基本原理

滚动复利,顾名思义,用利润滚动利润,简称:驴打滚.这种方法适用于大资金在起步建仓期,又或者在打净值安全垫期。利用极少一部分仓位将安全垫做出,这种方法比较适用于震荡市. 主要体现在灵活的仓位控制上,方法运用的过程中类似抗日战争时期八路军的"打游击”,在已既定选好股票池的基础上,以不恋战为原则,快进快出.

策略实现

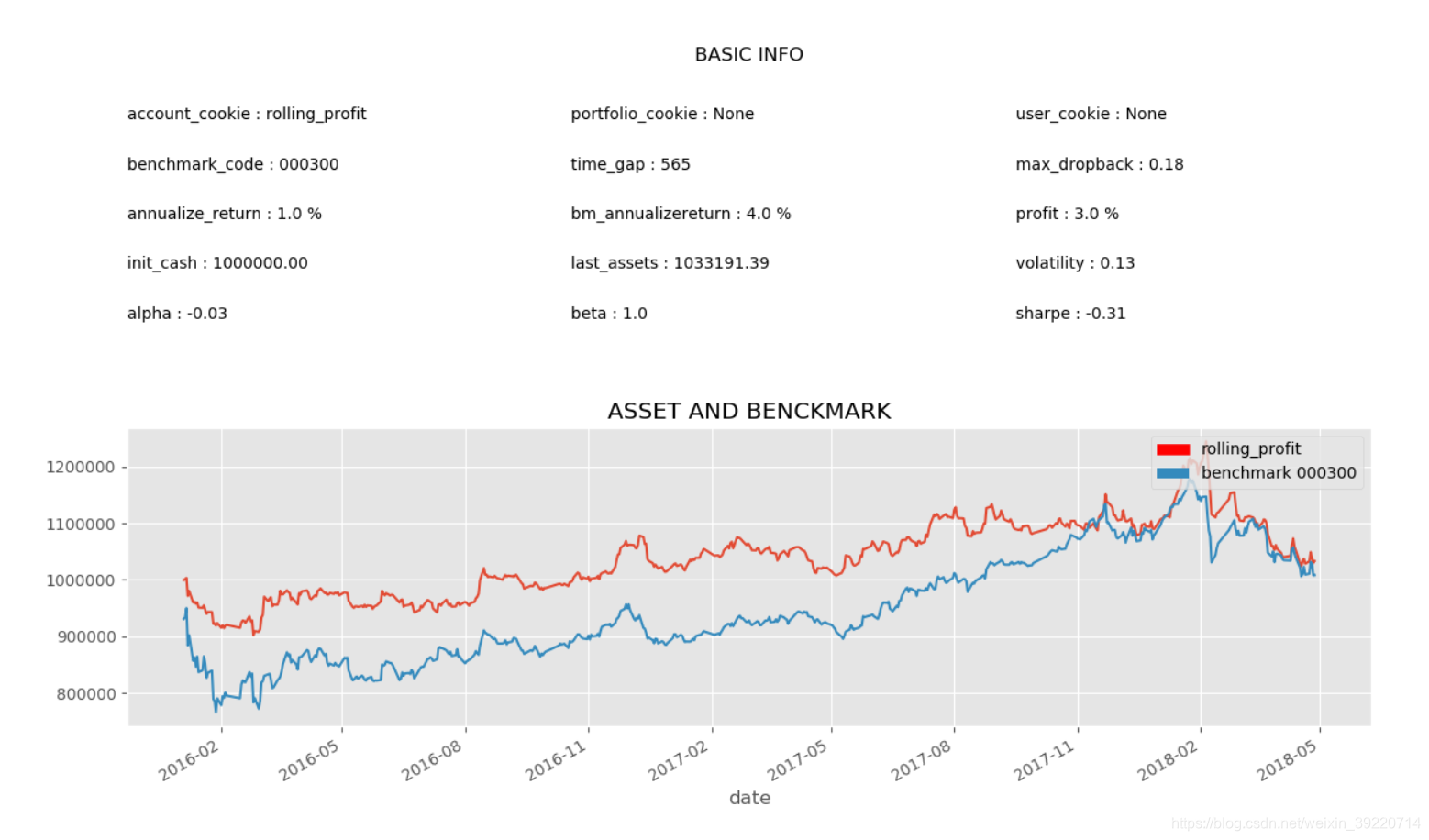

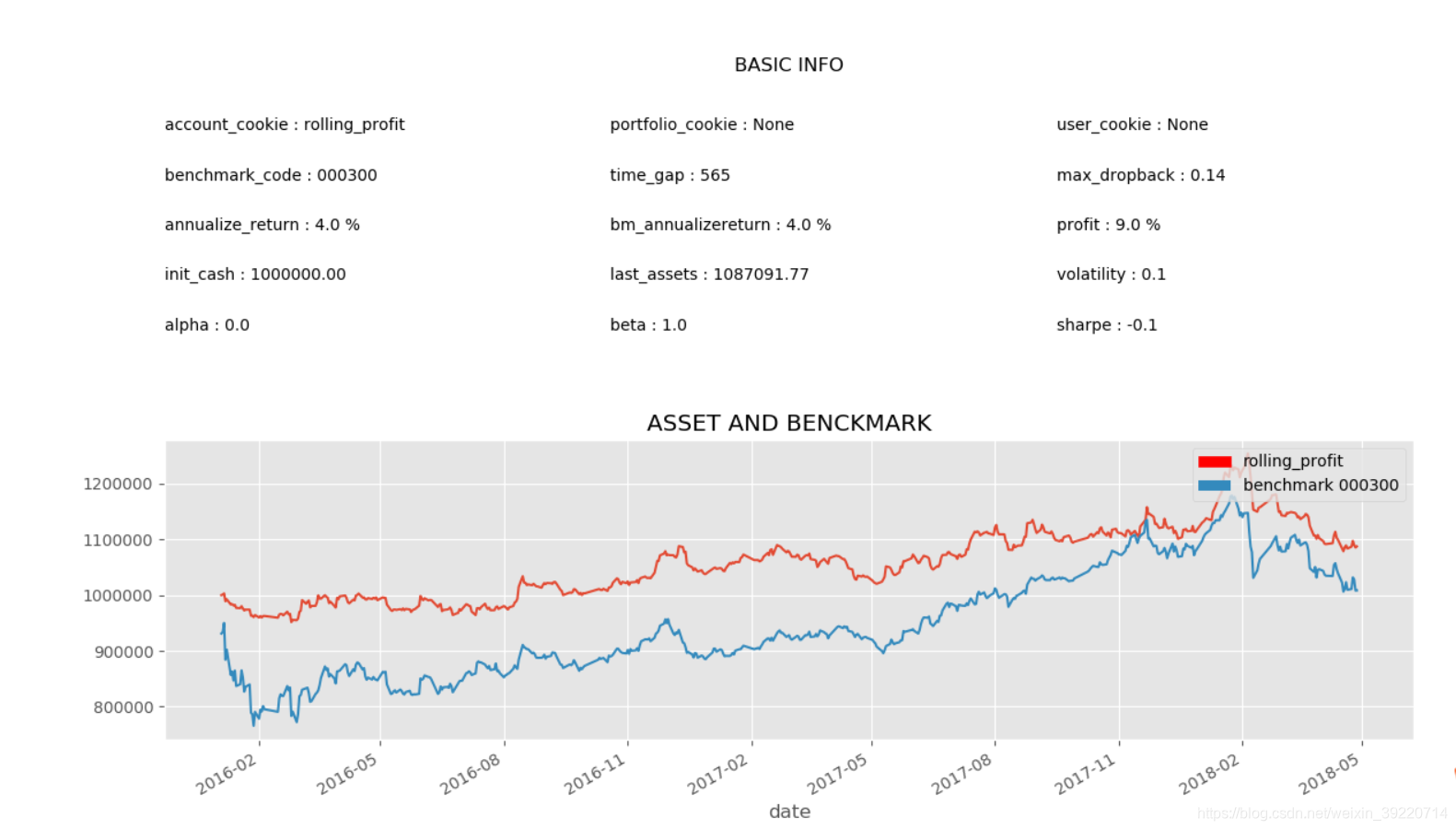

初始资金100万,时间段为:2016-01-01~2018-05-01

选择市盈率在0~20的市值最大的前n只股票

平均分给每只股票现金相同,五步建仓,相当于若选50只股票的话,一只股票初始资金5万,分五次一万出来;

个股5%止损和15%止盈

购买条件:连续五日下跌的以及价格高于5日或10日均线20%的股票不操作

每日对现金进行重新分配,对于每支股票,最多只能买入五次,不过每次买入的金额可能会不同,(之前是用每次买入的金额一致,见图二),下文代码使用的是对同一支每次买入金额可能不同的情况,即图一。每次买入金额相同即意味着第一次买入某支股票时,便把金额存储起来,每日剩余现金流减去这部分金额,再均分下去

运行截图:

图1:

图2:

