第三版本

我们前面已经有两个版本了,都涉及到woe转换之类的,现在我们尝试一下xgboost版本的,不需要做woe转换

import numpy as np # linear algebra import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv) from sklearn import preprocessing from sklearn import metrics from sklearn import model_selection from sklearn import ensemble from sklearn import tree from sklearn import linear_model import os, datetime, sys, random, time import seaborn as sns import xgboost as xgs import lightgbm as lgb import matplotlib.pyplot as plt import matplotlib.gridspec as gridspec #from mlxtend import classifier plt.style.use('fivethirtyeight') %matplotlib inline import warnings warnings.filterwarnings('ignore') from scipy import stats, special #import shap import catboost as ctb trainingData = pd.read_csv('F:\python\Give-me-some-credit-master\data\cs-training.csv') testData = pd.read_csv('F:\python\Give-me-some-credit-master\data\cs-test.csv')

探索性分析

trainingData.head() trainingData.info() trainingData.describe() print(trainingData.shape) print(testData.shape) testData.head() testData.info() testData.describe()

复制原数据

以后要养成在做数据基本分布之后就复制一份数据,避免修改原数据

finalTrain = trainingData.copy() finalTest = testData.copy()

因为,我们需要预测测试数据中拖欠的概率,所以我们需要首先从中删除附加列

finalTest.drop('SeriousDlqin2yrs', axis=1, inplace = True)

同样如上所述,让我们取ID列,即Unnamed:0,并将其存储在单独的变量中

trainID = finalTrain['Unnamed: 0'] testID = finalTest['Unnamed: 0'] finalTrain.drop('Unnamed: 0', axis=1, inplace=True) finalTest.drop('Unnamed: 0', axis=1, inplace=True)

y值分布

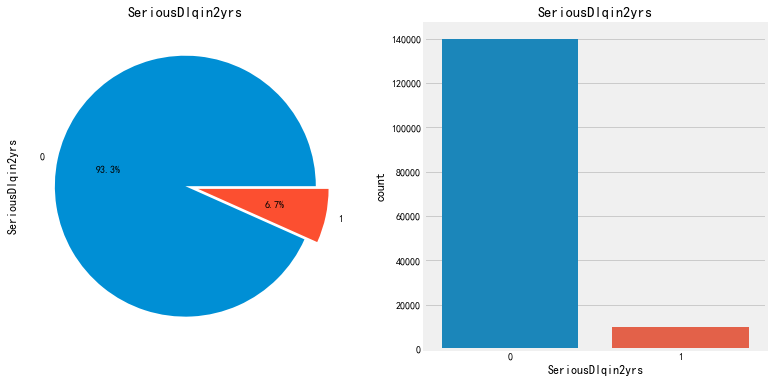

因为我们有15万的数据。它很有可能是一个不平衡的数据集。因此,检查正负拖欠比率。

fig, axes = plt.subplots(1,2,figsize=(12,6)) finalTrain['SeriousDlqin2yrs'].value_counts().plot.pie(explode=[0,0.1],autopct='%1.1f%%',ax=axes[0]) axes[0].set_title('SeriousDlqin2yrs') #ax[0].set_ylabel('') sns.countplot('SeriousDlqin2yrs',data=finalTrain,ax=axes[1]) axes[1].set_title('SeriousDlqin2yrs') plt.show()

