原文 http://tecdat.cn/?p=3385

最近我被要求撰写关于金融时间序列的copulas的调查。不幸的是,该文件目前是法文版,可在https://hal.archives-ouvertes.fr/上找到。从读取数据中获得各种模型的描述,包括一些图形和统计输出。

> temp < - tempfile()

> download.file(

+“http://freakonometrics.free.fr/oil.xls",temp)

> oil = read.xlsx(temp,sheetName =“DATA”,dec =“,”)

> oil = read.xlsx(“D:\ home \ acharpen \ mes documents \ oil.xls”,sheetName =“DATA”)

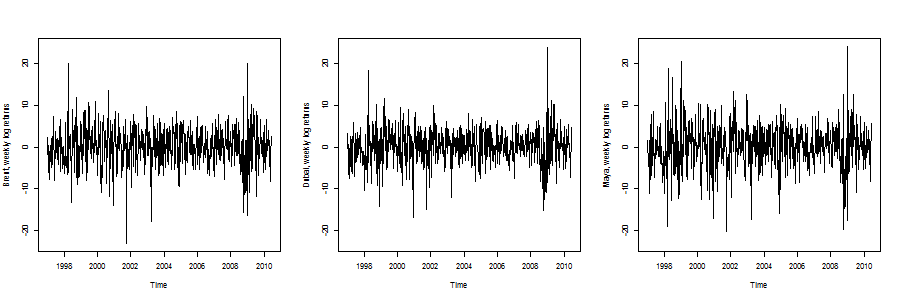

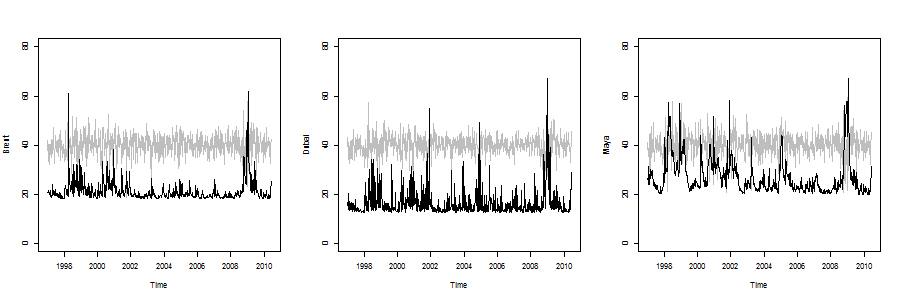

然后我们可以绘制这三个时间序列

1 1997-01-10 2.73672 2.25465 3.3673 1.5400

2 1997-01-17 -3.40326 -6.01433 -3.8249 -4.1076

3 1997-01-24 -4.09531 -1.43076 -6.6375 -4.6166

4 1997-01-31 -0.65789 0.34873 0.7326 -1.5122

5 1997-02-07 -3.14293 -1.97765 -0.7326 -1.8798

6 1997-02-14 -5.60321 -7.84534 -7.6372 -11.0549

这个想法是在这里使用一些多变量ARMA-GARCH过程。这里的启发式是第一部分用于模拟时间序列平均值的动态,第二部分用于模拟时间序列方差的动态。本文考虑了两种模型

- 关于ARMA模型残差的多变量GARCH过程(或方差矩阵动力学模型)

- 关于ARMA-GARCH过程残差的多变量模型(基于copula)

因此,这里将考虑不同的系列,作为不同模型的残差获得。我们还可以将这些残差标准化。来自ARMA模型

> fit1 = arima(x = dat [,1],order = c(2,0,1))

> fit2 = arima(x = dat [,2],order = c(1,0,1))

> fit3 = arima(x = dat [,3],order = c(1,0,1))

> m < - apply(dat_arma,2,mean)

> v < - apply(dat_arma,2,var)

> dat_arma_std < - t((t(dat_arma)-m)/ sqrt(v))

或者来自ARMA-GARCH模型

> fit1 = garchFit(formula = ~arma(2,1)+ garch(1,1),data = dat [,1],cond.dist =“std”)

> fit2 = garchFit(formula = ~arma(1,1)+ garch(1,1),data = dat [,2],cond.dist =“std”)

> fit3 = garchFit(formula = ~arma(1,1)+ garch(1,1),data = dat [,3],cond.dist =“std”)

