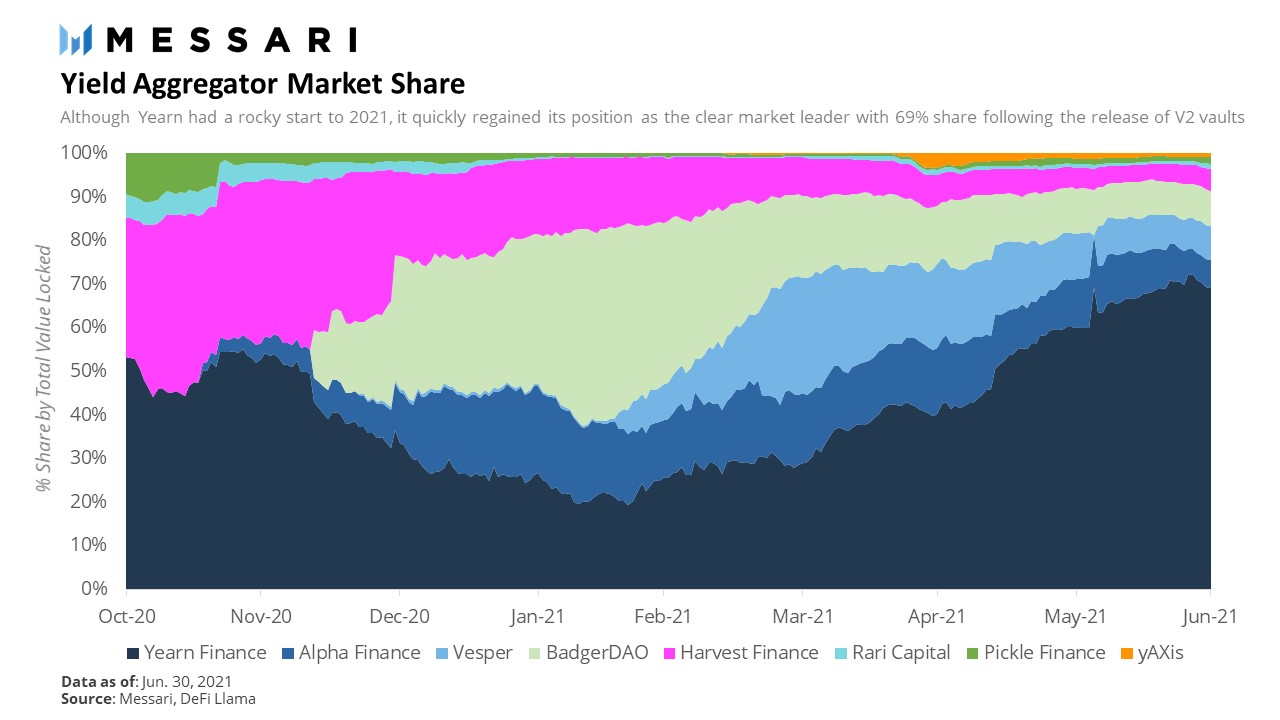

As for the yield aggregator market, the story of the quarter was the comeback and rise of Yearn which saw its market share rocket from 29% to 69% in the quarter (more on this below).

Q2 Developments

Yearn’s Growing Dominance

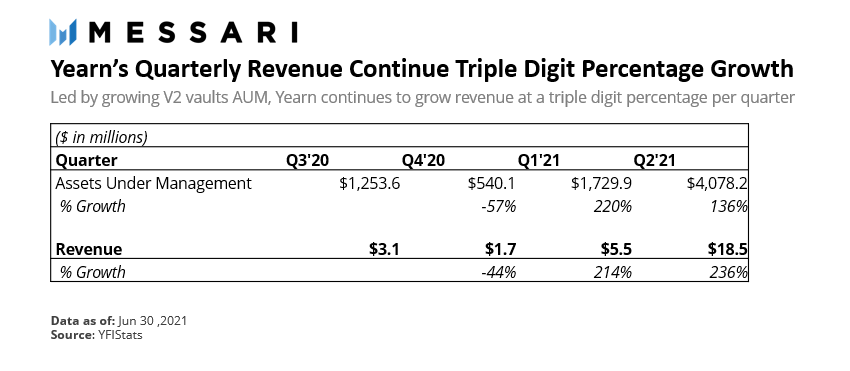

As mentioned in the previous section, the biggest story in the asset management sector for Q2 was Yearn’s resurgence and growing dominance. With Yearn’s incentive alignment issue having been addressed in Q1 clearing concerns over Yearn’s funding, focus then shifted to Yearn’s new V2 vaults. Yearn V2 has become a resounding success, leading Yearn’s assets under management from just $540 million at the beginning of the year to $4.1 billion by the end of Q2. Perhaps the most impressive feat Yearn achieved this quarter, however, was it continuing to grow AUM throughout the May crash, even reaching a new all-time high of over $5 billion by the end of May. It now controls just under 70% of the yield aggregator market.