负拖欠与正拖欠异常值的比率为93.3%至6.7%,约为14:1。因此,我们的数据集是高度不平衡的。

我们不能依靠精确分数来预测模型的成功。这里将考虑许多其他的评估指标。但稍后再谈

EDA

现在让我们继续EDA的离群值分析部分。在这里,我们将去除可能影响预测模型的潜在异常值。

异常值分析

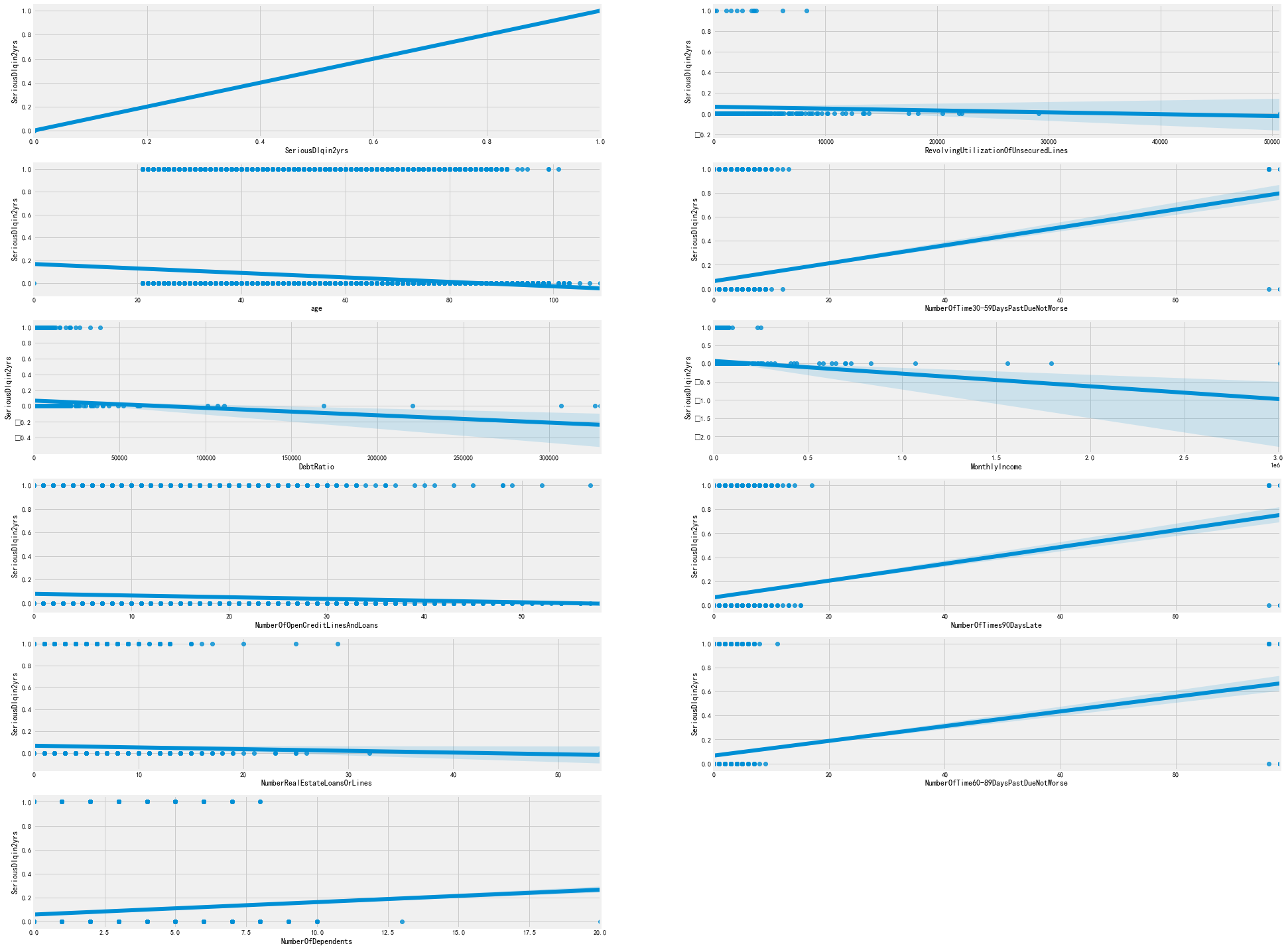

fig = plt.figure(figsize=[30,30]) for col,i in zip(finalTrain.columns,range(1,13)): axes = fig.add_subplot(7,2,i) sns.regplot(finalTrain[col],finalTrain.SeriousDlqin2yrs,ax=axes) plt.show()

从上图中我们可以观察到:

在NumberOfTime30-59DaysPastDueNotBesters、NumberOfTimes60-89DaysPastDueNotBeare和NumberOfTimes90DaysLate列中,我们可以看到超过90的拖欠范围,这在所有3个功能中都很常见。

有一些不寻常的DebtRatio and RevolvingUtilizationOfUnsecuredLines

第1步:修复NumberOfTime30-59dayspastduenotbears、NumberOfTime60-89dayspastduenotbear和NumberOfTimes90DaysLate列

print("Unique values in '30-59 Days' values that are more than or equal to 90:",np.unique(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTime30-59DaysPastDueNotWorse'])) print("Unique values in '60-89 Days' when '30-59 Days' values are more than or equal to 90:",np.unique(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in '90 Days' when '30-59 Days' values are more than or equal to 90:",np.unique(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTimes90DaysLate'])) print("Unique values in '60-89 Days' when '30-59 Days' values are less than 90:",np.unique(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']<90] ['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in '90 Days' when '30-59 Days' values are less than 90:",np.unique(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']<90] ['NumberOfTimes90DaysLate'])) print("Proportion of positive class with special 96/98 values:", round(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']>=90]['SeriousDlqin2yrs'].sum()*100/ len(finalTrain[finalTrain['NumberOfTime30-59DaysPastDueNotWorse']>=90]['SeriousDlqin2yrs']),2),'%')

Unique values in '30-59 Days' values that are more than or equal to 90: [96 98] Unique values in '60-89 Days' when '30-59 Days' values are more than or equal to 90: [96 98] Unique values in '90 Days' when '30-59 Days' values are more than or equal to 90: [96 98] Unique values in '60-89 Days' when '30-59 Days' values are less than 90: [ 0 1 2 3 4 5 6 7 8 9 11] Unique values in '90 Days' when '30-59 Days' values are less than 90: [ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 17] Proportion of positive class with special 96/98 values: 54.65 %

从下面我们可以看出,当“NumberOfTime30-59DaysPastDueNotBears”列中的记录超过90时,

其他记录逾期付款次数X天的列也具有相同的值。我们将这些分类为特殊标签,因为阳性的比例异常高达54.65%。

这96和98个值可以被视为会计错误。因此,我们将用96之前的最大值替换它们,即13、11和17

loc下面的用法是对应的行列,首先》=90选出对应的行,后面选择的是对应的列

finalTrain.loc[finalTrain['NumberOfTime30-59DaysPastDueNotWorse'] >= 90, 'NumberOfTime30-59DaysPastDueNotWorse'] = 13 finalTrain.loc[finalTrain['NumberOfTime60-89DaysPastDueNotWorse'] >= 90, 'NumberOfTime60-89DaysPastDueNotWorse'] = 11 finalTrain.loc[finalTrain['NumberOfTimes90DaysLate'] >= 90, 'NumberOfTimes90DaysLate'] = 17 print("Unique values in 30-59Days", np.unique(finalTrain['NumberOfTime30-59DaysPastDueNotWorse'])) print("Unique values in 60-89Days", np.unique(finalTrain['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in 90Days", np.unique(finalTrain['NumberOfTimes90DaysLate']))

Unique values in 30-59Days [ 0 1 2 3 4 5 6 7 8 9 10 11 12 13] Unique values in 60-89Days [ 0 1 2 3 4 5 6 7 8 9 11] Unique values in 90Days [ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 17]

测试集处理

print("Unique values in '30-59 Days' values that are more than or equal to 90:",np.unique(finalTest[finalTest['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTime30-59DaysPastDueNotWorse'])) print("Unique values in '60-89 Days' when '30-59 Days' values are more than or equal to 90:",np.unique(finalTest[finalTest['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in '90 Days' when '30-59 Days' values are more than or equal to 90:",np.unique(finalTest[finalTest['NumberOfTime30-59DaysPastDueNotWorse']>=90] ['NumberOfTimes90DaysLate'])) print("Unique values in '60-89 Days' when '30-59 Days' values are less than 90:",np.unique(finalTest[finalTest['NumberOfTime30-59DaysPastDueNotWorse']<90] ['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in '90 Days' when '30-59 Days' values are less than 90:",np.unique(finalTest[finalTest['NumberOfTime30-59DaysPastDueNotWorse']<90] ['NumberOfTimes90DaysLate']))

