Computational Investing

MC2: Computational Investing

Lessons: In this mini-course, we focus on modeling the behavior of stock markets.

- So you want to be a hedge fund manager?

- Market mechanics

- What is a company worth?

- The Capital Assets Pricing Model (CAPM)

- How hedge funds use the CAPM

- Technical Analysis

- Dealing with data

- Efficient Markets Hypothesis

- The Fundamental Law of active portfolio management

- Portfolio optimization and the efficient frontier

Projects:

- Build a market simulator

- Invent your own technical indicator

- Write a strategy that generates orders

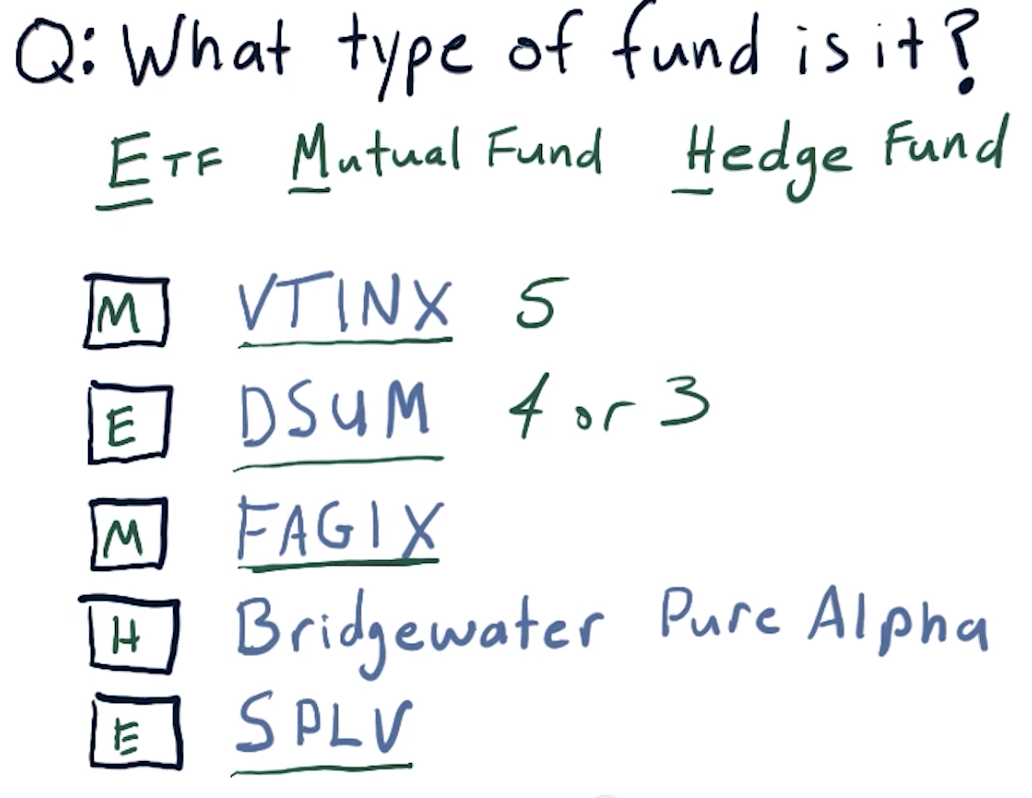

Types of funds

ETF = Exchange-Traded Fund

Liquidity and capitalization

liquidity => the ease with which one can buy or sell shares in a particular holding

large capitalization => how much is the company worth = shares that are outstanding × the price of the stock

Some popular sources for financial and investment data:

