Lesson outline

Lesson outline

Here's an overview of what you'll learn to do in this lesson. Documentation links are for reference.

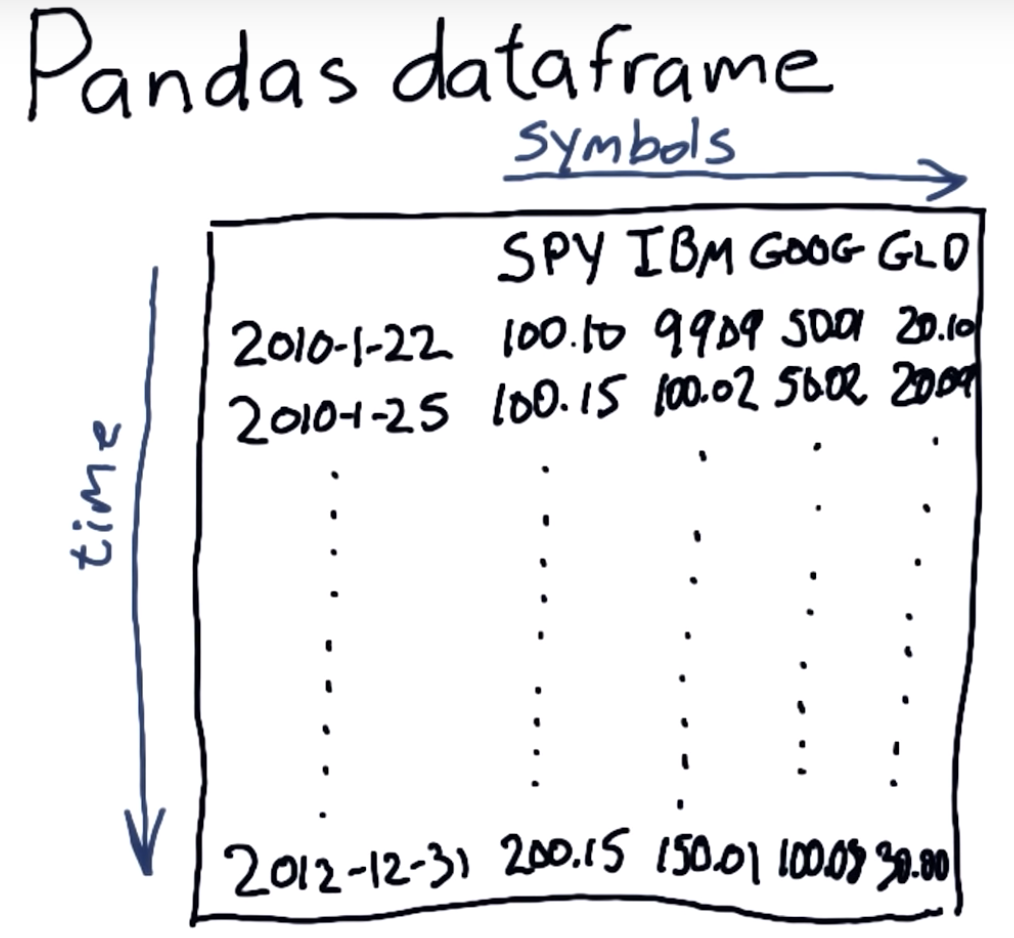

Read in multiple stocks:

- Create an empty pandas.DataFrame with dates as index: pandas.date_range

- Drop missing date rows: pandas.DataFrame.dropna

- Incrementally join data for each stock: pandas.DataFrame.join

Manipulate stock data:

- Index and select data by row (dates) and column (symbols)

- Plot multiple stocks at once (still using pandas.DataFrame.plot)

- Carry out arithmetic operations across stocks

Hit Next to continue.

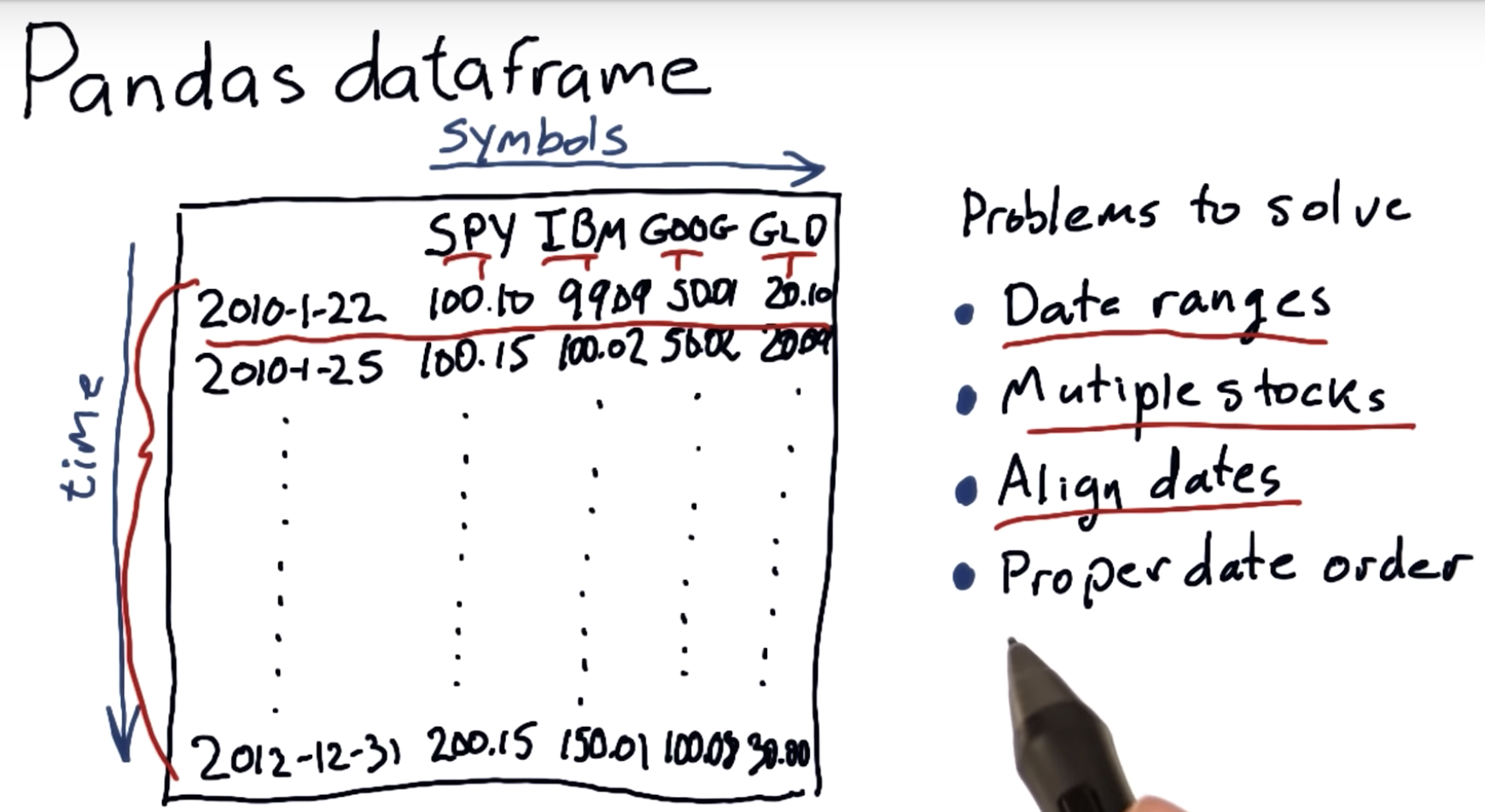

Pandas dataframe recap

Problems to solve

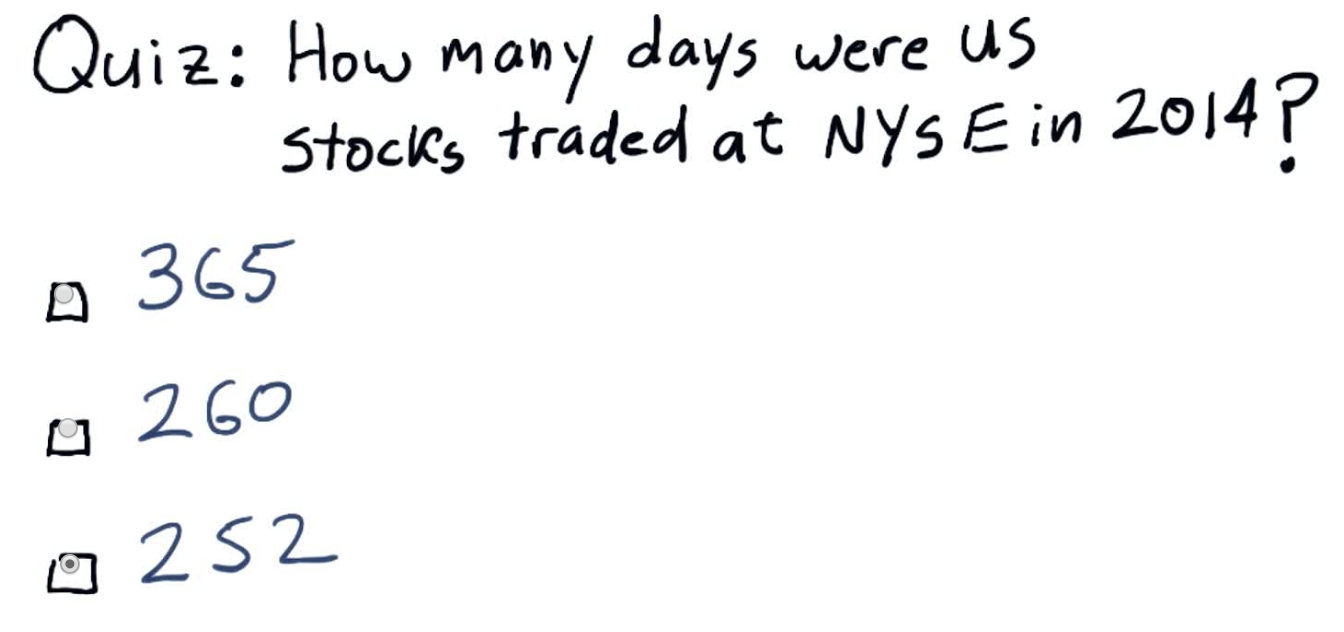

NYSE trading days

See if you can find the number of trading days here: www.nyse.com/markets/hours-calendars