> m_res < - apply(dat_res,2,mean)

> v_res < - apply(dat_res,2,var)

> dat_res_std = cbind((dat_res [,1] -m_res [1])/ sqrt(v_res [1]),(dat_res [,2] -m_res [2])/ sqrt(v_res [2]),(dat_res [ ,3] -m_res [3])/ SQRT(v_res [3]))

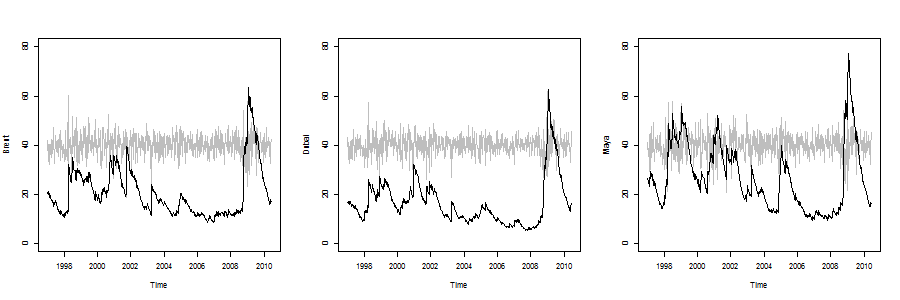

多变量GARCH模型

可以考虑的第一个模型是协方差矩阵的多变量EWMA,

> ewma = EWMAvol(dat_res_std,lambda = 0.96)

要想象波动性,请使用

> emwa_series_vol = function(i = 1){

+ lines(Time,dat_arma [,i] + 40,col =“gray”)

+ j = 1

+ if(i == 2)j = 5

+ if(i == 3)j = 9

隐含的相关性在这里

> emwa_series_cor = function(i = 1,j = 2){

+ if((min(i,j)== 1)&(max(i,j)== 2)){

+ a = 1; B = 9; AB = 3}

+ r = ewma $ Sigma.t [,ab] / sqrt(ewma $ Sigma.t [,a] *

+ ewma $ Sigma.t [,b])

+ plot(Time,r,type =“l”,ylim = c(0,1))

+}

也可能有一些多变量GARCH,即BEKK(1,1)模型,例如使用:

> bekk = BEKK11(dat_arma)

> bekk_series_vol function(i = 1){

+ plot(Time, $ Sigma.t [,1],type =“l”,

+ ylab = (dat)[i],col =“white”,ylim = c(0,80))

+ lines(Time,dat_arma [,i] + 40,col =“gray”)

+ j = 1

+ if(i == 2)j = 5

+ if(i == 3)j = 9

> bekk_series_cor = function(i = 1,j = 2){

+ a = 1; B = 5; AB = 2}

+ a = 1; B = 9; AB = 3}

+ a = 5; B = 9; AB = 6}

+ r = bk $ Sigma.t [,ab] / sqrt(bk $ Sigma.t [,a] *

+ bk $ Sigma.t [,b])