Like MakerDAO (mentioned above) which also had an incredible quarter, Yearn grew its revenue in lockstep with AUM as well, producing $18.5 million in revenue for Q2, up 236% from Q1.

Between new protocols building on top of Yearn such as Alchemix which created a MakerDAO like credit system using Yearn’s vaults as infrastructure, revenue sharing agreements with protocols that drive assets to Yearn vaults such as Badger, and a handful of new vaults for volatile assets such as Synthetix, it's becoming increasingly apparent that Yearn is an essential yield primitive for the DeFi ecosystem. The Theory of Yearn continues to hold water.

Expanding the Reach of On-Chain Asset Management - Enzyme V2

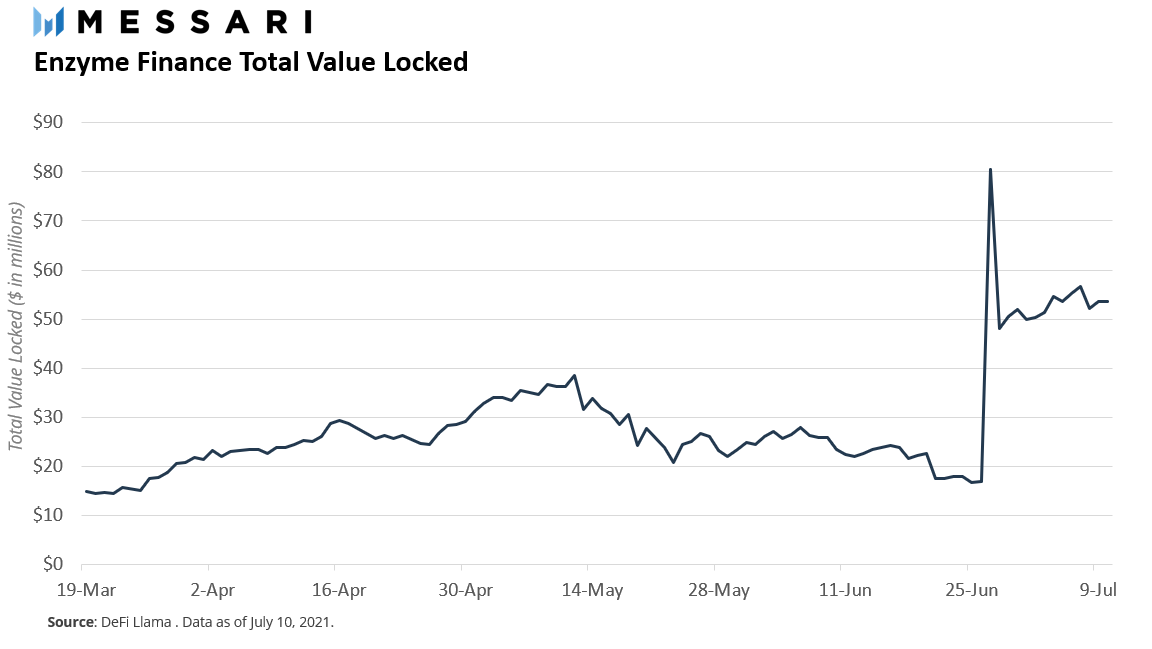

At the beginning of the year, on-chain asset management protocol Melon went through a rebranding process to a more DeFi-flavored theme called Enzyme Finance. In addition to changing the logo and name to create a more vibrant image, the protocol greatly expanded the investable asset universe available to portfolio managers. The protocol now supports nearly 150+ different assets, a significant amount considering the previous version had less than twenty assets to choose from. Additionally, asset managers now have the ability to engage in more sophisticated investment activities including lending, liquidity provisioning, and shorting through synthetic assets.