ETF => 4 or 3 letters

Mutual fund => 5 letters

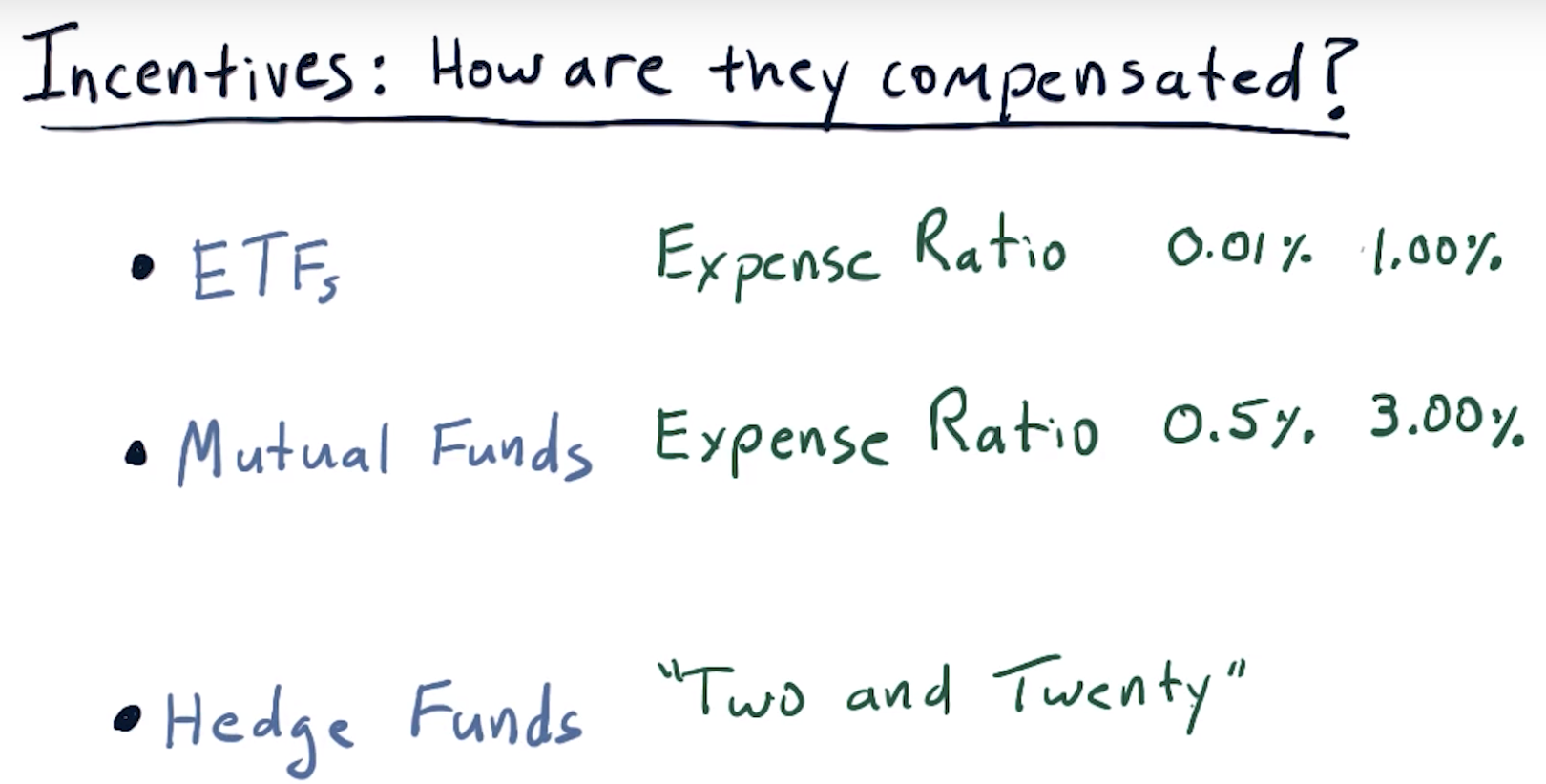

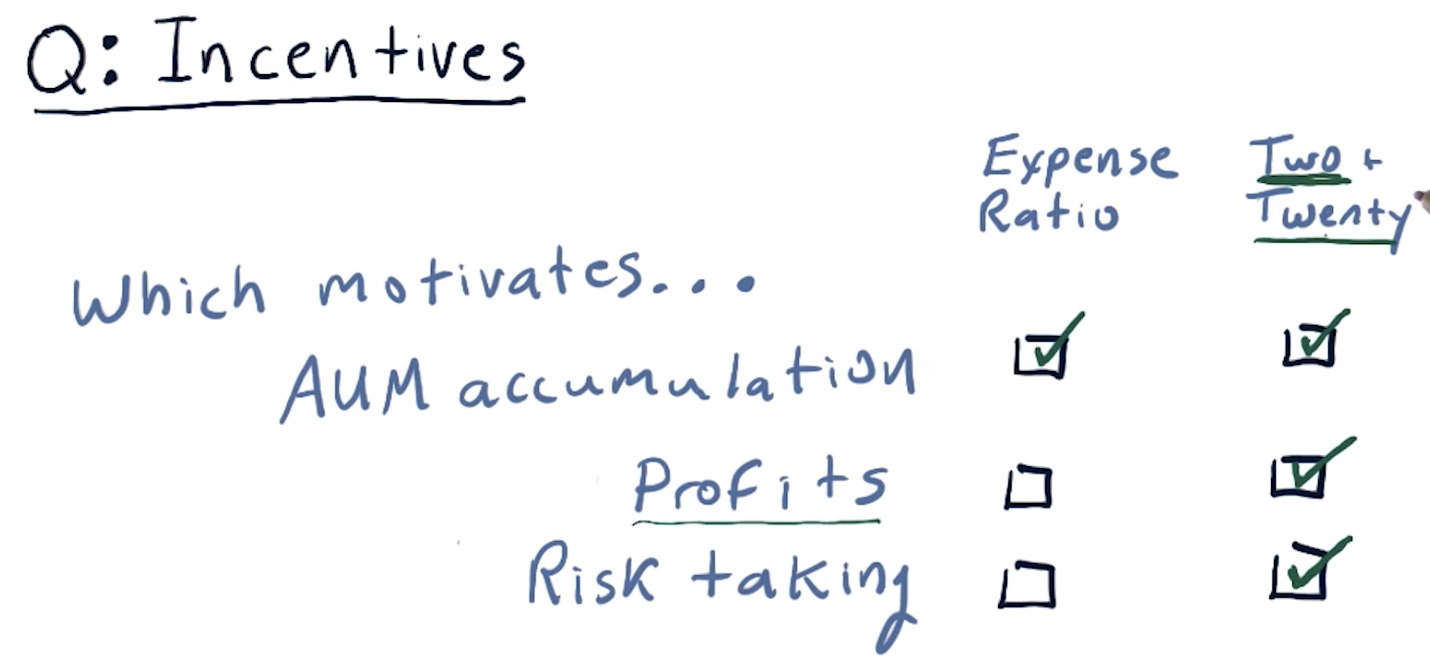

Incentives for fund managers

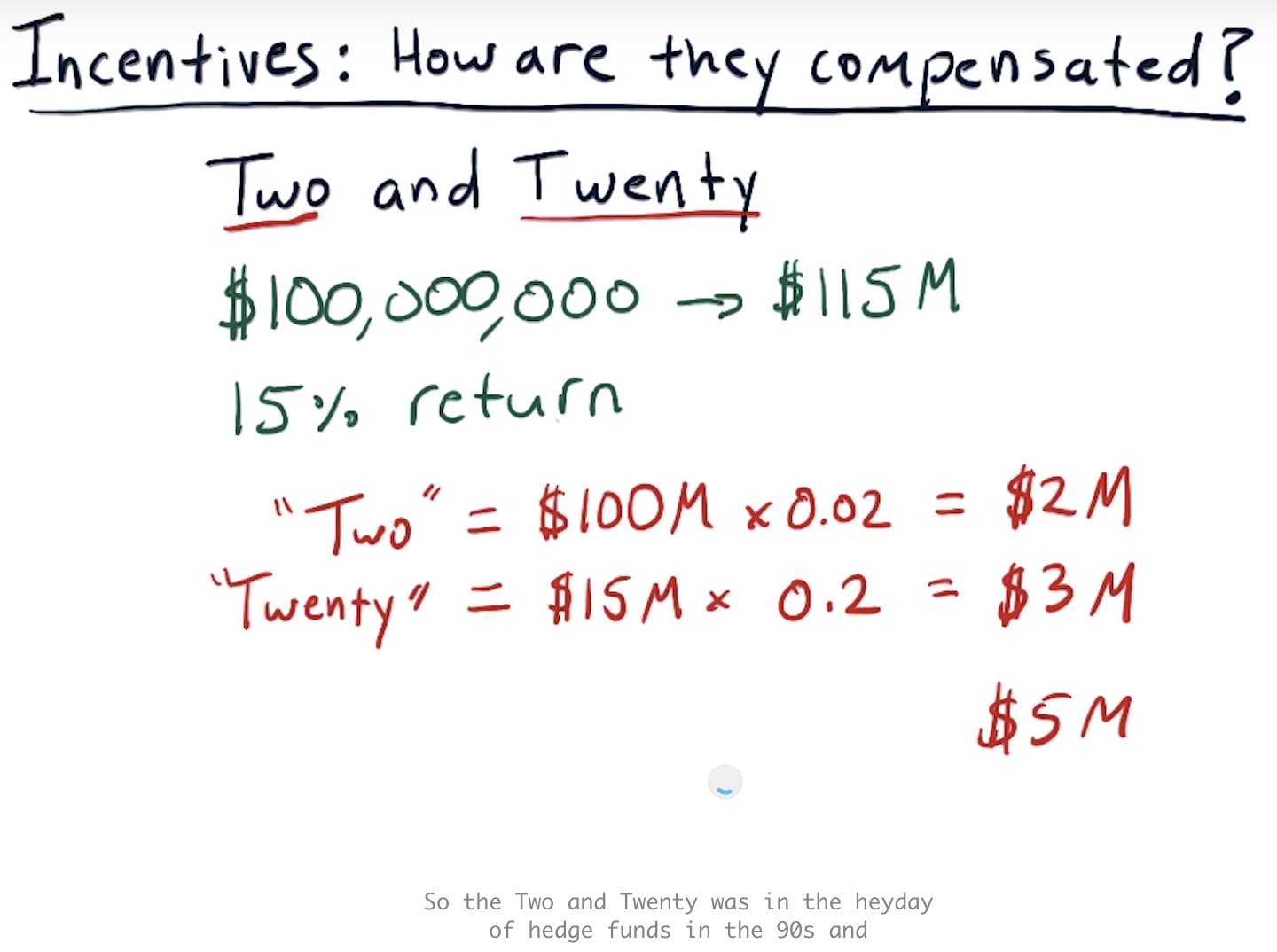

2 and 20 => 2% AUM and 20% profits

Assets Under Management (AUM) is the total amount of money being managed by the fund.