Note that we are interested in the number of trading days (i.e. days the market conducted trading) for US Equities during 2014

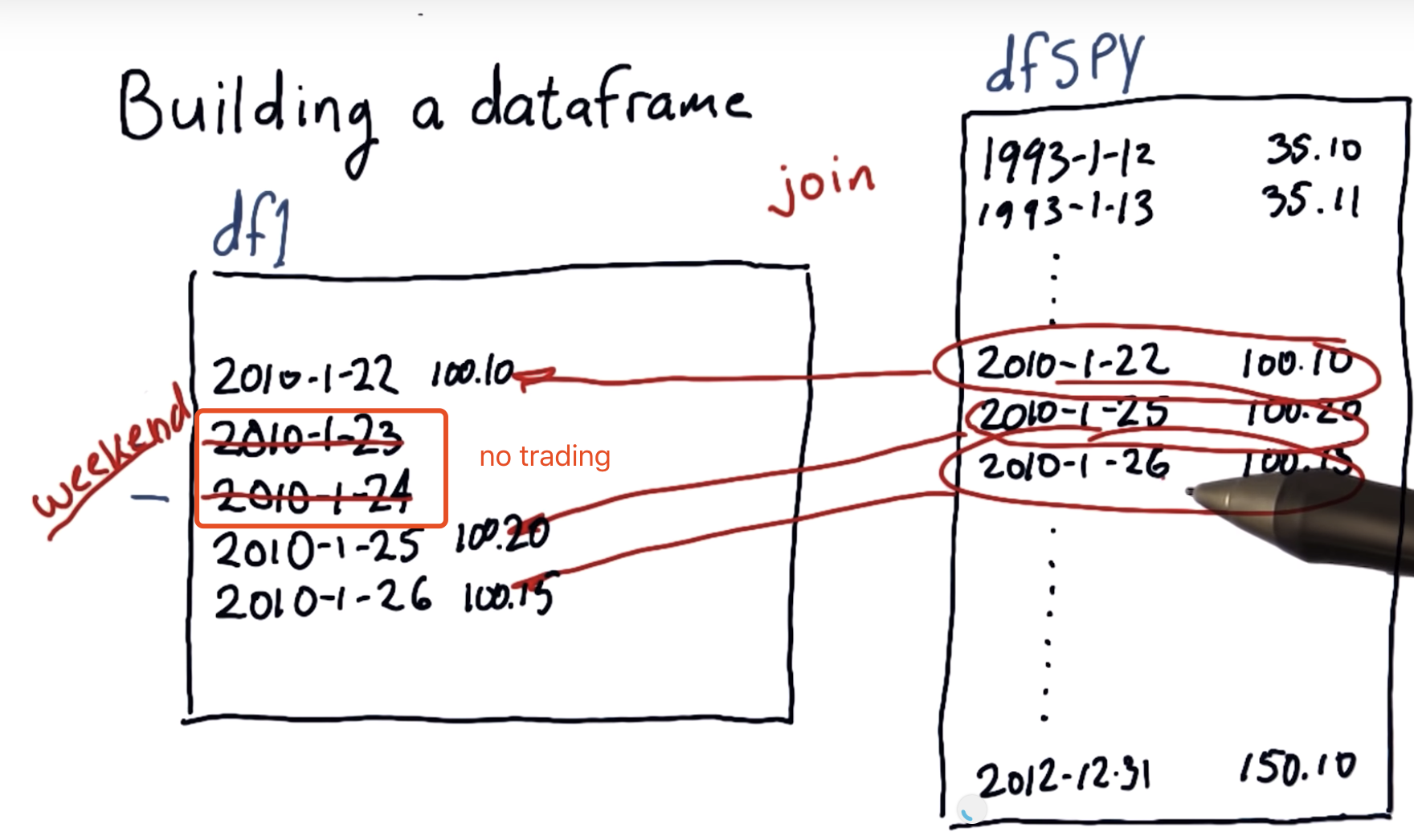

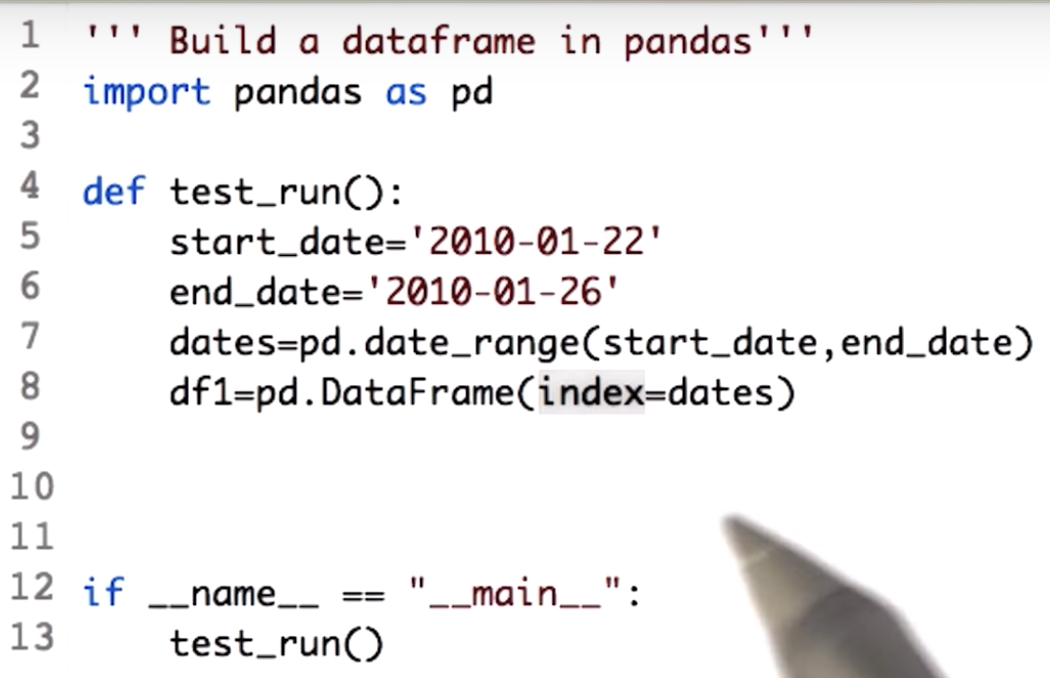

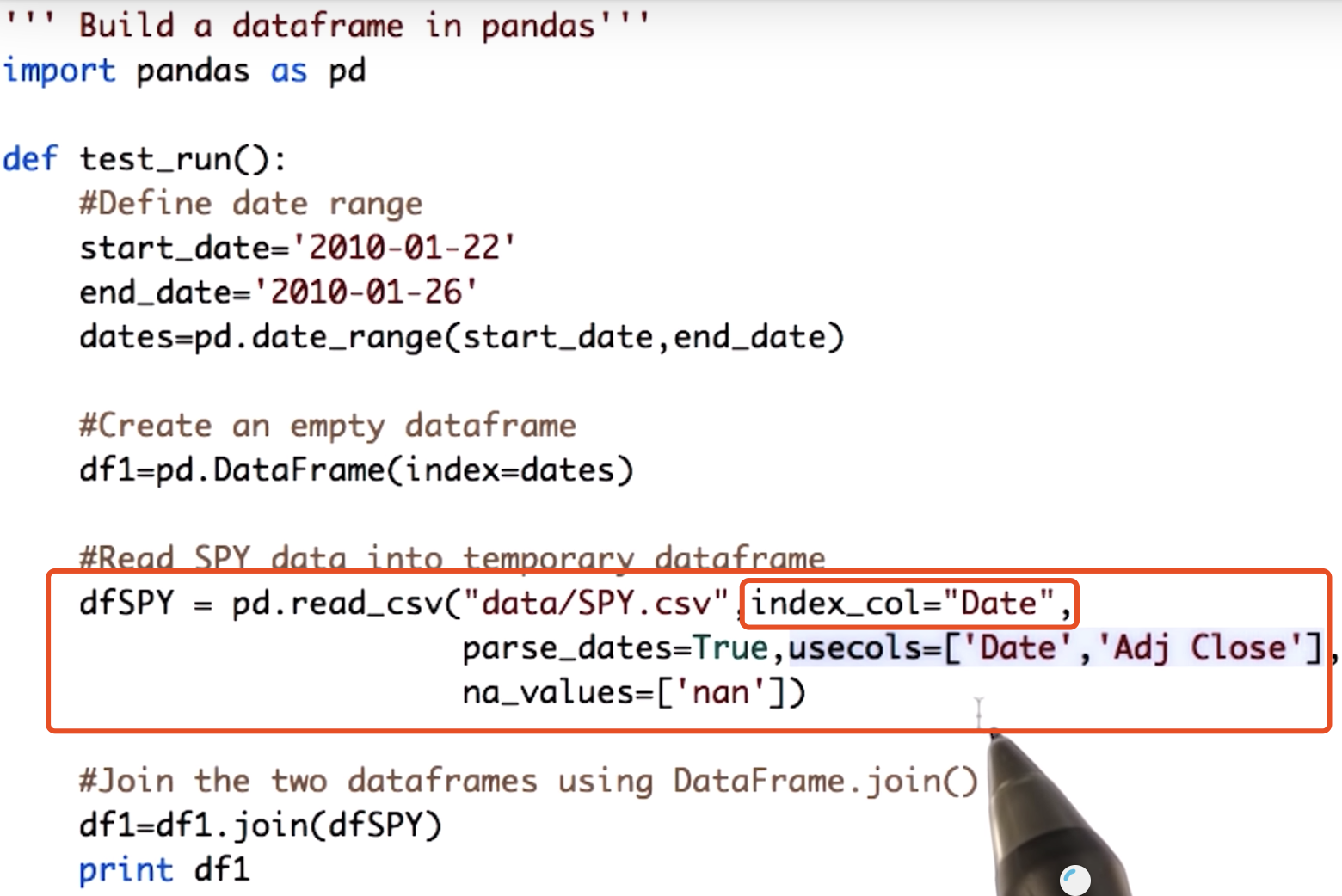

Building a dataframe

S&P 500 is a stock market index based on 500 large American companies listed on the NYSE or NASDAQ. Think of it as a weighted mean of the stock prices of the companies, where the number of shares are used as weights (with some adjustment for any events that may affect apparent stock value, such as splits).

SPDR® S&P 500 is an ETF (or exchange-traded fund) that tracks the S&P 500 index, and is itself listed on NYSE under the ticker symbol "SPY".

"Joining" dataframes

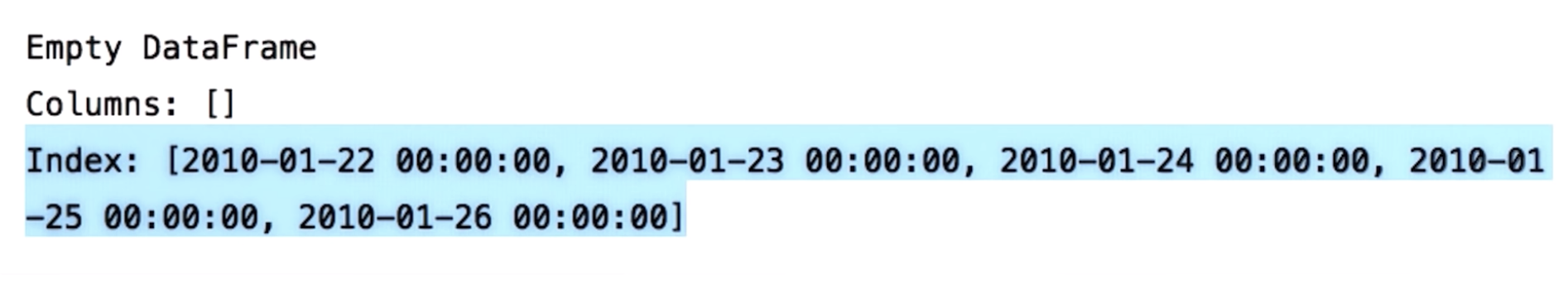

Create an empty data frame

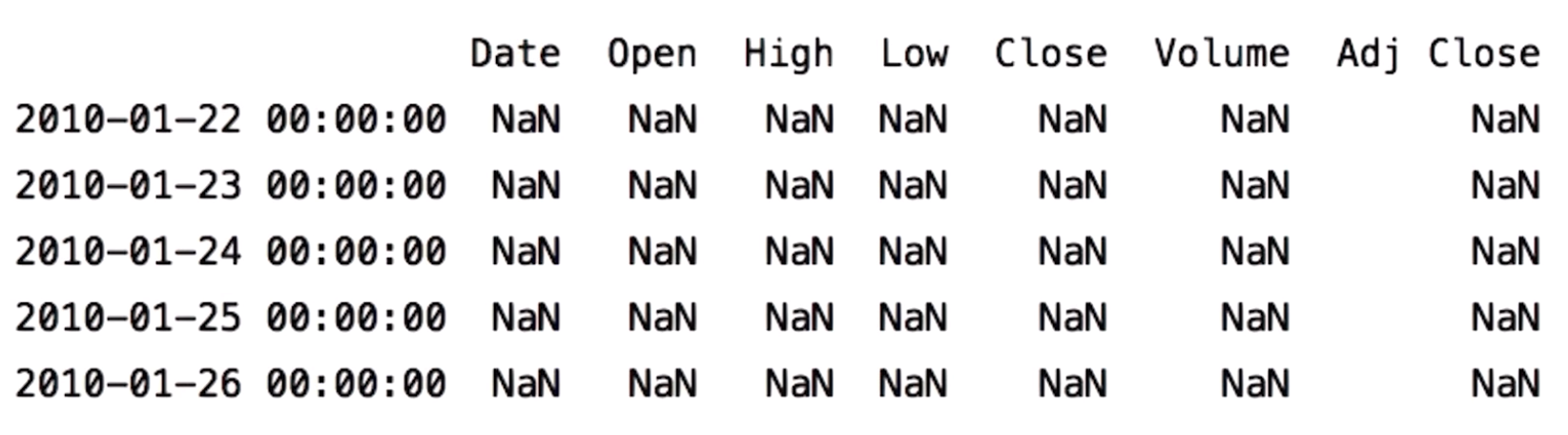

Join SPY data

NaN because SPY.cvs uses integers as index

Documentation: pandas.DataFrame.join

Look for the how parameter.