Recently, Enzyme has been scaling up its business through a number of DeFi partnerships. Last week, the protocol announced a collaboration with Yearn Finance to enhance its product suite. Through the partnership, Yearn vaults will be directly available on Enzyme allowing asset managers to include advanced yield farming strategies as part of their overall portfolio. Another recent collaboration took place last month between Enzyme and Unslashed Finance. In this joint effort, Unslashed Finance invested 4,000 Ether into a yield strategy on Enzyme in order to “buffer up their capital base for insurance”. As a result, Enzyme’s TVL more than doubled in June going from $16 million to $50 billion, according to DeFi Llama.

Looking Forward

A New Paradigm in Liquidity Provision

As a consequence of Uniswap V3’s concentrated liquidity model, liquidity management is no longer a passive game. The famous “set and forget” strategy that once dominated liquidity provisioning has become antiquated and suboptimal. In this new world, the highest returns will flow to those who research, develop and successfully implement active management strategies by constantly updating liquidity ranges to capture the highest amount of trading fees.

Uniswap’s new functionality has led to the creation of a new breed of market participants called “Liquidity Managers”. In the same way, professional asset managers are paid to effectively navigate the uncertain waters of financial markets, Liquidity Managers seek to fill the same need in the increasingly complicated realm of liquidity management. There are early entrants to the arena such as Visor, Lixir, Charm, Popsicle, and Gelato Network, as well as the elephant in the room Yearn which is also developing Uniswap V3 strategies.

