What is a company worth?

Yes, the value of $1 would typically reduce over time, and the sum of the individual $1's generated every year would converge to a finite value.

but other three answers can be correct in different point of view

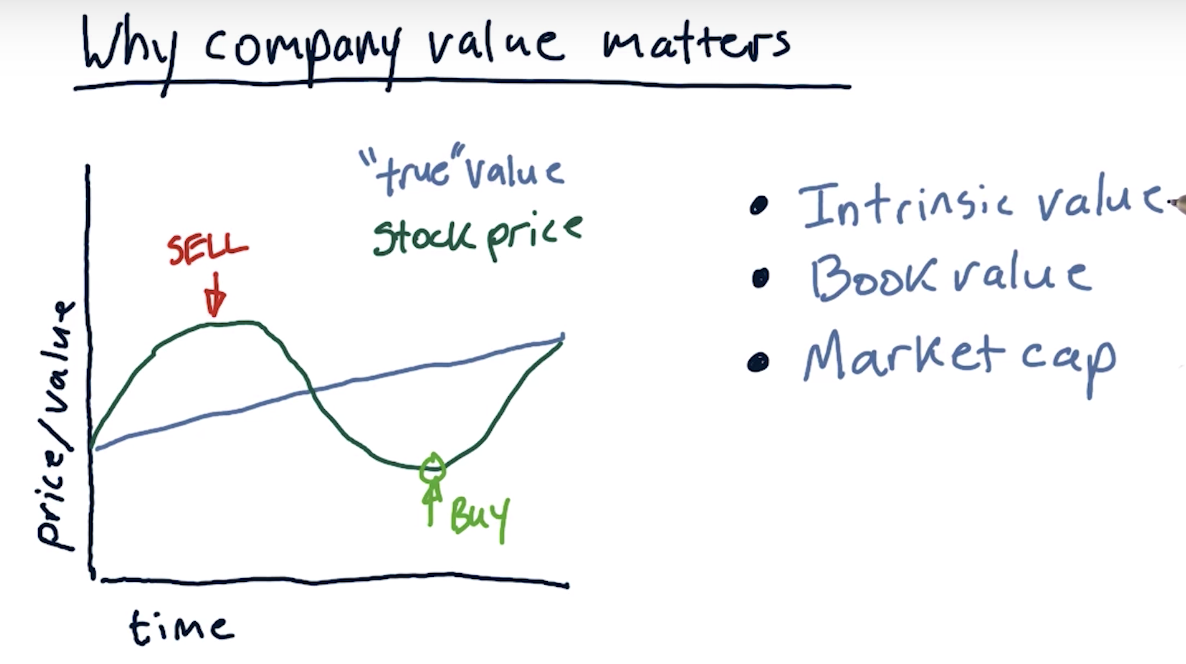

Why company value matters

intrinsic value => dividend accumulated in the future

book value => assets the company owns

market cap => the value of the stock on the market

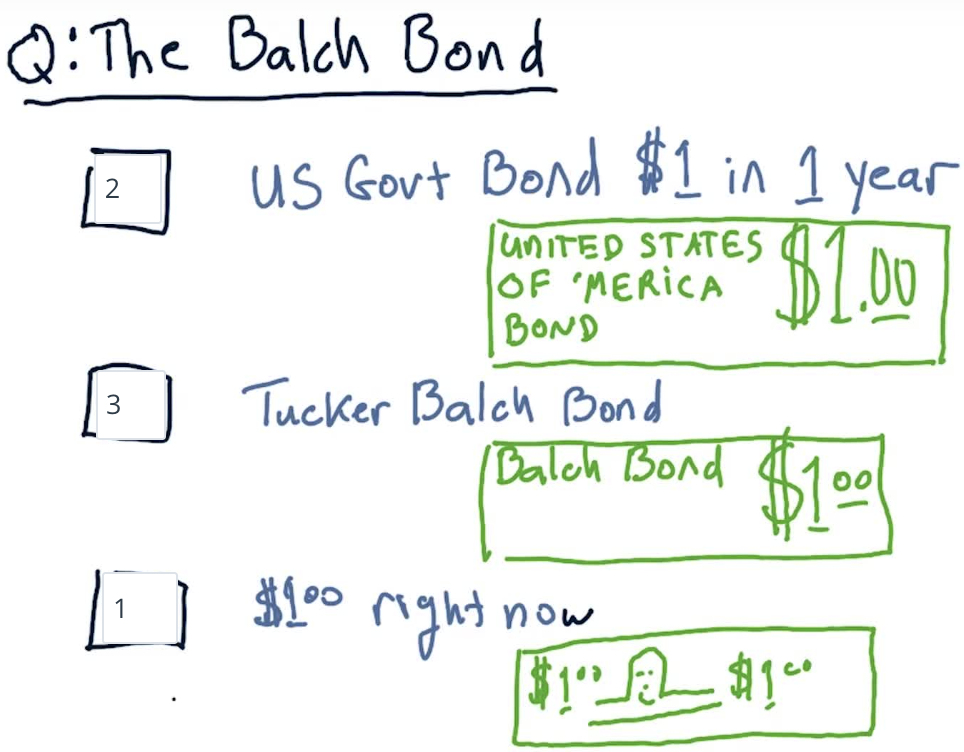

The Balch Bond

When comparing these different options, assume that they cost you the same today. Say, you have 80 cents to invest, and these are the 3 options you can get for that money.