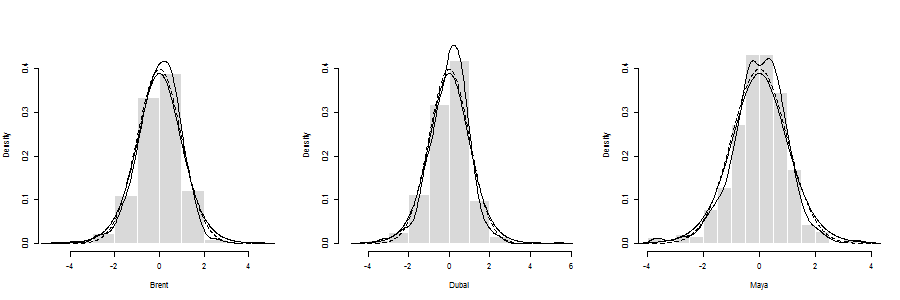

从单变量GARCH模型中模拟残差

第一步可能是考虑残差的一些静态(联合)分布。单变量边际分布是

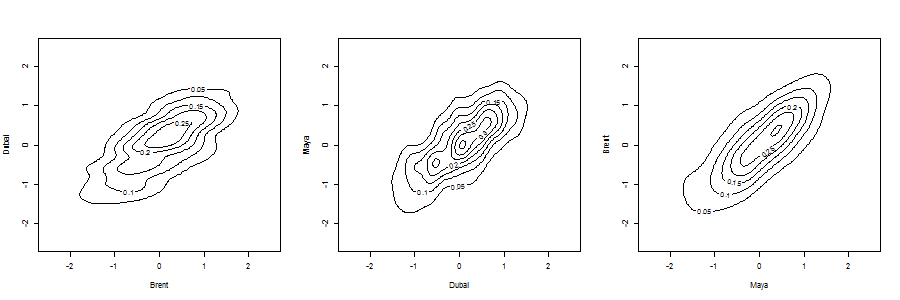

而关节密度的轮廓(使用双变量核估计器获得)是

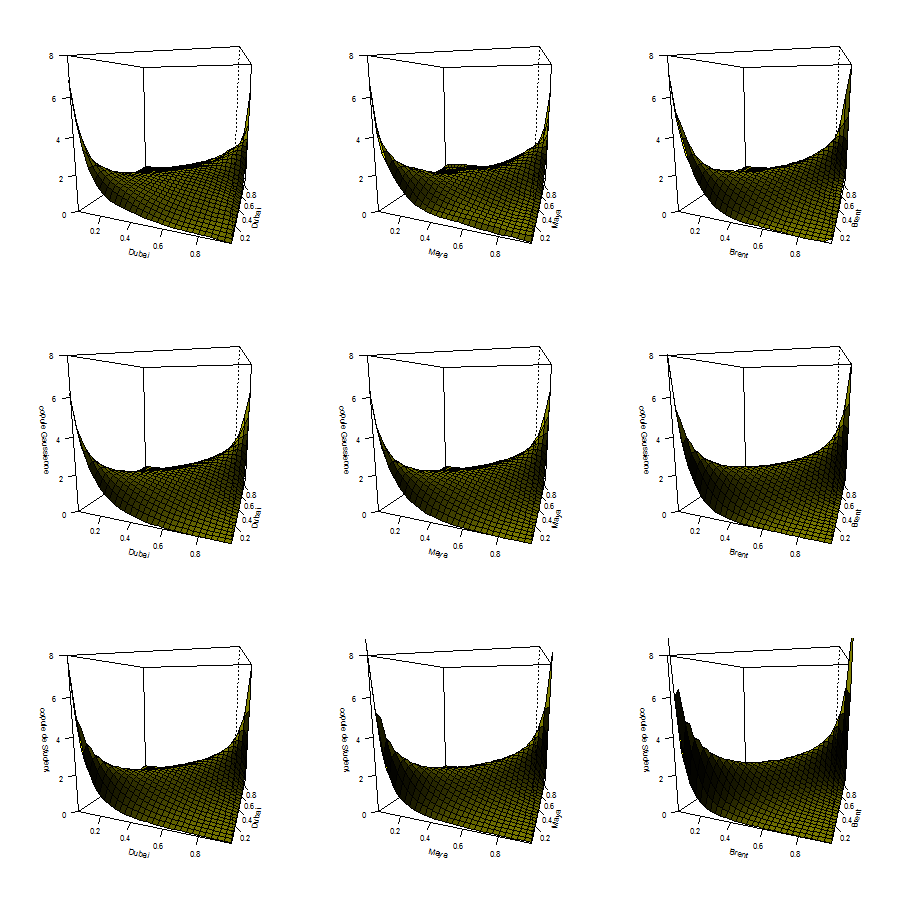

也可以将copula密度可视化(顶部有一些非参数估计,下面是参数copula)

> copula_NP = function(i = 1,j = 2){

+ n = nrow(uv)

+ s = 0.3

+ norm.cop < - normalCopula(0.5)

+ norm.cop < - normalCopula(fitCopula(norm.cop,uv)@estimate)

+ dc = function(x,y)dCopula(cbind(x,y),norm.cop)

+ ylab = names(dat)[j],zlab =“copule Gaussienne”,ticktype =“detailed”,zlim = zl)

+

+ t.cop < - tCopula(0.5,df = 3)

+ t.cop < - tCopula(t.fit [1],df = t.fit [2])

+ ylab = names(dat)[j],zlab =“copule de Student”,ticktype =“detailed”,zlim = zl)

