High-Touch Model

Traditionally, the Buy Side and Sell Side have been operating in the way of

-

Clients(fund managers) send order to sales trader. This can be by means of phone calling, email, FIX message or data exchanged through third party software.

-

Sales Trader enters the orders into firms Order Management System(if its not electronically sent in) and assign them to different execution traders.

-

Execution Trader(or Dealer) picks up the orders(and communicates to Sales Trader if necessary) and enter the order into Trader Workstation.

-

The orders sent by Trader Workstation and get traded in exchange.

functional blocks. Some software system(such as Fidessa) combines both Sales Application and Dealer Trader Workstation into one GUI application.

(Click to view larger image)

The above flow is usually called High-Touch flow it requires broker firm to

provide human intervention to the client orders.

Electronic Trading(Low Touch)

Lately the concept of Electronic Trading has been popular and many broker firms have built the systems based on this concept to meet the changing client requirements:

- Clients want more direct control on the orders in the exchange

- Clients want low latency trading on the competitive market

- Clients want the service of Algorithmic trading.

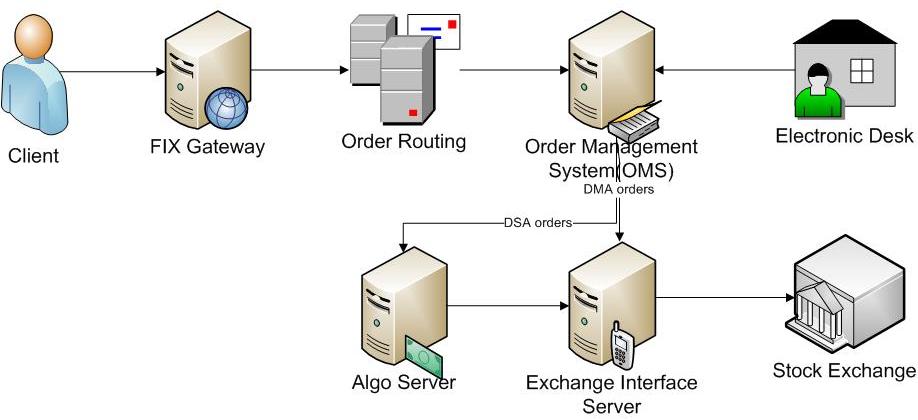

The diagram below shows a typical Electronic Trading System

(Click to view larger image)

Some details about the flow:

CLIENT SENDS ORDER THROUGH FIX PROTOCOL

The Client software can be from any vendor or house built, as long as it talks FIX protocol. Broker firm should discuss the support FIX versions with Client and usually some conformance tests should be done before going live.

The broker FIX gateway receives the order and forwards it to FIX Router

FIX ROUTER

FIX Router needs to make a decision on where the order should be forward to. Subject to the system configuration and broker office setup, the FIX Gateway could be regional and OMS partitioning could be office or country specific. FIX Router needs to look at the instrument and client instruction to route order to specific OMS for next handling.

ELECTRONIC DESK HANDLING.

An electronic order can go out to market without any human intervention from broker firm.

However, just like anything in life, it can go complicate:). Orders may run into some error state or failed Criteria Checks(Criteria Check is discussed in next section) due to various reasons, such as Client sends incorrect fields including unreasonable price/quantity, or even a bug in broker’s system itself.

This is when traders in Electronic Desk need to manually sort out the error by contacting Client if the error is in the order itself or broker firm’s support staff if the problem is in the broker firm system.

ELECTRONIC TRADING OMS

In addition to the traditional OMS functionalities which requires

- Showing the client order details

- Showing executions

- Operating on orders

An Electronic Trading OMS also needs to be able to perform

- Criteria Check

- Exception reporting and handling

- Order Routing

Criteria Check

Criteria Check is to prevent trading risk and meet the compliance requirement from stock exchange regulatory.

Exception Reporting and Handling

When an order has failed the criteria check or caused some internal system error, Electronic Desk needs to be informed immediately such that they can decide to inform client or remedy the problem in a timely fashion.

The last thing a broker firm wants to happen is to let the client find out the problem before the broker firm do, which surely will upset the client and lose the firm's credibility. This is why Exception reporting and handling are important that can made or break the whole electronic trading system.

Presentation of the Exception:

- GUI alert to Electronic Desk

- Monitoring software notification to system support staff

Severity of Exception

- Info

- Warning

- Error

DMA VS. DSA

A DMA order goes straight into the market without any changes to the client order. DSA order will be routed to Algo Server for strategy execution. Subject to the algo strategies offered by the broker firm, a DSA order can result in many “slices” of child orders to the market.