Unique values in '30-59 Days' values that are more than or equal to 90: [96 98] Unique values in '60-89 Days' when '30-59 Days' values are more than or equal to 90: [96 98] Unique values in '90 Days' when '30-59 Days' values are more than or equal to 90: [96 98] Unique values in '60-89 Days' when '30-59 Days' values are less than 90: [0 1 2 3 4 5 6 7 8 9] Unique values in '90 Days' when '30-59 Days' values are less than 90: [ 0 1 2 3 4 5 6 7 8 9 10 11 12 16 17 18]

finalTest.loc[finalTest['NumberOfTime30-59DaysPastDueNotWorse'] >= 90, 'NumberOfTime30-59DaysPastDueNotWorse'] = 19 finalTest.loc[finalTest['NumberOfTime60-89DaysPastDueNotWorse'] >= 90, 'NumberOfTime60-89DaysPastDueNotWorse'] = 9 finalTest.loc[finalTest['NumberOfTimes90DaysLate'] >= 90, 'NumberOfTimes90DaysLate'] = 18 print("Unique values in 30-59Days", np.unique(finalTest['NumberOfTime30-59DaysPastDueNotWorse'])) print("Unique values in 60-89Days", np.unique(finalTest['NumberOfTime60-89DaysPastDueNotWorse'])) print("Unique values in 90Days", np.unique(finalTest['NumberOfTimes90DaysLate']))

Unique values in 30-59Days [ 0 1 2 3 4 5 6 7 8 9 10 11 12 19] Unique values in 60-89Days [0 1 2 3 4 5 6 7 8 9] Unique values in 90Days [ 0 1 2 3 4 5 6 7 8 9 10 11 12 16 17 18]

第二步:检查 DebtRatio and RevolvingUtilizationOfUnsecuredLines.

print('Debt Ratio: ',finalTrain['DebtRatio'].describe()) print(' Revolving Utilization of Unsecured Lines: ',finalTrain['RevolvingUtilizationOfUnsecuredLines'].describe())

Debt Ratio: count 150000.000000 mean 353.005076 std 2037.818523 min 0.000000 25% 0.175074 50% 0.366508 75% 0.868254 max 329664.000000 Name: DebtRatio, dtype: float64 Revolving Utilization of Unsecured Lines: count 150000.000000 mean 6.048438 std 249.755371 min 0.000000 25% 0.029867 50% 0.154181 75% 0.559046 max 50708.000000 Name: RevolvingUtilizationOfUnsecuredLines, dtype: float64

在这里你可以看到75分位和最大值之间的巨大差异。让我们更深入地探讨一下

quantiles = [0.75,0.8,0.81,0.85,0.9,0.95,0.975,0.99] for i in quantiles: print(i*100,'% quantile of debt ratio is: ',finalTrain.DebtRatio.quantile(i))

75.0 % quantile of debt ratio is: 0.86825377325 80.0 % quantile of debt ratio is: 4.0 81.0 % quantile of debt ratio is: 14.0 85.0 % quantile of debt ratio is: 269.1499999999942 90.0 % quantile of debt ratio is: 1267.0 95.0 % quantile of debt ratio is: 2449.0 97.5 % quantile of debt ratio is: 3489.024999999994 99.0 % quantile of debt ratio is: 4979.040000000037

正如你所看到的,在81%之后,分位数有了巨大的增长。因此,

我们的主要目标是检查超过81%分位数的潜在异常值。然而,由于我们的数据是150000,

让我们考虑95%和97.5%的分位数进行进一步的分析

finalTrain[finalTrain['DebtRatio'] >= finalTrain['DebtRatio'].quantile(0.95)][['SeriousDlqin2yrs','MonthlyIncome']].describe()

SeriousDlqin2yrs MonthlyIncome

count 7501.000000 379.000000

mean 0.055193 0.084433

std 0.228371 0.278403

min 0.000000 0.000000

25% 0.000000 0.000000

50% 0.000000 0.000000

75% 0.000000 0.000000

max 1.000000 1.000000

我们可以观察到:

在7501名负债率高于95%的客户中,即债务高于收入的次数,只有379人拥有月收入值。

月收入的最大值是1,最小值是0,这让我们怀疑这是数据输入错误。让我们来看看两年严重的拖欠和月收入是否相等

finalTrain[(finalTrain["DebtRatio"] > finalTrain["DebtRatio"].quantile(0.95)) & (finalTrain['SeriousDlqin2yrs'] == finalTrain['MonthlyIncome'])]

因此,我们的疑点是真实的,379排中有331排的月收入等于2年内严重的拖欠。因此,

我们将从我们的分析中删除这些331个异常值,因为它们的当前值对我们的预测建模没有用处,而且会增加偏差和方差。

这背后的原因是,我们有331行的债务比率与客户的收入相比是巨大的,他们没有仔细审查违约,这只是一个数据输入错误

finalTrain = finalTrain[-((finalTrain["DebtRatio"] > finalTrain["DebtRatio"].quantile(0.95)) & (finalTrain['SeriousDlqin2yrs'] == finalTrain['MonthlyIncome']))] finalTrain

循环使用无担保额度

此字段基本上表示客户信用额度所欠金额的比率。比率高于1将被视为严重违约。

10的比率在功能上似乎也是可能的,让我们看看有多少客户的无担保额度的循环利用率大于10

finalTrain[finalTrain['RevolvingUtilizationOfUnsecuredLines']>10].describe()

在这里,如果你看到第50分位数和75分位数之间的差异,你会发现从13分位数到1891.25分位数有了巨大的增长。

既然13看起来是一个合理的比率(但太高了),让我们检查一下有多少计数在13以上。

finalTrain[finalTrain['RevolvingUtilizationOfUnsecuredLines']>13].describe()