Note: Rank 1 = most preferred option, 3 = least preferred.

Bond: 债券

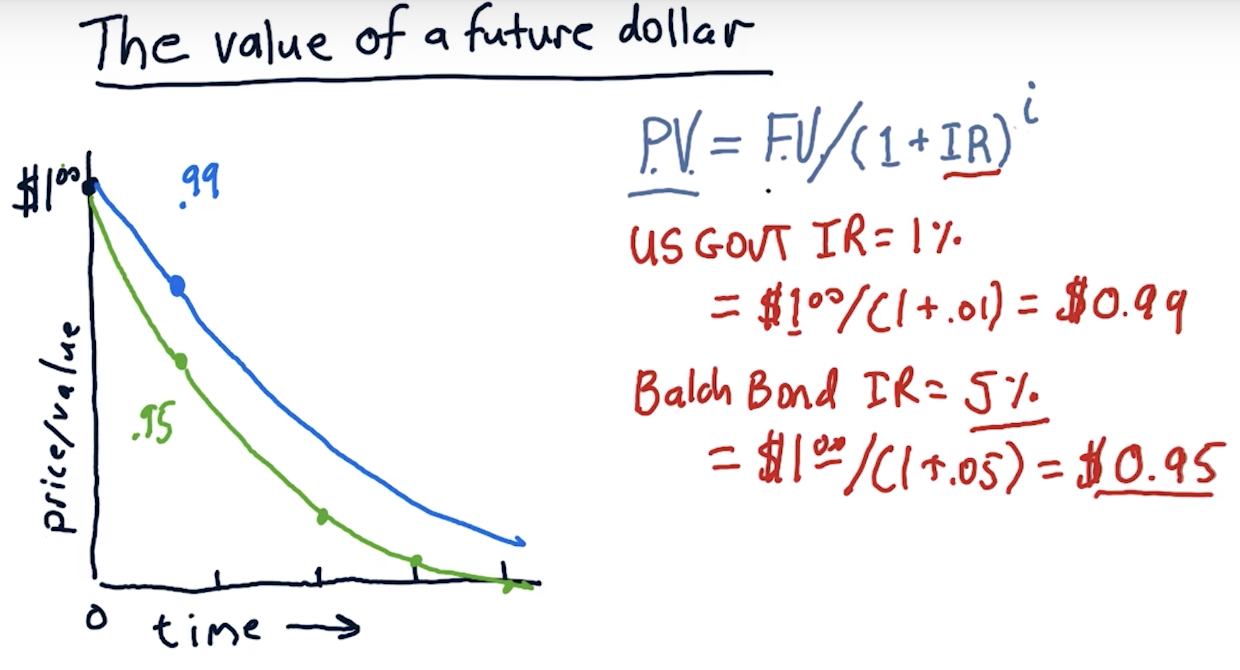

The value of a future dollar

US government promises 1% interest rate => today it's worthwhile to pay 0.99$ to US government for the promise that they'll return 1$ in a year

Balch Bond attracts buyers by a higher interest rate 5% <= the same as => charges less

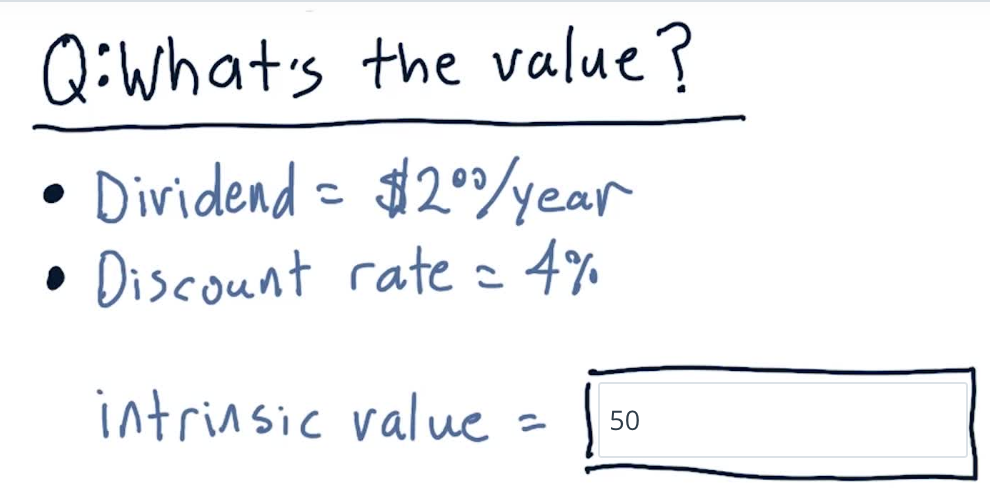

Intrinsic value

interest rate => how risky the company is

Interest Rate and Discount Rate are terms that refer to essentially the same quantity, but are used to distinguish two slightly different use cases:

- Interest Rate is used with a given Present Value, to figure out what the Future Value would be.