Two and twenty

Incentives quiz

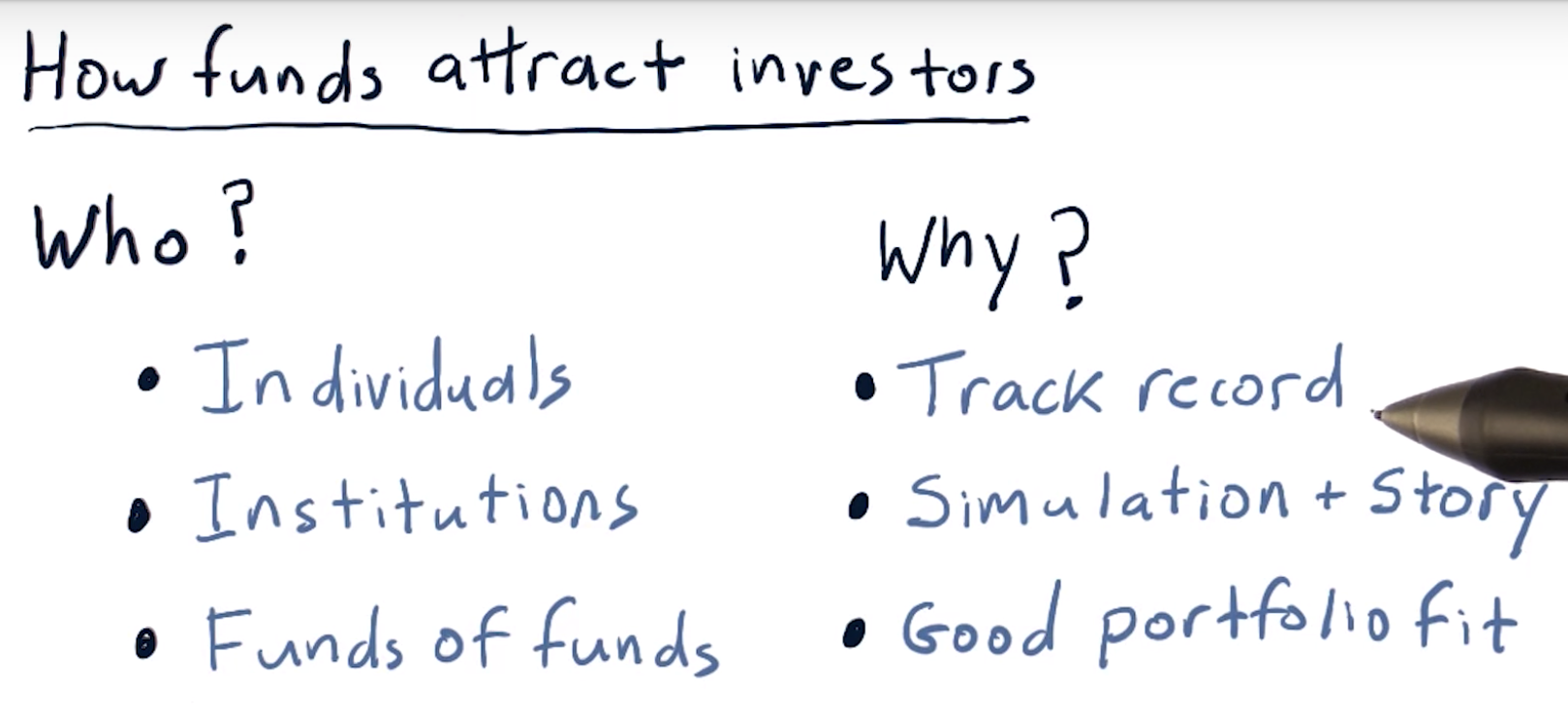

How funds attract investors

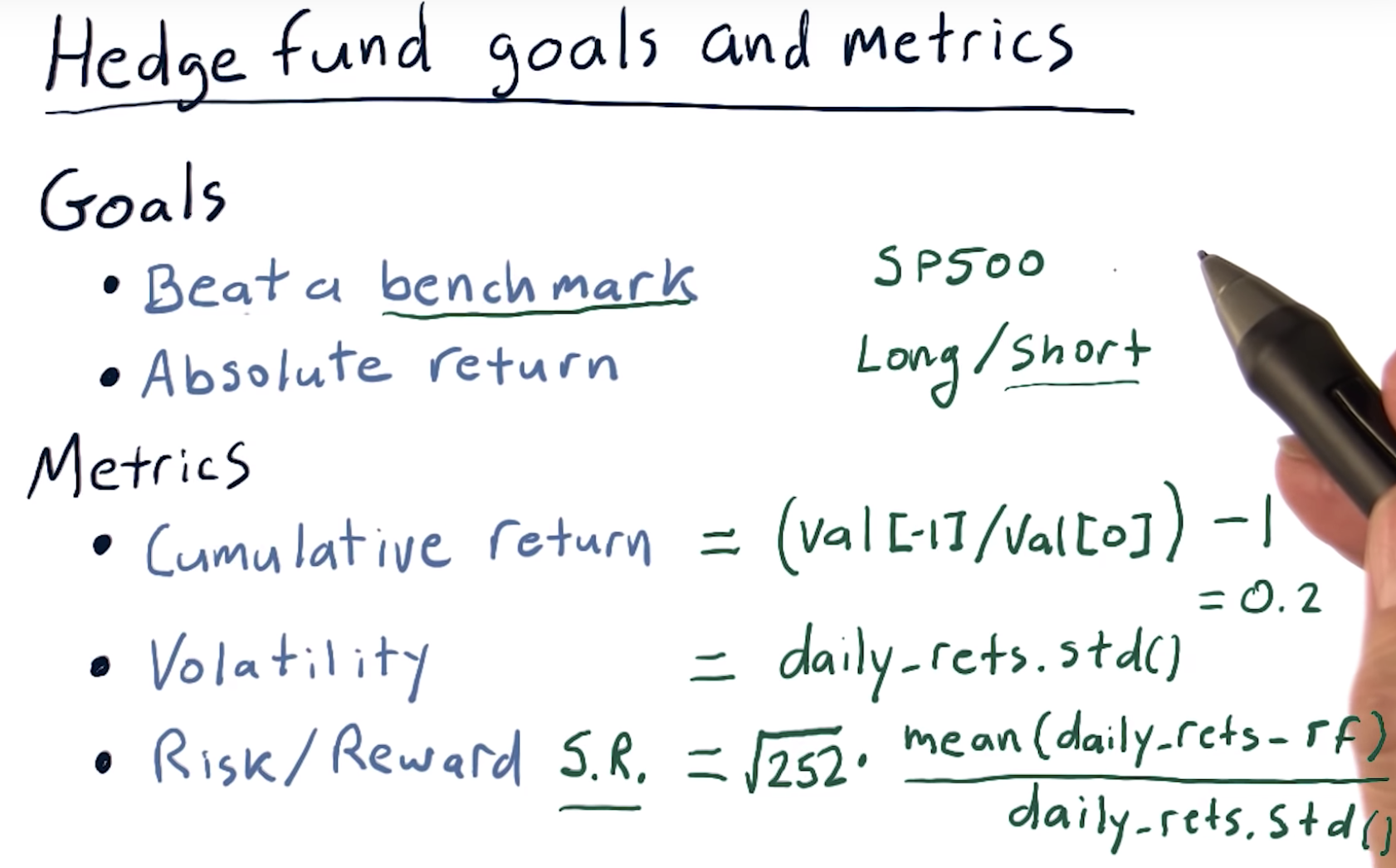

Hedge fund goals and metrics

