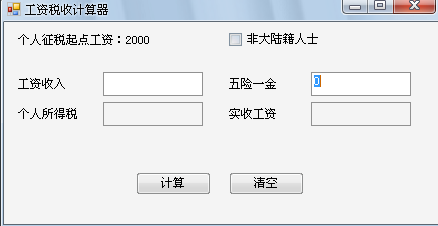

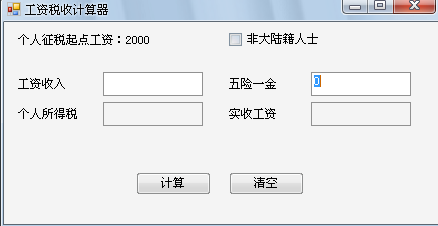

今天心血来潮,编写了一个个人所得税计算器,呵呵,虽然功能不是很强,而且也是重复造轮子(网上也有许多的个人所得税计算器),不过“纸上得来总觉浅,绝知此事要躬行”,自己动动手绝对有好处的。

下面是个人所得税计算的类:

下面是个人所得税计算的类:

1 namespace SalaryComputer

namespace SalaryComputer

2

{

{

3 public class PersonalIncomeTax

public class PersonalIncomeTax

4

{

{

5

字段/属性#region 字段/属性

字段/属性#region 字段/属性

6

/**//// <summary>

/**//// <summary>

7 /// 税率

/// 税率

8 /// </summary>

/// </summary>

9

private double[] taxRate =

private double[] taxRate =  { 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 };

{ 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 };

10

11

/**//// <summary>

/**//// <summary>

12 /// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分)

/// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分)

13 /// </summary>

/// </summary>

14 public double[] TaxRate

public double[] TaxRate

15

{

{

16

get

get  { return taxRate; }

{ return taxRate; }

17

set

set  { taxRate = value; }

{ taxRate = value; }

18 }

}

19

20

/**//// <summary>

/**//// <summary>

21 /// 速算扣除数

/// 速算扣除数

22 /// </summary>

/// </summary>

23

private double[] subtractNumber =

private double[] subtractNumber =  { 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 };

{ 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 };

24

25

/**//// <summary>

/**//// <summary>

26 /// 速算扣除数

/// 速算扣除数

27 /// </summary>

/// </summary>

28 public double[] SubtractNumber

public double[] SubtractNumber

29

{

{

30

get

get  { return subtractNumber; }

{ return subtractNumber; }

31

set

set  { subtractNumber = value; }

{ subtractNumber = value; }

32 }

}

33

34

/**//// <summary>

/**//// <summary>

35 /// 超过起征税的数额

/// 超过起征税的数额

36 /// </summary>

/// </summary>

37

private double[] surpassAmount =

private double[] surpassAmount =  { 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 };

{ 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 };

38

39

/**//// <summary>

/**//// <summary>

40 /// 超过起征税的数额

/// 超过起征税的数额

41 /// </summary>

/// </summary>

42 public double[] SurpassAmount

public double[] SurpassAmount

43

{

{

44

get

get  { return surpassAmount; }

{ return surpassAmount; }

45

set

set  { surpassAmount = value; }

{ surpassAmount = value; }

46 }

}

47

48

/**//// <summary>

/**//// <summary>

49 /// 征税起点工资

/// 征税起点工资

50 /// </summary>

/// </summary>

51 private double startTaxSalary;

private double startTaxSalary;

52

53

/**//// <summary>

/**//// <summary>

54 /// 征税起点工资

/// 征税起点工资

55 /// </summary>

/// </summary>

56 public double StartTaxSalary

public double StartTaxSalary

57

{

{

58

get

get  { return startTaxSalary; }

{ return startTaxSalary; }

59

set

set  { startTaxSalary = value; }

{ startTaxSalary = value; }

60 }

}

61 #endregion

#endregion

62

63

构造函数#region 构造函数

构造函数#region 构造函数

64

/**//// <summary>

/**//// <summary>

65 /// 无参构造函数

/// 无参构造函数

66 /// </summary>

/// </summary>

67 public PersonalIncomeTax()

public PersonalIncomeTax()

68

{

{

69 StartTaxSalary = 2000;

StartTaxSalary = 2000;

70 }

}

71

72

/**//// <summary>

/**//// <summary>

73 /// 征税基本工资有时会随国家政策,法律变更

/// 征税基本工资有时会随国家政策,法律变更

74 /// </summary>

/// </summary>

75 /// <param name="baseSalary">征税基本工资</param>

/// <param name="baseSalary">征税基本工资</param>

76 public PersonalIncomeTax(double taxSalary)

public PersonalIncomeTax(double taxSalary)