- Discount Rate is used when we have a known or desired Future Value, and want to compute the corresponding Present Value.

For instance, in this case we want to sum up all future dividends - equal to a constant ($1 or FV) every year.

n = 1+IR

DR => the same concept in reinforcement learning???

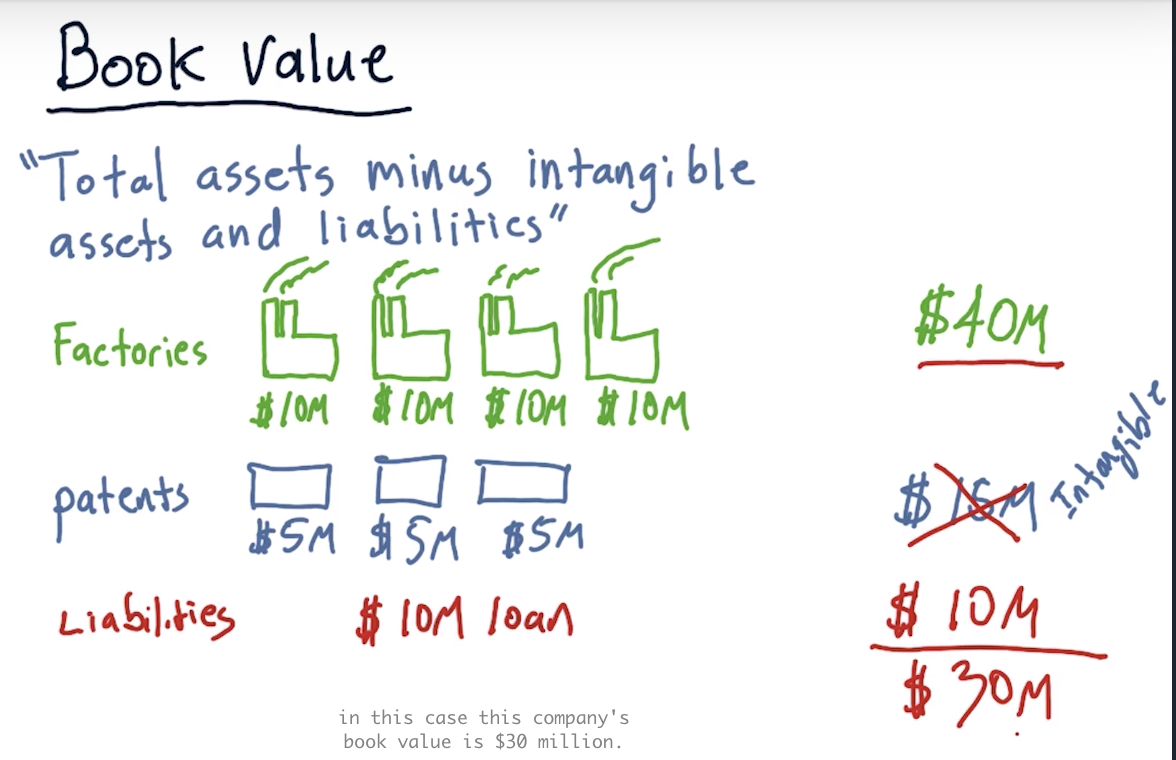

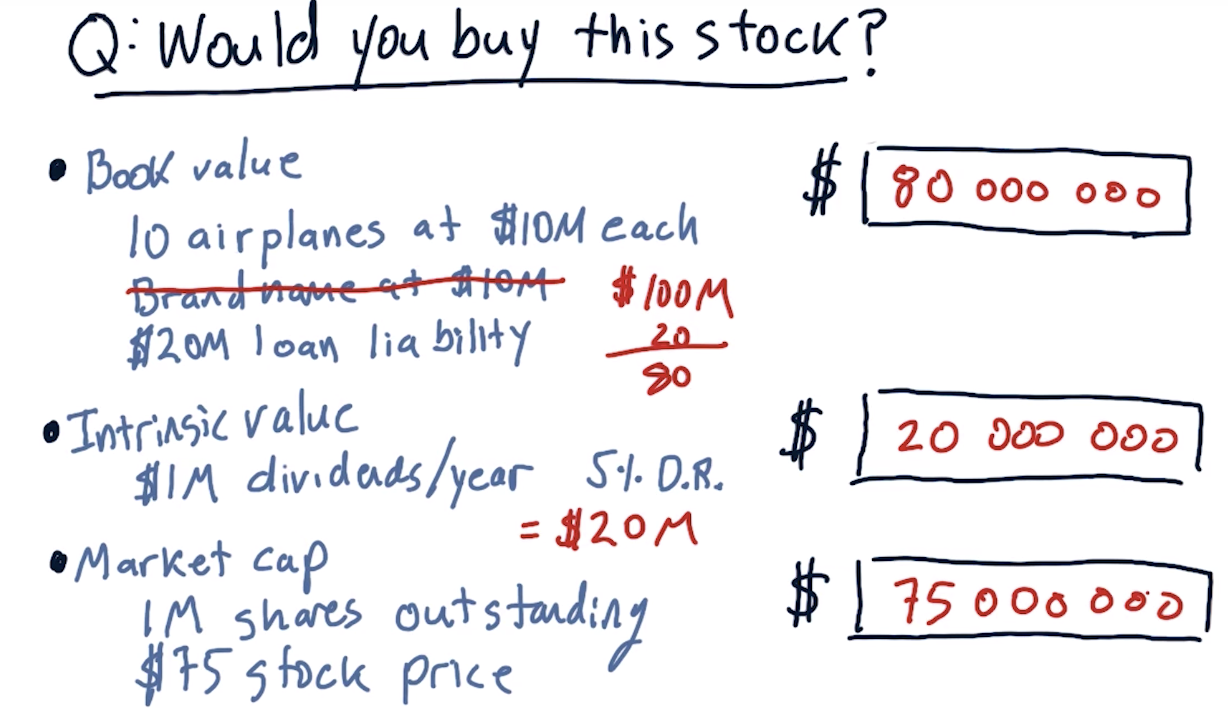

Book value

ignore patents' value

Market capitalization

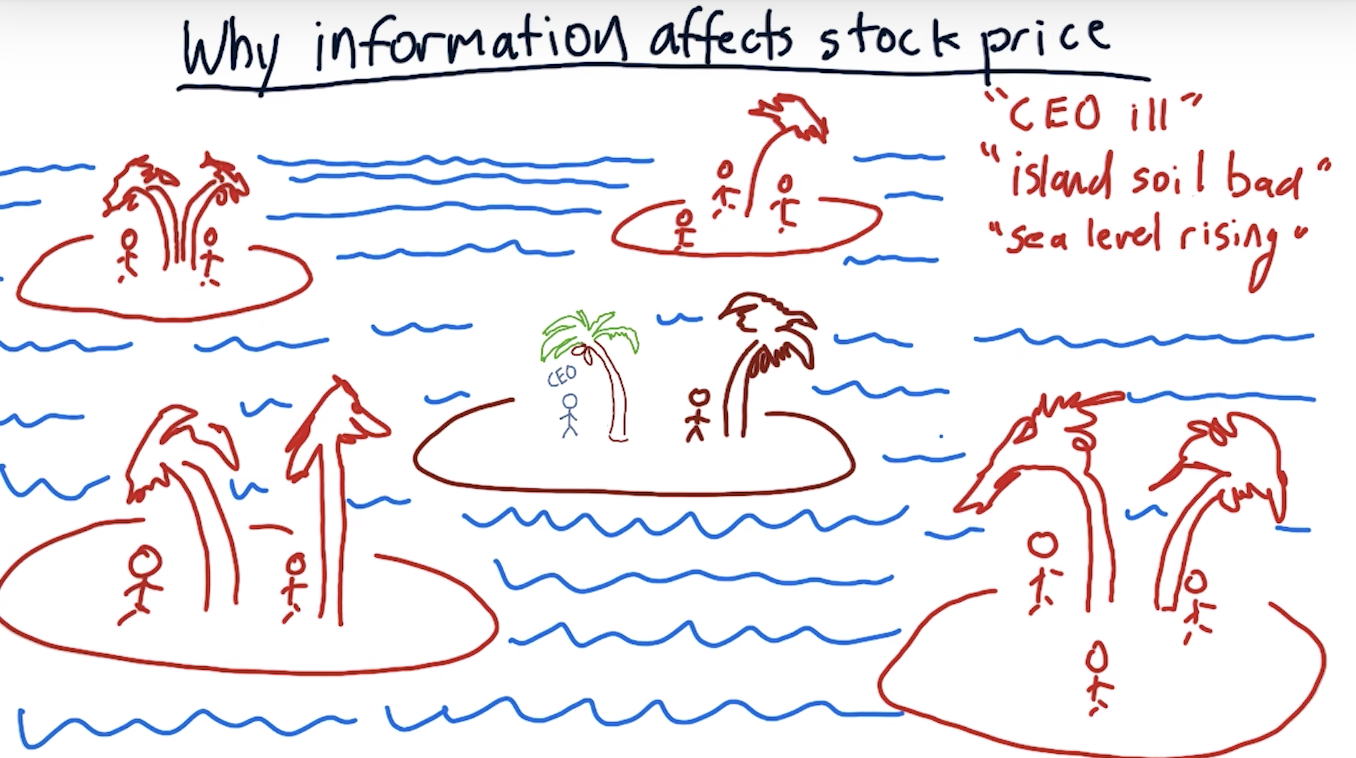

Why information affects stock price

future dividend decreases or increases

Compute company value

Yes, you should buy it right away!