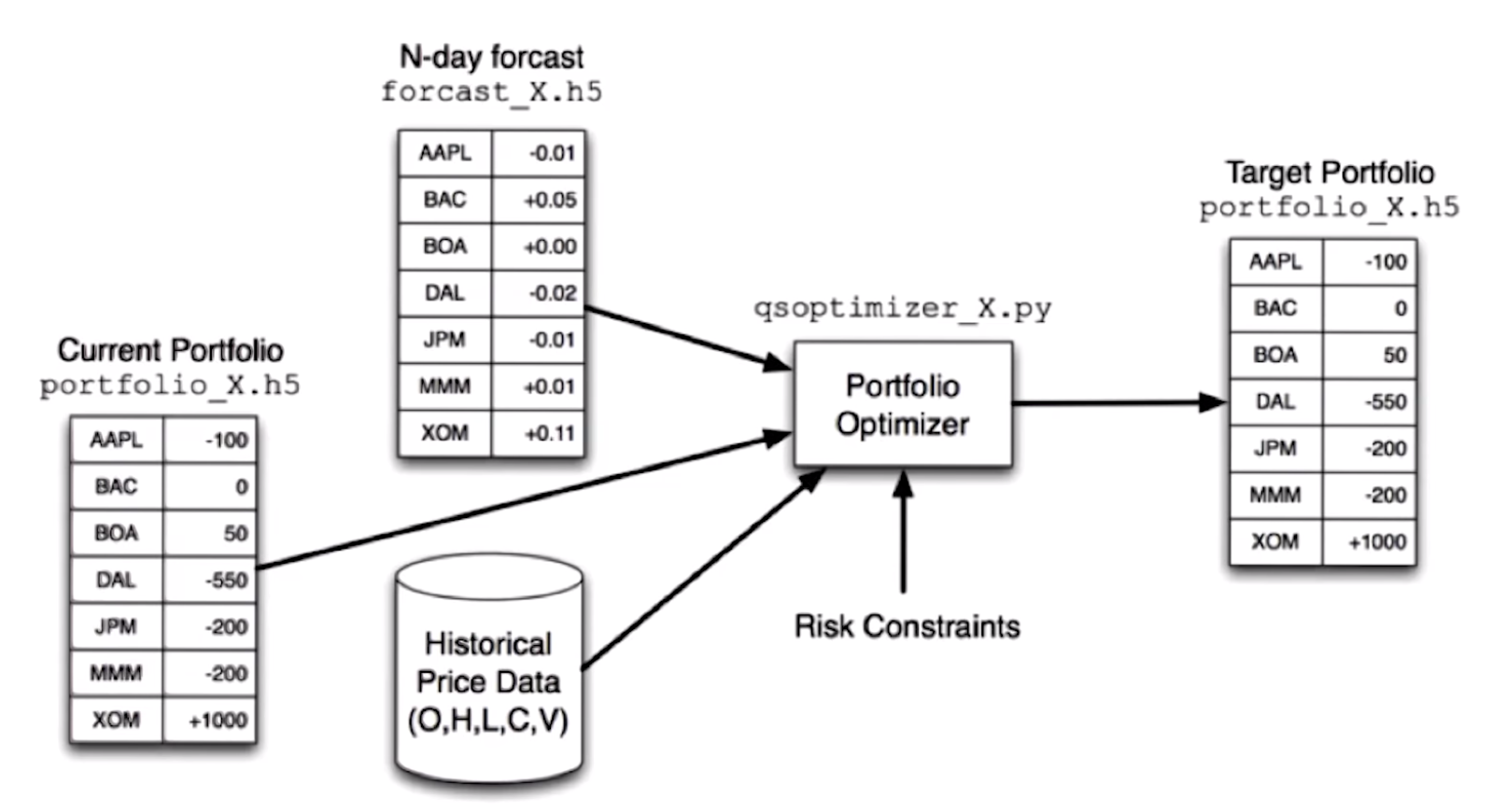

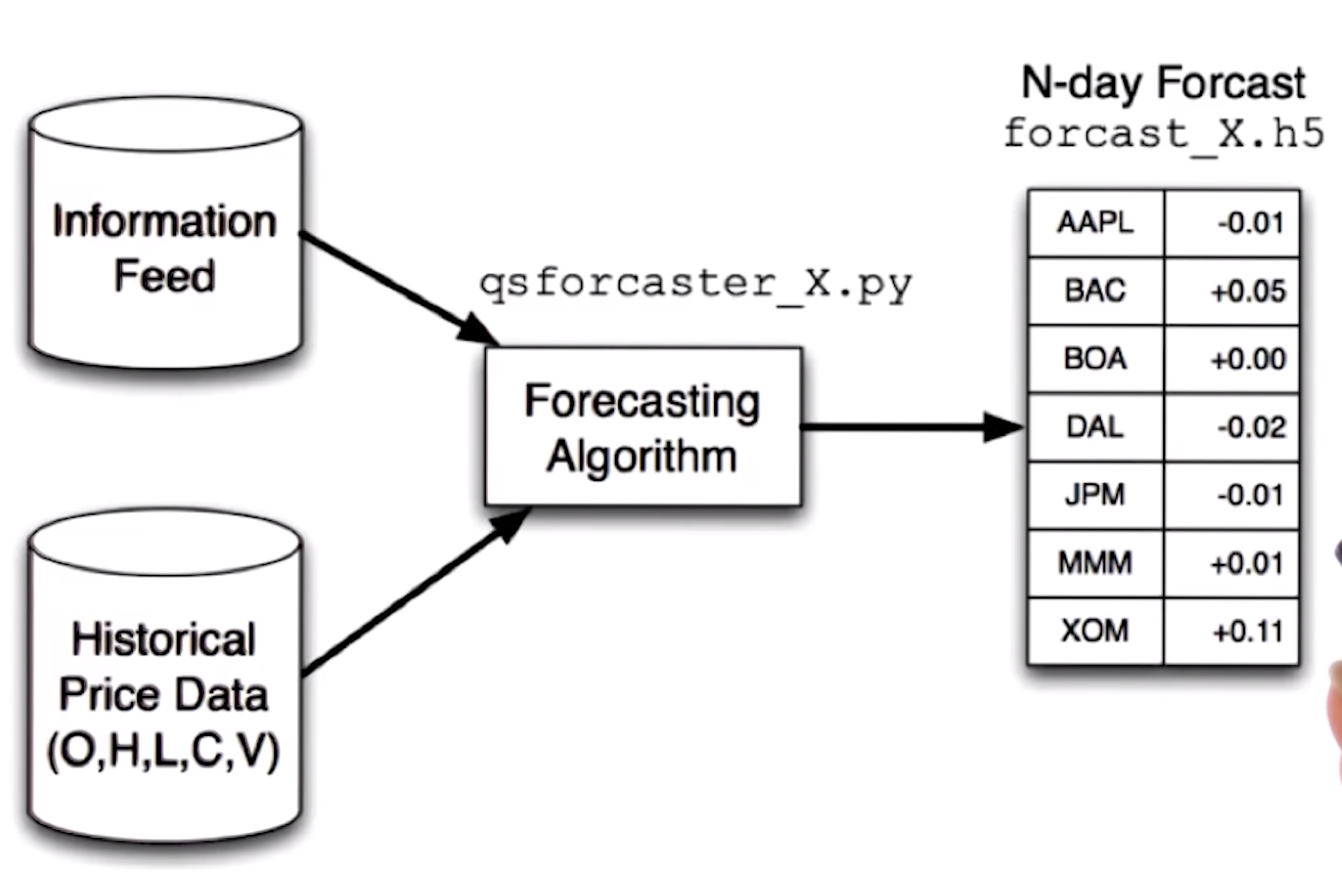

The computing inside a hedge fund

live portfolio == order ==> target portfolio

