一、双均线概念

均线:对于每一个交易日,都可以计算出前N天的移动平均值,然后把这些平均值连起来,成为一条线,就叫做N日移动平均线。移动平均线常用线有5日、10日、30日、60日、120日的指标。

5日和10日的是短线操作参照指标,称作日均线指标;

30日和60日的是中期均线指标,称作季均线指标;

120日和240日的是长期均线指标,称作年均线指标。

金叉:短期均线上穿长期均线,买入信号。

死叉:短期均线下穿长期均线,卖出信号。

交易策略:金叉买入,死叉卖出。

二、金叉死叉交易练习

1、使用tushare包获取某股票的历史行情

import numpy as np import pandas as pd import matplotlib.pyplot as plt # Python绘图和数据可视化的工具包 import tushare as ts ts.get_k_data("601318", start="2004-01-30").to_csv('601318.csv') df = pd.read_csv('601318.csv', index_col="date", parse_dates=['date'])[['open', 'close', 'high', 'low']] print(df) """ open close high low date 2007-03-01 21.254 19.890 21.666 19.469 2007-03-02 19.979 19.728 20.166 19.503 ... ... ... ... ... 2020-01-22 85.000 85.220 85.480 83.830 2020-01-23 84.010 83.490 84.560 82.480 [3076 rows x 4 columns] """

2、使用pandas包计算该股票历史数据的5日和30均线

5日均线则前4天没有均线,30日均线则前29天没有均线。

(1)普通方法

df['ma5'] = np.nan # 创建5日均值列 df['ma30'] = np.nan # 创建30日均值列 print(df) """ open close high low ma5 ma30 date 2007-03-01 21.254 19.890 21.666 19.469 NaN NaN 2007-03-02 19.979 19.728 20.166 19.503 NaN NaN ... ... ... ... ... ... ... 2020-01-22 85.000 85.220 85.480 83.830 NaN NaN 2020-01-23 84.010 83.490 84.560 82.480 NaN NaN """ for i in range(4, len(df)): # 从第五个到最后一个 # 当天和前四天的收盘价的平均值为5日均线值 df.loc[df.index[i], 'ma5'] = df["close"][i-4:i+1].mean() # i=4是第五天,[0,5] print(df) """ open close high low ma5 ma30 date 2007-03-01 21.254 19.890 21.666 19.469 NaN NaN 2007-03-02 19.979 19.728 20.166 19.503 NaN NaN 2007-03-05 19.545 18.865 19.626 18.504 NaN NaN 2007-03-06 18.704 19.235 19.554 18.597 NaN NaN 2007-03-07 19.252 19.758 19.936 19.090 19.4952 NaN ... ... ... ... ... ... ... 2020-01-23 84.010 83.490 84.560 82.480 85.6320 NaN """ for i in range(29, len(df)): # 从第30个到最后一个 # 当天和前29天的收盘价的平均值为30日均线值 df.loc[df.index[i], 'ma30'] = df["close"][i-29:i+1].mean() print(df) """ open close high low ma5 ma30 date 2007-03-01 21.254 19.890 21.666 19.469 NaN NaN 2007-03-02 19.979 19.728 20.166 19.503 NaN NaN 2007-03-05 19.545 18.865 19.626 18.504 NaN NaN 2007-03-06 18.704 19.235 19.554 18.597 NaN NaN 2007-03-07 19.252 19.758 19.936 19.090 19.4952 NaN ... ... ... ... ... ... ... 2020-01-17 86.150 86.250 86.900 85.850 86.1780 85.292333 2020-01-20 88.300 87.600 88.700 87.350 86.4080 85.387667 2020-01-21 87.000 85.600 87.290 85.600 86.1620 85.452667 2020-01-22 85.000 85.220 85.480 83.830 86.0440 85.507000 2020-01-23 84.010 83.490 84.560 82.480 85.6320 85.488667 """

(2)简单方法

df['ma5'] = df['close'].rolling(5).mean() df['ma30'] = df['close'].rolling(30).mean() print(df) """ open close high low ma5 ma30 date 2007-03-01 21.254 19.890 21.666 19.469 NaN NaN 2007-03-02 19.979 19.728 20.166 19.503 NaN NaN 2007-03-05 19.545 18.865 19.626 18.504 NaN NaN 2007-03-06 18.704 19.235 19.554 18.597 NaN NaN 2007-03-07 19.252 19.758 19.936 19.090 19.4952 NaN ... ... ... ... ... ... ... 2020-01-17 86.150 86.250 86.900 85.850 86.1780 85.292333 2020-01-20 88.300 87.600 88.700 87.350 86.4080 85.387667 2020-01-21 87.000 85.600 87.290 85.600 86.1620 85.452667 2020-01-22 85.000 85.220 85.480 83.830 86.0440 85.507000 2020-01-23 84.010 83.490 84.560 82.480 85.6320 85.488667 """