Ignoring the intrinsic value, if you buy the entire company off the market (for $75M) and immediately sell it for its book value ($80M), you have a $5M profit right there!

Even if you are buying some stocks (instead of the whole company), the stock price is expected to increase (as it is currently undervalued).

IV >> Market cap => buy stock

IV << Market cap => short the stock

BV => lowest price => stock value should not be lower than the book value, otherwise, why not buy the company and sell every facilities?

Two questions:

How a company determines its Interest Rate?

Why intrinsic value doesnt count the patent value?

The Capital Asset Pricing Model

1960s developed => 1990s nobel prize

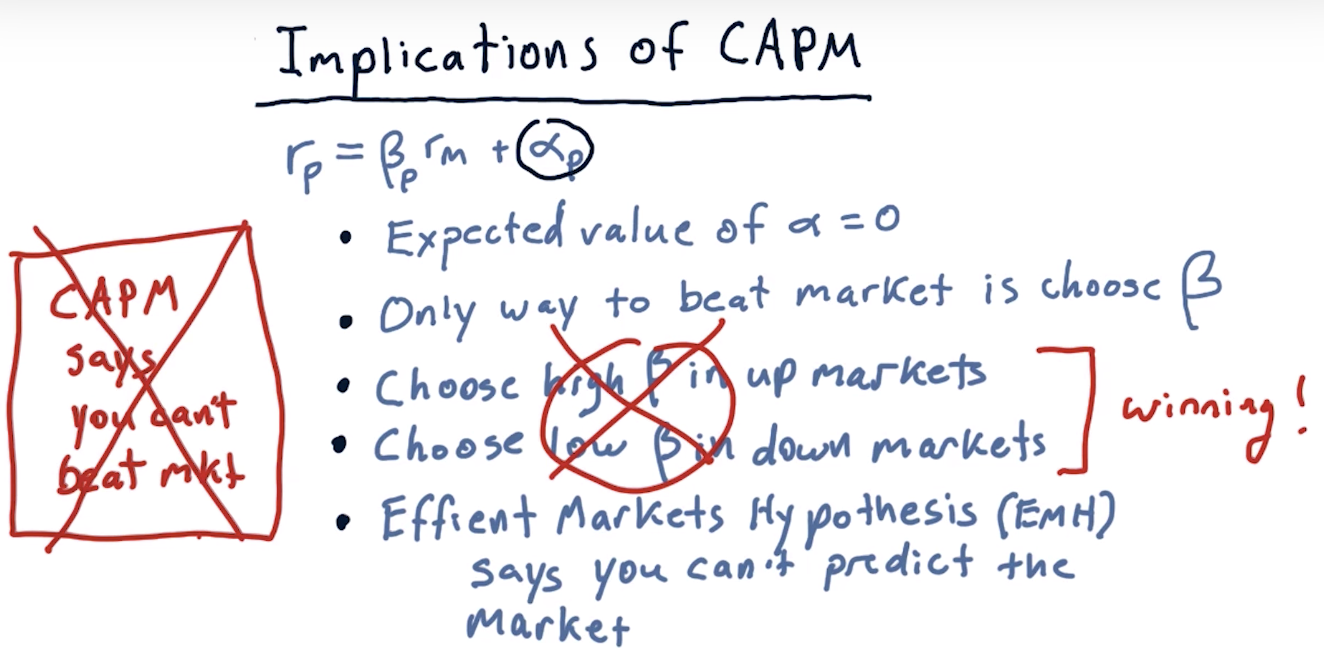

CAPM => led to the development of index funds and the belief that you can't beat the market