尽管欠了几千,这238人没有显示任何违约,这意味着这可能是另一个错误。即使不是错误,

这些数字也会给我们的最终预测增加巨大的偏差和偏差。因此,最好的决定是删除这些值

finalTrain = finalTrain[finalTrain['RevolvingUtilizationOfUnsecuredLines']<=13] finalTrain

现在处理异常值。接下来,我们将继续处理丢失的数据,

正如我们在本笔记本的开头所观察到的那样,MonthlyIncome和NumberOfDependents的值为空。

空处理

由于MonthlyIncome是一个整数值,我们将用中值替换null。

如果客户的依赖项的数量不存在,那么就意味着他们的依赖项的数量是可变的。因此,我们用零来填充它们

def MissingHandler(df): DataMissing = df.isnull().sum()*100/len(df) DataMissingByColumn = pd.DataFrame({'Percentage Nulls':DataMissing}) DataMissingByColumn.sort_values(by='Percentage Nulls',ascending=False,inplace=True) return DataMissingByColumn[DataMissingByColumn['Percentage Nulls']>0] MissingHandler(finalTrain)

Percentage Nulls

MonthlyIncome 19.850633

NumberOfDependents 2.617261

因此,月收入和家属人数分别为19.76%和2.59%。

finalTrain['MonthlyIncome'].fillna(finalTrain['MonthlyIncome'].median(), inplace=True) finalTrain['NumberOfDependents'].fillna(0, inplace = True)

重新检查空值

MissingHandler(finalTrain)

测试集

MissingHandler(finalTest) finalTest['MonthlyIncome'].fillna(finalTrain['MonthlyIncome'].median(), inplace=True) finalTest['NumberOfDependents'].fillna(0, inplace = True) MissingHandler(finalTest)

最后行数

print(finalTrain.shape) print(finalTest.shape) ''' (149431, 11) (101503, 10)

'''

附加EDA

让我们研究更多关于数据集的事情,以便更熟悉它。

相关矩阵

fig = plt.figure(figsize = [15,10]) mask = np.zeros_like(finalTrain.corr(), dtype=np.bool) mask[np.triu_indices_from(mask)] = True sns.heatmap(finalTrain.corr(), cmap=sns.diverging_palette(150, 275, s=80, l=55, n=9), mask = mask, annot=True, center = 0) plt.title("Correlation Matrix (HeatMap)", fontsize = 15)

从上面的相关热图中,我们可以看到最相关的值是NumberOfTime30-59dayspastduenotbears,NumberOfTime60-89dayspastduenotbearse和NumberOfTimes90DaysLate。

现在让我们转到笔记本的功能工程部分

特征工程

让我们首先将训练集和测试集结合起来,为数据添加特性并进行进一步的分析。稍后我们将在模型测试之前拆分它们

SeriousDlqIn2Yrs = finalTrain['SeriousDlqin2yrs'] finalTrain.drop('SeriousDlqin2yrs', axis = 1 , inplace = True) finalData = pd.concat([finalTrain, finalTest]) finalData.shape #(250934, 10)

添加一些新功能:

月收入:月收入除以受抚养人的数量

月收入乘以负债率

isRetired:月收入为0且年龄大于65岁(假定退休年龄)的人

回笼额度:未结贷款额度与房地产贷款额度之差

hasRevolvingLines:如果RevolvingLines存在,则1其他0

HasMultipleResaleStates:如果不动产数量大于2

收入:月收入除以1000。对于这些人来说,欺诈的可能性更大,也可能意味着这个人有了一份新工作,而且还没有加薪百分之十。这两组人都表示风险更高。

finalData['MonthlyIncomePerPerson'] = finalData['MonthlyIncome']/(finalData['NumberOfDependents']+1) finalData['MonthlyIncomePerPerson'].fillna(0, inplace=True) finalData['MonthlyDebt'] = finalData['MonthlyIncome']*finalData['DebtRatio'] finalData['MonthlyDebt'].fillna(finalData['DebtRatio'],inplace=True) finalData['MonthlyDebt'] = np.where(finalData['MonthlyDebt']==0, finalData['DebtRatio'],finalData['MonthlyDebt']) finalData['isRetired'] = np.where((finalData['age'] > 65), 1, 0) finalData['RevolvingLines'] = finalData['NumberOfOpenCreditLinesAndLoans']-finalData['NumberRealEstateLoansOrLines'] finalData['hasRevolvingLines']=np.where((finalData['RevolvingLines']>0),1,0) finalData['hasMultipleRealEstates'] = np.where((finalData['NumberRealEstateLoansOrLines']>=2),1,0) finalData['incomeDivByThousand'] = finalData['MonthlyIncome']/1000 finalData.shape #(250934, 17) MissingHandler(finalData) #Percentage Nulls