+}

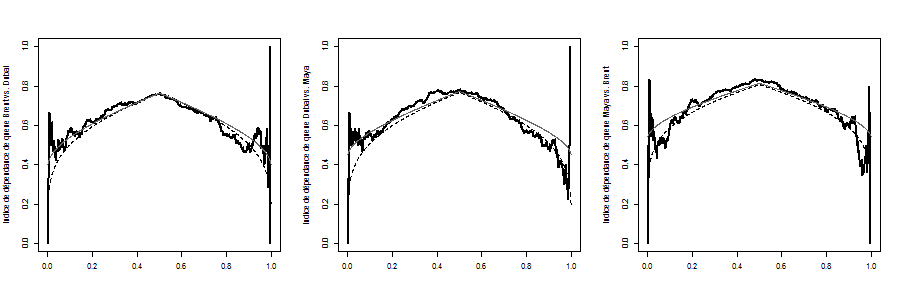

可以考虑这个 功能,

功能,

计算三对系列的经验版本,并将其与一些参数版本进行比较,

>

> lambda = function(C){

+ l = function(u)pcopula(C,cbind(u,u))/ u

+ v = Vectorize(l)(u)

+ return(c(v,rev(v)))

+}

>

> graph_lambda = function(i,j){

+ X = dat_res

+ U = rank(X [,i])/(nrow(X)+1)

+ V = rank(X [,j])/(nrow(X)+1)

+ normal.cop < - normalCopula(.5,dim = 2)

+ t.cop < - tCopula(.5,dim = 2,df = 3)

+ fit1 = fitCopula(normal.cop,cbind(U,V),method =“ml”)

d(U,V),method =“ml”)

+ C1 = normalCopula(fit1 @ copula @ parameters,dim = 2)

+ C2 = tCopula(fit2 @ copula @ parameters [1],dim = 2,df = trunc(fit2 @ copula @ parameters [2]))

+

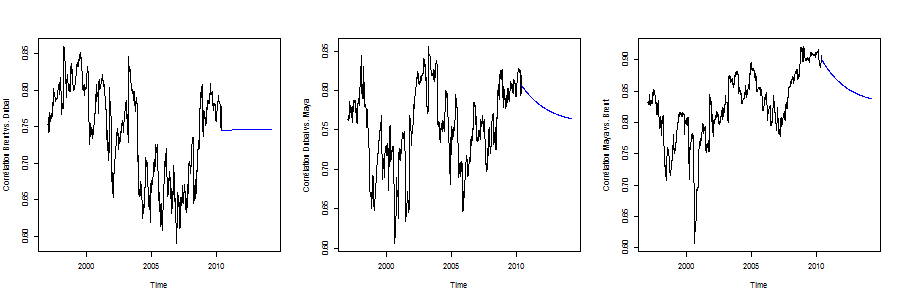

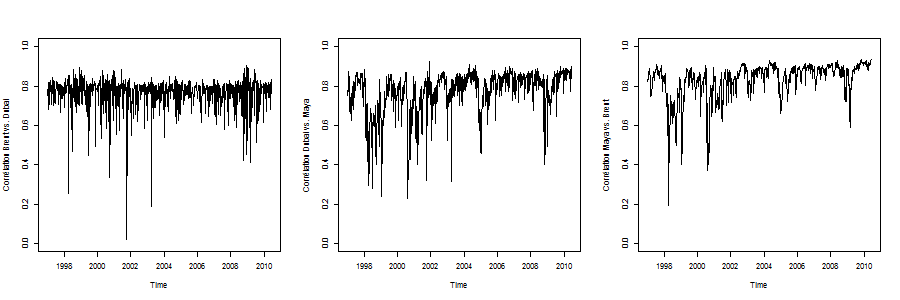

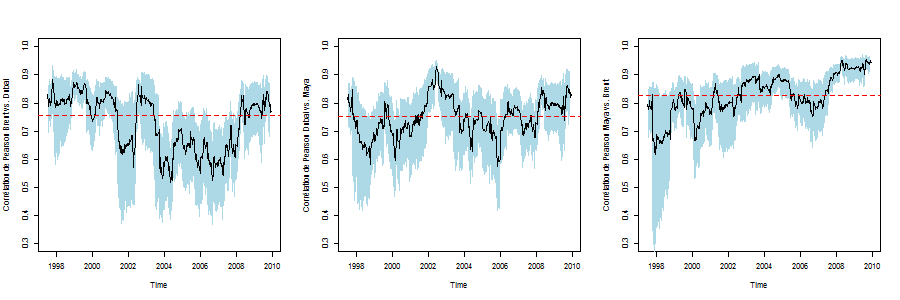

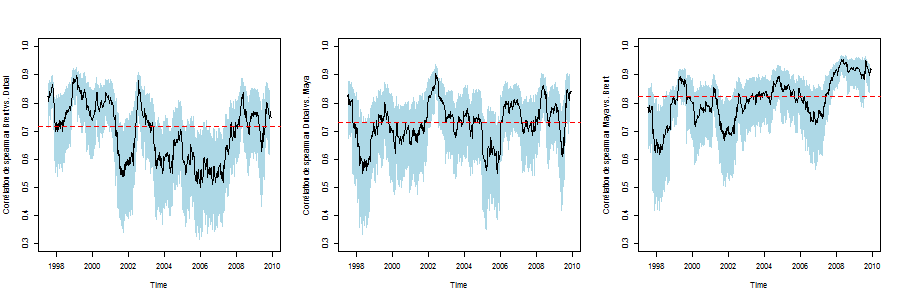

但人们可能想知道相关性是否随时间稳定。E:

> time_varying_correl_2 = function(i = 1,j = 2,

+ nom_arg =“Pearson”){

+ uv = dat_arma [,c(i,j)]

nom_arg))[1,2]

+}

> time_varying_correl_2(1,2)

> time_varying_correl_2(1,2,“spearman”)

> time_varying_correl_2(1,2,“kendall”)

斯皮尔曼 相关

或肯德尔 随着时间的推移

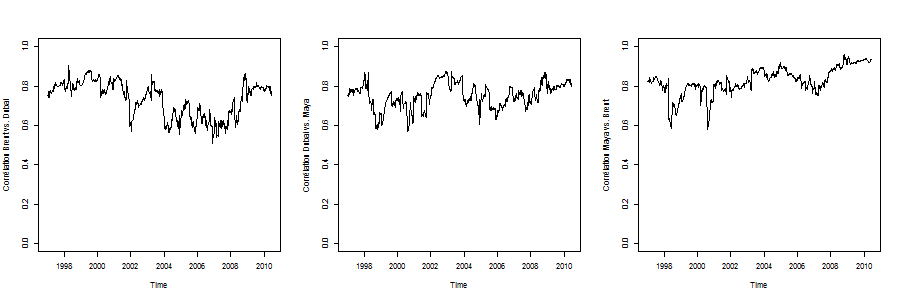

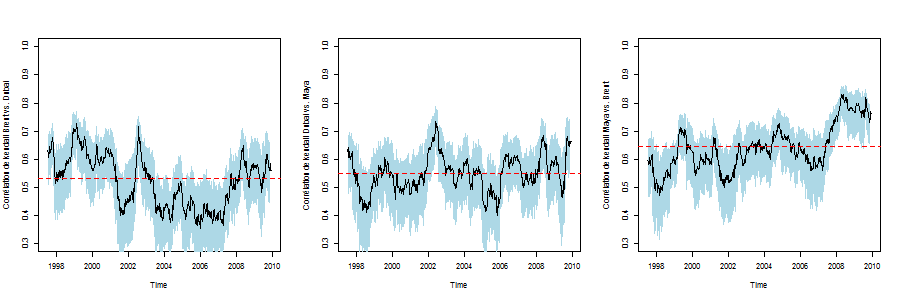

为了模型的相关性,考虑DCC模型(S)

> m2 = dccFit(dat_res_std)

> m3 = dccFit(dat_res_std,type =“Engle”)

> R2 = m2 $ rho.t

> R3 = m3 $ rho.t

要获得一些预测,请使用例如

> garch11.spec = ugarchspec(mean.model = list(armaOrder = c(2,1)),variance.model = list(garchOrder = c(1,1),model =“GARCH”))

> dcc.garch11.spec = dccspec(uspec = multispec(replicate(3,garch11.spec)),dccOrder = c(1,1),

distribution =“mvnorm”)

> dcc.fit = dccfit(dcc.garch11.spec,data = dat)

> fcst = dccforecast(dcc.fit,n.ahead = 200)