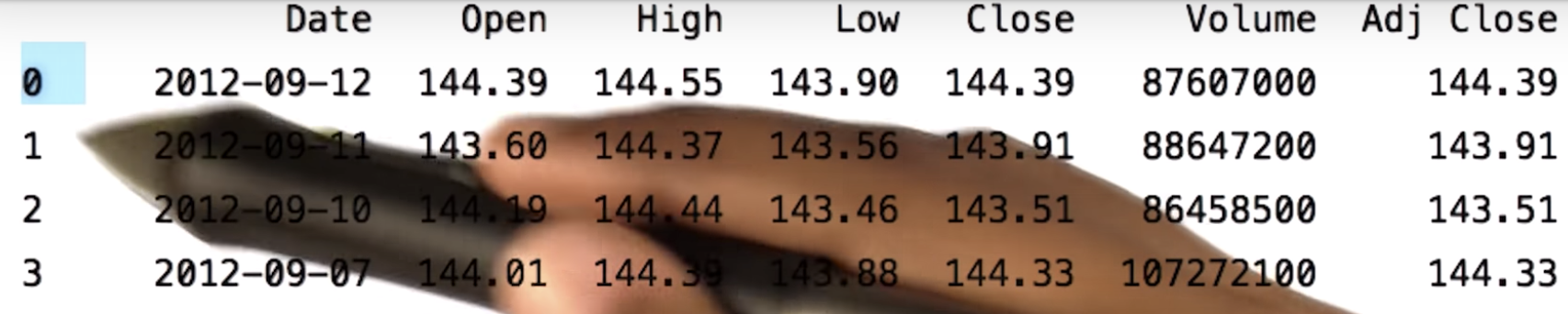

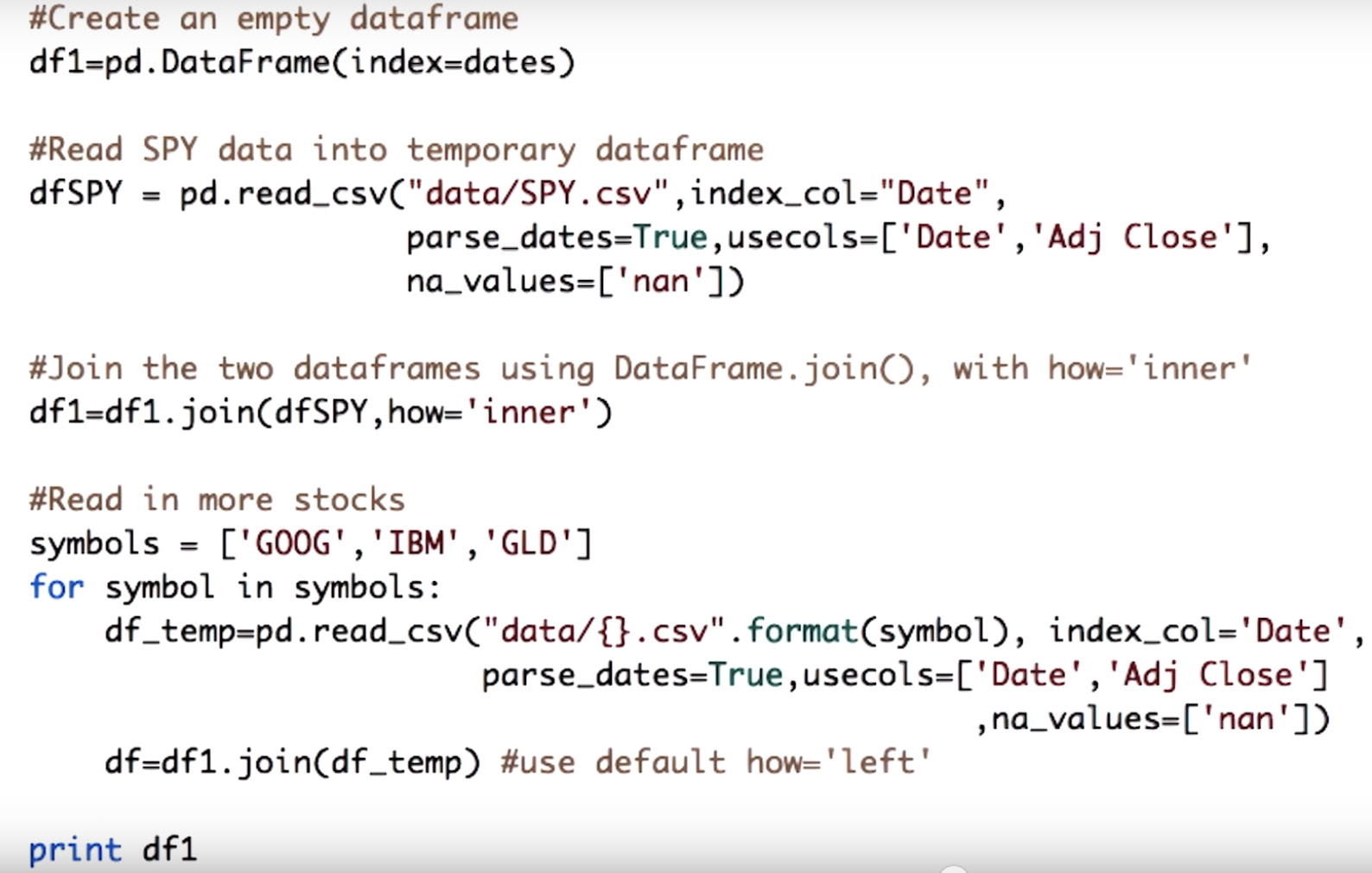

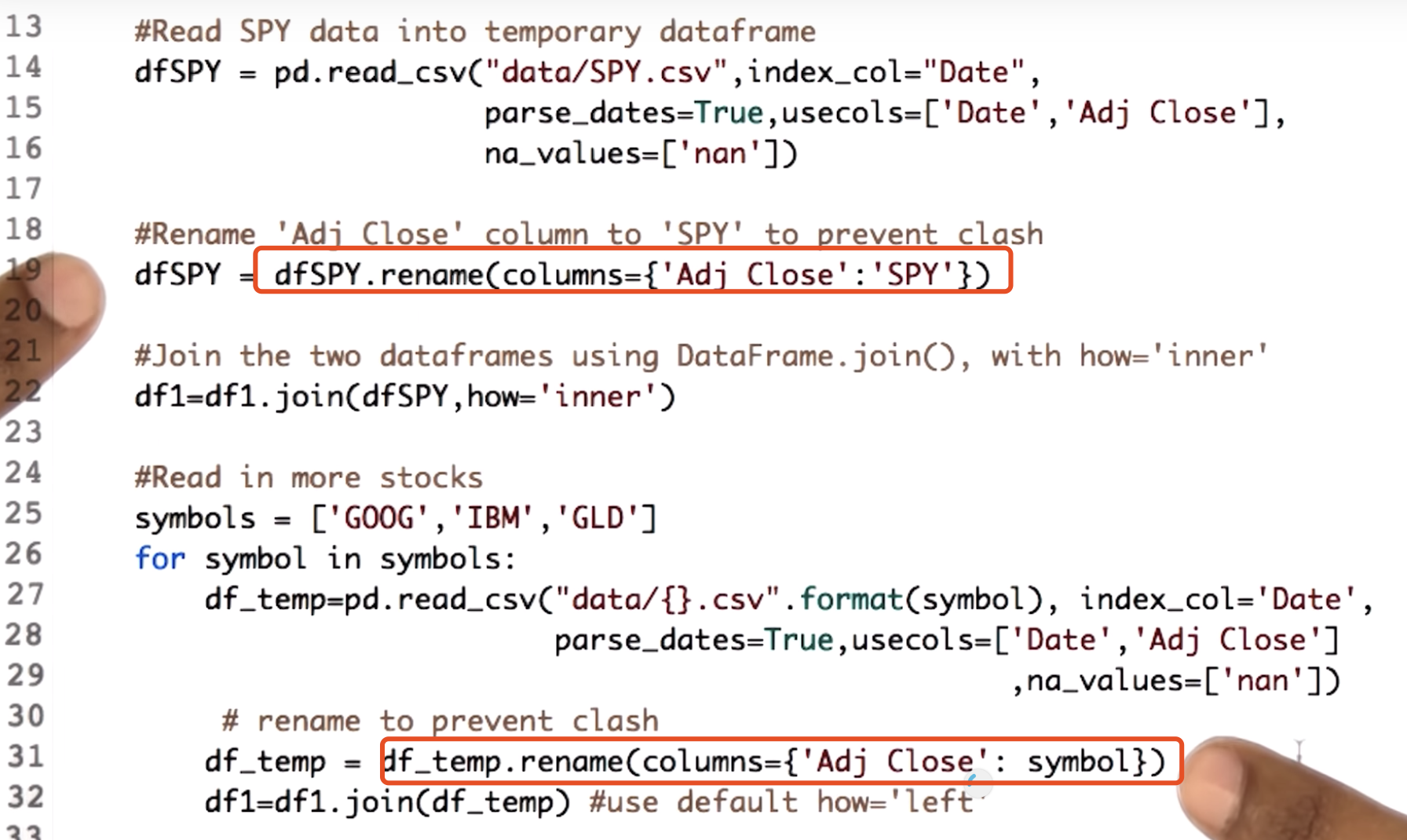

Read in more stocks

![]()

what's wrong?

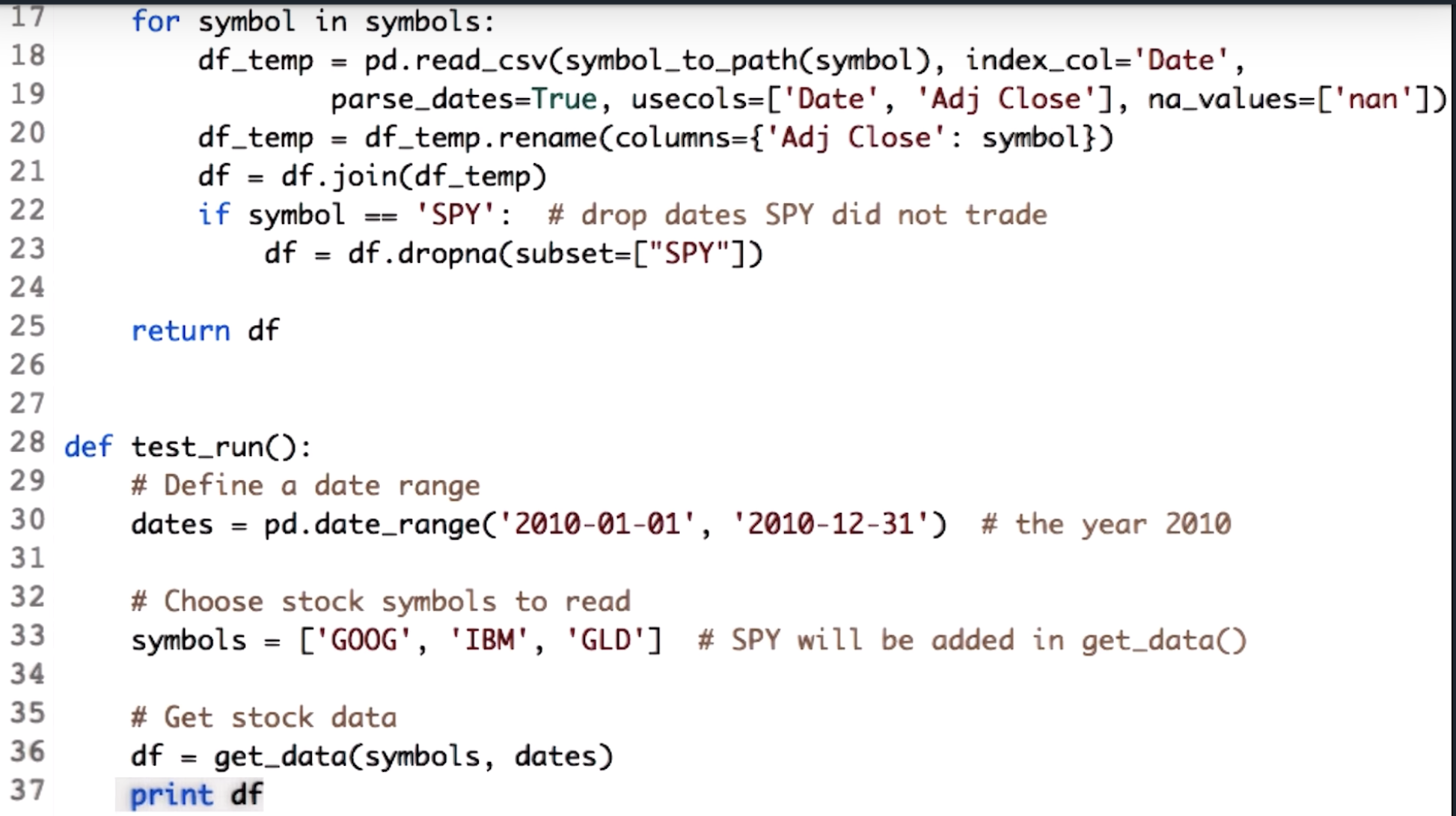

Utility functions for reading data

"""Utility functions""" import os import pandas as pd def symbol_to_path(symbol, base_dir="data"): """Return CSV file path given ticker symbol.""" return os.path.join(base_dir, "{}.csv".format(str(symbol))) def get_data(symbols, dates): """Read stock data (adjusted close) for given symbols from CSV files.""" df = pd.DataFrame(index=dates) if 'SPY' not in symbols: # add SPY for reference, if absent symbols.insert(0, 'SPY') for symbol in symbols: # TODO: Read and join data for each symbol df2 = pd.read_csv(symbol_to_path(symbol),index_col="Date",parse_dates=True,usecols=['Date','Adj Close'],na_values=['nan']) df2 = df2.rename(columns={'Adj Close': symbol}) df = df.join(df2) return df.dropna() def test_run(): # Define a date range dates = pd.date_range('2010-01-22', '2010-01-26') # Choose stock symbols to read symbols = ['GOOG', 'IBM', 'GLD'] # Get stock data df = get_data(symbols, dates) print df if __name__ == "__main__": test_run()

