python信用评分卡建模(附代码,博主录制)

https://blog.csdn.net/LuYi_WeiLin/article/details/88019102转载

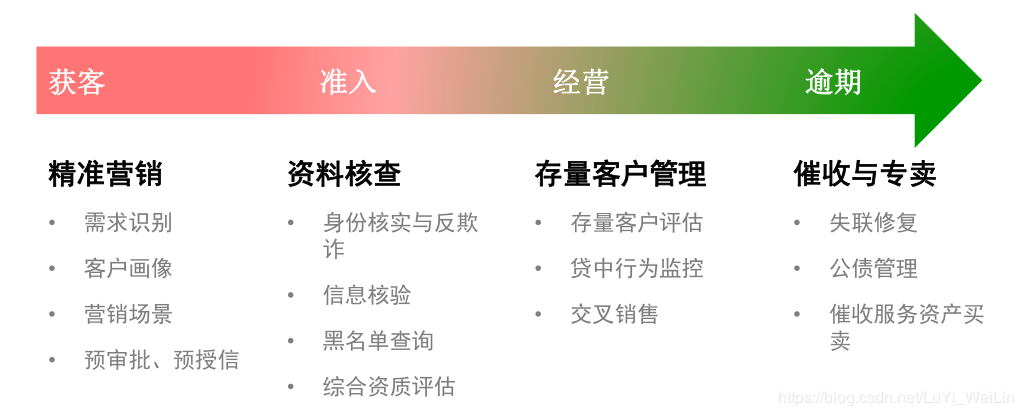

评分卡可分为申请评分卡(A卡)、行为评分卡(B卡)、催收评分卡(C卡)。不同的卡使用场景不一样,A卡用于贷前申请环节,用来区分客户好坏;B卡用于贷中环节,根据观察行为预测未来一段时间发生逾期/违约的概率;C卡主要用于贷后环节,这篇博客来总结一下C卡相关的知识点。