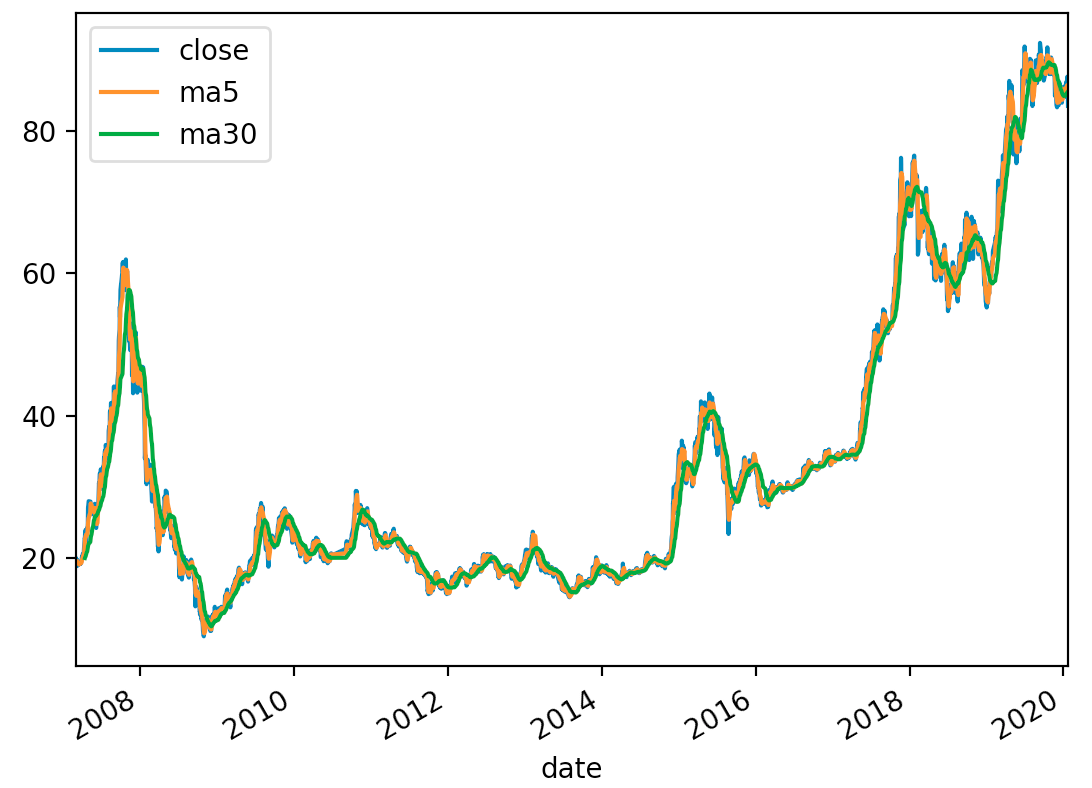

3、使用matplotlib包可视化历史数据的收盘价和两条均线

df[['close', 'ma5', 'ma30']].plot() plt.show()

运行后显示效果:

4、分析输出所有金叉日期和死叉日期

如果前一交易日五日均线小于30日均线,后一交易日五日均线大于30日均线,则说明是金叉;

如果前一交易日五日均线大于30日均线,后一交易日五日均线小于30日均线,则说明是死叉。

(1)循环的解法

# dropna()删除含有空数据的全部行,axis参数可删除含义空数据的全部列 df = df.dropna() gloden_cross = [] # 金叉 death_cross = [] # 死叉 for i in range(0, len(df)-1): if df['ma5'][i] >= df['ma30'][i] and df['ma5'][i-1] <= df['ma30'][i-1]: gloden_cross.append(df.index[i]) if df['ma5'][i] <= df['ma30'][i] and df['ma5'][i-1] >= df['ma30'][i-1]: death_cross.append(df.index[i]) print('金叉日期', gloden_cross) """ 金叉日期 [Timestamp('2007-06-14 00:00:00'), Timestamp('2007-12-10 00:00:00'),..., Timestamp('2020-01-02 00:00:00')] """ print('死叉日期', death_cross) """ 死叉日期 [Timestamp('2007-06-04 00:00:00'), Timestamp('2007-11-06 00:00:00'),..., Timestamp('2019-12-23 00:00:00')] """