Derivatives

Derivatives Landscape

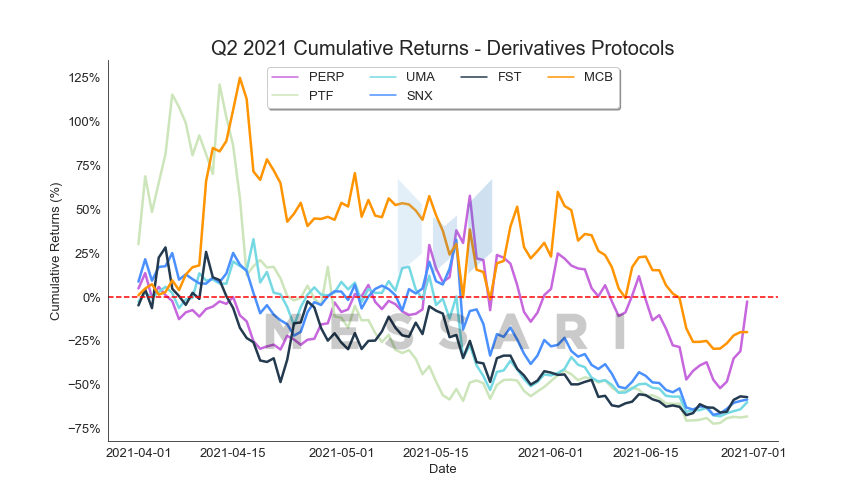

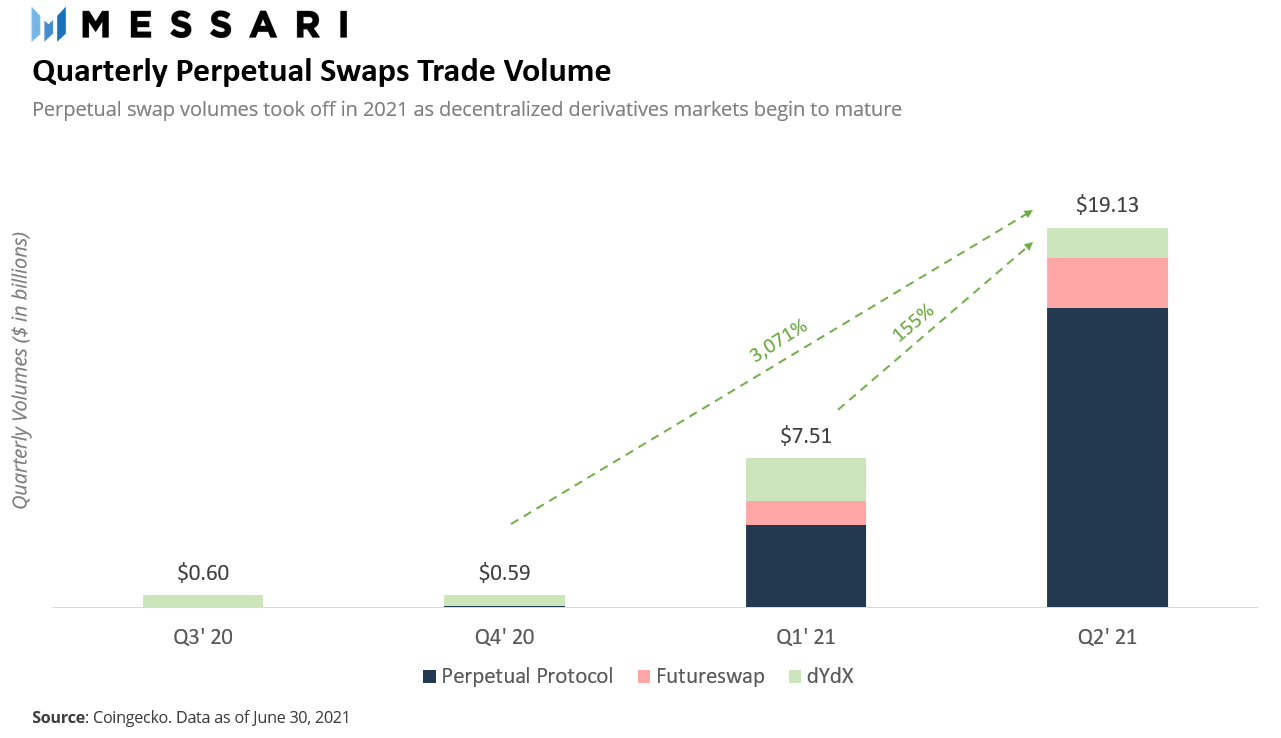

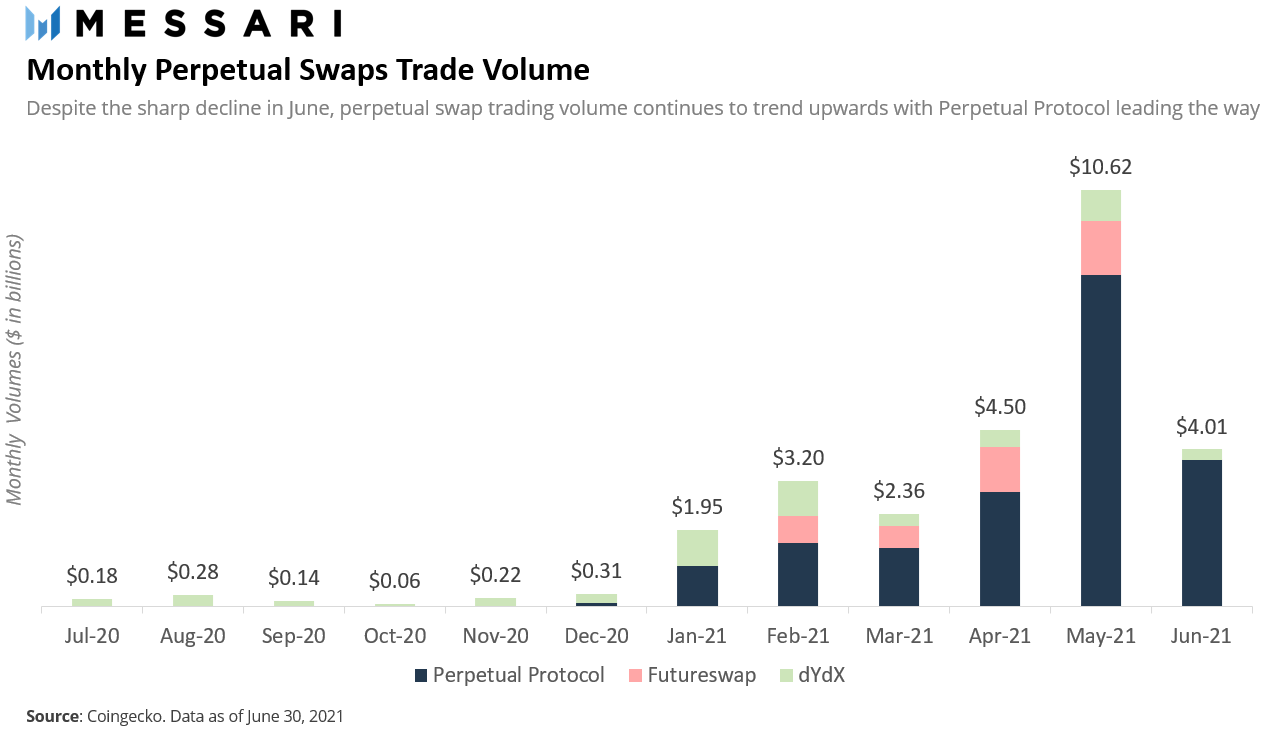

Decentralized derivative volumes continued their massive growth in the second quarter of 2021. Although still a fraction of decentralized spot trading volumes (see DEX section), perpetual swap trading volumes reached nearly $20 billion in the quarter, more than a 3,000% increase from Q4 2020 and a 155% jump from the previous quarter. Despite the current scaling hurdles (more on this below), decentralized derivative protocols are starting to see strong signs of adoption among DeFi users.

Following the market crash, trading volumes in June unsurprisingly declined as investors’ appetite for risky assets and leverage vanished in the face of increasing market uncertainty. However, when compared to levels at the beginning of 2021, trading volumes remain on a steady upward trend.