Documentation:

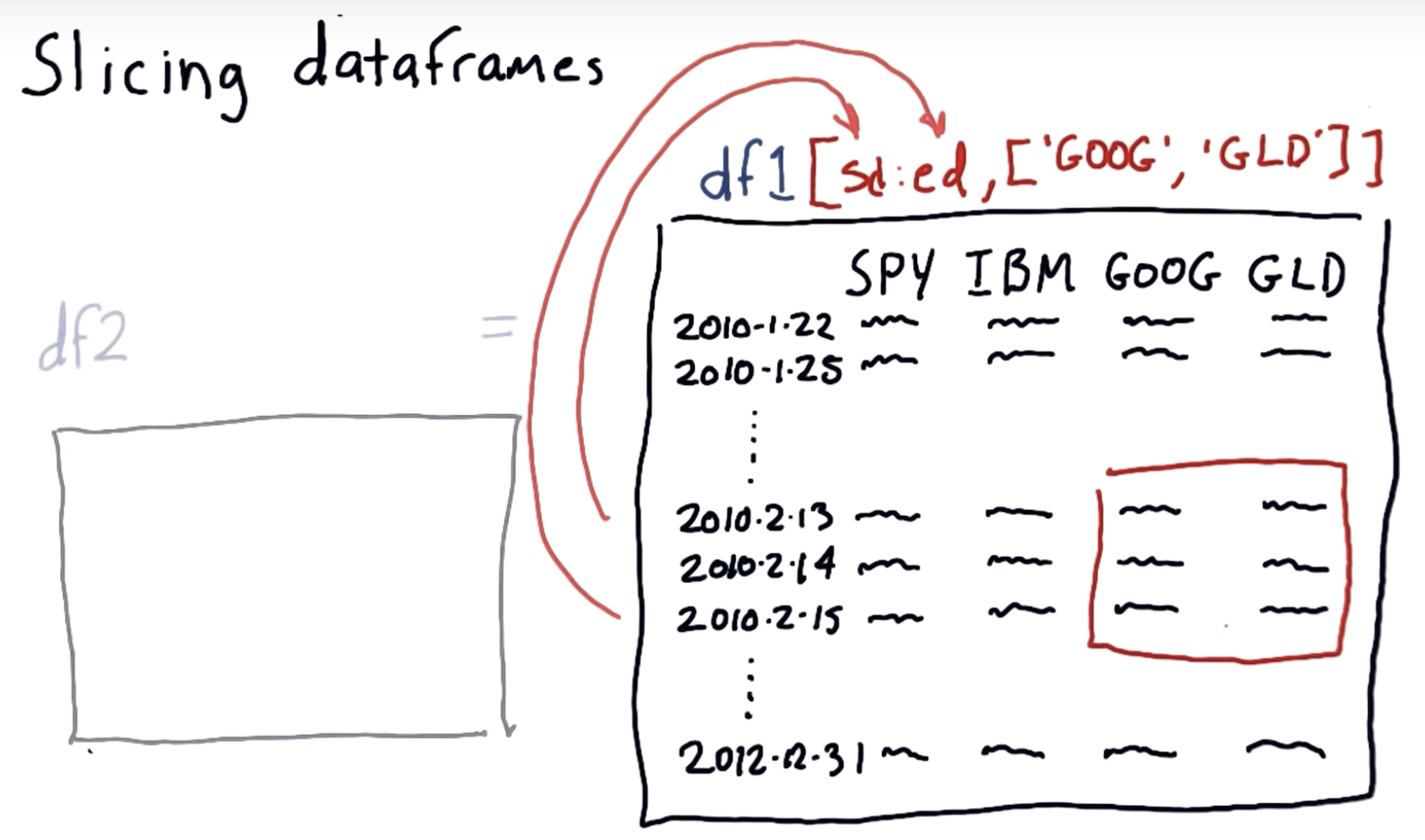

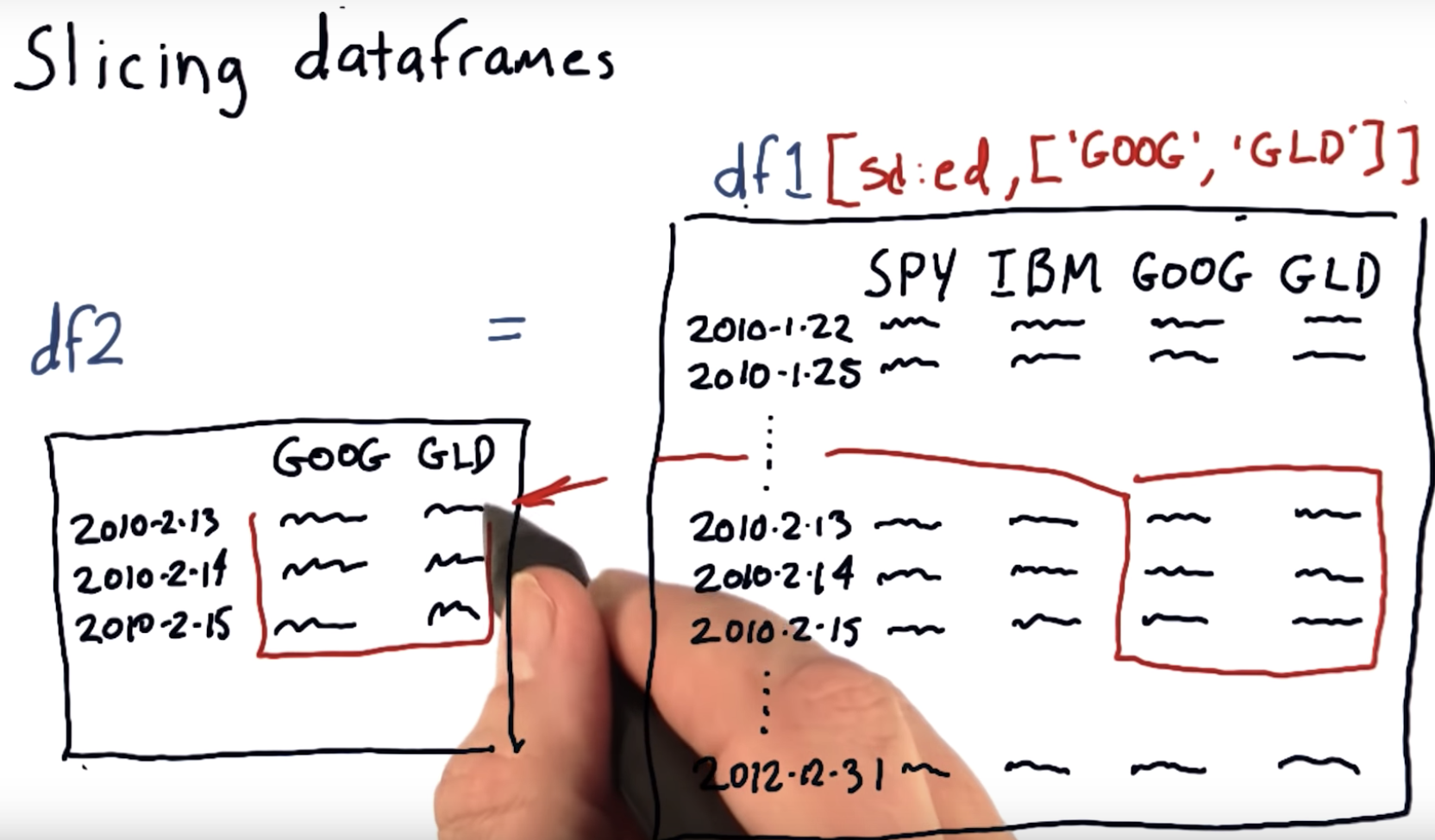

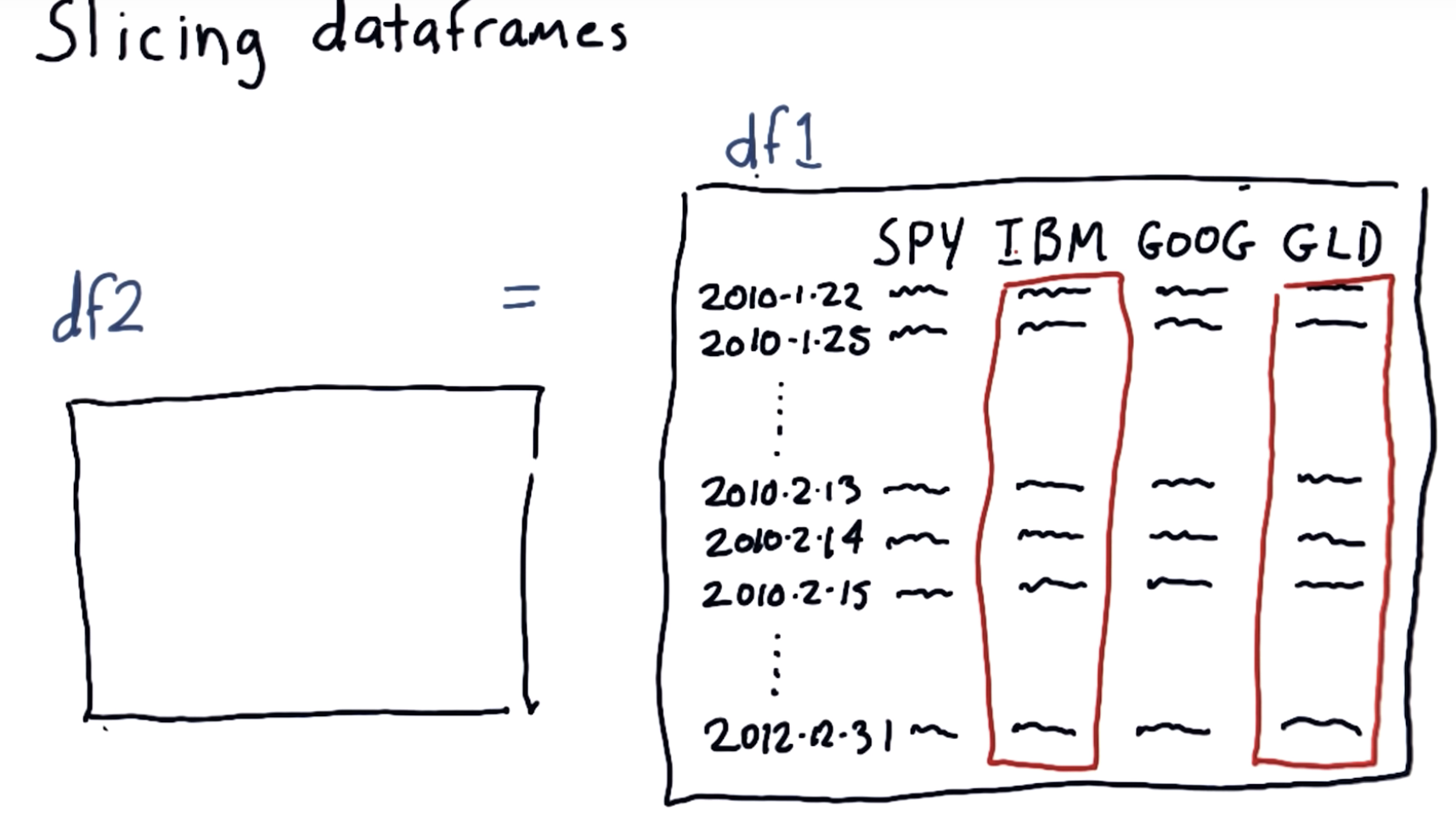

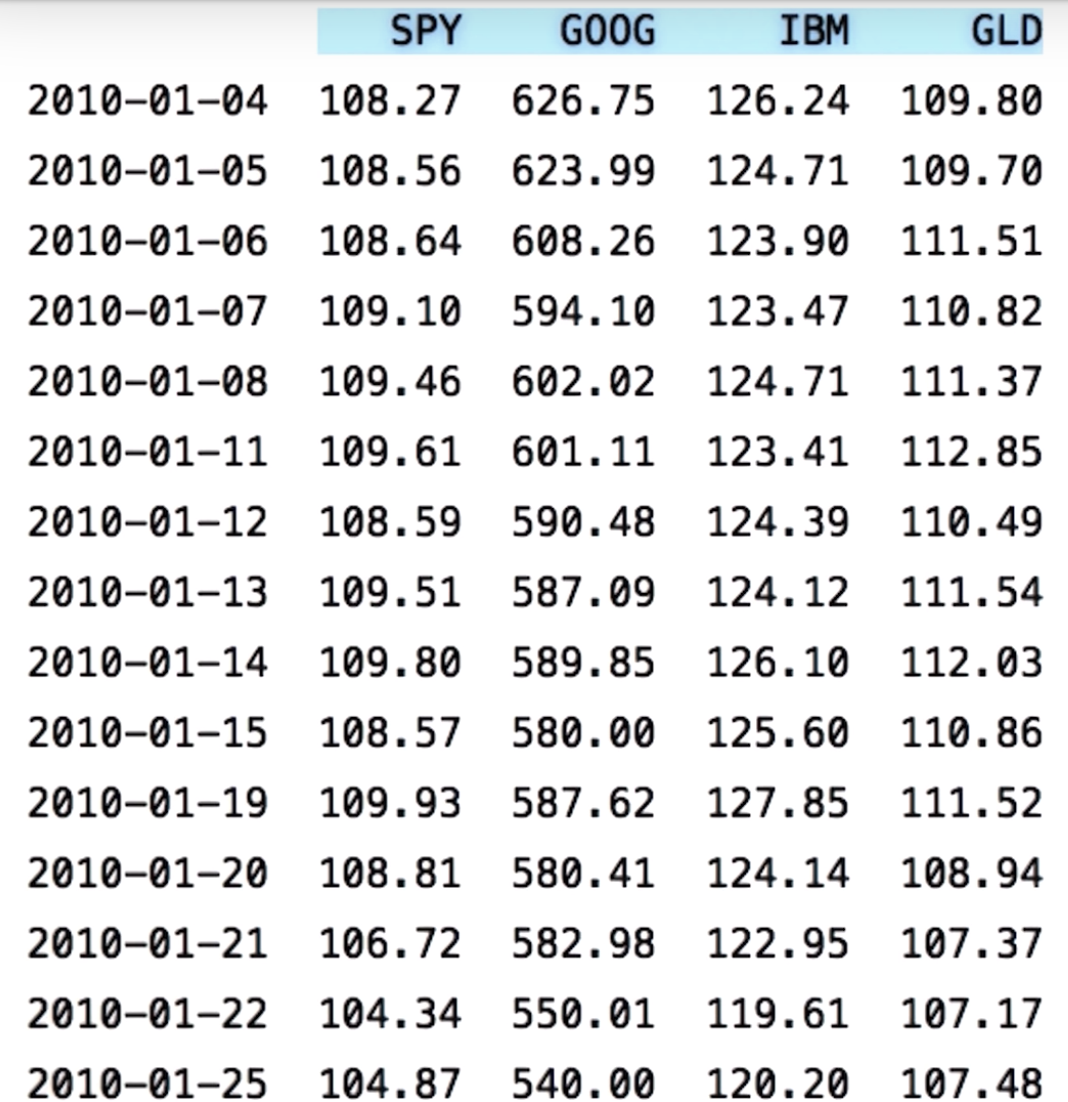

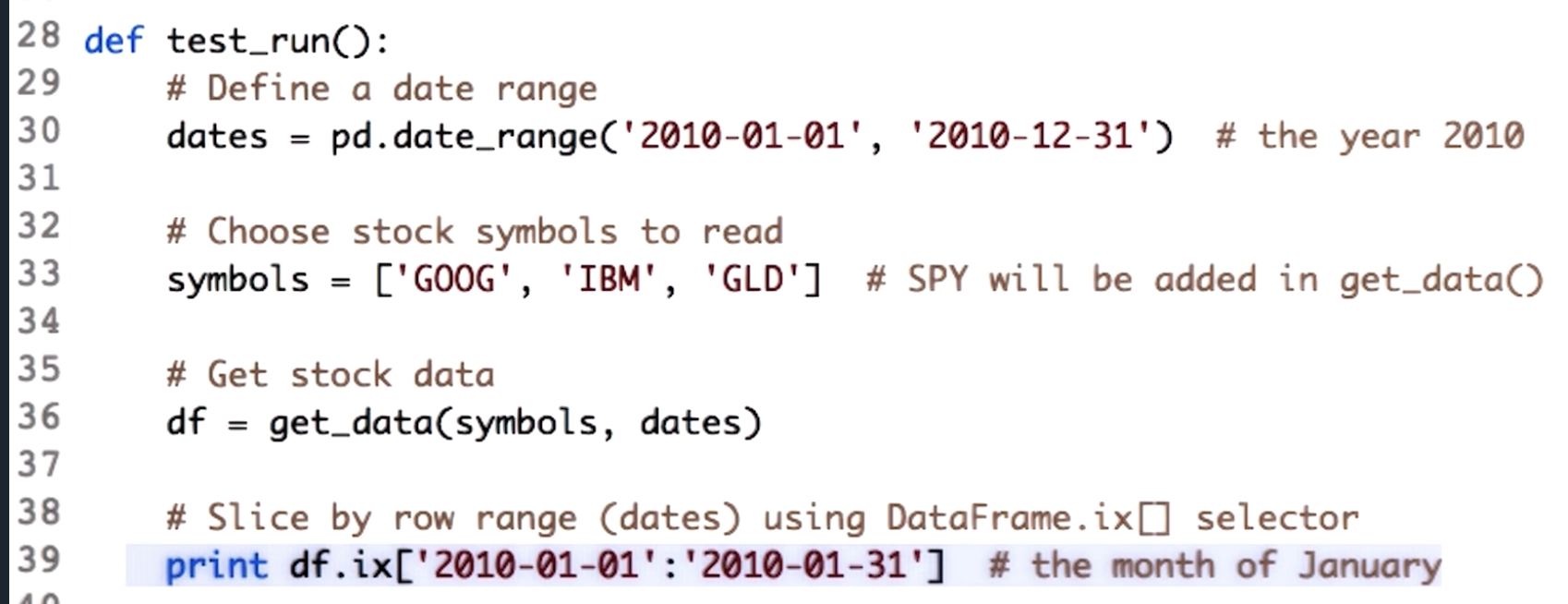

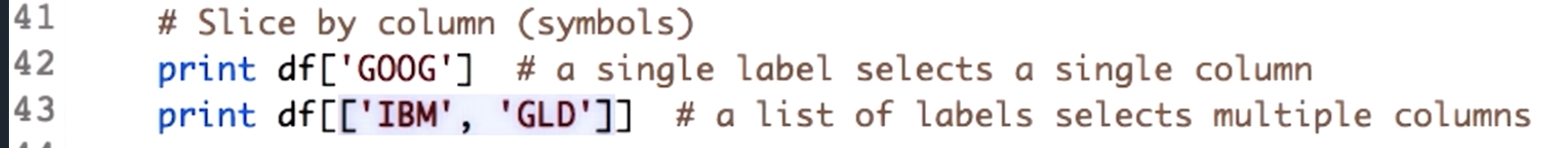

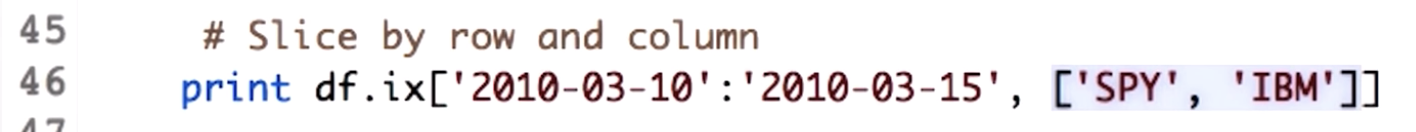

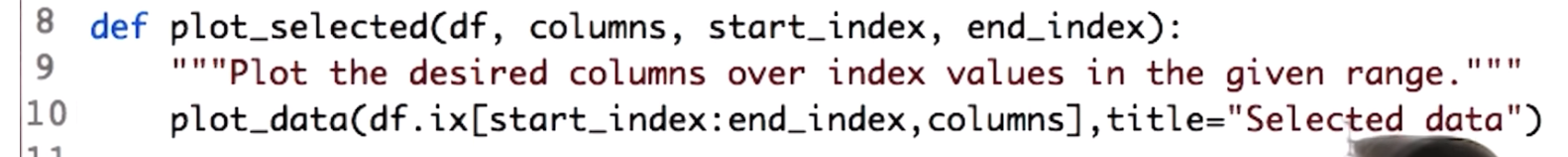

Obtaining a slice of data

More slicing

Problems with plotting

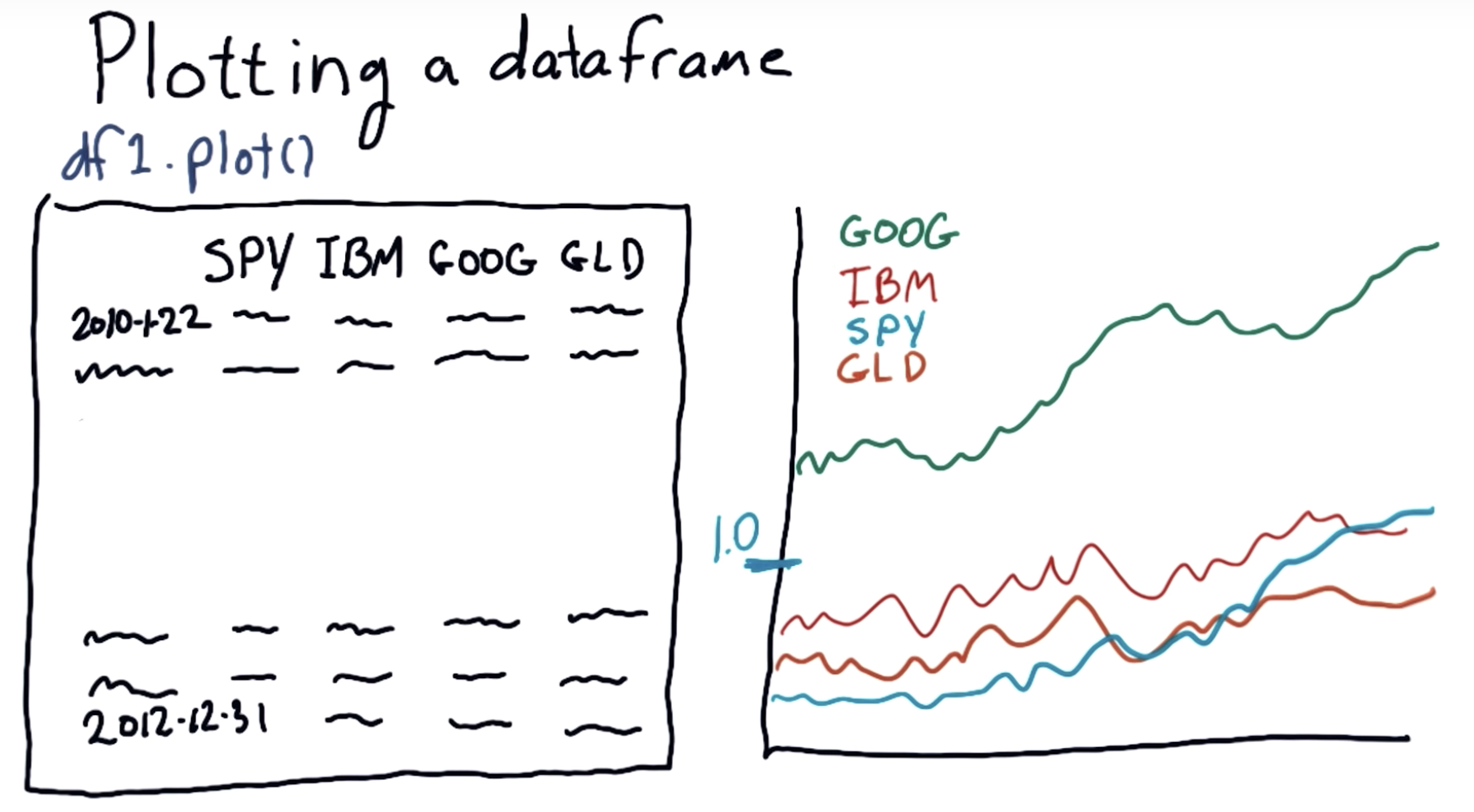