我们现在已经在数据集中添加了新的特性。接下来,我们将通过分析各个列的分布对数据进行偏斜检查,并执行Box-Cox变换来减少偏斜。

偏度检验与Box-Cox变换

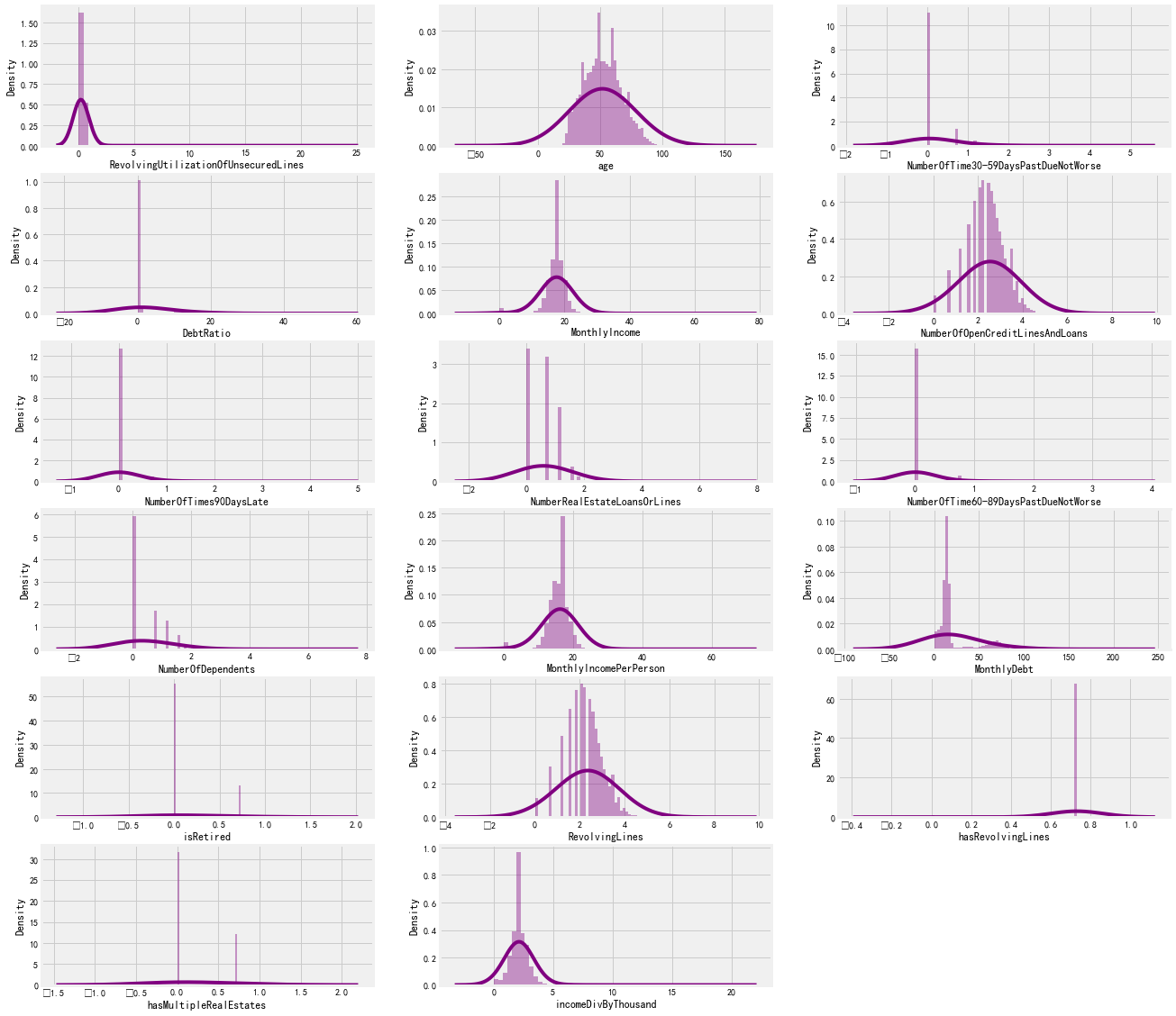

让我们先检查每个值的分布

columnList = list(finalData.columns) columnList fig = plt.figure(figsize=[20,20]) for col,i in zip(columnList,range(1,19)): axes = fig.add_subplot(6,3,i) sns.distplot(finalData[col],ax=axes, kde_kws={'bw':1.5}, color='purple') plt.show()

从上面的分布图中,我们可以看到,我们的大部分数据是在任何一个方向上倾斜的。我们只能看到年龄形成接近正态分布。让我们检查每列的倾斜度值

def SkewMeasure(df): nonObjectColList = df.dtypes[df.dtypes != 'object'].index skewM = df[nonObjectColList].apply(lambda x: stats.skew(x.dropna())).sort_values(ascending = False) skewM=pd.DataFrame({'skew':skewM}) return skewM[abs(skewM)>0.5].dropna() skewM = SkewMeasure(finalData) skewM

skew

MonthlyIncome 218.270205

incomeDivByThousand 218.270205

MonthlyIncomePerPerson 206.221804

MonthlyDebt 98.604981

DebtRatio 92.819627

RevolvingUtilizationOfUnsecuredLines 91.721780

NumberOfTimes90DaysLate 15.097509

NumberOfTime60-89DaysPastDueNotWorse 13.509677

NumberOfTime30-59DaysPastDueNotWorse 9.773995

NumberRealEstateLoansOrLines 3.217055

NumberOfDependents 1.829982

isRetired 1.564456

RevolvingLines 1.364633

NumberOfOpenCreditLinesAndLoans 1.219429

hasMultipleRealEstates 1.008475

hasRevolvingLines -8.106007

所有列的倾斜度都非常高。我们将使用λ=0.15的Box-Cox变换来减少这种偏斜

for i in skewM.index: finalData[i] = special.boxcox1p(finalData[i],0.15) #lambda = 0.15 SkewMeasure(finalData)