77

{

{

78 StartTaxSalary = taxSalary;

StartTaxSalary = taxSalary;

79 }

}

80 #endregion

#endregion

81

82

自定义方法#region 自定义方法

自定义方法#region 自定义方法

83

/**//// <summary>

/**//// <summary>

84 /// 计算个人所得税,返回应缴税收,征税后所得薪水

/// 计算个人所得税,返回应缴税收,征税后所得薪水

85 /// </summary>

/// </summary>

86 /// <param name="Salary">薪水</param>

/// <param name="Salary">薪水</param>

87 /// <param name="Welfare">五险一金数额</param>

/// <param name="Welfare">五险一金数额</param>

88 /// <param name="IsChinaNationality">是否是中国国籍</param>

/// <param name="IsChinaNationality">是否是中国国籍</param>

89 /// <param name="taxedSalary">税后所得实际工作</param>

/// <param name="taxedSalary">税后所得实际工作</param>

90 /// <returns>返回个人所得税</returns>

/// <returns>返回个人所得税</returns>

91 public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary)

public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary)

92

{

{

93 double RateSalary = 0;

double RateSalary = 0;

94

95 RateSalary = Salary - StartTaxSalary - Welfare;

RateSalary = Salary - StartTaxSalary - Welfare;

96

97 if (!IsChinaNationality)

if (!IsChinaNationality)

98

{

{

99 RateSalary = RateSalary - 3000;

RateSalary = RateSalary - 3000;

100 }

}

101

102 int rateIndex = 0;

int rateIndex = 0;

103

104 if (RateSalary >= 0)

if (RateSalary >= 0)

105

{

{

106 for (int index = 0; index < SurpassAmount.Length; index++)

for (int index = 0; index < SurpassAmount.Length; index++)

107

{

{

108 if (RateSalary >= SurpassAmount[index] && RateSalary <= SurpassAmount[index + 1])

if (RateSalary >= SurpassAmount[index] && RateSalary <= SurpassAmount[index + 1])

109

{

{

110 rateIndex = index + 1;

rateIndex = index + 1;

111 break;

break;

112 }

}

113 }

}

114 }

}

115

116 double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex];

double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex];

117 taxedSalary = Salary - Welfare - rate;

taxedSalary = Salary - Welfare - rate;

118

119 return rate;

return rate;

120 }

}

121

122 #endregion

#endregion

123 }

}

124 }

}

125

namespace SalaryComputer

namespace SalaryComputer2

{

{3

public class PersonalIncomeTax

public class PersonalIncomeTax4

{

{5

字段/属性#region 字段/属性

字段/属性#region 字段/属性6

/**//// <summary>

/**//// <summary>7

/// 税率

/// 税率8

/// </summary>

/// </summary>9

private double[] taxRate =

private double[] taxRate =  { 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 };

{ 0, 0.05, 0.10, 0.15, 0.20, 0.25, 0.30, 0.35, 0.40, 0.45 };10

11

/**//// <summary>

/**//// <summary>12

/// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分)

/// 税率(税率最好保存在数据库表里或xml文件,当国家出台新的个人所得税政策法规时,不需要修改代码部分)13

/// </summary>

/// </summary>14

public double[] TaxRate

public double[] TaxRate15

{

{16

get

get  { return taxRate; }

{ return taxRate; }17

set

set  { taxRate = value; }

{ taxRate = value; }18

}

}19

20

/**//// <summary>

/**//// <summary>21

/// 速算扣除数

/// 速算扣除数22

/// </summary>

/// </summary>23

private double[] subtractNumber =

private double[] subtractNumber =  { 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 };

{ 0, 0, 25, 125, 375, 1375, 3375, 6375, 10375, 15375 };24

25

/**//// <summary>

/**//// <summary>26

/// 速算扣除数

/// 速算扣除数27

/// </summary>

/// </summary>28

public double[] SubtractNumber

public double[] SubtractNumber29

{

{30

get

get  { return subtractNumber; }

{ return subtractNumber; }31

set

set  { subtractNumber = value; }

{ subtractNumber = value; }32

}

}33

34

/**//// <summary>

/**//// <summary>35

/// 超过起征税的数额

/// 超过起征税的数额36

/// </summary>

/// </summary>37

private double[] surpassAmount =

private double[] surpassAmount =  { 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 };

