为 QuantLib 的 Python 接口添加自定义扩展——以 FR007 互换为例

现在将 QuantLibEx 中的自定义扩展和 QuantLib 源代码合并封装成一个 Python 接口。

首先,要为自定义扩展添加 swig 接口文件,详见这里。

其次,要修改 setup.py 文件,让 python 知道需要编译那些 .cpp 文件,详见这里。

剩下的工作和往常一样:

- 生成

.cpp文件:swig3.0 -c++ -python -outdir QuantLib -o QuantLib/ql_wrap.cpp quantlib.i - 编译 .cpp 文件:

CC=clang CXX=clang++ python3 setup.py build - 安装 Python 包装:

python3 setup.py install

作为测试,将 QuantLibEx 中的例子 ChinaFixingRepoSwapCurve 翻译成 python 代码。

import QuantLib as ql

import seaborn as sns

calendar = ql.China(ql.China.IB)

today = ql.Date(21, ql.January, 2020)

ql.Settings.instance().evaluationDate = today

delayDays = 1

settlementDate = calendar.advance(

today, delayDays, ql.Days)

# must be a business day

settlementDate = calendar.adjust(settlementDate)

print("Today: ", today)

print("Settlement date: ", settlementDate)

termStrcDayCounter = ql.Actual365Fixed()

dy7 = ql.Period(7, ql.Days)

mn1 = ql.Period(1, ql.Months)

mn3 = ql.Period(3, ql.Months)

mn6 = ql.Period(6, ql.Months)

mn9 = ql.Period(9, ql.Months)

yr1 = ql.Period(1, ql.Years)

yr2 = ql.Period(2, ql.Years)

yr3 = ql.Period(3, ql.Years)

yr4 = ql.Period(4, ql.Years)

yr5 = ql.Period(5, ql.Years)

yr7 = ql.Period(7, ql.Years)

yr10 = ql.Period(10, ql.Years)

d7Rate = ql.SimpleQuote(2.5900 / 100.0)

s1mRate = ql.SimpleQuote(2.5848 / 100.0)

s3mRate = ql.SimpleQuote(2.5713 / 100.0)

s6mRate = ql.SimpleQuote(2.5788 / 100.0)

s9mRate = ql.SimpleQuote(2.5925 / 100.0)

s1yRate = ql.SimpleQuote(2.6033 / 100.0)

s2yRate = ql.SimpleQuote(2.6665 / 100.0)

s3yRate = ql.SimpleQuote(2.7415 / 100.0)

s4yRate = ql.SimpleQuote(2.8288 / 100.0)

s5yRate = ql.SimpleQuote(2.9130 / 100.0)

s7yRate = ql.SimpleQuote(3.0466 / 100.0)

s10yRate = ql.SimpleQuote(3.1763 / 100.0)

d7RateHandle = ql.QuoteHandle(d7Rate)

s1mRateHandle = ql.QuoteHandle(s1mRate)

s3mRateHandle = ql.QuoteHandle(s3mRate)

s6mRateHandle = ql.QuoteHandle(s6mRate)

s9mRateHandle = ql.QuoteHandle(s9mRate)

s1yRateHandle = ql.QuoteHandle(s1yRate)

s2yRateHandle = ql.QuoteHandle(s2yRate)

s3yRateHandle = ql.QuoteHandle(s3yRate)

s4yRateHandle = ql.QuoteHandle(s4yRate)

s5yRateHandle = ql.QuoteHandle(s5yRate)

s7yRateHandle = ql.QuoteHandle(s7yRate)

s10yRateHandle = ql.QuoteHandle(s10yRate)

depositDayCounter = ql.Actual365Fixed()

d7 = ql.DepositRateHelper(

d7RateHandle, dy7, 0, calendar,

ql.Unadjusted, False, depositDayCounter)

fixedLegFreq = ql.Quarterly

fixedLegConv = ql.ModifiedFollowing

fixedLegDayCounter = ql.Actual365Fixed()