skew

RevolvingUtilizationOfUnsecuredLines 23.234640

NumberOfTimes90DaysLate 6.787000

NumberOfTime60-89DaysPastDueNotWorse 6.602180

NumberOfTime30-59DaysPastDueNotWorse 3.212010

DebtRatio 1.958314

MonthlyDebt 1.817649

isRetired 1.564456

hasMultipleRealEstates 1.008475

NumberOfDependents 0.947591

incomeDivByThousand 0.708168

MonthlyIncomePerPerson -1.558107

MonthlyIncome -2.152376

hasRevolvingLines -8.106007

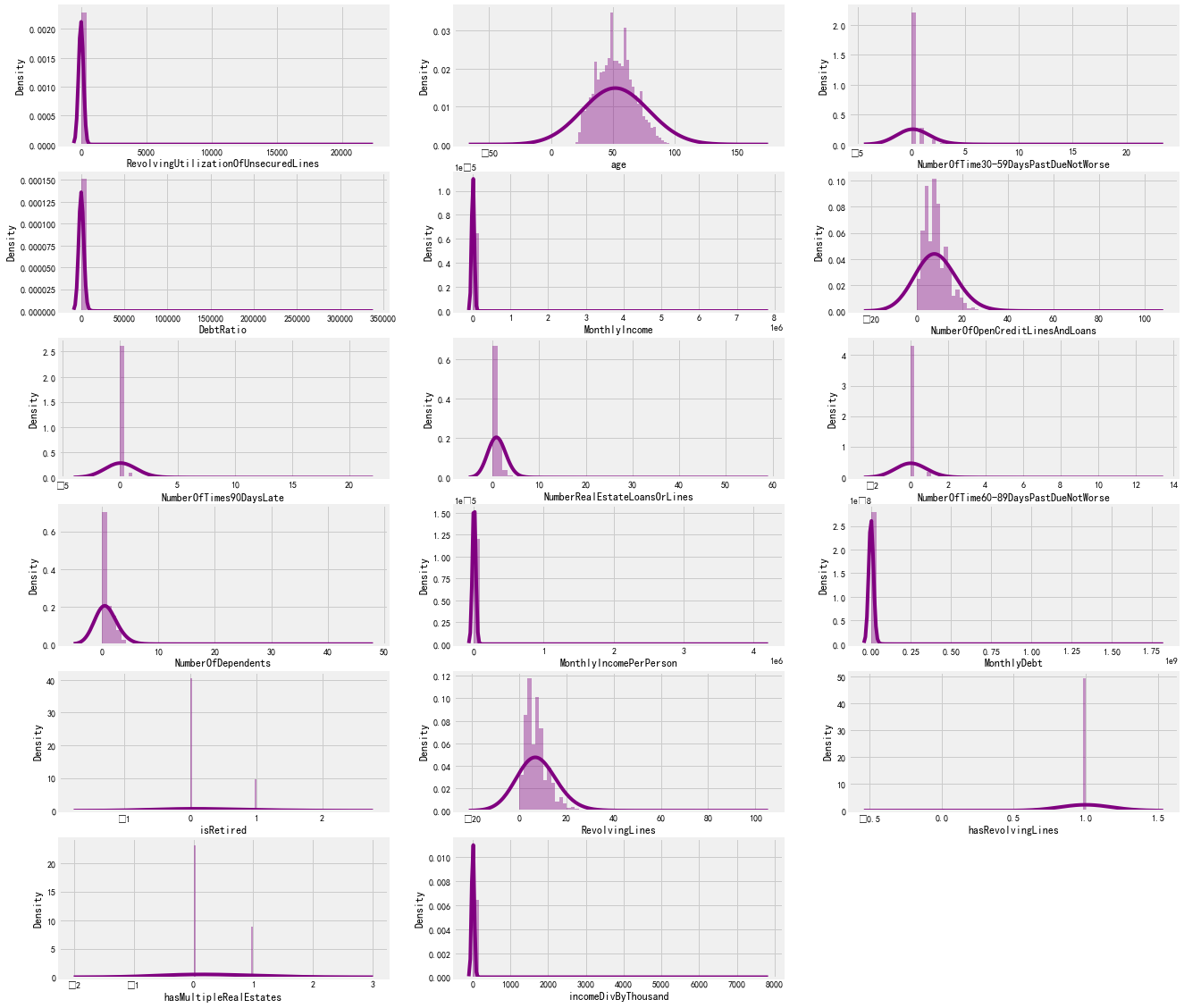

由于应用了Box-Cox变换,偏度在更高的范围内减小了。让我们再次检查各个列的分布图:

fig = plt.figure(figsize=[20,20]) for col,i in zip(columnList,range(1,19)): axes = fig.add_subplot(6,3,i) sns.distplot(finalData[col],ax=axes, kde_kws={'bw':1.5}, color='purple') plt.show()

As you can see, our graphs look much better now.

Model Training

Train-Validation Split

We will currently split the train and validation sets into a 70-30 proportion.

trainDF = finalData[:len(finalTrain)] testDF = finalData[len(finalTrain):] print(trainDF.shape) print(testDF.shape) ''' (149431, 17) (101503, 17) ''' xTrain, xTest, yTrain, yTest = model_selection.train_test_split(trainDF.to_numpy(),SeriousDlqIn2Yrs.to_numpy(),test_size=0.3,random_state=2020)

LightGBM

超参数调参

lgbAttributes = lgb.LGBMClassifier(objective='binary', n_jobs=-1, random_state=2020, importance_type='gain') lgbParameters = { 'max_depth' : [2,3,4,5], 'learning_rate': [0.05, 0.1,0.125,0.15], 'colsample_bytree' : [0.2,0.4,0.6,0.8,1], 'n_estimators' : [400,500,600,700,800,900], 'min_split_gain' : [0.15,0.20,0.25,0.3,0.35], #equivalent to gamma in XGBoost 'subsample': [0.6,0.7,0.8,0.9,1], 'min_child_weight': [6,7,8,9,10], 'scale_pos_weight': [10,15,20], 'min_data_in_leaf' : [100,200,300,400,500,600,700,800,900], 'num_leaves' : [20,30,40,50,60,70,80,90,100] } lgbModel = model_selection.RandomizedSearchCV(lgbAttributes, param_distributions = lgbParameters, cv = 5, random_state=2020) lgbModel.fit(xTrain,yTrain.flatten(),feature_name=trainDF.columns.to_list())

RandomizedSearchCV(cv=5,

estimator=LGBMClassifier(importance_type='gain',

objective='binary',

random_state=2020),

param_distributions={'colsample_bytree': [0.2, 0.4, 0.6, 0.8,

1],

'learning_rate': [0.05, 0.1, 0.125,

0.15],

'max_depth': [2, 3, 4, 5],

'min_child_weight': [6, 7, 8, 9, 10],

'min_data_in_leaf': [100, 200, 300, 400,

500, 600, 700, 800,

900],

'min_split_gain': [0.15, 0.2, 0.25, 0.3,

0.35],

'n_estimators': [400, 500, 600, 700,

800, 900],

'num_leaves': [20, 30, 40, 50, 60, 70,

80, 90, 100],

'scale_pos_weight': [10, 15, 20],

'subsample': [0.6, 0.7, 0.8, 0.9, 1]},

random_state=2020)

bestEstimatorLGB = lgbModel.best_estimator_

bestEstimatorLGB

LGBMClassifier(colsample_bytree=0.4, importance_type='gain', max_depth=5,

min_child_weight=6, min_data_in_leaf=600, min_split_gain=0.25,

n_estimators=900, num_leaves=50, objective='binary',

random_state=2020, scale_pos_weight=10, subsample=0.9)