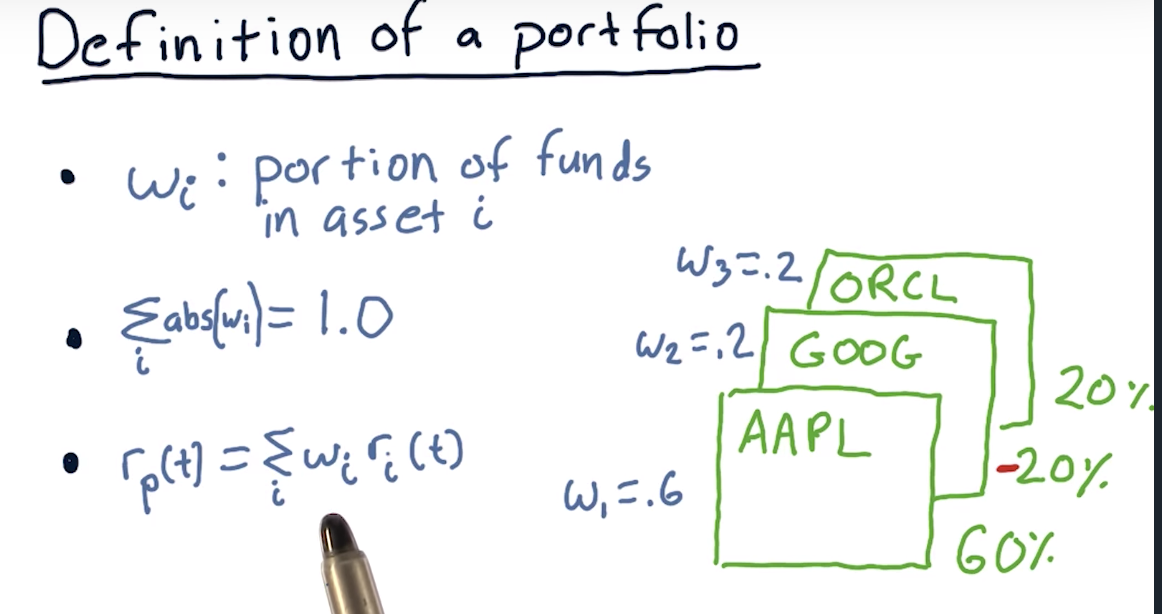

Definition of a portfolio

Portfolio return

0.75 1% + (-0.25) (-2%)