dont want to do everything at once

machine leanrnig => forcasting

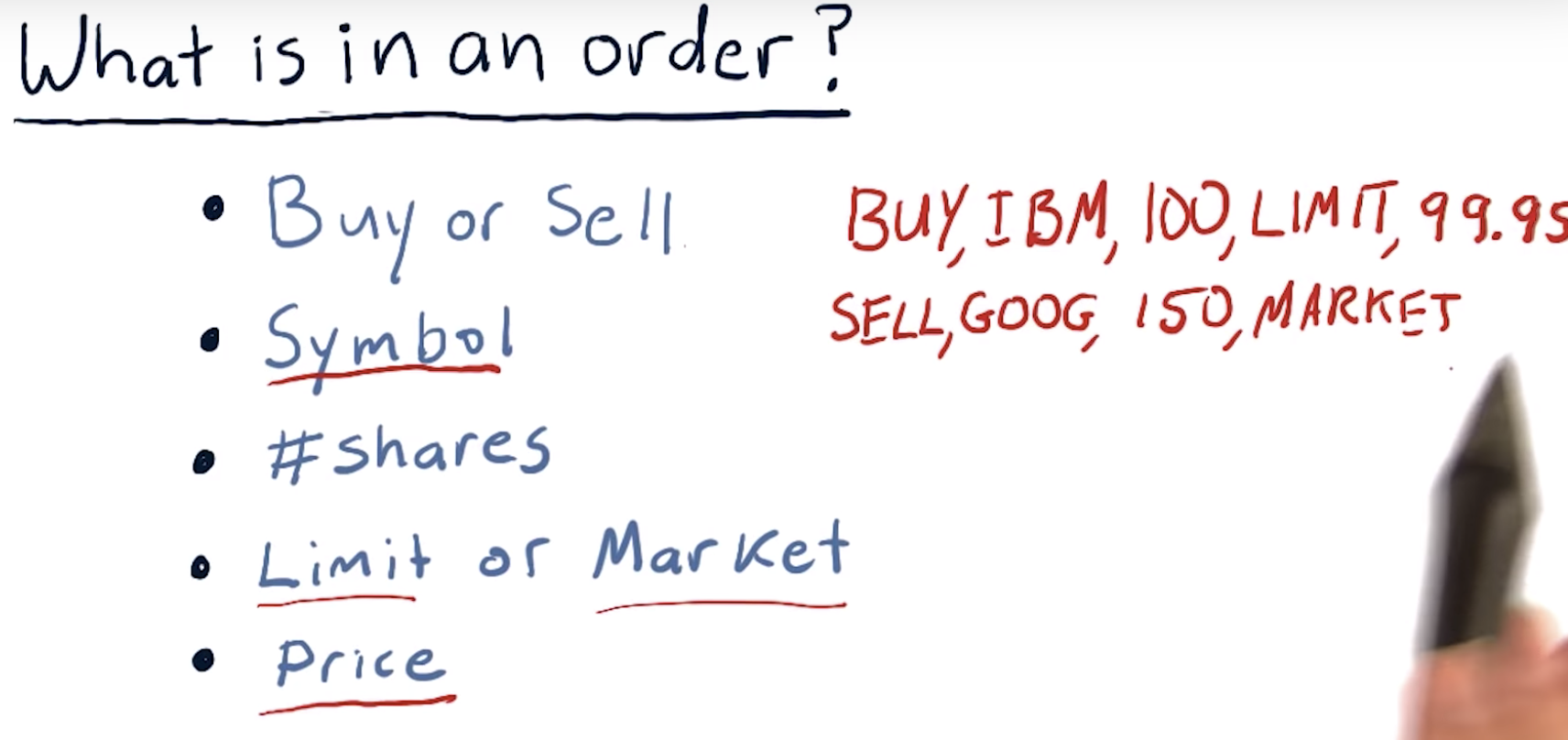

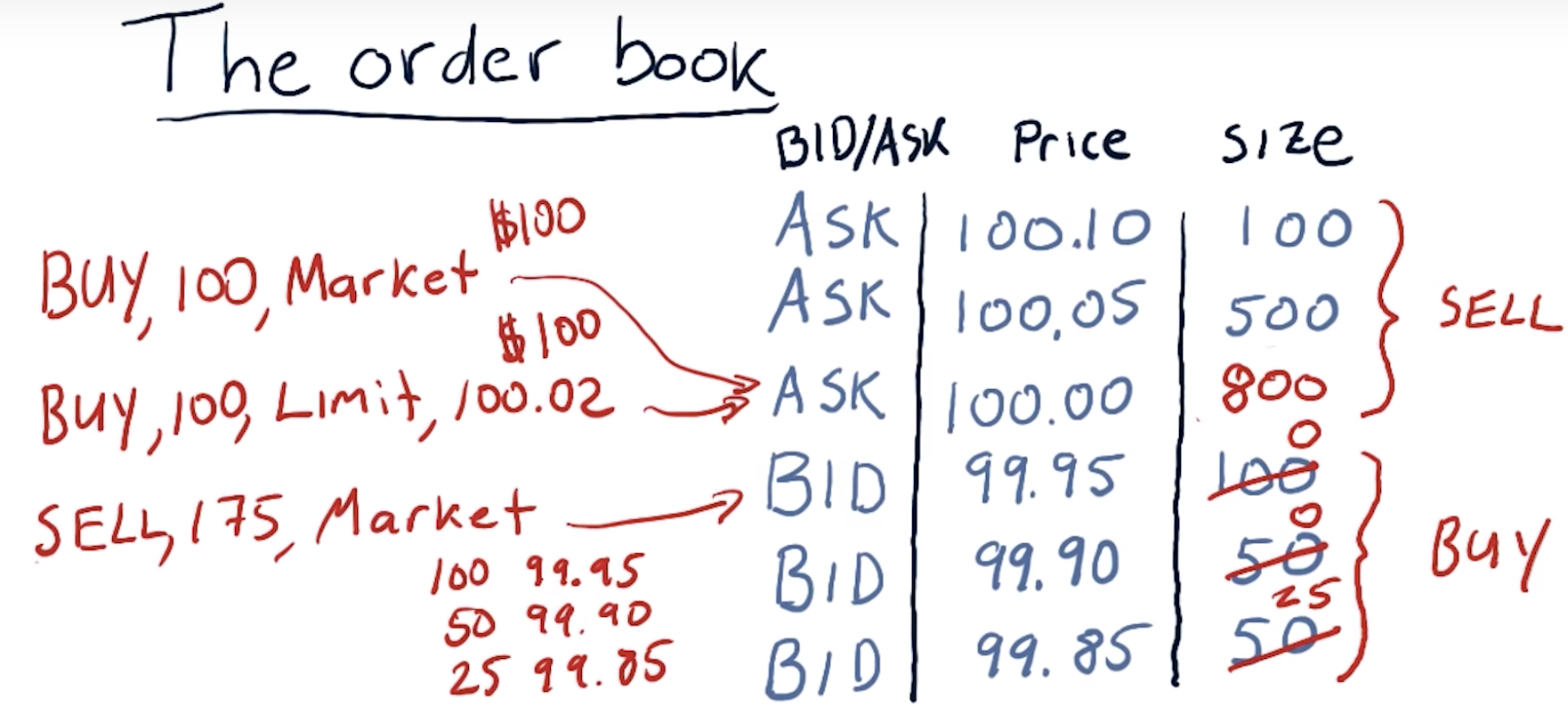

What is in an order?