从RandomSearchCV中保存最佳估计量

bestEstimatorLGB = lgb.LGBMClassifier(colsample_bytree=0.4, importance_type='gain', max_depth=5, min_child_weight=6, min_data_in_leaf=600, min_split_gain=0.25, n_estimators=900, num_leaves=50, objective='binary', random_state=2020, scale_pos_weight=10, subsample=0.9).fit(xTrain,yTrain.flatten(),feature_name=trainDF.columns.to_list()) yPredLGB = bestEstimatorLGB.predict_proba(xTest) yPredLGB = yPredLGB[:,1] yTestPredLGB = bestEstimatorLGB.predict(xTest) print(metrics.classification_report(yTest,yTestPredLGB))

precision recall f1-score support

0 0.97 0.86 0.92 41956

1 0.26 0.68 0.37 2973

accuracy 0.85 44929

macro avg 0.62 0.77 0.64 44929

weighted avg 0.93 0.85 0.88 44929

metrics.confusion_matrix(yTest,yTestPredLGB)

array([[36214, 5742],

[ 965, 2008]], dtype=int64)

LGBMMetrics = pd.DataFrame({'Model': 'LightGBM',

'MSE': round(metrics.mean_squared_error(yTest, yTestPredLGB)*100,2),

'RMSE' : round(np.sqrt(metrics.mean_squared_error(yTest, yTestPredLGB)*100),2),

'MAE' : round(metrics.mean_absolute_error(yTest, yTestPredLGB)*100,2),

'MSLE' : round(metrics.mean_squared_log_error(yTest, yTestPredLGB)*100,2),

'RMSLE' : round(np.sqrt(metrics.mean_squared_log_error(yTest, yTestPredLGB)*100),2),

'Accuracy Train' : round(bestEstimatorLGB.score(xTrain, yTrain) * 100,2),

'Accuracy Test' : round(bestEstimatorLGB.score(xTest, yTest) * 100,2),

'F-Beta Score (β=2)' : round(metrics.fbeta_score(yTest, yTestPredLGB, beta=2)*100,2)},index=[1])

LGBMMetrics

Model MSE RMSE MAE MSLE RMSLE Accuracy Train Accuracy Test F-Beta Score (β=2)

1 LightGBM 14.49 3.81 14.49 6.96 2.64 86.55 85.51 51.35

ROC AUC

fpr,tpr,_ = metrics.roc_curve(yTest,yPredLGB) rocAuc = metrics.auc(fpr, tpr) plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for LightGBM Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

特征重要性

lgb.plot_importance(bestEstimatorLGB, importance_type='gain')

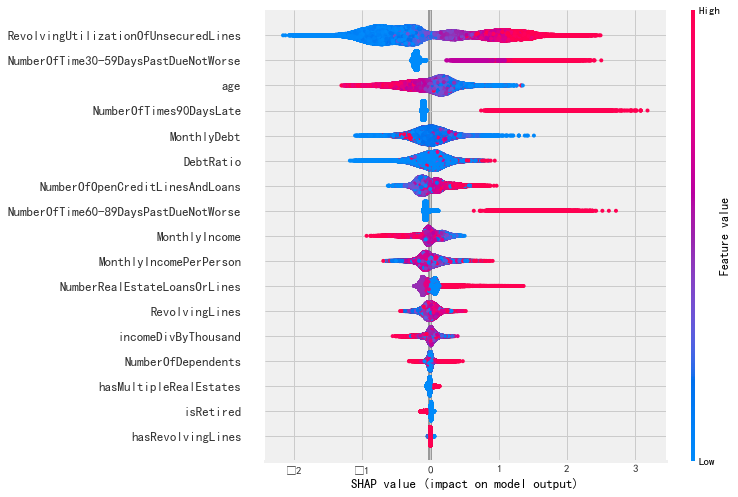

使用SHAP的特征重要性

import shap

X = pd.DataFrame(xTrain, columns=trainDF.columns.to_list()) explainer = shap.TreeExplainer(bestEstimatorLGB) shap_values = explainer.shap_values(X) shap.summary_plot(shap_values[1], X)

XGBoost

调参,由于我没有安装CPU版本的,具体请参考https://xgboost.readthedocs.io/en/latest/gpu/index.html,CPU版本的速度会快很多

xgbAttribute = #xgs.XGBClassifier(tree_method='gpu_hist',n_jobs=-1, gpu_id=0) #由于我没有安装CPU版本的,所以只能使用非CPU版本的,因此改一下参数 xgs.XGBClassifier(tree_method='hist',n_jobs=-1, ) xgbParameters = { 'max_depth' : [2,3,4,5,6,7,8], 'learning_rate':[0.05,0.1,0.125,0.15], 'colsample_bytree' : [0.2,0.4,0.6,0.8,1], 'n_estimators' : [400,500,600,700,800,900], 'gamma':[0.15,0.20,0.25,0.3,0.35], 'subsample': [0.6,0.7,0.8,0.9,1], 'min_child_weight': [6,7,8,9,10], 'scale_pos_weight': [10,15,20] } xgbModel = model_selection.RandomizedSearchCV(xgbAttribute, param_distributions = xgbParameters, cv = 5, random_state=2020) xgbModel.fit(xTrain,yTrain.flatten())