Q2 Developments

Dominating the Decentralized Perpetual Swap Market - Perpetual Protocol

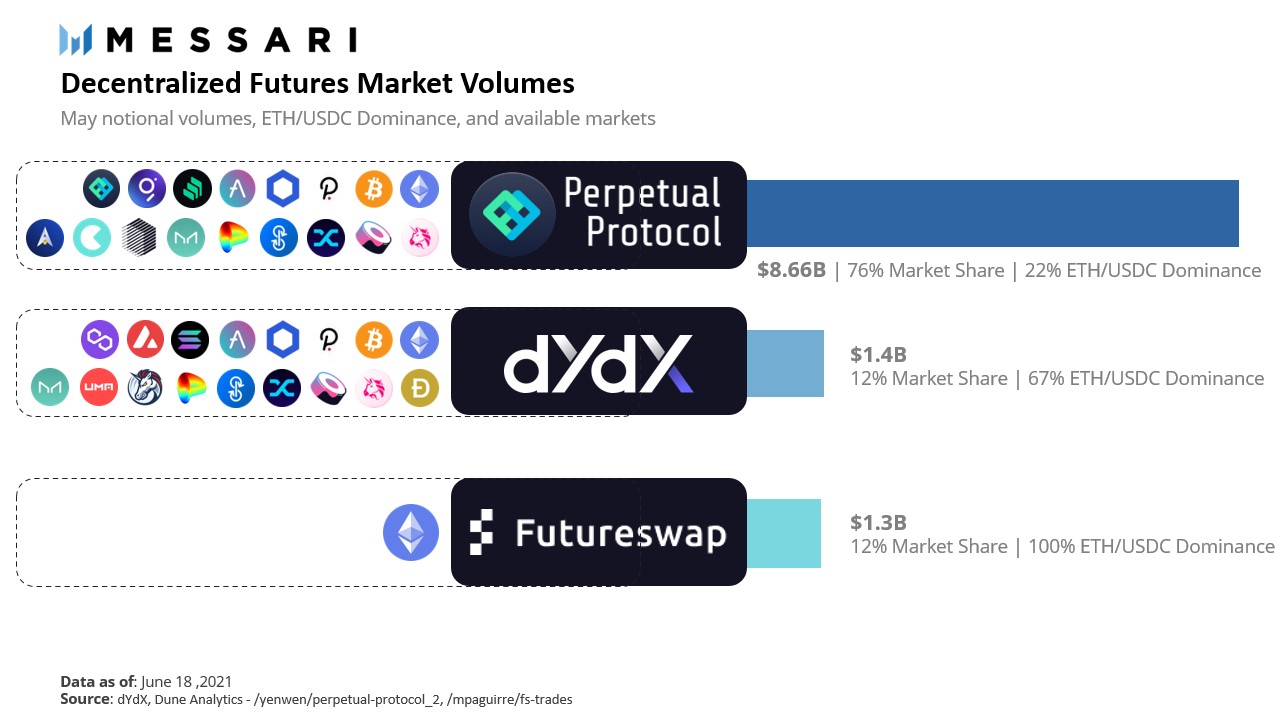

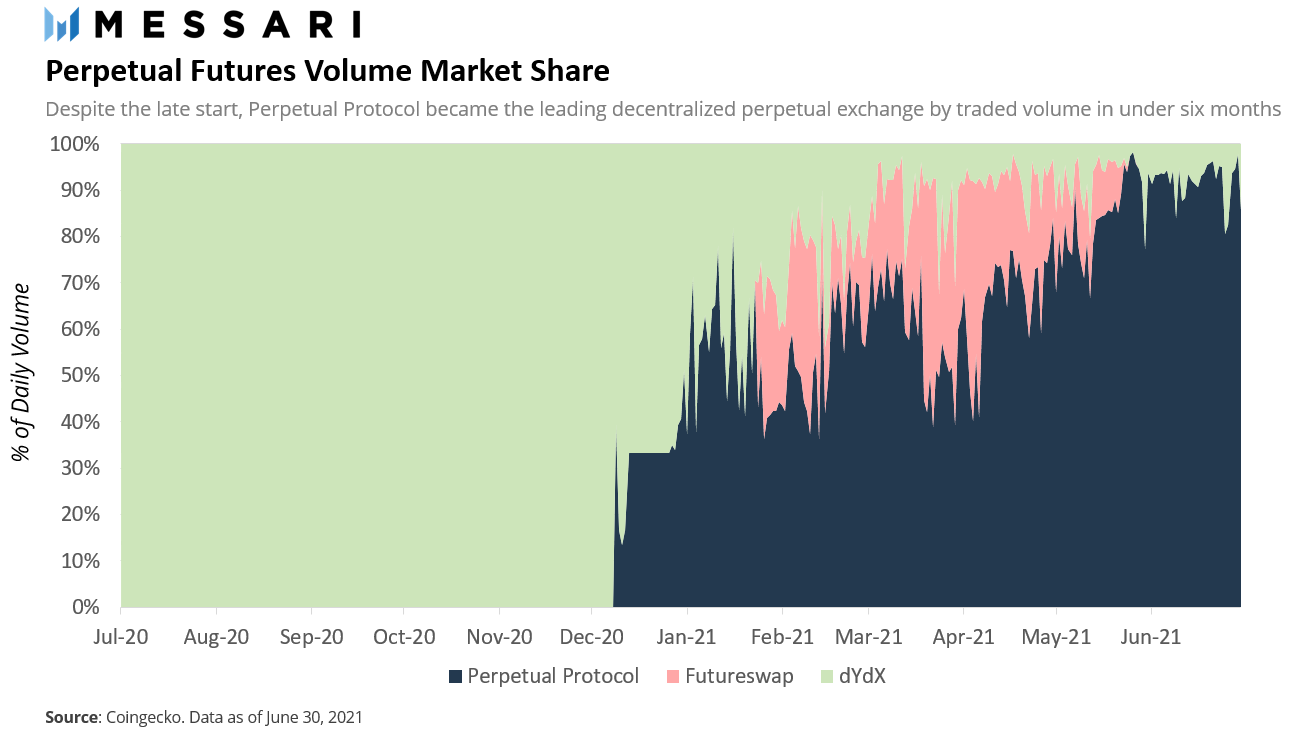

The most important development in the second quarter of 2021 was the dominant rise of Perpetual Protocol. Despite its late arrival relative to incumbent players like dYdX, Perpetual Protocols currently offers investors the most trading options available in the perpetual swaps market and controls the vast majority of the decentralized futures trading volume.

In a matter of six months, Perpetual Protocol became the dominant perpetual swaps exchange by a wide margin. At the beginning of 2021, the protocol controlled less than 30% of all the trading volume in decentralized futures markets. After five months, its dominance tripled, now controlling over 90% of the perpetual swap market.

Looking Forward

In Honor of Marie Curie - Perpetual Protocol V2

Perpetual Protocol announced the release of the second version of the protocol called “Curie'', in honor of the famous physicist Marie Curie. The upgrade is set to launch on Arbitrum in order to improve user experience, increasing transaction speeds, and lower trading costs. Additionally, the upgrade will launch with cross-margin collateral management allowing traders to use the same pool of collateral to open multiple positions.

One of the most important features of V2 is the combination of Perpetual Protocol’s vAMM with Uniswap V3 as the protocol’s trading settlement layer. The merger will allow Perpetual Protocol to leverage Uniswap’s concentrated liquidity feature, improving the capital efficiency of the entire protocol. Moving forward, all trades will be executed on Uniswap, using v-tokens, while keeping the trader experience the same as before.