(2)简便算法

# dropna()删除含有空数据的全部行,axis参数可删除含义空数据的全部列 df = df.dropna() sr1 = df['ma5'] < df['ma30'] sr2 = df['ma5'] >= df['ma30'] death_cross = df[sr1 & sr2.shift(1)].index golden_cross = df[-(sr1 | sr2.shift(1))].index print('金叉日期', golden_cross) """ 金叉日期 DatetimeIndex(['2007-04-12', '2007-06-14', '2007-12-10', '2008-04-23',..., '2020-01-02'] """ print('死叉日期', death_cross) """ 死叉日期 DatetimeIndex(['2007-06-04', '2007-11-06', '2007-12-13', '2008-05-20',..., '2019-11-12', '2019-12-23'] """

5、使用该策略的炒股收益率

如果我从2010年1月1日起,初始资金为100000元,金叉尽量买入,死叉全部卖出,则到今天为止,我的炒股收益率?

# 炒股收益率 first_money = 100000 money = first_money # 持有的资金 hold = 0 # 持有的股票 sr1 = pd.Series(1, index=golden_cross) sr2 = pd.Series(0, index=death_cross) sr = sr1.append(sr2).sort_index() # 将两个表合并,并按时间排序 sr = sr['2010-01-01':] # 从2010年1月1日开始 for i in range(0, len(sr)): p = df['open'][sr.index[i]] # 当天的开盘价 if sr.iloc[i] == 1: # 金叉 buy = money // (100 * p) # 买多少手 hold += buy * 100 money -= buy * 100 * p else: # 死叉 money += hold * p hold = 0 # 持有股票重置为0 # 计算最后一天股票市值加上持有的资金 p = df['open'][-1] now_money = hold * p + money print('当前持有资产总额:', now_money) print('盈亏情况:', now_money - first_money) """ 当前持有资产总额: 551977.7999999997 盈亏情况: 451977.7999999997 """

需要注意的是:这里金叉死叉都是按照当天的收盘价计算的。但是如果得到当天的收盘价就已经无法进行交易了。因此要让策略可行,需要按照当天的开盘价计算。

三、在JoinQuant(聚宽)平台实现双均线策略

金叉:若5日均线大于10日均线且不持仓

死叉:若5日均线小于10日均线且持仓

1、策略实现

# 导入函数库 from jqdata import * # 初始化函数,设定基准等等 def initialize(context): # 设定沪深300作为基准 set_benchmark('000300.XSHG') # 开启动态复权模式(真实价格) set_option('use_real_price', True) # 股票类每笔交易时的手续费是:买入时佣金万分之三,卖出时佣金万分之三加千分之一印花税, 每笔交易佣金最低扣5块钱 set_order_cost(OrderCost(close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = ["601318.XSHG"] g.p1 = 5 # 五日均线 g.p2 = 10 # 十日均线 def handle_data(context, data): # 遍历股票 for stock in g.security: df = attribute_history(stock, g.p2) # 十日均线的值 ma10 = df['close'].mean() # 五日均线的值 ma5 = df['close'][-5:].mean() if ma10 > ma5 and stock in context.portfolio.positions: # 具有持仓 # 死叉卖出 order_target(stock, 0) if ma10 < ma5 and stock not in context.portfolio.positions: # 不具有持仓 # 金叉买入 # order(stock, context.portfolio.available_cash) # 能买多少买多少 order(stock, context.portfolio.available_cash * 0.8) # 可用资金的80%买入

执行效果:

2、record函数——画图函数

调用record函数可用来描画额外的曲线。

参数:一个或多个key=value形式的参数,key为曲线名称,value为值。

在双均线策略中加入画图函数:

# 导入函数库 from jqdata import * # 初始化函数,设定基准等等 def initialize(context): # 设定沪深300作为基准 set_benchmark('000300.XSHG') # 开启动态复权模式(真实价格) set_option('use_real_price', True) # 股票类每笔交易时的手续费是:买入时佣金万分之三,卖出时佣金万分之三加千分之一印花税, 每笔交易佣金最低扣5块钱 set_order_cost(OrderCost(close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = ["601318.XSHG"] g.p1 = 5 # 五日均线 g.p2 = 10 # 十日均线 def handle_data(context, data): # 遍历股票 for stock in g.security: df = attribute_history(stock, g.p2) # 十日均线的值 ma10 = df['close'].mean() # 五日均线的值 ma5 = df['close'][-5:].mean() if ma10 > ma5 and stock in context.portfolio.positions: # 具有持仓 # 死叉卖出 order_target(stock, 0) if ma10 < ma5 and stock not in context.portfolio.positions: # 不具有持仓 # 金叉买入 # order(stock, context.portfolio.available_cash) # 能买多少买多少 order(stock, context.portfolio.available_cash * 0.8) # 可用资金的80%买入 record(ma5=ma5, ma10=ma10)

执行显示如下: