代码

代码

using System;

using System.Collections.Generic;

public class Constant

{

public static double Base_salary=4000;

}

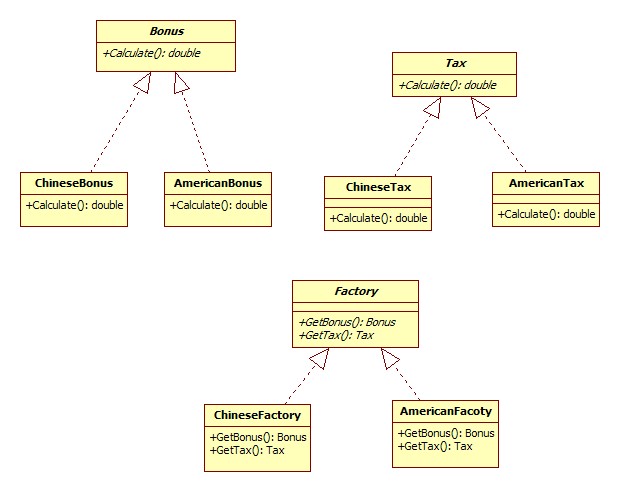

/// <summary>

/// 定义抽象奖金类

/// </summary>

public abstract class Bonus

{

public abstract double Calculate();

}

/// <summary>

/// 中国奖金

/// </summary>

public class ChineseBonus:Bonus

{

override public double Calculate()

{

return Constant.Base_salary*0.1;

}

}

/// <summary>

/// 美国奖金

/// </summary>

public class AmericanBonus:Bonus

{

override public double Calculate()

{

return Constant.Base_salary*0.15;

}

}

/// <summary>

/// 定义抽象税收

/// </summary>

public abstract class Tax

{

public abstract double Calculate();

}

/// <summary>

/// 中国税收

/// </summary>

public class ChineseTax:Tax

{

override public double Calculate()

{

return Constant.Base_salary*0.1;

}

}

/// <summary>

/// 美国税收

/// </summary>

public class AmericanTax:Tax

{

override public double Calculate()

{

return Constant.Base_salary*0.2;

}

}

/// <summary>

/// 抽像工厂

/// </summary>

public abstract class AbstractFactory

{

public abstract Tax getTax();

public abstract Bonus getBonus();

}

/// <summary>

/// 中国工厂

/// </summary>

public class ChineseFactory:AbstractFactory

{

public override Tax getTax()

{

return new ChineseTax();

}

public override Bonus getBonus()

{

return new ChineseBonus();

}

}

/// <summary>

/// 美国工厂

/// </summary>

public class AmericanFactory:AbstractFactory

{

// public static AbstractFactory GetInstance()

// {

// string factoryName = Constant.STR_FACTORYNAME.ToString();

//

// AbstractFactory instance;

//

// if(factoryName != "")

// instance = (AbstractFactory)Assembly.Load(factoryName).CreateInstance(factoryName);

// else

// instance = null;

//

// return instance;

// }

public override Tax getTax()

{

return new AmericanTax();

}

public override Bonus getBonus()

{

return new AmericanBonus();

}

}

using System.Collections.Generic;

public class Constant

{

public static double Base_salary=4000;

}

/// <summary>

/// 定义抽象奖金类

/// </summary>

public abstract class Bonus

{

public abstract double Calculate();

}

/// <summary>

/// 中国奖金

/// </summary>

public class ChineseBonus:Bonus

{

override public double Calculate()

{

return Constant.Base_salary*0.1;

}

}

/// <summary>

/// 美国奖金

/// </summary>

public class AmericanBonus:Bonus

{

override public double Calculate()

{

return Constant.Base_salary*0.15;

}

}

/// <summary>

/// 定义抽象税收

/// </summary>

public abstract class Tax

{

public abstract double Calculate();

}

/// <summary>

/// 中国税收

/// </summary>

public class ChineseTax:Tax

{

override public double Calculate()

{

return Constant.Base_salary*0.1;

}

}

/// <summary>

/// 美国税收

/// </summary>

public class AmericanTax:Tax

{

override public double Calculate()

{

return Constant.Base_salary*0.2;

}

}

/// <summary>

/// 抽像工厂

/// </summary>

public abstract class AbstractFactory

{

public abstract Tax getTax();

public abstract Bonus getBonus();

}

/// <summary>

/// 中国工厂

/// </summary>

public class ChineseFactory:AbstractFactory

{

public override Tax getTax()

{

return new ChineseTax();

}

public override Bonus getBonus()

{

return new ChineseBonus();

}

}

/// <summary>

/// 美国工厂

/// </summary>

public class AmericanFactory:AbstractFactory

{

// public static AbstractFactory GetInstance()

// {

// string factoryName = Constant.STR_FACTORYNAME.ToString();

//

// AbstractFactory instance;

//

// if(factoryName != "")

// instance = (AbstractFactory)Assembly.Load(factoryName).CreateInstance(factoryName);

// else

// instance = null;

//

// return instance;

// }

public override Tax getTax()

{

return new AmericanTax();

}

public override Bonus getBonus()

{

return new AmericanBonus();

}

}