{ 0, 500, 2000, 5000, 20000, 40000, 60000, 80000, 100000 };38

39

/**//// <summary>

/**//// <summary>40

/// 超过起征税的数额

/// 超过起征税的数额41

/// </summary>

/// </summary>42

public double[] SurpassAmount

public double[] SurpassAmount43

{

{44

get

get  { return surpassAmount; }

{ return surpassAmount; }45

set

set  { surpassAmount = value; }

{ surpassAmount = value; }46

}

}47

48

/**//// <summary>

/**//// <summary>49

/// 征税起点工资

/// 征税起点工资50

/// </summary>

/// </summary>51

private double startTaxSalary;

private double startTaxSalary;52

53

/**//// <summary>

/**//// <summary>54

/// 征税起点工资

/// 征税起点工资55

/// </summary>

/// </summary>56

public double StartTaxSalary

public double StartTaxSalary57

{

{58

get

get  { return startTaxSalary; }

{ return startTaxSalary; }59

set

set  { startTaxSalary = value; }

{ startTaxSalary = value; }60

}

}61

#endregion

#endregion62

63

构造函数#region 构造函数

构造函数#region 构造函数64

/**//// <summary>

/**//// <summary>65

/// 无参构造函数

/// 无参构造函数66

/// </summary>

/// </summary>67

public PersonalIncomeTax()

public PersonalIncomeTax()68

{

{69

StartTaxSalary = 2000;

StartTaxSalary = 2000;70

}

}71

72

/**//// <summary>

/**//// <summary>73

/// 征税基本工资有时会随国家政策,法律变更

/// 征税基本工资有时会随国家政策,法律变更74

/// </summary>

/// </summary>75

/// <param name="baseSalary">征税基本工资</param>

/// <param name="baseSalary">征税基本工资</param>76

public PersonalIncomeTax(double taxSalary)

public PersonalIncomeTax(double taxSalary)77

{

{78

StartTaxSalary = taxSalary;

StartTaxSalary = taxSalary;79

}

}80

#endregion

#endregion81

82

自定义方法#region 自定义方法

自定义方法#region 自定义方法83

/**//// <summary>

/**//// <summary>84

/// 计算个人所得税,返回应缴税收,征税后所得薪水

/// 计算个人所得税,返回应缴税收,征税后所得薪水85

/// </summary>

/// </summary>86

/// <param name="Salary">薪水</param>

/// <param name="Salary">薪水</param>87

/// <param name="Welfare">五险一金数额</param>

/// <param name="Welfare">五险一金数额</param>88

/// <param name="IsChinaNationality">是否是中国国籍</param>

/// <param name="IsChinaNationality">是否是中国国籍</param>89

/// <param name="taxedSalary">税后所得实际工作</param>

/// <param name="taxedSalary">税后所得实际工作</param>90

/// <returns>返回个人所得税</returns>

/// <returns>返回个人所得税</returns>91

public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary)

public double CalculatePersonTax(double Salary, double Welfare, bool IsChinaNationality, out double taxedSalary)92

{

{93

double RateSalary = 0;

double RateSalary = 0;94

95

RateSalary = Salary - StartTaxSalary - Welfare;

RateSalary = Salary - StartTaxSalary - Welfare;96

97

if (!IsChinaNationality)

if (!IsChinaNationality)98

{

{99

RateSalary = RateSalary - 3000;

RateSalary = RateSalary - 3000;100

}

}101

102

int rateIndex = 0;

int rateIndex = 0;103

104

if (RateSalary >= 0)

if (RateSalary >= 0)105

{

{106

for (int index = 0; index < SurpassAmount.Length; index++)

for (int index = 0; index < SurpassAmount.Length; index++)107

{

{108

if (RateSalary >= SurpassAmount[index] && RateSalary <= SurpassAmount[index + 1])

if (RateSalary >= SurpassAmount[index] && RateSalary <= SurpassAmount[index + 1])109

{

{110

rateIndex = index + 1;

rateIndex = index + 1;111

break;

break;112

}

}113

}

}114

}

}115

116

double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex];

double rate = RateSalary * TaxRate[rateIndex] - SubtractNumber[rateIndex];117

taxedSalary = Salary - Welfare - rate;

taxedSalary = Salary - Welfare - rate;118

119

return rate;

return rate;120

}

}121

122

#endregion

#endregion123

}

}124

}

}125