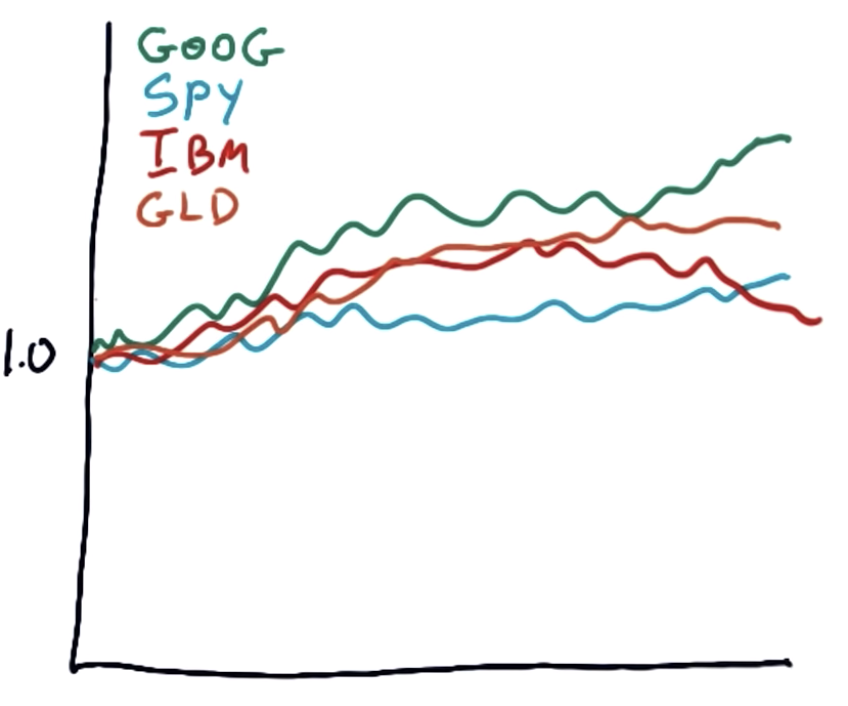

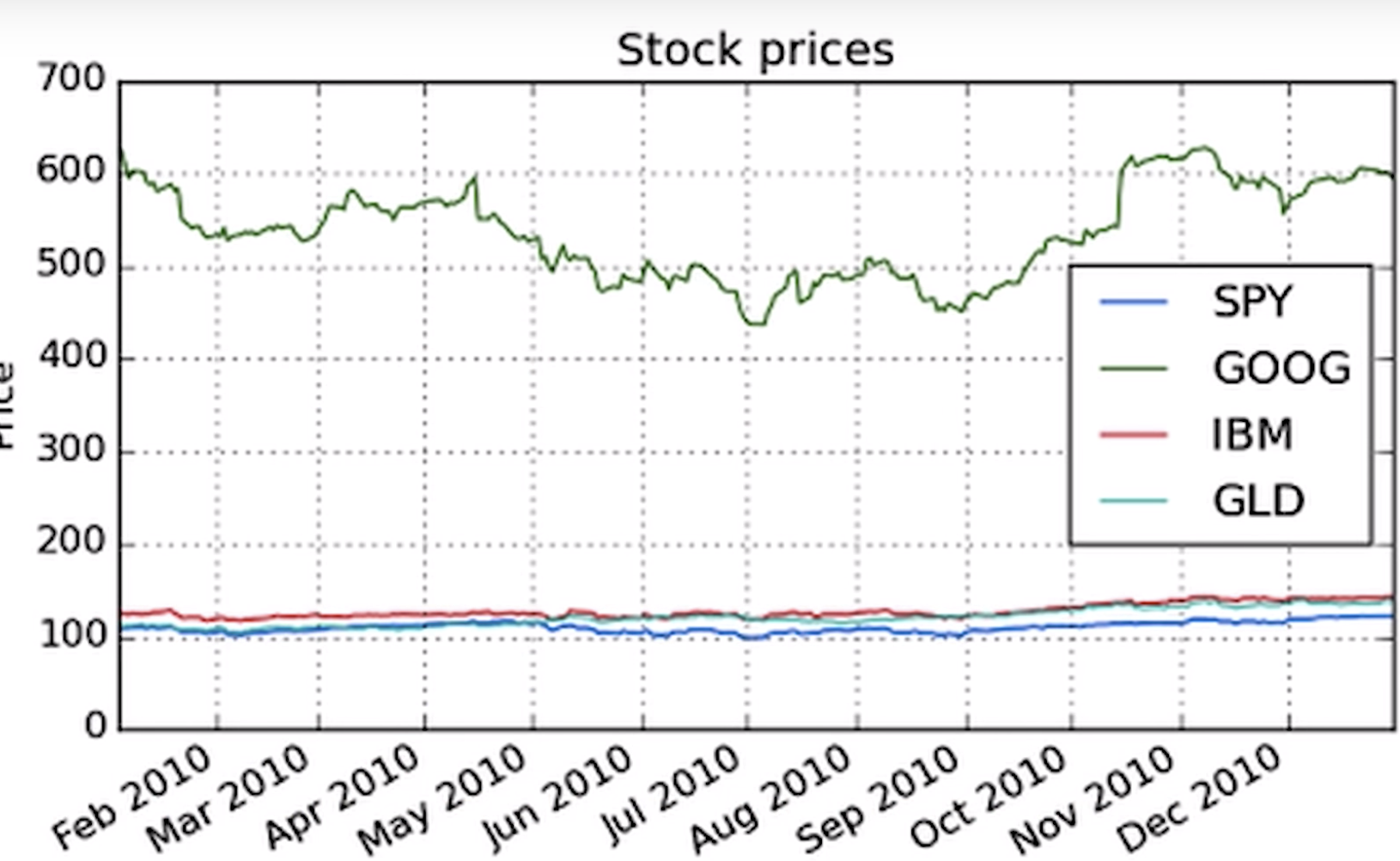

Plotting multiple stocks

Carly Fiorina was named "the most powerful woman in business" by Forbes in 1998, while at AT&T/Lucent. She was the CEO of HP from 1999-2005, and has held several leadership positions at technology firms and business institutes.

Listen to her talk about The Importance of Selective Information as part of Stanford's Entrepreneurial Thought Leaders Lecture series [full podcast].