Market => not to specify the money

Limit => hand-craft some price limit for trading

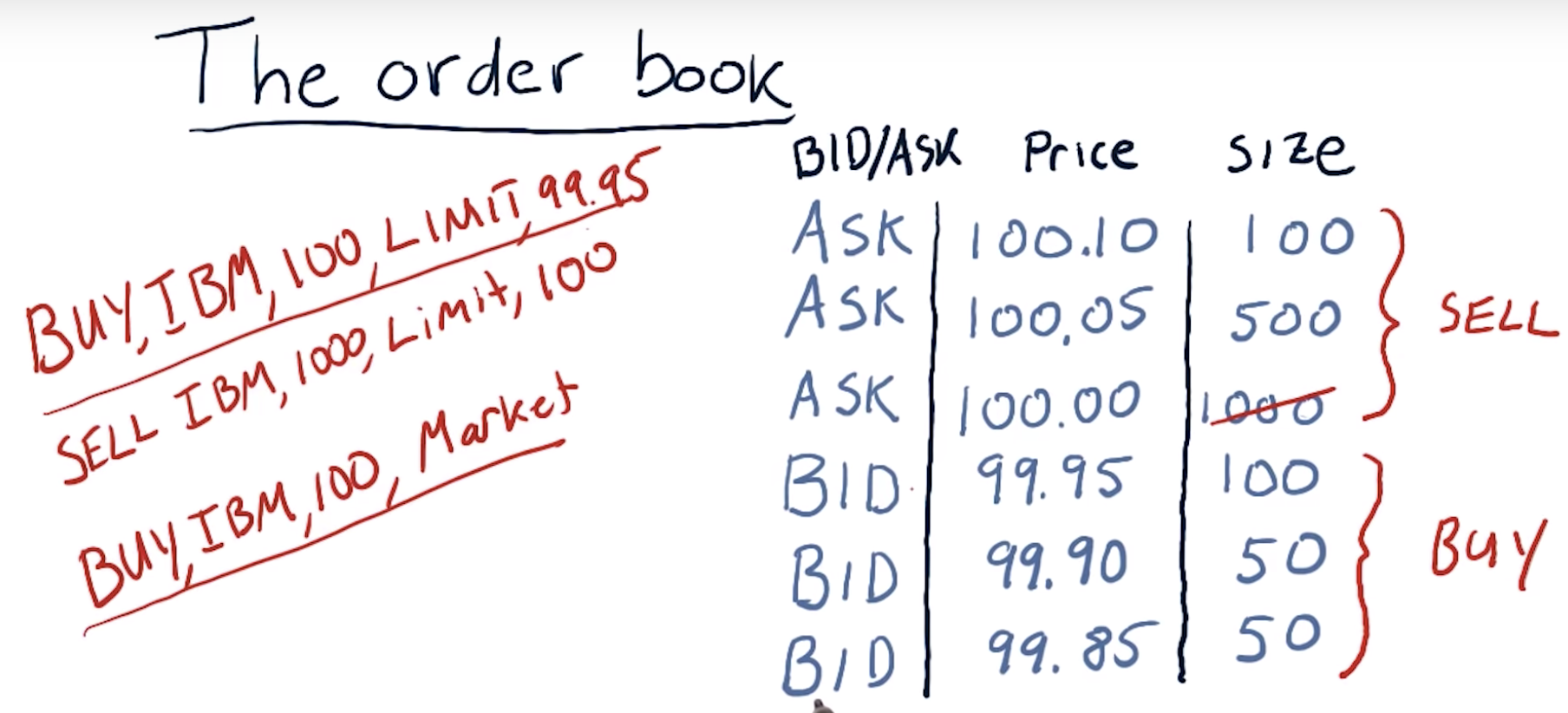

The order book

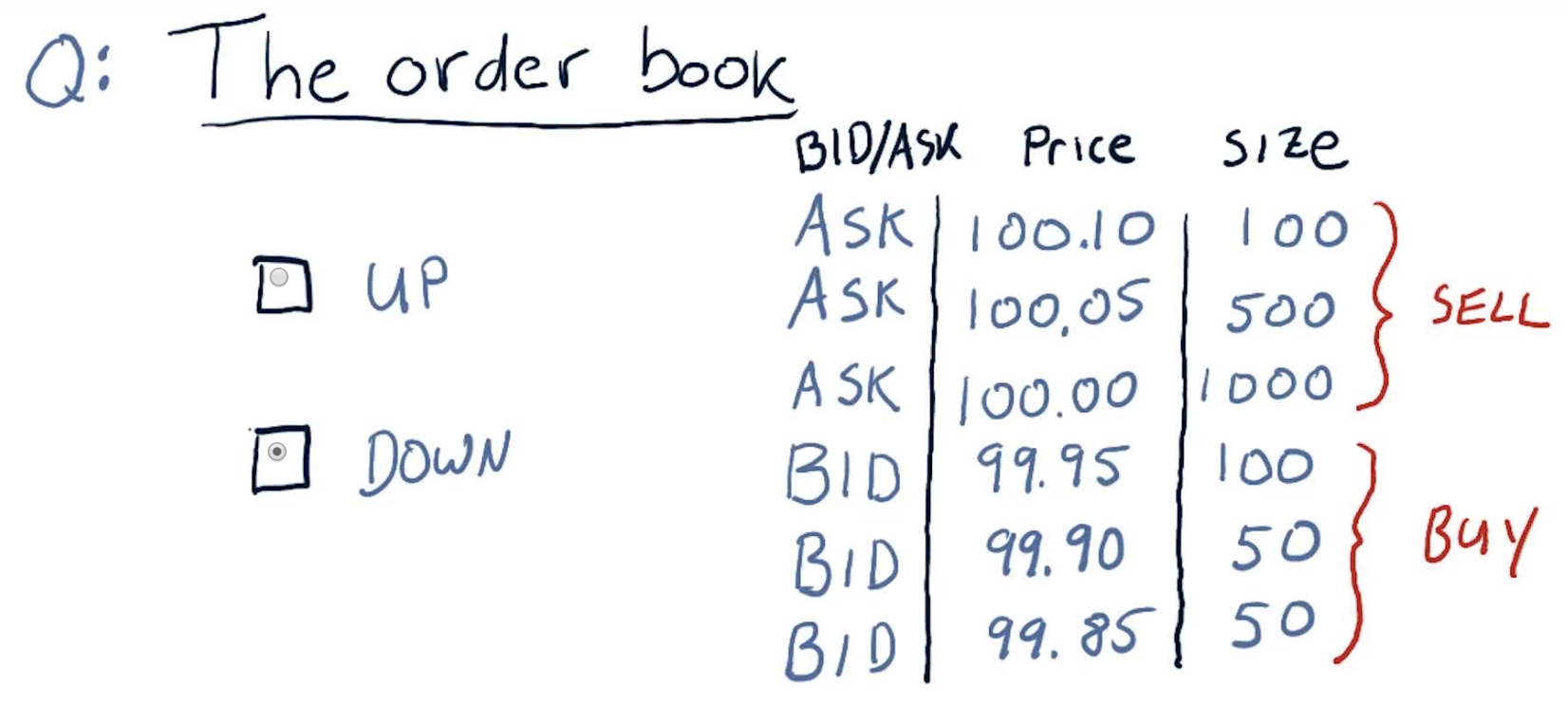

Up or down

If you put in a SELL order (at market value), you will sell the first 100 shares at $99.95, the next 50 at $99.90, and so on.

In case of a BUY order, the market value won't change for the first 1000 shares.

So, depending on your volume of trade, the value of the stock will likely go down.

How orders affect the order book

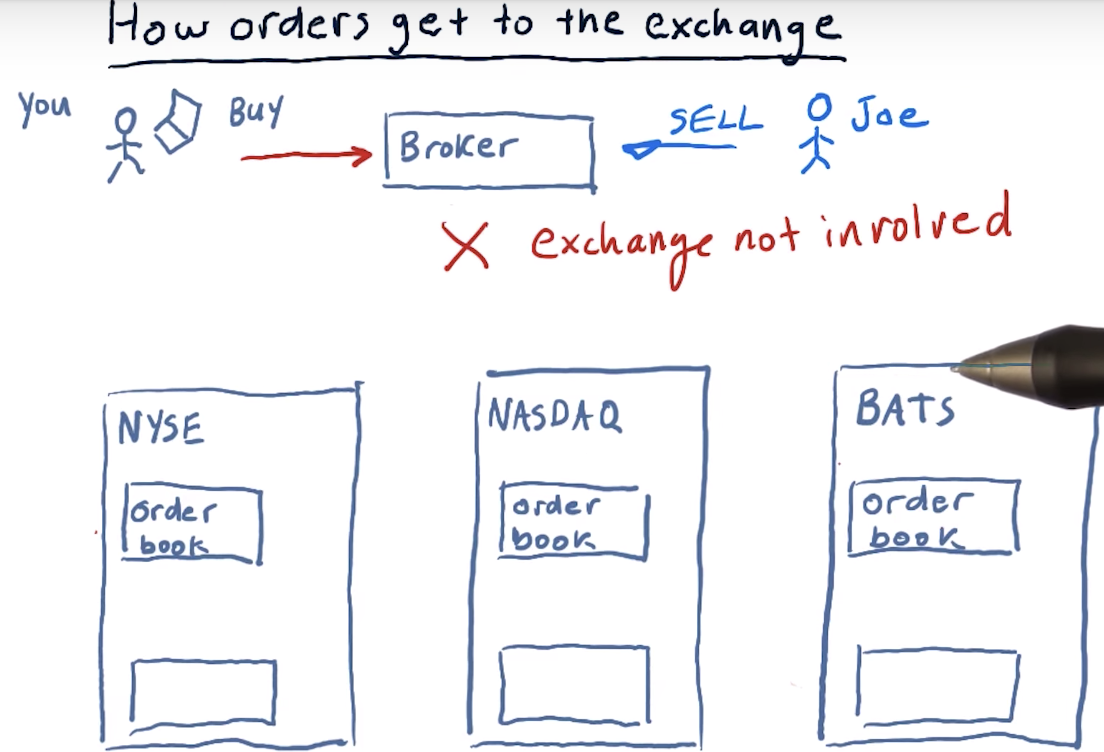

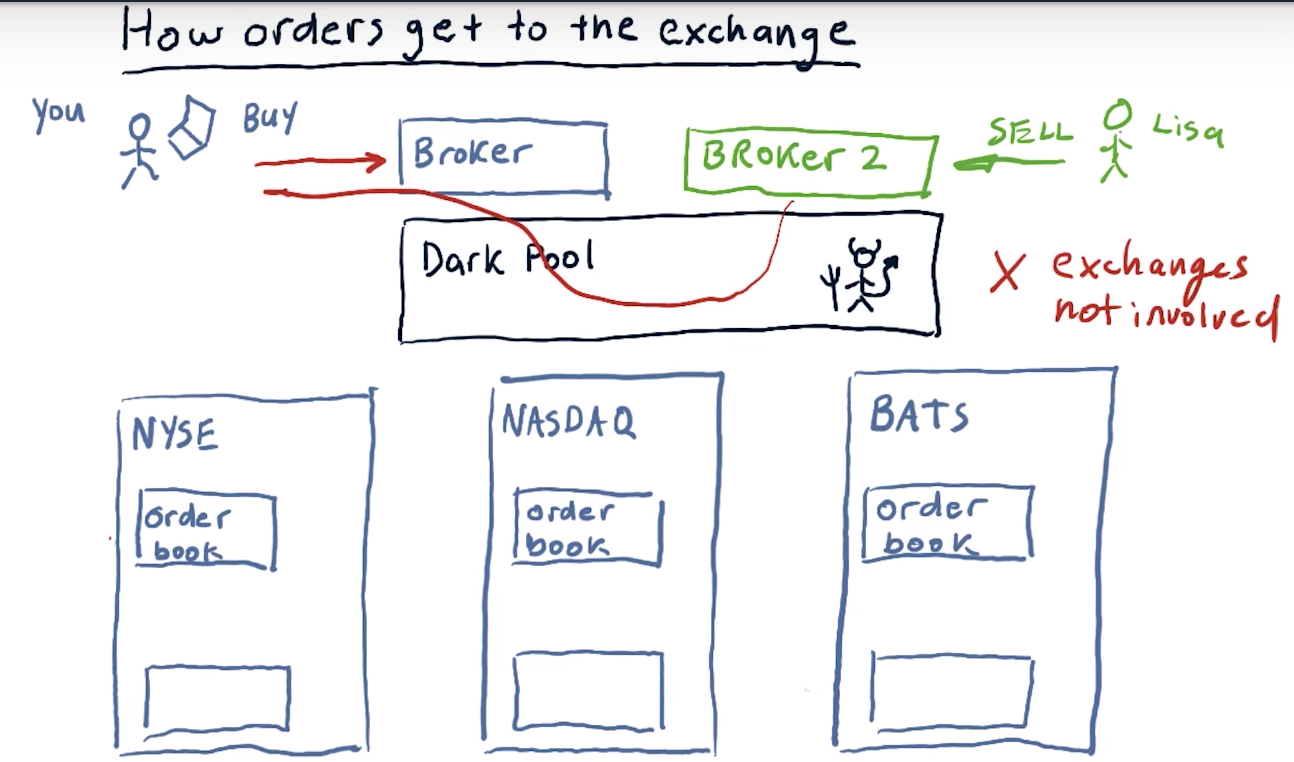

How orders get to the exchange

How hedge funds exploit market mechanics

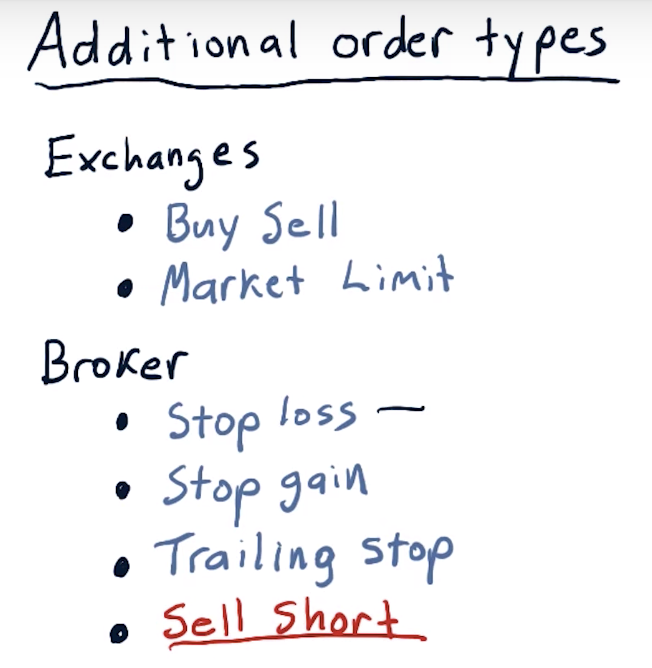

Additional order types

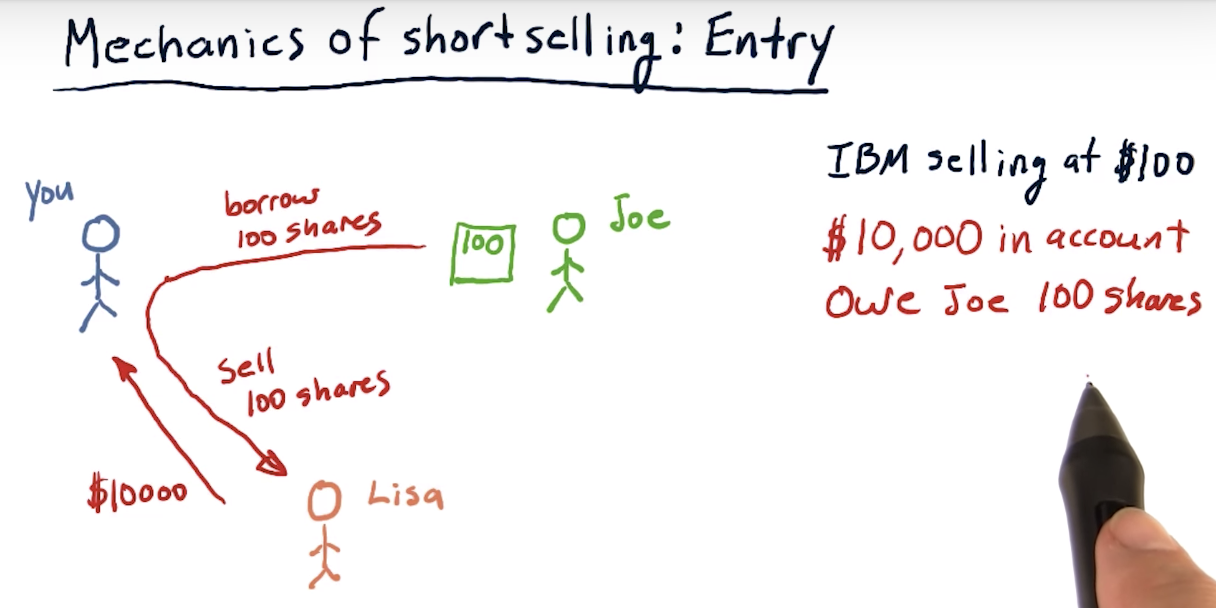

Mechanics of short selling: Entry

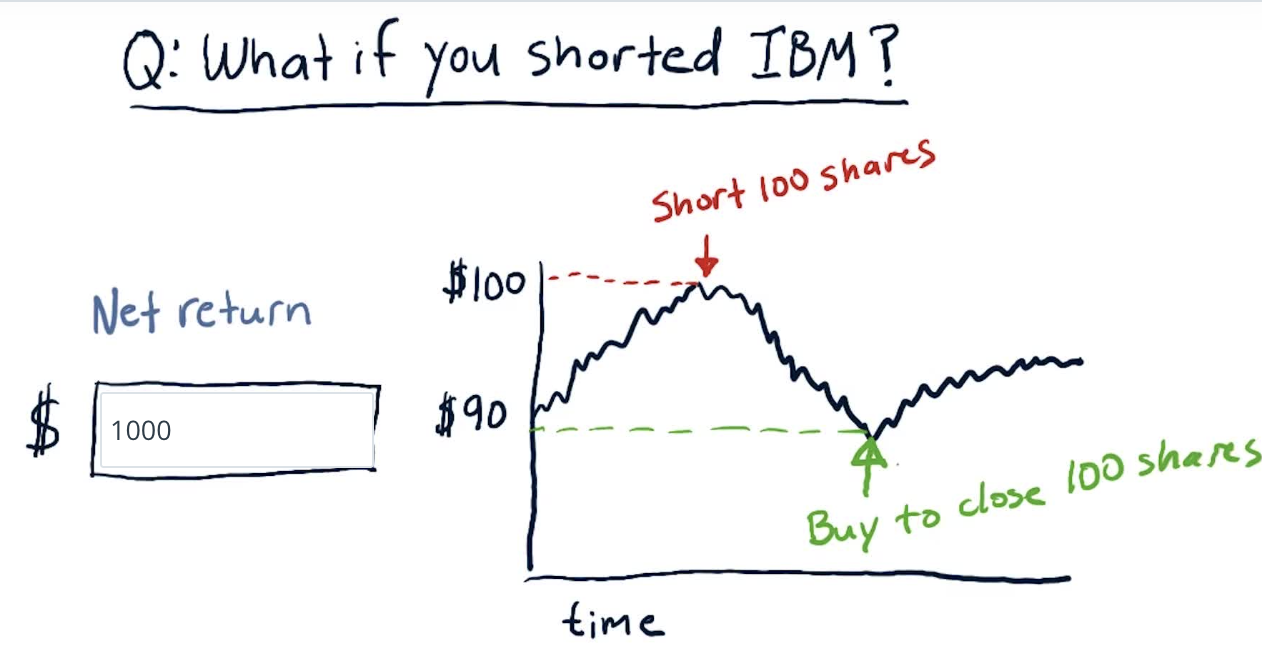

Short selling

The buying occurred after selling, but nonetheless, you sold the stocks for more than you paid - so profit!

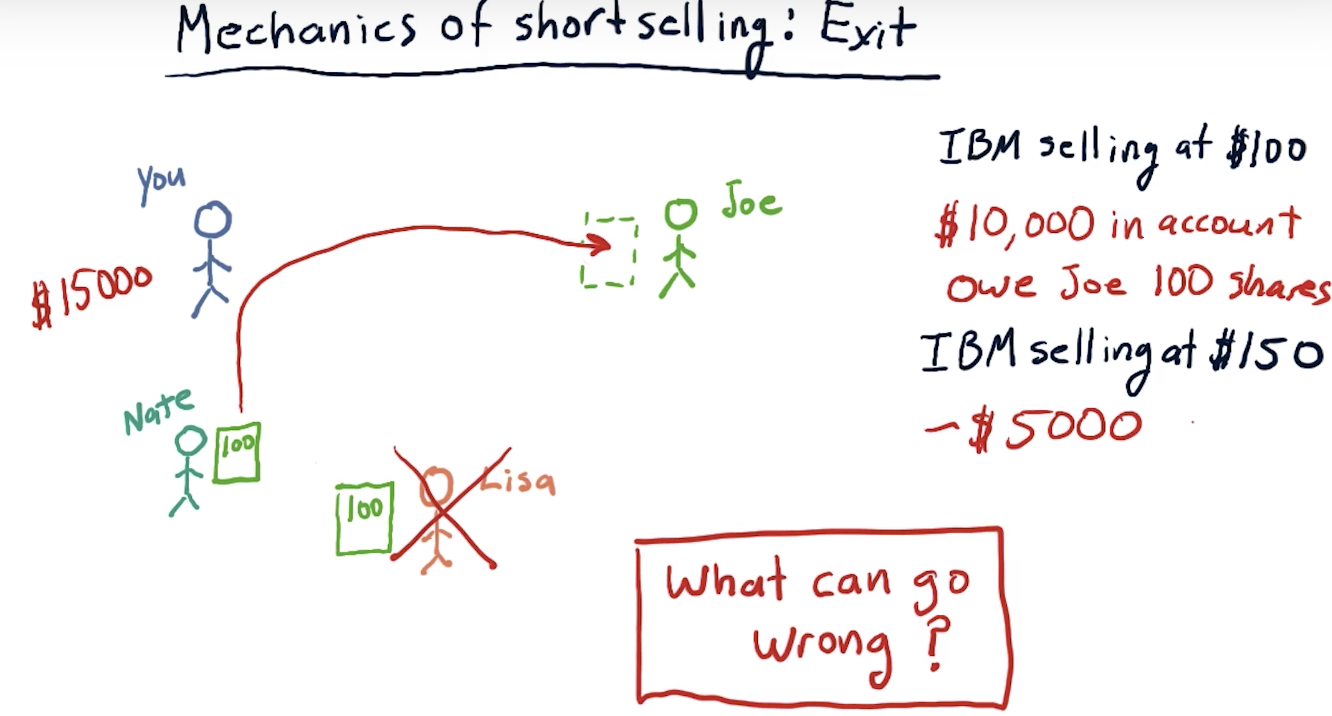

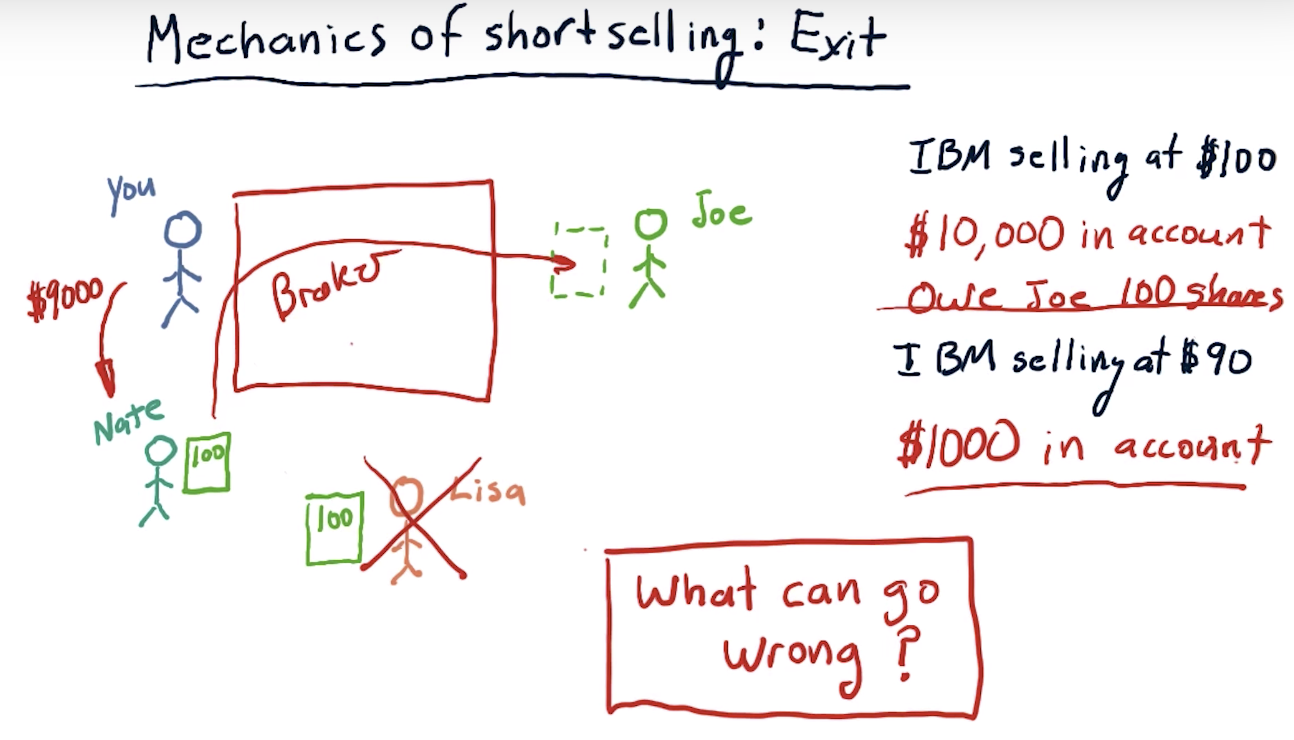

Mechanics of short selling: Exit

What can go wrong?