0.75% + 0.5%

= 1.25%

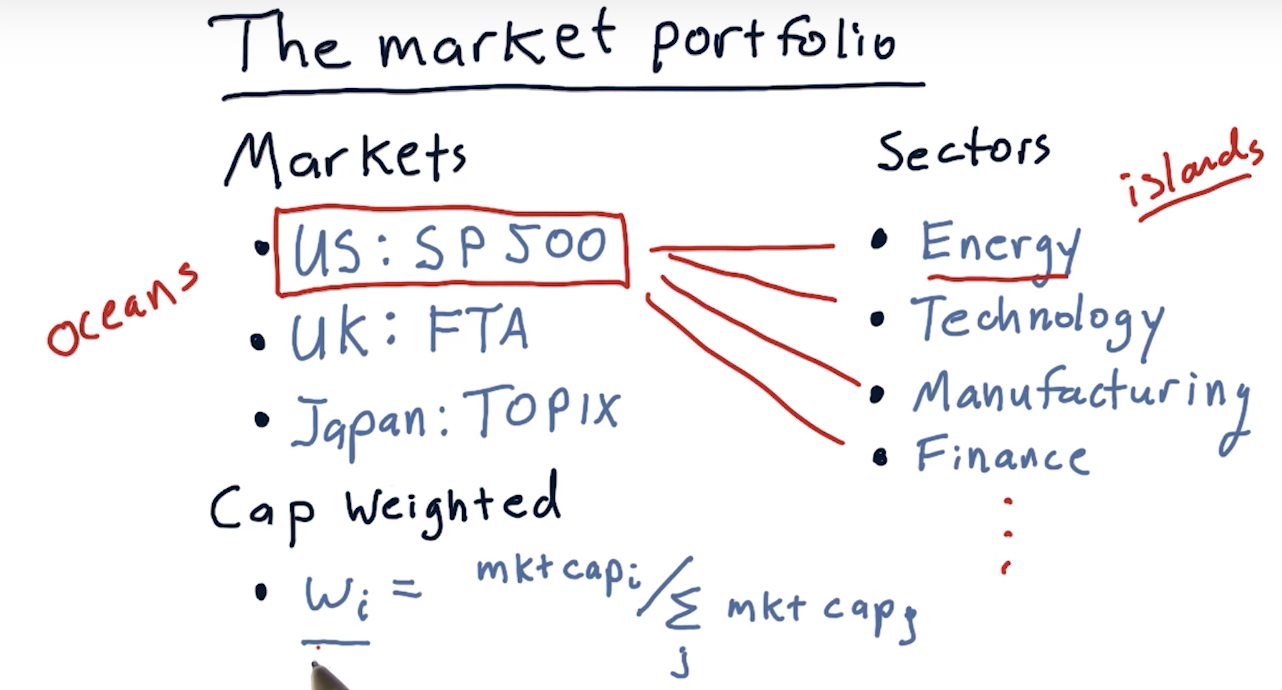

The market portfolio

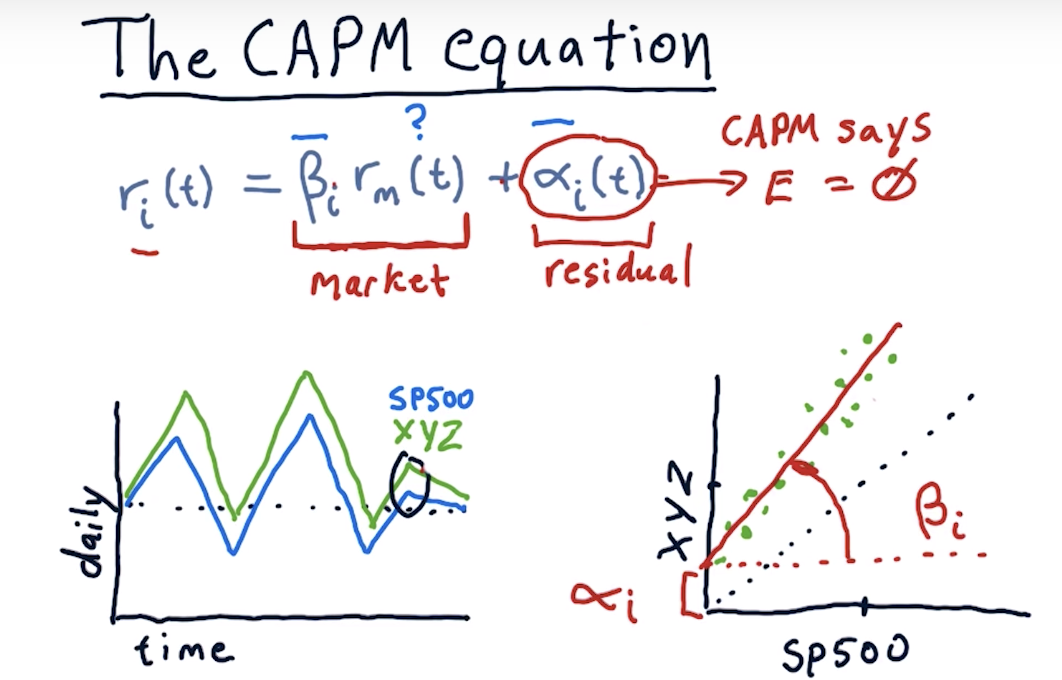

The CAPM equation

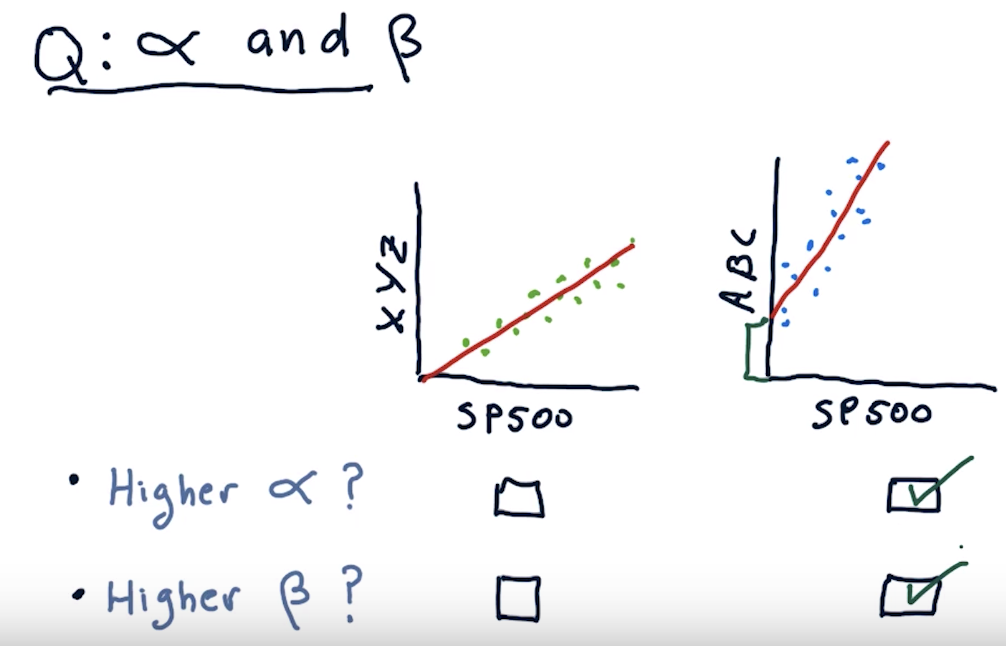

Compare alpha and beta

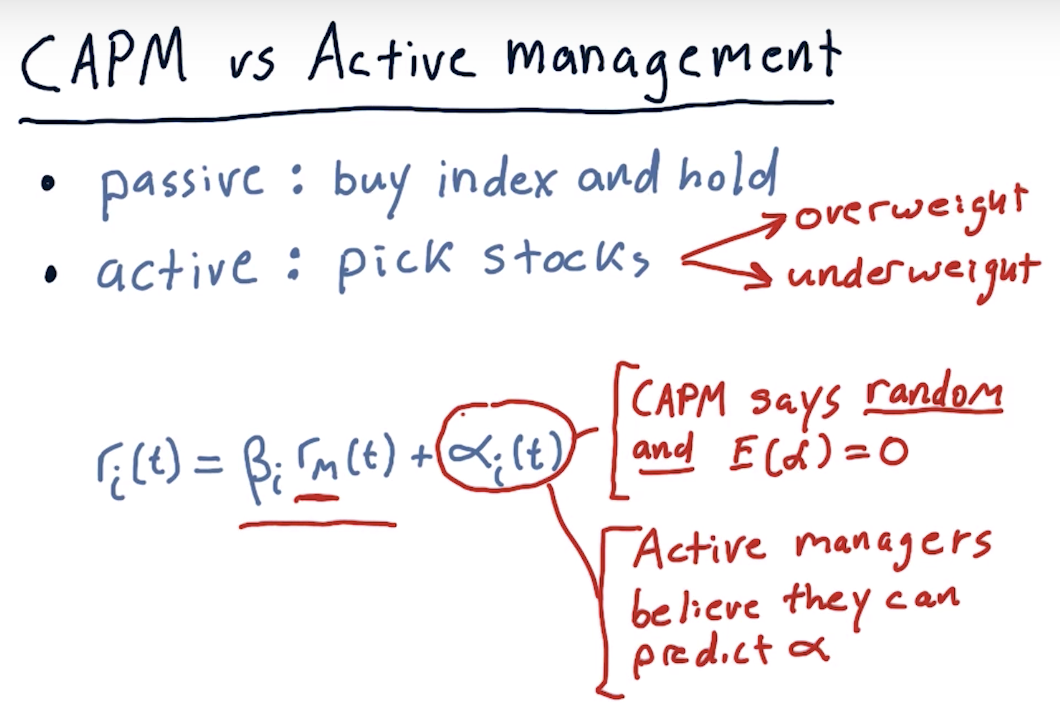

CAPM vs active management

