- The income statement measures performance over some period of time,usually a quarter or a year.The income statement equation is:Revenus - Expenses = Income

From the last section,we know that the balance sheet is as a snapshot,and here the income statement is as a video recording covering the period between a before and an after picture.

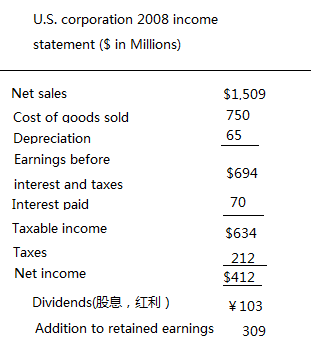

- An income statement is usually revenue and expenses from the firm's principle operations.Subsequent parts include:financing expenses such as interest paid,and the taxes paid are reported separately.The last item is net income(the so-called bottom line) which is often expressed on a per-share basis and called earnings per share(EPS,每股净利润,每股收益).Let's see a income statement for an U.S corpoation:

The difference between net income and cash dividends is the addition to retained earnings(留存收益) for the year.

The difference between net income and cash dividends is the addition to retained earnings(留存收益) for the year.

Earnings per share(EPS) = Net income/Total shares outstanding

Dividends per share = Total dividends/Total shares outstanding

When looking at an income statement, the financial manager needs to keep three things in mind:GAAP,cash versus noncash item,and time and costs.

1.GAAP and the income statement:The general rule (the recognition principle) is to recognize revenue when the earnings process is virtually complete and the value of an exchange of goods or services if known or can be reliably determined.This principle usually means that revenue is recognized at the time of sale,which need not be the same as the time of collection(cash),so is the expense.

2.Noncash item:A primary reason that accounting income differs from cash flow is that an income statement contains noncash item.The most important of these is depreciation(折旧).The depreciation deduction is simply another application of the matching principle in accounting.The revenues associated with an asset would generally occur over some length of time.So the accountant seeks to match the expense of purchasing the asset with the benefits produced from owning it.

For the financial manager,the actual timing of cash inflows and outflows is critical in coming up with a reasonable estimate of market value,so we need to learn how to separate the cash flows from noncash accounting entries.

3.Time and costs:It's often useful to think of the future as having two distinct parts:the short run and the long run.These are not precise time periods.The distinct has to to do with whether costs are fixed or variable.In the long run,all business costs are variable.Given sufficient time, assets can be sold,debts can be paid,and so on.

If our time horizon is relatively short,however,some costs are effectively fixed---they must be paid no matter what(property taxes财产税).Other costs such as wages to laborers and payments to suppliers are still variable.As a result,even in the short run,the firm can vary its output level by varying expenditures in these area.