催收工作介绍

要学习催收评分卡,首先要先了解一下信贷客户管理的周期

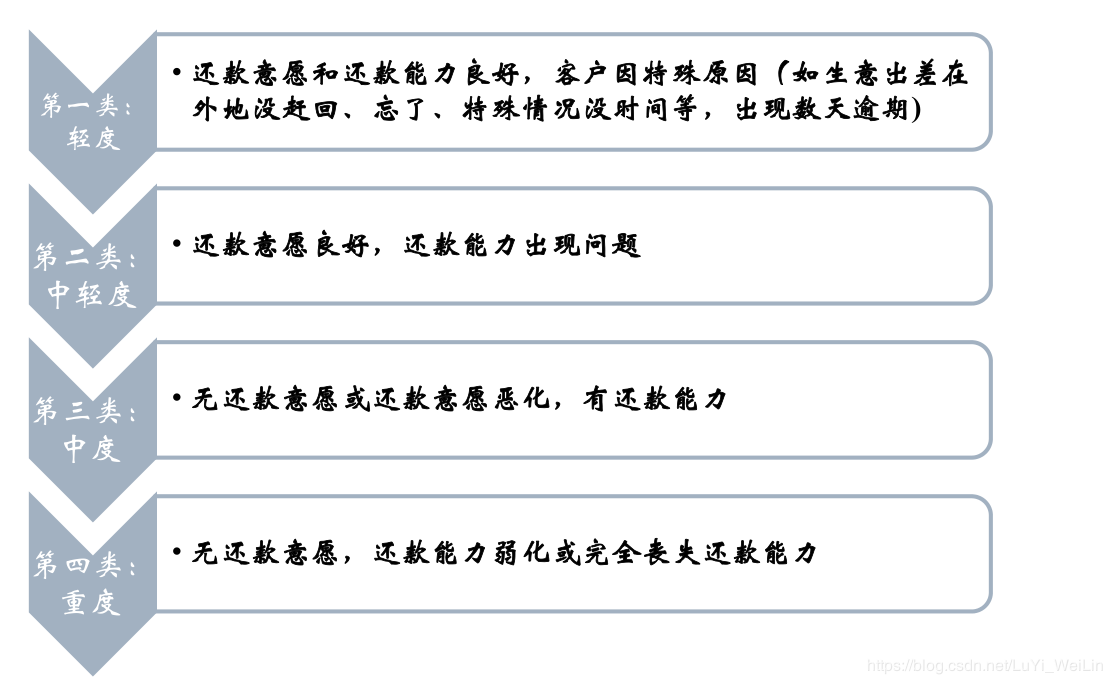

其实对于逾期,不能一棍子打死,逾期有时候罚息对于公司来说也是一种收益,所以我们需要对逾期客户进行分类,不同客户类别采取的催收手段都是不一样的

其中风险等级(第四类>第三类>第二类>第一类)

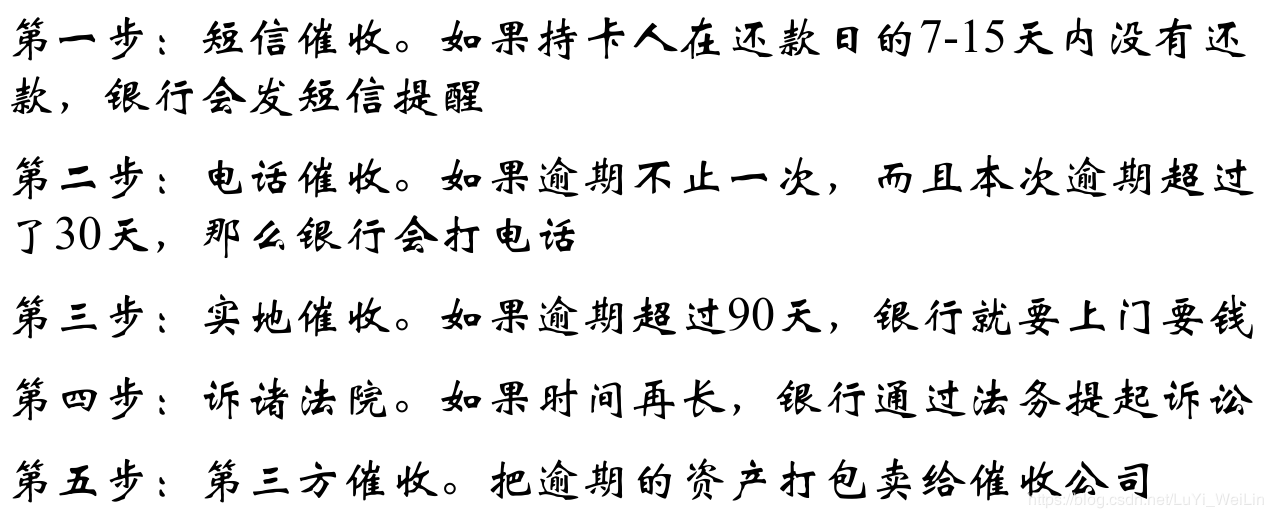

催收的流程大致可以分为以下几步:

催收评分卡的介绍

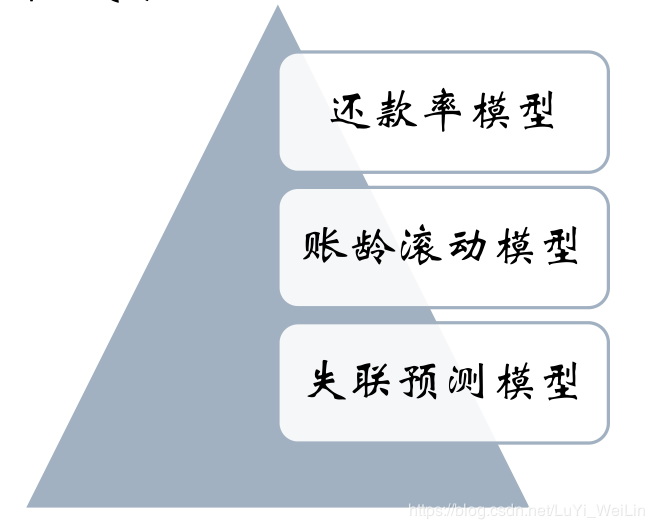

催收评分卡和申请评分卡和行为评分卡不太一样,一般申请评分卡和行为评分卡使用一个模型就可以了,但是催收评分卡由三个模型构成:(不同的模型功能目的不一样,其中失联预测模型是比较重要的)

- 还款率模型

- 账龄滚动模型

- 失联预测模型

下面介绍一下这三种模型的目的以及模型常用的数据特征

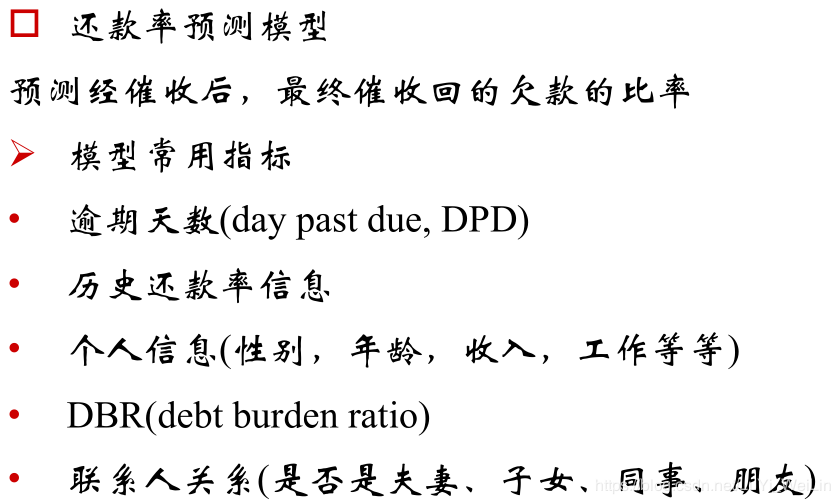

还款率模型

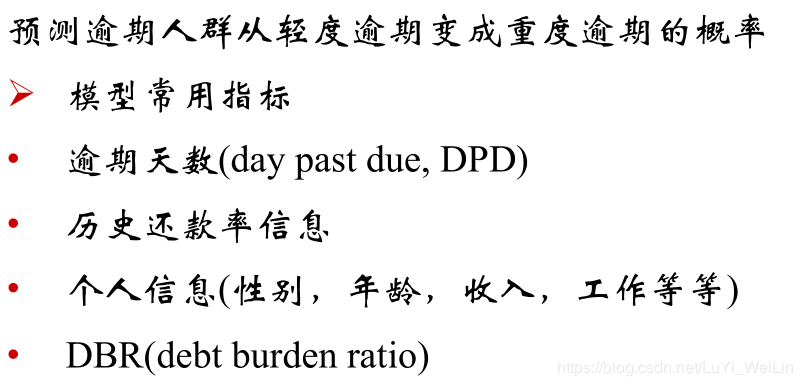

账龄滚动模型

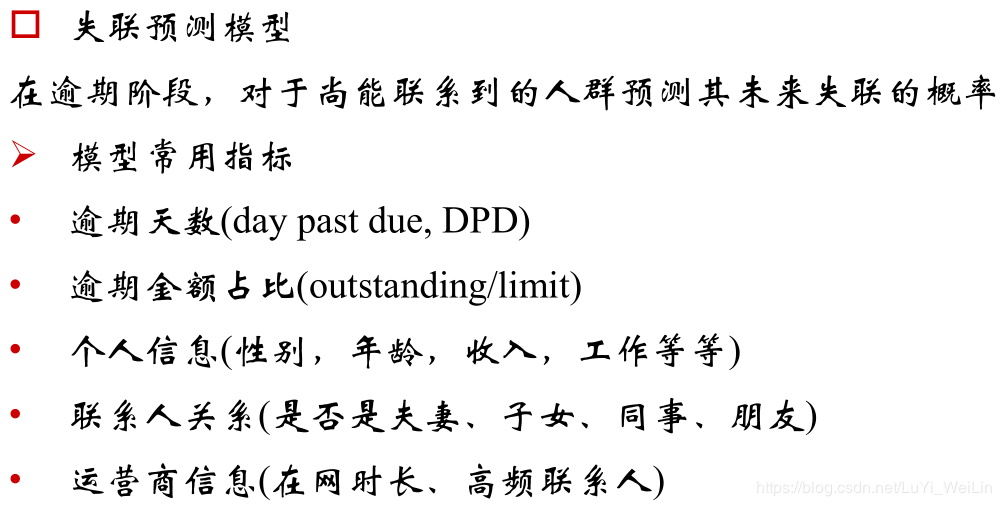

失联预测模型

催收评分卡和申请评分卡和行为评分卡不太一样,一般申请评分卡和行为评分卡使用一个模型就可以了,但是催收评分卡由三个模型构成:(不同的模型功能目的不一样,其中失联预测模型是比较重要的)

还款率模型

账龄滚动模型

失联预测模型

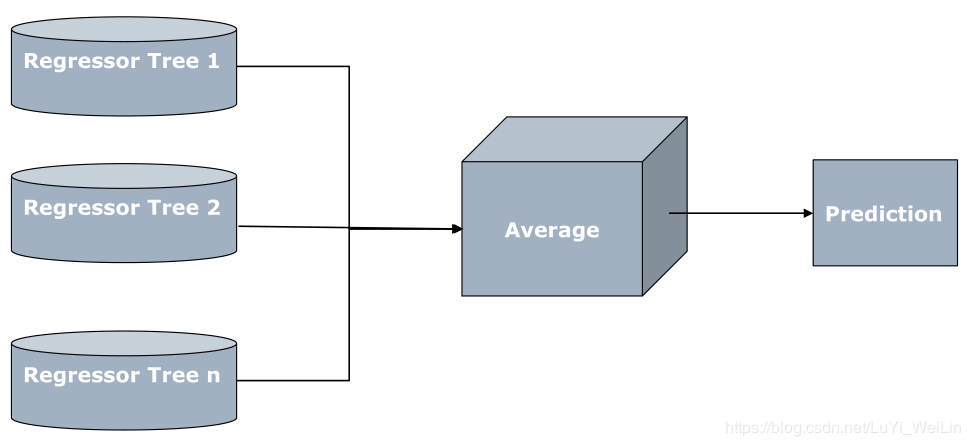

这篇博客以还款率模型进行讲解,要讲解还款率模型,我们首先要了解一下随机森林模型python实现代码

基于回归树的随机森林(元分类器是由许多回归树构成,每一个元分类器模型并行运行得出一个预测值,取所有元分类器模型的平均值作为最终的预测值)

代码如下,数据可以在我的资源下载,当然了,还款率模型完之后还可以对其进行延伸,预测出来的催回还款率假设定一个阈值(80%,自己可以定),大于80%为可摧回,小于为不可催回,之后可以使用二分类的逻辑回归对客户情况进行预测该客户是可摧回还是不可催回:

import pandas as pd

import numpy as np

from sklearn.model_selection import train_test_split

from sklearn.ensemble import RandomForestRegressor

from sklearn.model_selection import GridSearchCV

def MakeupMissingCategorical(x):

if str(x) == 'nan':

return 'Unknown'

else:

return x

def MakeupMissingNumerical(x,replacement):

if np.isnan(x):

return replacement

else:

return x

'''

第一步:文件准备

'''

foldOfData = 'H:/'

mydata = pd.read_csv(foldOfData + "还款率模型.csv",header = 0,engine ='python')

#催收还款率等于催收金额/(所欠本息+催收费用)。其中催收费用以支出形式表示

mydata['rec_rate'] = mydata.apply(lambda x: x.LP_NonPrincipalRecoverypayments /(x.AmountDelinquent-x.LP_CollectionFees), axis=1)

#还款率假如大于1,按作1处理

mydata['rec_rate'] = mydata['rec_rate'].map(lambda x: min(x,1))

#整个开发数据分为训练集、测试集2个部分

trainData, testData = train_test_split(mydata,test_size=0.4)

'''

第二步:数据预处理

'''

#由于不存在数据字典,所以只分类了一些数据

categoricalFeatures = ['CreditGrade','Term','BorrowerState','Occupation','EmploymentStatus','IsBorrowerHomeowner','CurrentlyInGroup','IncomeVerifiable']

numFeatures = ['BorrowerAPR','BorrowerRate','LenderYield','ProsperRating (numeric)','ProsperScore','ListingCategory (numeric)','EmploymentStatusDuration','CurrentCreditLines',

'OpenCreditLines','TotalCreditLinespast7years','CreditScoreRangeLower','OpenRevolvingAccounts','OpenRevolvingMonthlyPayment','InquiriesLast6Months','TotalInquiries',

'CurrentDelinquencies','DelinquenciesLast7Years','PublicRecordsLast10Years','PublicRecordsLast12Months','BankcardUtilization','TradesNeverDelinquent (percentage)',

'TradesOpenedLast6Months','DebtToIncomeRatio','LoanFirstDefaultedCycleNumber','LoanMonthsSinceOrigination','PercentFunded','Recommendations','InvestmentFromFriendsCount',

'Investors']

'''

类别型变量需要用目标变量的均值进行编码

'''

encodedFeatures = []

encodedDict = {}

for var in categoricalFeatures:

trainData[var] = trainData[var].map(MakeupMissingCategorical)

avgTarget = trainData.groupby([var])['rec_rate'].mean()

avgTarget = avgTarget.to_dict()

newVar = var + '_encoded'

trainData[newVar] = trainData[var].map(avgTarget)

encodedFeatures.append(newVar)

encodedDict[var] = avgTarget

#对数值型数据的缺失进行补缺

trainData['ProsperRating (numeric)'] = trainData['ProsperRating (numeric)'].map(lambda x: MakeupMissingNumerical(x,0))

trainData['ProsperScore'] = trainData['ProsperScore'].map(lambda x: MakeupMissingNumerical(x,0))

avgDebtToIncomeRatio = np.mean(trainData['DebtToIncomeRatio'])

trainData['DebtToIncomeRatio'] = trainData['DebtToIncomeRatio'].map(lambda x: MakeupMissingNumerical(x,avgDebtToIncomeRatio))

numFeatures2 = numFeatures + encodedFeatures

'''

第三步:调参

对基于CART的随机森林的调参,主要有:

1,树的个数

2,树的最大深度

3,内部节点最少样本数与叶节点最少样本数

4,特征个数

此外,调参过程中选择的误差函数是均值误差,5倍折叠

'''

X, y= trainData[numFeatures2],trainData['rec_rate']

param_test1 = {'n_estimators':range(60,91,5)}

gsearch1 = GridSearchCV(estimator = RandomForestRegressor(min_samples_split=50,min_samples_leaf=10,max_depth=8,max_features='sqrt' ,random_state=10),param_grid = param_test1, scoring='neg_mean_squared_error',cv=5)

gsearch1.fit(X,y)

gsearch1.best_params_, gsearch1.best_score_

best_n_estimators = gsearch1.best_params_['n_estimators']

param_test2 = {'max_depth':range(3,15), 'min_samples_split':range(10,101,10)}

gsearch2 = GridSearchCV(estimator = RandomForestRegressor(n_estimators=best_n_estimators, min_samples_leaf=10,max_features='sqrt' ,random_state=10,oob_score=True),param_grid = param_test2, scoring='neg_mean_squared_error',cv=5)