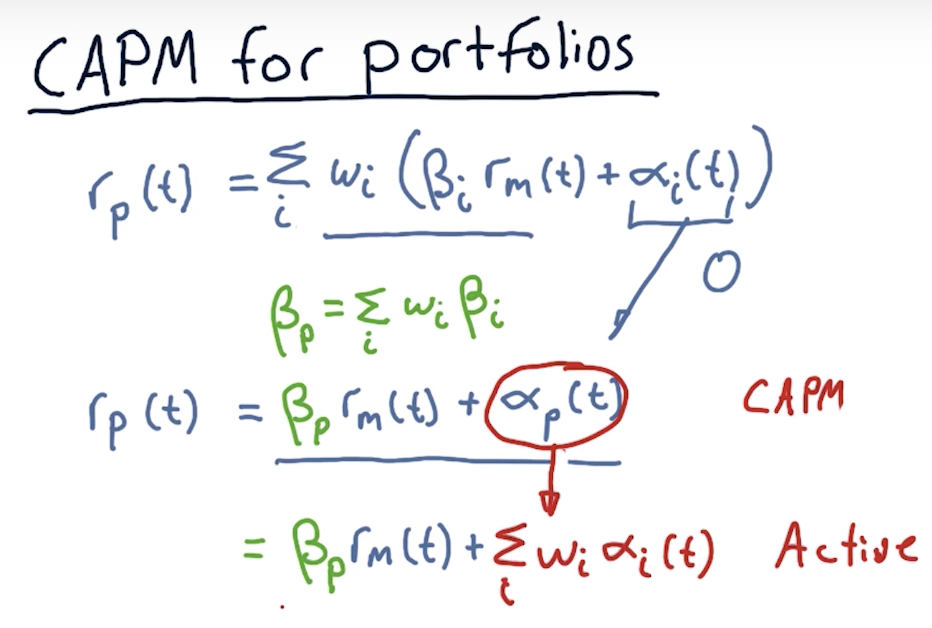

CAPM for portfolios

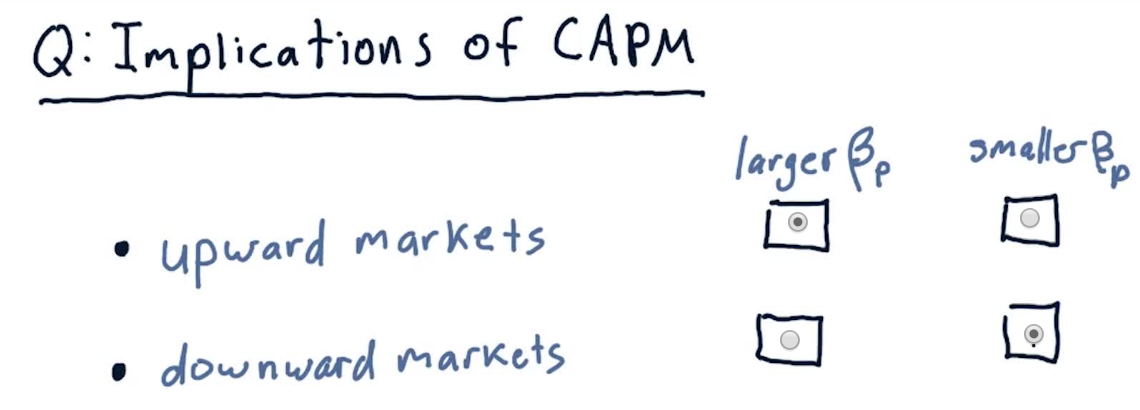

That's right - you want a higher β in upward markets so that you can ride the surge, but a lower β in downward markets so you don't crash as much.

Implications of CAPM

Arbitrage Pricing Theory