chinaFixingRepo = ql.ChinaFixingRepo(dy7, delayDays)

s1m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn1,

s1mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s3m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn3,

s3mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s6m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn6,

s6mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s9m = ql.ChinaFixingRepoSwapRateHelper(

delayDays, mn9,

s9mRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s1y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr1,

s1yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s2y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr2,

s2yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s3y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr3,

s3yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s4y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr4,

s4yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s5y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr5,

s5yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s7y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr7,

s7yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

s10y = ql.ChinaFixingRepoSwapRateHelper(

delayDays, yr10,

s10yRateHandle, chinaFixingRepo, ql.YieldTermStructureHandle(), 0,

fixedLegConv, fixedLegFreq, calendar)

instruments = ql.RateHelperVector()

instruments.push_back(d7)

instruments.push_back(s1m)

instruments.push_back(s3m)

instruments.push_back(s6m)

instruments.push_back(s9m)

instruments.push_back(s1y)

instruments.push_back(s2y)

instruments.push_back(s3y)

instruments.push_back(s4y)

instruments.push_back(s5y)

instruments.push_back(s7y)

instruments.push_back(s10y)

termStrc = ql.PiecewiseBackwardFlatForward(

today,

instruments,

termStrcDayCounter)

curveNodeDate = calendar.adjust(settlementDate + dy7)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn1)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn3)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn6)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + mn9)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr1)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr2)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr3)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr4)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr5)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr7)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

curveNodeDate = calendar.adjust(settlementDate + yr10)

print(curveNodeDate - today, '{0:.8f}'.format(termStrc.discount(curveNodeDate)),

'{0:.7f}'.format(termStrc.zeroRate(curveNodeDate, termStrcDayCounter, ql.Continuous).rate() * 100.0))

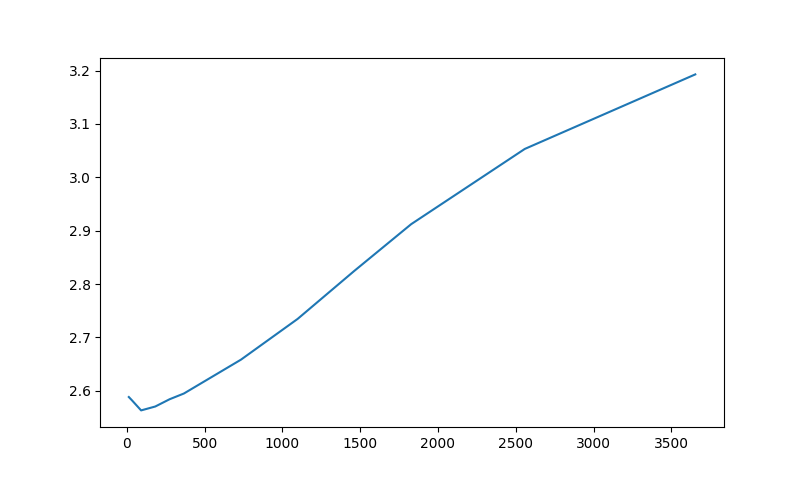

sns.lineplot(

x=[13, 34, 92, 183, 275, 367, 734, 1098, 1462, 1828, 2558, 3654],

y=[2.5884391, 2.5819802, 2.5633687, 2.570667, 2.5842461, 2.5950071,

2.6584605, 2.7347369, 2.8246057, 2.9122383, 3.0531303, 3.1927605])

结果和之前的完全一样。

Today: January 21st, 2020

Settlement date: January 22nd, 2020

13 0.99907852 2.5884391

34 0.99759776 2.5819802

92 0.99355973 2.5633687

183 0.98719415 2.5706670

275 0.98071798 2.5842461

367 0.97424520 2.5950071

734 0.94794334 2.6584605

1098 0.92102612 2.7347369

1462 0.89302652 2.8246057

1828 0.86428623 2.9122383

2558 0.80737256 3.0531303

3654 0.72642071 3.1927605