Some of her popular quotes can be found here.

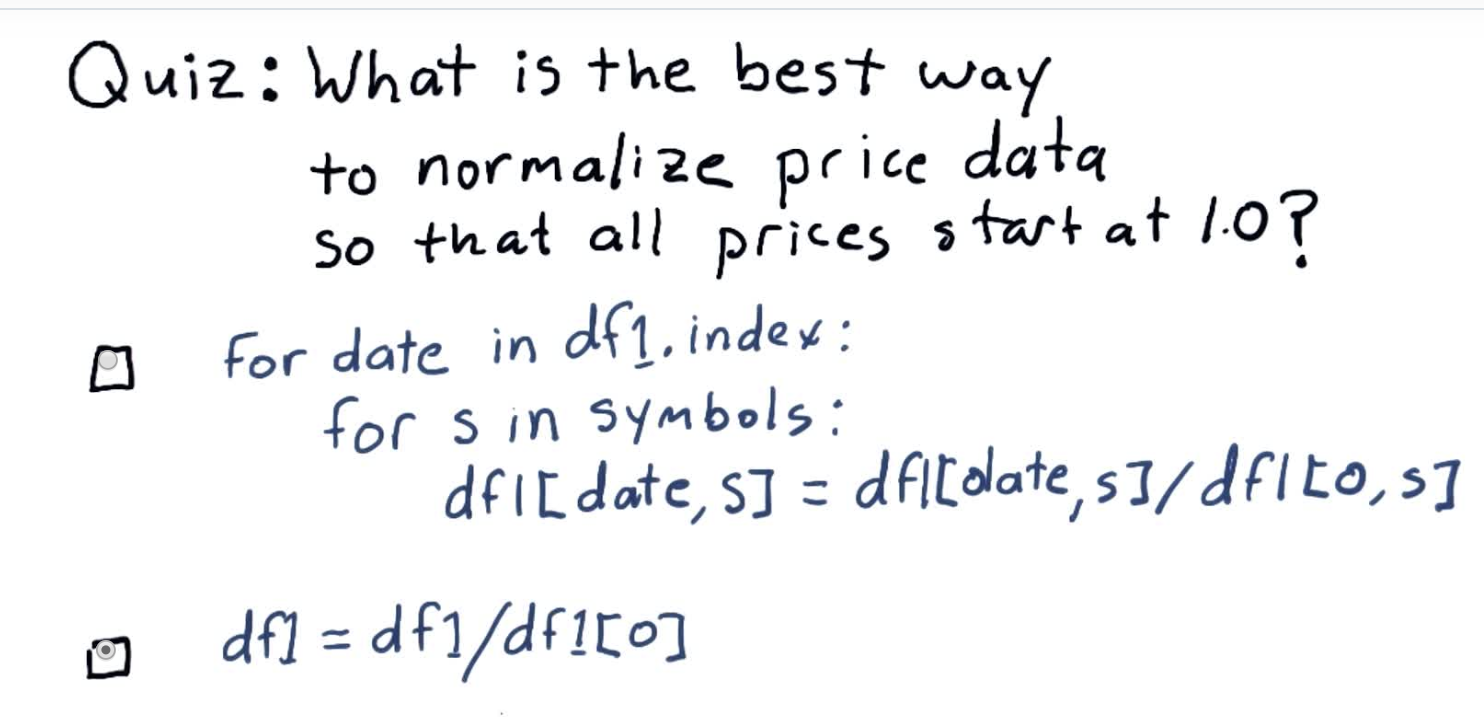

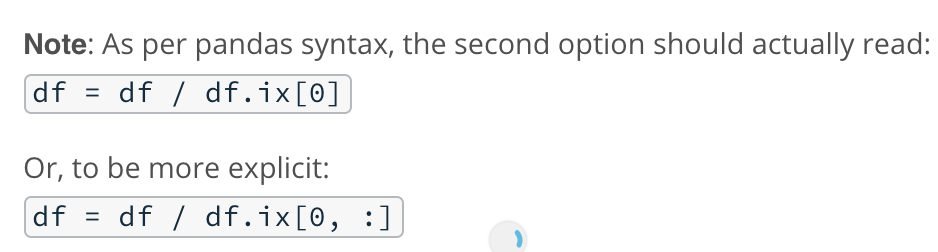

Normalizing

Lesson summary

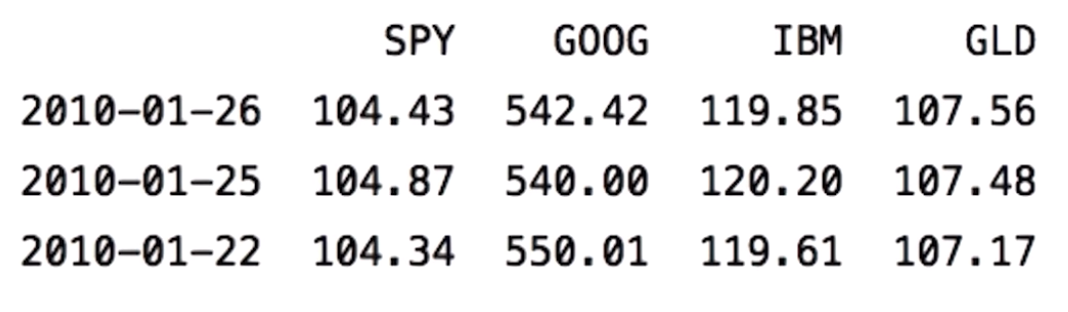

To read multiple stocks into a single dataframe, you need to:

- Specify a set of dates using pandas.date_range

- Create an empty dataframe with dates as index

- This helps align stock data and orders it by trading date

- Read in a reference stock (here SPY) and drop non-trading days using pandas.DataFrame.dropna

- Incrementally join dataframes using pandas.DataFrame.join

Once you have multiple stocks, you can:

- Select a subset of stocks by ticker symbols

- Slice by row (dates) and column (symbols)

- Plot multiple stocks at once (still using pandas.DataFrame.plot)

- Carry out arithmetic operations across stocks, e.g. normalize by the first day's price

Hit Next to continue.