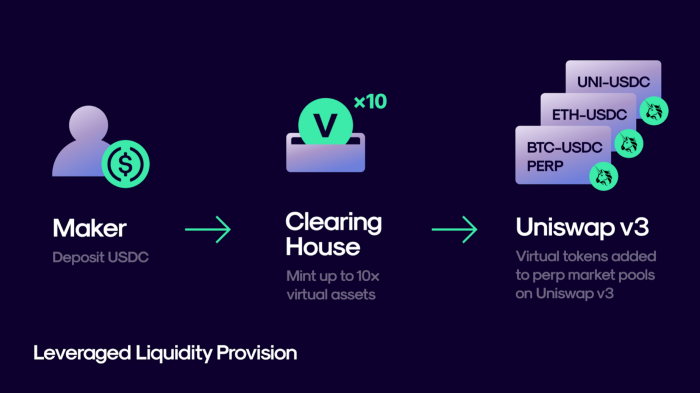

Another interesting aspect of using Uniswap as the trading layer for the system is the emergence of a whole new way of liquidity provisioning. In addition to earning protocol fees, liquidity providers (called makers) will be able to apply leverage when providing liquidity to the protocol. In the same way that traders use the protocol to lever their long/short positions, makers will be able to deposit USDC on Perpetual Protocol and have the option to instruct the clearinghouse - the smart contract in charge of minting v-tokens - to mint vUSDC with up to 10x leverage. The vUSDC can then be deployed in a Uniswap V3 pool essentially creating a leverage liquidity position.

Source: Perpetual Protocol

In addition to the trading mechanism enchantments, Curie will also allow permissionless market creation. The protocol will support Uniswap V3 TWAP and Chainlink oracles to determine the index price of any asset including non-crypto assets like stock and commodities.

Rollups To the Rescue

As mentioned earlier, decentralized derivative protocols currently face a number of hurdles that have hampered the growth of the space. Today, there are three main reasons why the decentralized futures market hasn't reached widespread adoption. The first relates to token compossibility. At the moment, derivative products can’t be used in activities like liquidity provisioning, yield farming, staking, or governance making them inferior to physical tokens in terms of utility. The second reason is market depth. Due to the nascency of the sector, most exchanges have limited liquidity to trade against and also lack hefty insurance funds to backstop unexpected losses arising from leverage trading.

Lastly, the third reason, and likely the most important one, is Ethereuem’s high fee environment. By nature, derivative products are much more sophisticated financial instruments compared to physical tokens. Therefore, trading derivative instruments in a decentralized manner tends to be more complex than spot trading.

As a consequence, derivatives trading volume, in particular perpetual swaps, is hindered by higher transaction costs which are either incurred by the derivatives exchange or passed on to the trader. However, derivatives applications are on the cusp of reaching a wider market as protocols take advantage of the scaling capabilities offered by Layer-2 solutions like Arbitrum and Optimism.

As the Layer-2 race heats up, derivative protocols are starting to pick their respective horses. For the most part, perpetual swap exchanges like MCDEX, Futureswap, and Perpetual Protocol are choosing Arbitrum as their scaling solution (MCDEX went live on mainnet last month and the remaining two will launch in testnet in the coming months). In late 2020, dYdX announced a partnership with StarkWare, and after eight months of work, the team successfully ported its perpetual trading platform to StarkEx, StarkWare’s Layer-2 scalability engine. Lastly, earlier this year Synthetix staking contract went live on Optimism Ethereum, making the first Ethereum-native DeFi application to cross the chasm to the Layer-2 world.

The Seeds of DeFi’s Next Leg

While it's clear in many cases that DeFi activity has been negatively impacted by declining market sentiment and depressed asset prices, the sector remains multiples larger than it was even just to start the year. In the coming months in quarters ahead it is likely DeFi has its growing up moment as scaling solutions arrive, institutions begin to dip their toes into DeFi protocols, and ecosystems continue to mature, providing increased safety for users.

It's not yet clear when market sentiment will turn around for the sector. It not only took one of the biggest hits post May crash, but also underperformed ETH as a whole year-to-date. In any case DeFi will continue to march on, with each step making progress towards a radically new open, global financial system governed by code but built for people.

Learn more from Mainnet 2021

Watch main stage programming from Messari's annual summit Mainnet 2021 to learn more about this exciting topic. Hear Andre Cronje, Rune Christensen, Qiao Wang, Robert Leshner, Diane Dai, and Stani Kulechov discuss these topics during, "Mainnet 2021: The Future of DeFi". See more programming on the event portal.