RandomizedSearchCV(cv=5, estimator=XGBClassifier(n_jobs=-1, tree_method='hist'),

param_distributions={'colsample_bytree': [0.2, 0.4, 0.6, 0.8,

1],

'gamma': [0.15, 0.2, 0.25, 0.3, 0.35],

'learning_rate': [0.05, 0.1, 0.125,

0.15],

'max_depth': [2, 3, 4, 5, 6, 7, 8],

'min_child_weight': [6, 7, 8, 9, 10],

'n_estimators': [400, 500, 600, 700,

800, 900],

'scale_pos_weight': [10, 15, 20],

'subsample': [0.6, 0.7, 0.8, 0.9, 1]},

random_state=2020)

bestEstimatorXGB = xgbModel.best_estimator_

bestEstimatorXGB

最好的参数是:

XGBClassifier(colsample_bytree=0.4, gamma=0.25, learning_rate=0.125,

max_depth=5, min_child_weight=9, n_estimators=800, n_jobs=-1,

scale_pos_weight=10, tree_method='hist')

bestEstimatorXGB = xgs.XGBClassifier(base_score=0.5, booster='gbtree', colsample_bylevel=1, colsample_bynode=1, colsample_bytree=0.4, gamma=0.25, importance_type='gain', interaction_constraints='', learning_rate=0.125, max_delta_step=0, max_depth=5, min_child_weight=9, monotone_constraints='(0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0,0)', n_estimators=800, n_jobs=-1, num_parallel_tree=1, random_state=0, reg_alpha=0, reg_lambda=1, scale_pos_weight=10, subsample=1, tree_method='hist', validate_parameters=1).fit(xTrain,yTrain.flatten()) yPredXGB = bestEstimatorXGB.predict_proba(xTest) yPredXGB = yPredXGB[:,1] yTestPredXGB = bestEstimatorXGB.predict(xTest) print(metrics.classification_report(yTest,yTestPredXGB))

precision recall f1-score support

0 0.97 0.89 0.93 41956

1 0.28 0.62 0.38 2973

accuracy 0.87 44929

macro avg 0.62 0.75 0.66 44929

weighted avg 0.92 0.87 0.89 44929

混淆矩阵

metrics.confusion_matrix(yTest,yTestPredXGB)

array([[37174, 4782],

[ 1132, 1841]], dtype=int64)

XGBMetrics = pd.DataFrame({'Model': 'XGBoost',

'MSE': round(metrics.mean_squared_error(yTest, yTestPredXGB)*100,2),

'RMSE' : round(np.sqrt(metrics.mean_squared_error(yTest, yTestPredXGB)*100),2),

'MAE' : round(metrics.mean_absolute_error(yTest, yTestPredXGB)*100,2),

'MSLE' : round(metrics.mean_squared_log_error(yTest, yTestPredXGB)*100,2),

'RMSLE' : round(np.sqrt(metrics.mean_squared_log_error(yTest, yTestPredXGB)*100),2),

'Accuracy Train' : round(bestEstimatorLGB.score(xTrain, yTrain) * 100,2),

'Accuracy Test' : round(bestEstimatorLGB.score(xTest, yTest) * 100,2),

'F-Beta Score (β=2)' : round(metrics.fbeta_score(yTest, yTestPredXGB, beta=2)*100,2)},index=[2])

XGBMetrics

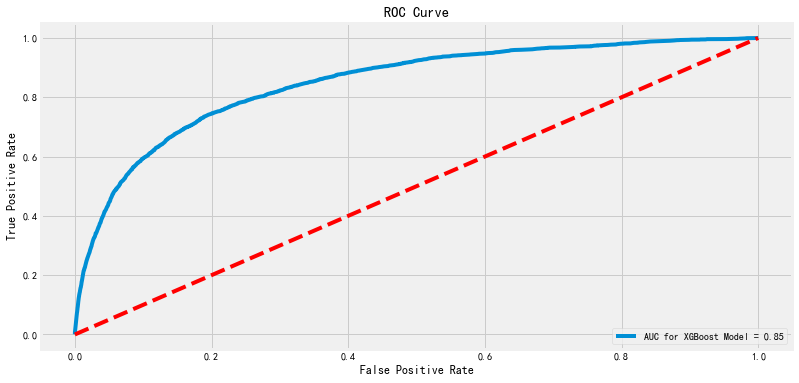

ROC AUC

fpr,tpr,_ = metrics.roc_curve(yTest,yPredXGB) rocAuc = metrics.auc(fpr, tpr) plt.figure(figsize=(12,6)) plt.title('ROC Curve') sns.lineplot(fpr, tpr, label = 'AUC for XGBoost Model = %0.2f' % rocAuc) plt.legend(loc = 'lower right') plt.plot([0, 1], [0, 1],'r--') plt.ylabel('True Positive Rate') plt.xlabel('False Positive Rate') plt.show()

FEATURE IMPORTANCE

bestEstimatorXGB.get_booster().feature_names = trainDF.columns.to_list() xgs.plot_importance(bestEstimatorXGB, importance_type='gain')

FEATURE IMPORTANCE USING SHAP

mybooster = bestEstimatorXGB.get_booster() model_bytearray = mybooster.save_raw()[4:] def myfun(self=None): return model_bytearray mybooster.save_raw = myfun X = pd.DataFrame(xTrain, columns=trainDF.columns.to_list()) explainer = shap.TreeExplainer(mybooster) shap_values = explainer.shap_values(X) shap.summary_plot(shap_values, X)

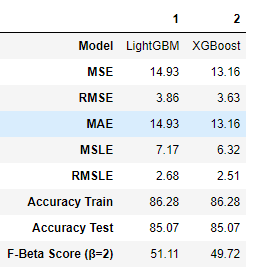

二者比较

frames = [LGBMMetrics, XGBMetrics] TrainingResult = pd.concat(frames) TrainingResult.T

LGBM Submission

因为,我们可以看到我们的LGBM表现更好,我们会提交这个。(迟交)

lgbProbs = bestEstimatorLGB.predict_proba(testDF) lgbDF = pd.DataFrame({'ID': testID, 'Probability': lgbProbs[:,1]}) lgbDF.to_csv('submission.csv', index=False) #因此拖欠的可能性 lgbDF