gsearch2.fit(X,y)

gsearch2.best_params_, gsearch2.best_score_

best_max_depth = gsearch2.best_params_['max_depth']

best_min_samples_split = gsearch2.best_params_['min_samples_split']

param_test3 = {'min_samples_leaf':range(1,20,2)}

gsearch3 = GridSearchCV(estimator = RandomForestRegressor(n_estimators=best_n_estimators, max_depth = best_max_depth,max_features='sqrt',min_samples_split=best_min_samples_split,random_state=10,oob_score=True),param_grid = param_test3, scoring='neg_mean_squared_error',cv=5)

gsearch3.fit(X,y)

gsearch3.best_params_, gsearch3.best_score_

best_min_samples_leaf = gsearch3.best_params_['min_samples_leaf']

numOfFeatures = len(numFeatures2)

mostSelectedFeatures = numOfFeatures/2

param_test4 = {'max_features':range(3,numOfFeatures+1)}

gsearch4 = GridSearchCV(estimator = RandomForestRegressor(n_estimators=best_n_estimators, max_depth=best_max_depth,min_samples_leaf=best_min_samples_leaf,min_samples_split=best_min_samples_split,random_state=10,oob_score=True),param_grid = param_test4, scoring='neg_mean_squared_error',cv=5)

gsearch4.fit(X,y)

gsearch4.best_params_, gsearch4.best_score_

best_max_features = gsearch4.best_params_['max_features']

#把最优参数全部获取去做随机森林拟合

cls = RandomForestRegressor(n_estimators=best_n_estimators,max_depth=best_max_depth,min_samples_leaf=best_min_samples_leaf,min_samples_split=best_min_samples_split,max_features=best_max_features,random_state=10,oob_score=True)

cls.fit(X,y)

trainData['pred'] = cls.predict(trainData[numFeatures2])

trainData['less_rr'] = trainData.apply(lambda x: int(x.pred > x.rec_rate), axis=1)

np.mean(trainData['less_rr'])

err = trainData.apply(lambda x: np.abs(x.pred - x.rec_rate), axis=1)

np.mean(err)

#随机森林评估变量重要性

importance=cls.feature_importances_

featureImportance=dict(zip(numFeatures2,importance))

featureImportance=sorted(featureImportance.items(),key=lambda x:x[1],reverse=True)

'''

第四步:在测试集上测试效果

'''

#类别型数据处理

for var in categoricalFeatures:

testData[var] = testData[var].map(MakeupMissingCategorical)

newVar = var + '_encoded'

testData[newVar] = testData[var].map(encodedDict[var])

avgnewVar = np.mean(trainData[newVar])

testData[newVar] = testData[newVar].map(lambda x: MakeupMissingNumerical(x, avgnewVar))

#连续性数据处理

testData['ProsperRating (numeric)'] = testData['ProsperRating (numeric)'].map(lambda x: MakeupMissingNumerical(x,0))

testData['ProsperScore'] = testData['ProsperScore'].map(lambda x: MakeupMissingNumerical(x,0))

testData['DebtToIncomeRatio'] = testData['DebtToIncomeRatio'].map(lambda x: MakeupMissingNumerical(x,avgDebtToIncomeRatio))

testData['pred'] = cls.predict(testData[numFeatures2])

testData['less_rr'] = testData.apply(lambda x: int(x.pred > x.rec_rate), axis=1)

np.mean(testData['less_rr'])

err = testData.apply(lambda x: np.abs(x.pred - x.rec_rate), axis=1)

np.mean(err)

python风控建模实战lendingClub(博主录制,catboost,lightgbm建模,2K超清分辨率)

https://study.163.com/course/courseMain.htm?courseId=1005988013&share=2&shareId=400000000398149

微信扫二维码,免费学习更多python资源