# coding: utf-8 # @author: lin # @date: 2018/11/14 import QUANTAXIS as QA import pandas as pd import time import matplotlib.pyplot as plt pd.set_option('max_colwidth', 5000) pd.set_option('display.max_columns', 5000) pd.set_option('display.max_rows', 5000) class RollingProfitStrategy: def __init__(self, start_time, stop_time, n=20, ascending=False, stock_init_cash=1000000): self.Account = QA.QA_Account() # 初始化账户 self.Account.reset_assets(stock_init_cash) # 初始化账户 self.Broker = QA.QA_BacktestBroker() self.time_quantum_list = ['-12-31', '-09-30', '-06-30', '-03-31'] self.start_time = start_time self.stop_time = stop_time self.stock_pool = [] self.cash_n = 5 self.bought_price = {} # 入场的价格 self.last_price = {} # 上一天的价格 self.init_cash = {} # 入场的现金分配 self.bought_stock = {} # 每种股票是否已入场, boolean self.init_strategy(n, ascending) def init_strategy(self, n, ascending): self.get_stock_pool_price(n, ascending) # 获取股票和初始价格 for stock_code in self.stock_pool: self.init_cash[stock_code] = [1 for i in range(self.cash_n)] # 五等分 self.bought_stock[stock_code] = False def get_financial_time(self): """ 得到此日期前一个财务数据的日期 :return: """ year = self.start_time[0:4] while (True): for day in self.time_quantum_list: the_financial_time = year + day if the_financial_time <= self.start_time: return the_financial_time year = str(int(year) - 1) def get_assets_eps(self, stock_code, the_financial_time): """ 得到高级财务数据 :param stock_code: :param the_financial_time: 离开始时间最近的财务数据的时间 :return: """ financial_report = QA.QA_fetch_financial_report(stock_code, the_financial_time) if financial_report is not None: return financial_report.iloc[0]['totalAssets'], financial_report.iloc[0]['EPS'] return None, None def get_stock_pool_price(self, n, ascending): """ 选取哪些股票 :param n: n只 :param ascending: True则资产最少的前n,False则最多前n :return: """ stock_code_list = QA.QA_fetch_stock_list_adv().code.tolist() stock_dict = {'stock': [], 'totalAssets': [], 'price': []} the_financial_time = self.get_financial_time() for stock_code in stock_code_list: # print(stock_code) assets, EPS = self.get_assets_eps(stock_code, the_financial_time) if assets is not None and EPS != 0: data = QA.QA_fetch_stock_day_adv(stock_code, self.start_time, self.stop_time) if data is None: continue price = data.to_pd().iloc[0]['close'] if 0 < price / EPS < 20: # 满足条件才添加进行排序 # print(price / EPS) stock_dict['stock'].append(stock_code) stock_dict['totalAssets'].append(assets) stock_dict['price'].append(price) data = pd.DataFrame(stock_dict) data.dropna(inplace=True) data.sort_values(by='totalAssets', ascending=ascending, axis=0, inplace=True) # print(data.iloc[:20]) # data.reset_index(inplace=True, drop=True) self.stock_pool = list(data['stock'].iloc[:n]) # 前十行,若是用loc,则是查找索引 price_list = list(data['price'].iloc[:n]) for i in range(n): self.bought_price[self.stock_pool[i]] = price_list[i] self.last_price[self.stock_pool[i]] = price_list[i] print(self.stock_pool) def get_pre_month_date(self, date): # 得到一个月前的1日的日期,为了得到某天前十个交易日的数据 date = date[:10] times = date.split('-') times = [int(i) for i in times] times[1] -= 1 if times[1] == 0: times[0] -= 1 times[1] = 12 times[2] = 1 return '%d-%02d-%02d' % (times[0], times[1], times[2]) def is_decrease(self, data): # 是否连续五日下跌,此时当start_time为交易日时,第五天为start_time,若是用于实际数据中,我有点疑惑是否用reality_time数据或是前五个交易日 close_data = list(data['close'].iloc[-5:]) if len(close_data) < 5: return False if close_data[0] > close_data[1] > close_data[2] > close_data[3] > close_data[4]: # 五日连续下跌 print(close_data) return False return True def is_increase(self, data): close_data = list(data['close'].iloc[-10:]) if len(close_data) < 10: return False mean_5_close = sum(close_data[5:10]) / 5 mean_10_close = sum(close_data[:10]) / 10 if (close_data[-1] - mean_5_close) / mean_5_close > 0.2 or (close_data[-1] - mean_10_close) / mean_10_close > 0.2: # 价格大于五日均线或者是十日均线 20%,则返回True print(close_data) return False return True def if_buy(self, stock_code, date): # 若是连续五日下跌或者昨日价格大于五日或十日均线20%则不进行操作 pre_month_date = self.get_pre_month_date(date) data = QA.QA_fetch_stock_day_adv(stock_code, pre_month_date, date) data = data.to_qfq() # 前复权 if self.is_decrease(data) or self.is_increase(data): return True return False def run(self): """ 每个股票初始五等分,可以进场则进场,每个股票盈亏单独算,当止损或者止盈时,股票池中所有未入场的股票现金均分一下 也可每天均分一次,这样就把止损和止盈的情况包括进去了。 :return: """ self.Account.account_cookie = 'rolling_profit' # 每天均分一下现金 data = QA.QA_fetch_stock_day_adv(self.stock_pool, self.start_time, self.stop_time).to_qfq() # print(data) for items in data.panel_gen: # 每一天 # 股票池中所有未入场的股票现金均分一下 n_percent = 0 for stock_code in self.stock_pool: n_percent += sum(self.init_cash[stock_code]) if n_percent == 0: n_money = 0 else: n_money = self.Account.cash_available / n_percent print(n_money) for item in items.security_gen: close_price = item.close[0] date = str(item.date[0])[:10] stock_code = item.code[0] # item = item.to_pd() # item.reset_index(inplace=True) if not self.bought_stock[stock_code]: # 股票未入场的情况 if self.if_buy(stock_code, date): # 若是可以买 if n_money >= close_price*100: order = self.Account.send_order( code=stock_code, time=date, money=n_money, towards=QA.ORDER_DIRECTION.BUY, price=close_price, order_model=QA.ORDER_MODEL.CLOSE, amount_model=QA.AMOUNT_MODEL.BY_MONEY ) self.Broker.receive_order(QA.QA_Event(order=order, market_data=item)) trade_mes = self.Broker.query_orders(self.Account.account_cookie, 'filled') res = trade_mes.loc[order.account_cookie, order.realorder_id] order.trade(res.trade_id, res.trade_price, res.trade_amount, res.trade_time) # date 应为res.trade_time的 self.init_cash[stock_code][0] = 0 self.bought_stock[stock_code] = True self.bought_price[stock_code] = close_price # 入场价格 self.last_price[stock_code] = close_price # 最新价格 else: # 股票已经入场,一种是止盈或止亏,一种是继续买入 if (close_price - self.bought_price[stock_code]) / close_price > 0.15 or (close_price - self.bought_price[stock_code]) / close_price < -0.05: # 止盈止亏 order = self.Account.send_order( code=stock_code, time=date, amount=self.Account.sell_available.get(stock_code, 0), towards=QA.ORDER_DIRECTION.SELL, price=0, order_model=QA.ORDER_MODEL.CLOSE, amount_model=QA.AMOUNT_MODEL.BY_AMOUNT ) self.Broker.receive_order(QA.QA_Event(order=order, market_data=item)) trade_mes = self.Broker.query_orders(self.Account.account_cookie, 'filled') res = trade_mes.loc[order.account_cookie, order.realorder_id] order.trade(res.trade_id, res.trade_price, res.trade_amount, res.trade_time) self.bought_stock[stock_code] = False self.init_cash[stock_code] = [1 for i in range(self.cash_n)] else: if (close_price - self.last_price[stock_code]) / close_price >= 0.01: # 日涨1%(今日比昨日涨1%,才算) for i in range(self.cash_n): if self.init_cash[stock_code][i] == 1: if n_money >= close_price * 100: order = self.Account.send_order( code=stock_code, time=date, money=n_money, towards=QA.ORDER_DIRECTION.BUY, price=close_price, order_model=QA.ORDER_MODEL.CLOSE, amount_model=QA.AMOUNT_MODEL.BY_MONEY ) self.Broker.receive_order(QA.QA_Event(order=order, market_data=item)) trade_mes = self.Broker.query_orders(self.Account.account_cookie, 'filled') res = trade_mes.loc[order.account_cookie, order.realorder_id] order.trade(res.trade_id, res.trade_price, res.trade_amount, res.trade_time) self.init_cash[stock_code][i] = 0 self.last_price[stock_code] = close_price self.Account.settle() Risk = QA.QA_Risk(self.Account) Risk.assets.plot() # 总资产 plt.show() Risk.benchmark_assets.plot() # 基准收益的资产 plt.show() Risk.plot_assets_curve() # 两个合起来的对比图 plt.show() Risk.plot_dailyhold() # 每只股票每天的买入量 plt.show() start = time.time() one = RollingProfitStrategy('2016-01-01', '2018-05-01', ascending=False, stock_init_cash=1000000) stop = time.time() print(stop - start) print(one.stock_pool) one.run() stoo = time.time() print(stoo - stop) # init_cash = {} # init_price = {} # for stock_code in stock_pool: # init_cash[stock_code] = 10000 # init_price[stock_code] = 0 # 15%止盈

————————————————

版权声明:本文为CSDN博主「Trident_lin」的原创文章,遵循CC 4.0 BY-SA版权协议,转载请附上原文出处链接及本声明。

原文链接:https://blog.csdn.net/weixin_39220714/article/details/88105378